- Home

- »

- Medical Devices

- »

-

Wound Care Market Size, Share And Trends Report, 2030GVR Report cover

![Wound Care Market Size, Share & Trends Report]()

Wound Care Market Size, Share & Trends Analysis Report By Application (Chronic, Acute), By End-use (Hospitals, Nursing Homes), By Product (Advanced, Traditional), By Distribution Channel, By Mode of Purchase, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-300-3

- Number of Pages: 200

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Wound Care Market Size & Trends

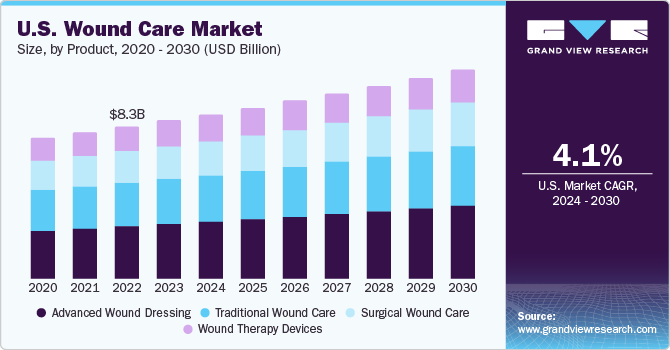

The global wound care market size was estimated at USD 22.25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.17% from 2024 to 2030. The demand for wound care products is increasing owing to a rising volume of surgical procedures and the high prevalence of chronic diseases Furthermore, the increasing incidence of diabetes due to sedentary lifestyles is one of the leading factors contributing to market growth. For instance, as per a report by the Centers for Disease Control and Prevention (CDC), which was last reviewed in April 2023, 37.3 million Americans have diabetes. Similarly, as per the same source, 96 million American adults have prediabetes. These factors are expected to boost market growth over the forecast period.

Wound care products help cure diabetic foot ulcers, which are prevalent in diabetic patients. For instance, according to a NIH report, last updated in August 2023, diabetes is a major cause of non-traumatic amputations in the U.S. Overall, 5% of patients with diabetes develop foot ulcers, of which 1% may need amputation. Wound care products, such as hydrocolloid dressings, help in moisture retention and allow rapid healing of wounds internally as well as externally. Moreover, these products help in the absorption of necrotic tissues, which are effective in cases of surgical site infections. Thus, healthcare professionals prefer to use wound care products, which is anticipated to propel the wound care market growth over the forecast period.

Advanced wound dressings held the largest revenue share in 2023. One of the key factors responsible for the segment dominance is an increase in the number of burn cases. Following are some general statistics on burn injuries based on data from the World Health Organization (WHO) and the American Burn Association:

-

An estimated 180,000 deaths occur each year worldwide due to burn injuries

-

In the U.S., there are approximately 486,000 burn injuries that require medical treatment each year, with about 40,000 of those requiring hospitalization

-

In the U.S., fire/flame burns are the most common type of burn injury (43%), followed by scalds (34%), contact burns (9%), electrical burns (4%), chemical burns (3%), and other types of burns (7%)

-

The elderly, young children and low-income populations are at a higher risk for burn injuries

-

The majority of burn injuries (69%) occur in residential places while 8% occur in workplaces, and 5% occur in traffic accidents

-

In terms of mortality, burn injuries are the 8th leading cause of unintentional injury deaths in the U.S.

-

The estimated cost of burn injuries in the U.S. is approximately USD 7.5 Billion annually, including medical care and lost productivity

Increasing cases of burn injuries globally is a major driver of the market growth. It is leading to the development of new and advanced products for the treatment of burns, including dressings, grafts, and biologics.

Market Dynamics

An increasing number of Ambulatory Surgical Centers (ASCs) are expected to drive the market growth. ASCs offer a variety of services, such as surgical care, diagnostics, and preventive procedures. Surgeries for pain management, urology, orthopedics, restorative, reconstructive, or alternative plastic surgeries, and Gastro-Intestinal (GI) related surgeries are performed in ASCs. In addition, ASCs offer cost-effective services. As per a report by Blue House Sales Group, in August 2023, there were about 6,179 Medicare-certified ASCs present in the U.S. Thus, with an increasing number of ASCs, the market is expected to grow during the forecast period.

Furthermore, the increasing cases of traumatic injuries globally will propel market growth. For instance, according to the WHO report (published in June 2022), around 1.3 million people died every year as a result of road traffic accidents. Similarly, as per nationgroup.com, in 2022, about 14,737 individuals died in Thailand as a result of traffic-related incidents. Collagenase-based enzymatic wound debridement products are majorly used to treat, such acute wounds. Thus, such cases are expected to increase the demand for wound care products.

Product Insights

On the basis of products, the global market has been further categorized into advanced wound dressings, surgical wound care, traditional wound care, and wound therapy devices. The advanced wound dressing segment held the maximum share of 34.8% in 2023. It is projected to expand further at the highest growth rate from 2024 to 2030 maintaining its dominant position. Advanced wound dressing is mainly used to treat chronic and non-healing wounds. Thus, increasing cases of chronic wounds, such as diabetic foot ulcers, is expected to help boost segment growth.

For instance, as per NCBI, in August 2023, incidence of diabetic foot ulcer globally was between 9.1 million and 26.1 million. In addition, about 15% to 25% patients with diabetes may develop a diabetic foot ulcer during their lifetime. These factors are expected to propel market growth during the forecast period. The surgical wound care segment is anticipated to grow at a considerable CAGR of 4.30% from 2024 to 2030. This can be attributed to rising cases of SSIs worldwide. For instance, as per a report by NIH, published in January 2023, around 0.5% to 3% of patients undergoing surgery may experience SSI. Thus, impelling segment growth.

Application Insights

The chronic wounds segment held the largest share of 59.8% in 2023 and is anticipated to witness a considerable growth rate over the forecast period. An increasing number of geriatric populations, along with the rising prevalence of diabetic foot ulcers, venous pressure ulcers, and other chronic wounds is expected to drive the segment growth. For instance, as per a United Health Foundation report (published in May 2023), more than 55.8 million adults aged 65 years and older lived in the U.S., accounting for about 16.8% of the nation's population in 2021. Furthermore, the number of people suffering from varicose vein in U.S. is increasing year-on-year.

For instance, according to the Journal of the American Heart Association, approximately 23% i.e., 1 in every 4 U.S. resident have varicose veins. In some cases, varicose veins may lead to the development venous leg ulcers, thereby augmenting product demand. Increasing cases of different traumatic wounds and burns is the major factor driving segment growth. Multiple benefits of acute wound products include reduced SSIs, improved results & patient satisfaction, and reduced hospital stays. There is also an increase in the cases of burn wound cases across the globe. Since acute wound products are majorly used for treating traumatic wounds, the use of wound care products is expected to help boost the segment growth.

End-use Insights

The hospital segment held the largest share of 39.0% in 2023. The growth of this segment can be attributed to upsurge in surgical procedures globally because of sedentary lifestyle, and rising bariatric surgeries which require the use of wound care products to contain surgical site infections. Furthermore, surgical wound care dressings and NPWT are predominantly suitable for hospital use and are not feasible for home care. In addition, hospital institutions are considered large-scale buyers having long-term contracts with product suppliers. In addition, a rise in hospital admissions due to surgeries is anticipated to propel segment growth. Patients, after surgery, generally require wound care products to heal from surgical site wounds. Therefore, the segment is expected to witness significant growth. The home care segment is expected to register the fastest CAGR of 5.51% from 2024 to 2030.

During the pandemic, home healthcare wound care products were more in demand. Wound care in homecare settings is majorly initiated with the introduction of single-use NPWT systems. These devices are lightweight, portable, canister-free, and are easy to use. In addition, the cost-effectiveness of such therapy for treating wounds also encourages patients to adopt homecare settings over hospital stays. Moreover, rising geriatric population is expected to propel segment growth as elderly patients tend to opt for homecare settings or nursing home care. Furthermore, the presence of several organizations offering home care services in North America and Europe is promoting the home care services market. Thus, with an increase in geriatric population and nursing home care centers, the segment is anticipated to expand rapidly.

Distribution Channel Insights

Institutional sales dominated the distribution channel segment. Wound care product manufacturers may also sell products directly to healthcare providers, such as hospitals and clinics, or to patients through direct-to-consumer marketing. This approach can provide more control over the distribution process and enable manufacturers to build relationships with their customers. Institutional sales comprise majorly direct distributors and manufacturers. Hospitals, clinics, wound care centers, and other healthcare facilities, such as nursing homes, long-term care facilities, diagnostic laboratories, and birth centers, usually, have long-term contracts and tie-ups with distributors and manufacturers. Key players are adopting long-term contracts with end users as a strategy to expand their reach and strengthen their foothold in the market.

Retail sales are expected to witness the fastest growth in the forecast period, with a CAGR of 4.55% from 2024 to 2030. Retail sales mainly comprise retail pharmacy stores, e-commerce, etc. Customers benefit from pharmacies as they are large in numbers. They offer various delivery options and usually provide good service. Customers typically purchase prescription and non-prescription wound care products at retail pharmacy stores and specialty pharmacies. These pharmacies may stock wound care products, such as dressings, ointments, and bandages, and may also provide wound care advice and services. The e-commerce segment is anticipated to expand at the fastest CAGR from 2024 to 2030. Online stores and mail-order companies are quite similar, and their main advantages are cheap prices and ease of access. Rising online and e-commerce accessibility of wound care products will likely aid in market expansion. eHealth is a fast-growing part of e-commerce.

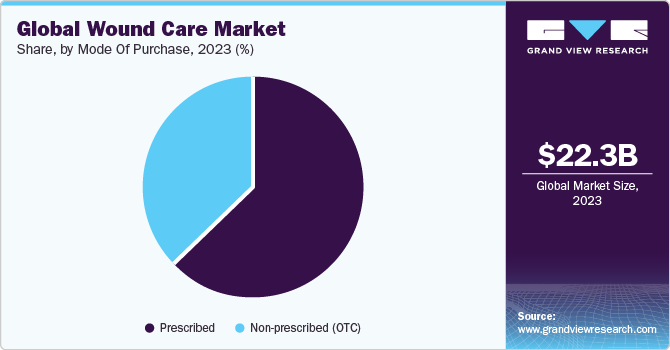

Mode of Purchase Insights

The prescribed segment dominated the market in 2023 and is projected to expand further at the fastest CAGR of 4.98% from 2024 to 2030. The prescribed wound care products depend on the type of product and the severity of the wound. For mild to moderate wounds, over-the-counter (OTC) wound care products, such as bandages, gauze, and antiseptic creams, can be purchased at pharmacies, drug stores, or online retailers.

For more severe wounds, prescription wound care products such as wound dressings, wound cleansers, and topical antibiotics may be required. These products can only be obtained with a prescription from a healthcare provider and can be purchased at a pharmacy. Moreover, people are inclined toward prescribed wound care products as Medicare covers around 80% of the cost of medically necessary wound care supplies and surgical dressings. This encourages people to visit physicians and receive prescribed wound care medication.

Regional Insights

North America dominated the market with a share of 45.4% in 2023 and is expected to witness considerable growth from 2024 to 2030. Presence of large population base, rising patient pool in countries, such as the U.S., are major factors driving market growth in this region. Moreover, geriatric population is at a higher risk of wounds, which will boost product demand. For instance, as per a United Health Foundation report (Published in May 2023) more than 55.8 million adults ages 65 years and older live in the U.S., accounting for about 16.8% of the nation's population in 2021. In addition, increasing number of road accidents, and availability of skilled professionals in this region is expected to drive the product demand.

Asia Pacific is estimated to witness the highest CAGR 4.8% from 2024 to 2030. This can be attributed to changing lifestyles leading to increased incidences of chronic diseases in this region. For instance, according to a December 2021 survey by Down to Earth, India had 74.2 million diabetic patients aged 20 - 79 years.This number is expected to increase to 124.8 million by 2045. Furthermore, medical tourism in this region is growing rapidly, which is increasing the number of surgeries performed. Thus, these factors are projected to boost the Asia Pacific regional market’s growth.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of several small and large manufacturers. Competitive rivalry and degree of competition in the market is expected to intensify over the forecast period due to the presence of many players. Furthermore, leading players are involved in collaborations, product launches, and mergers & acquisitions to strengthen their product portfolios. For instance, in June 2023, an Evonik company—JeNaCell—introduced the wound dressing epicite balance to the German market. This dressing is well-suited and optimized for pressure ulcers, venous leg ulcers, arterial leg ulcers, diabetic foot ulcers, and soft tissue lesions, which are chronic wounds with low to medium exudation. Similarly, in January 2023, Convatec launched the ConvaFoam in the U.S. ConvaFoam is a family of advanced foam dressings designed to meet the demands of medical professionals and their patients. This helped the company strengthen its presence in the U.S. market. Thus, with various strategies acquired by leading players, the market is expected to grow significantly.

Key Wound Care Companies:

- Smith & Nephew

- Mölnlycke Health Care AB

- ConvaTec Group PLC

- Ethicon (Johnson & Johnson)

- Baxter International

- URGO Medical

- Coloplast Corp.

- Medtronic

- 3M

- Derma Sciences Inc. (Integra LifeSciences)

- Medline Industries

- Advancis Medical

- B. Braun Melsungen AG

Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.14 billion

Revenue forecast in 2030

USD 29.57 billion

Growth Rate

CAGR of 4.17% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, mode of purchase, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Smith & Nephew; Mölnlycke Health Care AB; ConvaTec Group PLC; Ethicon (Johnson & Johnson); Baxter International; URGO Medical; Coloplast Corp.; Medtronic; 3M; Derma Sciences Inc. (Integra LifeSciences); Medline Industries; Advancis Medical; B. Braun Melsungen AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the wound care market report on the basis of product, application, end-use, mode of purchase, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Wound Dressing

-

Foam Dressings

-

Hydrocolloid Dressings

-

Film Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Other Advanced Dressings

-

-

Surgical Wound Care

-

Sutures & staples

-

Tissue adhesive and sealants

-

Anti-infective dressing

-

-

Traditional Wound Care

-

Medical Tapes

-

Cotton

-

Bandages

-

Gauzes

-

Sponges

-

Cleansing Agents

-

-

Wound Therapy Devices

-

Negative pressure wound therapy

-

Oxygen and hyperbaric oxygen equipment

-

Electric stimulation devices

-

Pressure relief devices

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic foot ulcers

-

Pressure ulcers

-

Venous leg ulcers

-

Other chronic wounds

-

-

Acute Wounds

-

Surgical & traumatic wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescribed

-

Non-prescribed (OTC)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wound care market size was estimated at USD 22.25 billion in 2023 and is expected to reach USD 23.14 billion in 2024.

b. The global wound care market is expected to grow at a compound annual growth rate of 4.17% from 2024 to 2030 to reach USD 29.57 billion by 2030.

b. Advanced wound dressing dominated the wound care market in 2023 with a market share of 34.8% and is expected to witness the fastest growth over the forecast period due to an increase in technological advancement, rising cases of chronic diseases, and an increase in the number of sports-related injuries.

b. Some key players operating in the wound care market include Smith & Nephew PLC, Mölnlycke Health Care AB, ConvaTec Group PLC, Ethicon (Johnson & Johnson), Baxter International, URGO Medical, Coloplast Corp., Medtronic, 3M, and Derma Sciences, (Integra LifeSciences)

b. An aging population drives the wound care market, rising incidence of chronic diseases such as diabetes, increasing prevalence of pressure ulcers and venous leg ulcers, and growing demand for advanced wound care products and therapies. Technological advancements in wound care products, increasing awareness about wound care management, and favorable reimbursement policies are also contributing to market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With COVID-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for COVID-19 as a key market contributor.