- Home

- »

- Clothing, Footwear & Accessories

- »

-

Writing Instruments Market Size And Share Report, 2030GVR Report cover

![Writing Instruments Market Size, Share & Trends Report]()

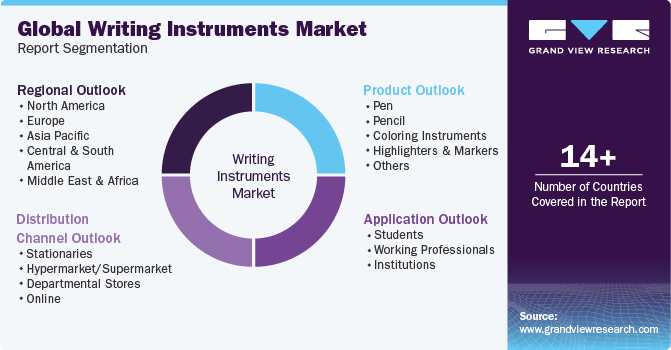

Writing Instruments Market Size, Share & Trends Analysis Report By Product (Pencil, Pen), By Application (Students, Institutions), By Distribution Channel (Departmental Stores, Stationaries), By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-352-2

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global writing instruments market size was estimated at USD 17.08 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. One of the primary drivers of the market growth is the enduring appeal of handwritten communication and the culture surrounding penmanship. While digital devices have revolutionized communication, the art of writing has not lost its charm. Many individuals still appreciate the tactile experience of putting pen to paper, whether it be for personal correspondence, journaling, or creative expression. The emotional and personal connection associated with handwriting drives the demand for quality writing instruments.

Pens and other writing instruments are popular choices for corporate gifting, both within companies and at events. Personalized pens with company logos or engraved messages are frequently used as promotional items. The demand for premium, branded writing instruments for these purposes drives market growth as businesses seek to create a lasting impression and foster brand loyalty. The growing preference for premium and luxury writing instruments as gifts on special occasions is expected to open new opportunities for writing instrument manufacturers over the forecast period. A rise in the number of book readers and story writers has raised the scope of coloring instruments, such as highlighters and markers, for underlining important passages and words while reading.

There has been a growing emphasis on sustainability and eco-friendly products, including writing instruments. Consumers are increasingly conscious of the environmental impact of their choices and seek alternatives to disposable pens. This has led to the rise of refillable pens, pens made from recycled materials, and those with replaceable ink cartridges. The availability of sustainable options appeals to environmentally conscious consumers and drives market growth in this segment. Key players are launching products made from sustainable materials to meet consumer expectations that are further projected to provide growth opportunities to the market. For instance, in September 2022, PENON Inc. launched a sustainable pen 'Penon' at Books Kinokuniya, one of the largest retail booksellers in Japan.

The product is made available in the U.S., UAE, Taiwan, and Singapore. In addition, customized plantable pencils are gaining popularity worldwide as they are an eco-friendly alternative to plastic pens and pencils, and users are increasingly aligned toward zero-waste living. The plantable pencils can be planted after usage and can be grown into herbs, vegetables, and flowers which raises the scope of the market. In addition, manufacturers are constantly trying to appeal to customers with customized designs of pens and pencils along with superior grip and comfort for ease of usage. Manufacturers continually introduce innovative designs, patterns, and colors to cater to changing consumer preferences. Pens and pencils have become fashion accessories, with brands collaborating with designers and artists to create limited editions and collectible items.

The emphasis on aesthetics and style drives consumers to purchase products that reflect their personalities and align with the latest trends. In addition, companies focus on partnerships and strategic acquisitions to expand their portfolio of pencils and pens with engraved prints and designs of their brand symbols to create a brand image among customers. In January 2022, Moleskine, the cult favorite notebook brand, partnered with Kaweco, a German heritage pen maker to create custom writing sets including, fountain and rollerball pens with matching leather cases in purple, red, black, and green. The Moleskine and Kaweco partnership logo is imprinted on the fountain and rollerball pens.

Education and office supplies form a significant segment of the market. Pens and pencils are essential tools for students, teachers, and professionals. As the workforce continues to expand globally, the demand for writing instruments follows suit. The rise of e-learning and remote work has also led to increased sales of writing tablets, stylus pens, and other digital writing tools, creating new growth opportunities within the market. Furthermore, emerging economies with growing populations, such as India and China, present vast opportunities for market expansion. In addition, the rise of middle-class consumers with disposable income fuels the demand for high-quality products.

Product Insights

The pens segment accounted for the largest share of 35.8% of the global revenue in 2022. Pens are classified according to their ink colorants and ink composition. The availability and accessibility of a diverse range of pen types, such as ballpoint pens, rollerball pens, gel pens, and ink pens, at various price points, boost the demand for pens among users. Furthermore, pens are designed to provide comfort and ease of writing, and they have become a status symbol among the privileged class because they are considered a luxury. The market growth is mainly driven by a shift in the population's living standards and willingness to purchase branded goods to fulfill personal interests associated with a specific brand.

Coloring instruments are expected to grow at a CAGR of 3.3% over the forecast period. These products are witnessing an upsurge in popularity owing to the growing demand for highlighters, markers, and other coloring instruments, among consumers. Moreover, the increasing number of schools, offices, and coaching institutions in developing countries in Southeast Asia and the Middle East is boosting the demand for pencils. In addition, the high demand for notebooks in primary schools can be attributed to the significant growth in the education sector. Moreover, the growing use of paper-based stationery products in government offices and the architecture industry is expected to widen the scope of pencils over the next few years.

Application Insights

Based on application, the market has been further categorized into students, working professionals, and others. The students application segment accounted for the largest share and generated a revenue of USD 9,783.3 million in 2022. Writing instruments are essential tools for students in their academic pursuits. The sheer volume of writing required throughout their educational journey creates a consistent demand for these products thus driving the market growth.

Also, governmental initiatives to encourage students to pursue education in schools and colleges in underdeveloped and developing countries will likely boost the demand for pens and pencils among students globally. This is a key indicator of the market’s growth. The working professionals segment is anticipated to register the fastest CAGR of 4.0% from 2023 to 2030 owing to the increased use of pens, highlighters, and markers by professionals to make their work more presentable. The usage of these products makes their work simpler by highlighting the key points, thereby boosting segment growth.

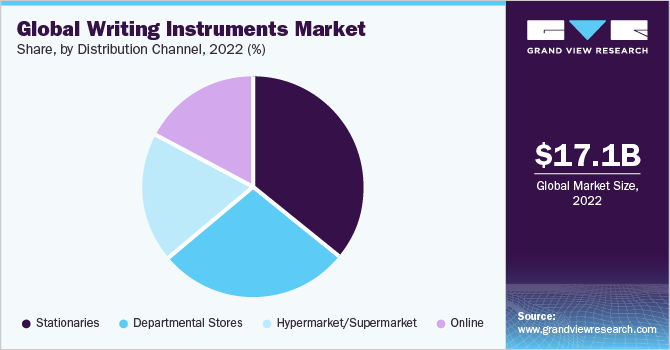

Distribution Channel Insights

The stationeries segment accounted for the largest share of 35.8% in 2022. This segment has been gaining traction owing to the benefits offered by stationeries, such as physical verification of products before purchase. Moreover, the presence of in-store experts to help consumers choose the right product and the availability of instant buying options are expected to encourage consumers to opt for stationaries as a buying medium. The availability of various brands, styles, colors, and designs enables customers to find writing instruments that suit their preferences and needs. Stationery stores act as a one-stop destination for consumers to explore and purchase different types of writing instruments.

The sales through online channels are projected to grow at the highest CAGR of 5.0% from 2023 to 2030. With evolving technologies, the Internet has given consumers the flexibility to shop at their convenience through their laptops, tablets, mobile phones, or personal computers. This has redefined customer experience and helped product manufacturers reach a wider consumer base. Moreover, the availability of a wide range of products, competitive pricing & discounts, user reviews & ratings, and convenience for reordering & refills, promote the growth of the online distribution channel. Online platforms continue to evolve and provide an engaging and seamless shopping experience for customers, contributing to the increasing popularity of online shopping and segment growth.

Regional Insights

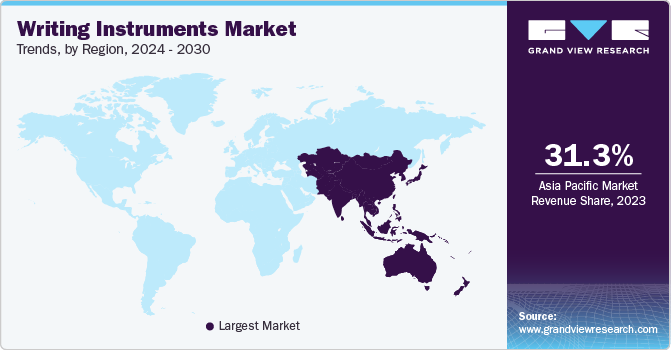

In 2022, Asia Pacific dominated the market, accounting for 31.4% share of the overall revenue on account of the increasing awareness regarding the importance of education among the young population. The government initiatives regarding the expansion of educational institutions across developing countries, such as India, China, and Australia, for the betterment of the educational sector, are expected to set new opportunities for market growth. The market growth in India is mainly driven by the growing number of educational institutes in the country. According to a 2019 report from the Brookings Institution, Reviving Higher Education in India, published by NAFSA in April 2022, the number of educational institutes has expanded by more than 400 percent from 2001 to 2019.

The booming growth of corporate businesses propelled the growth of the market in Australia. The market in China is growing due to the high number of educational institutions and the rising popularity of digital, smart, and stylus pens in the country. The Europe regional market was valued at USD 3,186.2 million in 2022 and is expected to grow at a CAGR of 4.8% from 2023 to 2030 as there is an increasing trend of using colorful writing instruments for story books, magazines, and other fun decorated notebooks among the young population. The increasing curiosity for creative artwork is further expected to boost the demand for such products among kids. In Europe, the market in the UK is likely to grow at a CAGR of 5.7% over the forecast period.

The demand for writing and drawing instruments has been witnessing considerable growth in line with the rising number of artists and creative hobbyists. Germany accounted for a share of 15.8% in 2022 leveraging the rapid expansion of the corporate sector and the hotel industry. The sales of various writing products, including different types of pens and pencils, are therefore expected to witness a significant boost over the forecast period. North America was valued at USD 3,777.1 million in 2022 and is expected to grow at a CAGR of 5.2% over the forecast period as there is an increase in technological innovation and product variety across the U.S. that emphasizes solely launching innovations and developments in features to writing products, such as ballpoint combo pens, highlighters, and stylus, for usage across different applications, such as professional institutions or industrial usage.

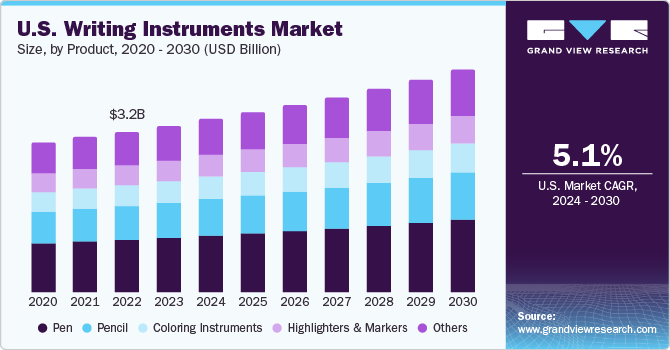

The U.S. market was estimated at 3,241.0 million in 2022 and is expected to grow at a CAGR of 5.0% over the forecast period. The market is mainly driven by the increasing employment rate in the country, coupled with the presence of numerous corporate firms. Moreover, the increasing number of students in the country willing to pursue college as well as university degrees would further fuel market growth during the forecast period. As per the OECD data, the employment rate of the working-age population in the U.S. was 67.07% in 2020, which increased to 69.40% in 2021.

Key Companies & Market Share Insights

Key industry players face intense competition and have large customer bases in both regional and international markets. New product launches and establishment of strategic business units in developing economies including China and India are expected to remain the key strategies among the industry participants. Some of the initiatives undertaken by key players include:

-

In February 2023, Zebra Pen Corp., a prominent player in the industry, announced its partnership with Liqui-Mark. This collaboration is set to revolutionize distribution in the market, bringing about a new era of possibilities

-

In April 2022, Zebra Pen Corp. announced the launch of its official website. This initiative was taken by the company to enhance user experience, increase e-commerce functionality and improve brand communication

Some prominent players in the global writing instruments market include:

-

Faber-Castell

-

Newell Brands

-

Mitsubishi Pencil Co., Ltd.

-

Linc Ltd.

-

Hindustan Pencils Pvt. Ltd.

-

Flair Group

-

Shanghai M&G Stationery Inc.

-

Pentel of America, Ltd.

-

Luxor

-

Pilot Corporation of America

Writing Instruments Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.73 billion

Revenue Forecast in 2030

USD 23.94 billion

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; South Africa; Brazil

Key companies profiled

Faber-Castell; Newell Brands; Mitsubishi Pencil Co., Ltd.; Linc Ltd.; Hindustan Pencils Pvt. Ltd.; Flair Group; Shanghai M&G Stationery Inc.; Pentel of America, Ltd.; Luxor; Pilot Corporation of America

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Writing Instruments Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the writing instruments market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Pen

-

Ball Point Pen

-

Gel Pen

-

Fountain Pen

-

Others

-

-

Pencil

-

Graphite Pencil

-

Mechanical Pencil

-

-

Coloring Instruments

-

Highlighters and Markers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Students

-

Working Professionals

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Stationaries

-

Hypermarket/Supermarket

-

Departmental Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global writing instruments market size was estimated at USD 17.08 billion in 2022 and is expected to reach USD 17.73 billion in 2023.

b. The global writing instruments market is expected to grow at a compounded growth rate of 4.3% from 2023 to 2030 to reach USD 23.94 billion by 2030.

b. Asia Pacific dominated the global writing instruments market with a share of 31.4% in 2022. This is attributed to increasing awareness regarding the importance of education among the young population.

b. Some key players operating in writing instruments market include Faber-Castell; Newell Brands; MITSUBISHI PENCIL CO., LTD.; Linc Limited; Hindustan Pencils Private Limited; Flair Group; Shanghai M&G Stationery Inc.; Pentel of America, Ltd.; Luxor; Pilot Corporation of America

b. Key factor that is driving the market growth includes the enduring appeal of handwritten communication and the culture surrounding penmanship.

b. The U.S. writing instruments market size was estimated at USD 3.24 billion in 2022 and is expected to grow at a CAGR of 5.0% over the forecast period.

b. India writing instruments market size was estimated at USD 1.61 billion in 2022 and is expected to grow at a CAGR of 4.2% over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The clothing, footwear, & accessories industry is anticipated to witness checkered growth throughout 2020, as a result of the unprecedented supply chain disruptions caused by the COVID-19 outbreak worldwide. The expected decline in the global sales of clothing, footwear, & accessories is attributable to massive supply chain disruptions across significant export markets, including China and India. However, the industry is likely to recover over the forecast timeframe, given the rising popularity of online/e-commerce sales. From a manufacturing standpoint, the sustainable or ethical fashion trend is expected to favor market growth throughout the forecast timeframe. Luxury apparel is another lucrative space for prospective manufacturers to target, given the mushrooming number of affluent and fashion-conscious consumers across the globe. Our team is diligently working towards accounting these factors in our report with the aim of providing you with the up-to-date, actionable market information and projections.