- Home

- »

- Advanced Interior Materials

- »

-

White Cement Market Size, Share & Trends Report, 2030GVR Report cover

![White Cement Market Size, Share & Trends Report]()

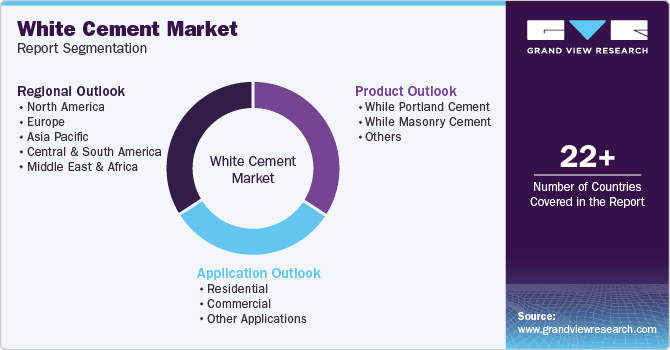

White Cement Market Size, Share & Trends Analysis Report By Product (While Portland Cement, While Masonry Cement), By Application (Residential, Commercial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-145-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

White Cement Market Size & Trends

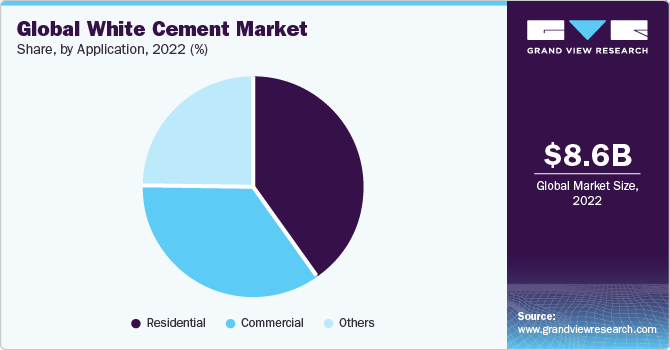

The global white cement market size was estimated at USD 8.65 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. The growing construction expenditures across the globe are expected to drive the growth. The strong development of the industrial sector in developing economies such as India, Mexico, and Brazil after the recovery from the COVID-19 pandemic is expected to contribute to the overall growth of the industry over the forecast period. White cement is made from non-iron raw materials including China clay and white limestone, as well as materials with low levels of coloring components such as Fe, Mn, Cr, and Ti. Furthermore, as white cement is produced in a separate kiln, it is more costly than standard Portland cement. The whiteness content of white cement is its most essential feature. It is also available in 325, 400, and 475 strength classifications.

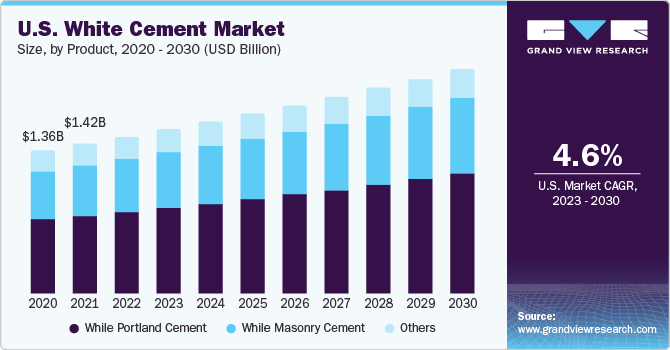

The U.S. market has witnessed strong growth in recent years on account of the growing product demand by ongoing residential and commercial construction projects. As per TST Europe, in 2022, commercial construction spending in the country was around USD 97 billion, while spending for single-family residential buildings was USD 404 billion. Moreover, the multifamily residential construction spending was USD 119 billion in 2022, with a predicted spending of USD 123 billion by the end of 2023, which amounts to a 4% rise in the country's construction spending.

The value-added features such as heat reflection and increased aesthetic appeal have led to white cement often being employed as an alternative to grey cement. The product demand is higher in countries with warmer climates owing to the resulting white concrete surface which reflects more heat than regular grey concrete. Furthermore, it is a commonly available concrete element that is effective well in a variety of applications as it improves the aesthetics and performance of pavements, buildings, and other structures.

The value chain of the market comprises raw material suppliers, manufacturers, distributors, and end-users. Companies operating as raw material suppliers are involved in providing various machinery, tools, limestone, and additives to the manufacturers. The manufacturers then are involved in grinding, processing, and finishing the raw materials to produce white cement.

The applications of white cement are majorly based on the factors involving the construction practices in the country, purchasing power of the people, GDP of the country, and campaigns by the manufacturers and other stakeholders to raise awareness of new uses of white cement in construction. The primary applications of white cement in residential construction are in repair works, tile installation, and prefabricated items owing to their quality, usage, aesthetics, and product range.

Developing countries such as India, China, Mexico, Brazil, and Indonesia are expected to generate staggering demand for the product over the coming years owing to the presence of major manufacturers in these countries. For instance, UltraTech Cement Ltd. is India's largest producer of white cement, grey cement, and RMC (white concrete). It operates in India, UAE, Bangladesh, Bahrain, and Sri Lanka. It is also India's largest cement exporter, extending out to countries in the Middle East. The company sells white cement under the brand name Birla White in the Indian market and has a manufacturing plant with a capacity of 0.68 metric tonnes per annum (MTPA).

Application Insights

Based on application, the residential segment accounted for the largest revenue share of 40.2%.in 2022. The residential segment is inclusive of residential buildings, apartments, complexes, and small houses. White cement is majorly used in residential applications on account of its high compressive strength, low alkali content, and aesthetic looks. The growing housing sector in emerging economies such as India is expected to trigger the product demand owing to their high usage in cast-in-situ floorings, marble/tile laying, mosaic tile manufacturing, wall finishes, whitewashing, and repair work.

The favorable growth of the residential sector in emerging markets including Turkey, South Africa, India, China, and Middle East countries on account of the easy availability of home loans is expected to have a strong impact on the market growth over the next seven years. In addition, innovation in product varieties using advanced technology and hassle-free installation is projected to drive the market growth from the residential application segment over the forecast period.

The commercial segment is expected to be the fastest growing application with a notable CAGR over the forecast period owing to the rising demand for highly durable and cost-efficient cement for use in high-traffic commercial sectors. The development of new products such as RMC, dry mix mortars (various ready-to-use products), and stamped concrete has considerably driven the market growth. In addition, white cement is emerging as a cost cost-effective solution used in various sectors including healthcare, office, institution, retail, and other commercial areas owing to an increase in understanding of architectural concepts of the end-users.

The other application segment includes industrial and infrastructural applications, which are increasing due to their rising preference by designers and architects. Moreover, the expansion of modern manufacturing plants, factories, warehouses, and rapid industrialization in developing economies are expected to propel market growth over the forecast period.

Product Insights

The white Portland cement was the largest and fastest-growing product segment in 2022 in terms of revenue. White Portland cement, as the name suggests, is a kind of cement that is white. Except for the color and fineness, it is identical to standard grey Portland cement.The segment is expected to grow over the forecast period as it is made from iron oxide and manganese oxide making them ideal for applications such as designer flooring, paver tiles, stonecrete walls, grit wash walls, and tyrolean walls.

The use of white cement for architectural and decorative concrete has the benefit of providing a neutral tinting foundation and uniform color results. It is available in every color, from pure whites to vibrant and pastel hues. White cement is prepared following the American Society for Testing and Materials (ASTM International) C 150 standard called ‘Portland Cement Specification’. The most widespread are Types I and III, but Types II and V are also manufactured.

White masonry cement is expected to grow at a significant CAGR over the 2023 to 2030 period as they are designed to be used instantly at the construction site. White masonry cement yields reliable workability, improves board life, and provides a more cohesive mix. There are two main types of white masonry cement namely, Type N and Type S. Type N is majorly used for normal masonry construction whereas Type S is used in masonry structures that require more than double the strength of a Type N.

Regional Insights

The Asia Pacific region accounted for the largest revenue share of the global market in 2022 and is expected to continue its dominance over the forecast period. High product demand from residential and non-residential construction segments in emerging economies of Asia Pacific including China and India is expected to provide growth opportunities for the market. The product has majorly penetrated the regional construction sector owing to the widespread availability of prominent manufacturers such as UltraTech Cement Ltd.; Shree Cement Limited; and, Ambuja Cements Limited.

The North American market is expected to witness substantial growth in the coming years, aided by the growing regional construction of residential and commercial buildings. The market is witnessing a rapid shift toward domestic white cement production, backed by the rising demand for walling and flooring applications. The need for the upgradation of existing buildings and structures in the region is expected to augment the demand for white cement in both residential and commercial constructions.

The Central & South American construction sector is poised to witness strong growth due to the flourishing industry expansion. Emerging economies, such as Brazil, Argentina, and Peru are witnessing population growth coupled with rapid urbanization. These factors are triggering the construction of commercial units in Central & South America, thereby fueling the product demand in the region.

Key Companies & Market Share Insights

Key players are using a variety of methods, including company expansion, acquisitions, new product launches, and collaboration to maintain competitiveness and their market share. For instance, in June 2023, Dyckerhoff AG announced the launch of a new product called Blue Star, a white pozzolan cement. This new product is aimed towards reducing CO2 emissions for its product portfolio. Also, the new launch will help the company to grow its product portfolio and sustain itself in the German market

Key White Cement Companies:

- Cementir Holding N.V.

- Çimsa Çimento Sanayi ve Ticaret A.Ş

- Royal White Cement

- LafargeHolcim

- Aditya Birla (Grasim Industries Limited)

- Cimsa

- Dyckerhoff GMBH

- Federal White Cement

- India Cements Ltd

- J.K. Cement Company

- Ultratech Cement Ltd

- Saudi White Cement Company

White Cement Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.04 billion

Revenue forecast in 2030

USD 12.14 billion

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; Argentina

Segments covered

Product, application, region

Key companies profiled

Cementir Holding N.V.; Çimsa Çimento Sanayi ve Ticaret A.Ş; Royal White Cement; LafargeHolcim; Aditya Birla (Grasim Industries Limited); Cimsa; Dyckerhoff GMBH; Federal White Cement; India Cements Ltd; J.K. Cement Company; Ultratech Cement Ltd; Saudi White Cement Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global White Cement Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global white cement market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

While Portland Cement

-

While Masonry Cement

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the white cement market include Cementir Holding N.V., Çimsa Çimento Sanayi ve Ticaret A.Ş, Royal White Cement, LafargeHolcim, Aditya Birla (Grasim Industries Limited), and Cimsa.

b. The key factor which is driving white cement market is growing construction expenditures of economies around the globe and rise in industrial and commercial activities.

b. The global white cement market size was estimated at USD 8.65 billion in 2022 and is expected to reach USD 9.04 billion in 2023.

b. The global white cement market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 12.14 billion by 2030.

b. Among products, white Portland cement dominated the white cement market with approximately 54% share in 2022 owing to their versitality, durability, and enhanced aesthetics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."