- Home

- »

- Advanced Interior Materials

- »

-

Welding Equipment Market Size, Share & Growth Report, 2030GVR Report cover

![Welding Equipment Market Size, Share & Trends Report]()

Welding Equipment Market Size, Share & Trends Analysis Report By Type (Automatic, Manual), By Technology (Arc Welding, Resistance Welding), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-587-8

- Number of Pages: 137

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global welding equipment market size was estimated at USD 18,831.6 million in 2022 and is expected to expand at a compounded annual growth rate (CAGR) of 5.0% from 2023 to 2030. The market has witnessed considerable growth over the past years owing to the increasing need for welding equipment in a variety of industries, including shipbuilding, offshore exploration, oil & gas, aerospace, automotive, construction, and energy. The demand for welding equipment is also being fueled by consumers' preference for automated devices over manual ones. The majority of the demand for welding equipment is tied to end-use businesses such as automotive, aerospace, transportation, and construction, which are also experiencing operational difficulties due to the pandemic.

Due to the global lockdowns, numerous construction projects and activities including government infrastructure projects came to a total standstill. These aforementioned factors hampered the growth of the welding equipment industry during the Covid-19 pandemic.

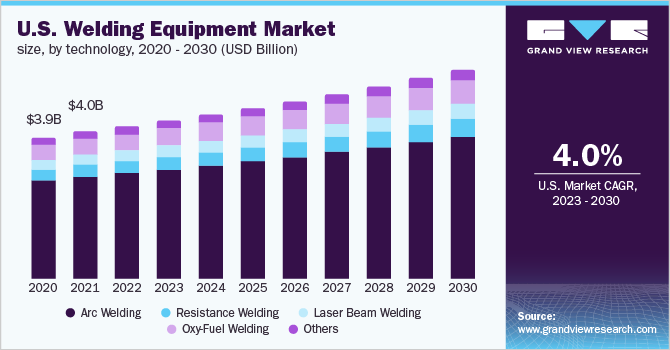

The U.S. is one of the prime automotive markets in North America, it witnesses high consumption of welding equipment by established players such as Ford, Toyota, GM, Nissan, and Chevrolet. Continuous improvements, development of innovative manufacturing methods, technological advancements, and application of standard and specific welding techniques are expected to help overcome the challenges and aid in the robust growth of the welding equipment industry in the U.S.

Increasing defense expenditure by the U.S. federal government is expected to augment the production of naval ships, patrol vehicles, and submarines at a domestic level in the country. The rising usage of mega-ships as they outsize older models is expected to positively impact the growth of the shipbuilding industry in the country. These trends are anticipated to drive the demand for welding equipment in the U.S. as they play a key role in the assembling of ships and carrying out their maintenance and repair operations.

The global automobile industry is anticipated to have double-digit growth in 2021. According to The Economist Intelligence, commercial vehicle sales will rise by 16% in 2021, following a 16% dip in 2020. The continually increasing demand for automobiles worldwide is anticipated to increase the demand for tools and robots in the automotive industry. This, in turn, is expected to boost the demand for welding equipment over the projected period.

The ongoing developments in automation, welding technologies, and research & development have facilitated the ever-increasing demand. Industries are improving welding efficiency by switching from manual to semi-automatic and fully automated equipment for lowering costs and increasing efficiency. For instance, in April 2021, the Lincoln Electric Company acquired Zeman Bauelemente Produktionsgesellschaft m.b.H. This acquisition will increase the former’s global annual automation sales by 10%.

Type Insights

Automatic type segment led the market and accounted for 56.2% of the global revenue share in 2022. Owing to their quick weld cycle time, high output, and decreased welding costs. The fast-paced adoption of this equipment in various end-use industries such as automotive, construction, and aerospace is expected to fuel the demand for automatic welding equipment across the world over the forecast period

Fully automated welding equipment increase productivity, decrease cycle duration, and increase efficiency. In addition, weld quality is improved as a result of the elimination of human involvement in the welding process as it minimizes the chances of human errors. In a completely automated welding process, there is no human participation resulting in reduced labor expenses.

The semi-automatic segment is estimated to witness growth at a CAGR of 4.8% over the forecast period. Semi-automatic welding requires some human involvement during the welding process; however, this interaction is significantly lesser than that required in manual welding. Various examples of semi-automatic welding are metal inert gas (MIG), metal active gas (MAG), and flux-cored arc welding (FCAW) welding.

The manual type segment accounted for 10.4% of the global revenue share in 2022. In manual welding, welders use their hands for operating electrode holders, utilizing welding hand torches, and handling blowpipes. This approach is illustrated through Shielded metal arc welding (SMAW) and manual Gas tungsten arc welding (GTAW) arc welding.

Technology Insights

The arc welding technology segment led the market and accounted for more than 70.7% of the global revenue share in 2022. Arc welding technology is being increasingly utilized owing to its characteristics such as flexibility and the ability to perform in all conditions. Continuous development in robotic arc welding is an important factor driving the arc welding segment in the welding equipment industry.

Resistance welding is majorly used in the automotive sector for processes such as projection welding, spot welding, and seam welding. These three types of welding processes are deployed on account of their beneficial characteristics including high stability, cost-effectiveness, and low environmental impact. Rising demand for resistance welding from the automobile and transportation sectors is expected to drive the resistance welding market over the forecast period.

The laser beam welding technology segment is likely to grow at a CAGR of 6.3% over the forecast period. Laser beam welding technology is experiencing high demand from applications, such as automotive and transportation, for mold making and welding entire automotive bodies. Continuous innovation in laser technology coupled with the ability to weld difficult-to-access areas and small components play a crucial role in boosting the growth of laser beam welding equipment.

The widespread use of oxy-fuel technology in the automotive and transportation industries is driving the global welding equipment industry. Asia Pacific and North America have emerged as the leading markets for the use of oxy-fuel welding due to the expansion of the automotive and aerospace industries in these regions.

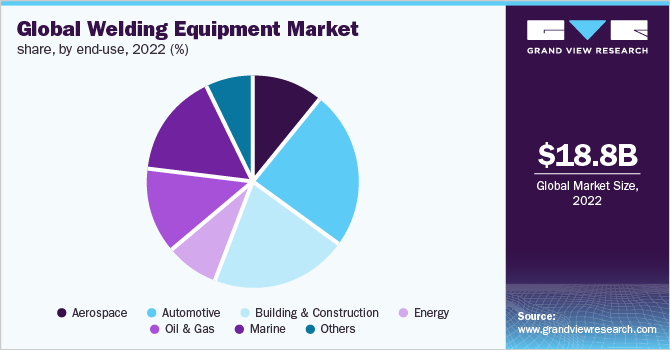

End-use Insights

The automotive end-use segment led the market and accounted for 24.7% of the global revenue share in 2022. Ongoing electrification in the global transportation sector, particularly in automobiles, along with continuous innovations and advancements in automotive technologies, is anticipated to help different environmental agencies mitigate the challenge of climate change. Increasing the use of electric vehicles to reduce carbon footprint is anticipated to increase automobile sector demand, consequently boosting the welding equipment industry.

The welding applications in aerospace manufacturing also include inductors, circuit board traces, electronic components, actuators, heating elements, fine ribbon welding, mesh welding, and hybrid micro-weld devices. Growing demand for air travel and cargo transport is anticipated to boost the demand for welding equipment within the aerospace industry.

The building and construction end-use segment is likely to grow at a CAGR of 4.6% over the forecast period. Arc welding is widely used in various construction fabrication applications. Over the past few years, arc welding has witnessed innovation in high-power laser welding and electron-beam welding. These welding types are widely used for welding heavy and complex structures. All the factors above are expected to boost the demand for welding equipment over the forecast period.

Welding is one of the most used hot-work processes within the shipbuilding industry. The development of welding technology has allowed the manufacturing sector to construct completely waterproof and oil-tight connections. For instance, welded joints are easier to construct and reduce the cycle time of a project as compared to riveted connections. The rapid expansion of the shipping industry is likely to raise the need for ships over the coming years, increasing the market for welding equipment over the forecast period.

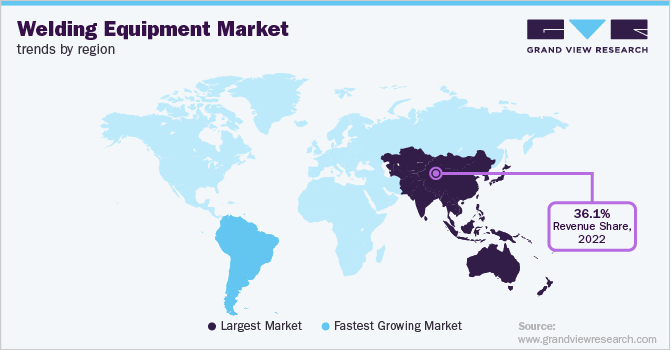

Regional Insights

Asia Pacific led the market and accounted for 36.1% of the global revenue share in 2022. The Asia Pacific welding equipment industry is expected to exhibit the highest growth rate on account of the robust automotive industry. Increasing demand for electric and hybrid cars is expected to benefit the demand for welding equipment. Furthermore, shifting consumer preferences toward customization, and maintaining the ride quality and fuel efficiency of vehicles is likely to heighten the frequency of vehicle maintenance and repair activities, which, in turn, is expected to drive the demand for welding equipment.

Europe is one of the largest producers of automobiles across the globe and attracts maximum foreign direct investment (FDI) in the automotive sector. Process innovation, improving R&D, and expansion of automobile production in countries such as Germany, the U.K., and France are expected to fuel the growth of the automotive sector over the forecast period. Furthermore, the region is marked by the presence of global automobile manufacturers including Volkswagen, BMW, and Mercedes, which focus on increasing the production volume every year, thereby strengthening the demand for welding equipment in the region.

The Central & South America market is likely to grow at a CAGR of 5.5% over the forecast period. The focus of various governments in Central & South America is on the development of sustainable infrastructures related to railways, urban mass transits, energy and oil & gas production, renewable energy generation, etc. to meet the demands for welding equipment of the growing population. This, in turn, fuels the demand for welding equipment used in construction applications in the region.

The demand for welding equipment in the Middle East & Africa is driven by the increasing automobile production due to the growing demand for passenger cars, primarily in emerging economies of the region such as the UAE, Saudi Arabia, South Africa, and Egypt. The governments of the Middle Eastern economies are increasingly investing in improving and extending industrial infrastructure. For instance, in February 2020, Oman's Ministry of Transport and Communication launched the National Aviation Strategy 2030 to strengthen its growing aviation industry. Such initiatives are expected to boost the demand for welding equipment used in the development of industrial infrastructure.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including acquisitions, mergers, joint ventures, new product developments, and geographical expansions, to enhance market penetration and cater to the changing technological requirements from various end-use sectors such as aerospace, automotive, building and construction, energy, oil & gas and others.

For instance, Miller Electric Mfg. LLC and NCCER collaborated in February 2022. (National Center for Construction Education & Research). The collaboration will provide Miller AugmentedArc Augmented Reality Welding Systems, version 2.2.0, activities for NCCER welding levels 1 and 2. In addition, in July 2022, the lightweight, dual-input voltage POWER MIG 215 MPi multi-process welder, with a novel ergonomic design, was introduced by the Lincoln Electric Company. With a sturdy case made for portability, this device offers enhanced functionality. Some prominent players in the global welding equipment market include:

-

Lincoln Electric

-

ACRO Automation Systems, Inc

-

AIR LIQUIDE

-

ARCON - Mitco Weld Products Pvt. Ltd.

-

voestalpine Böhler Welding Group GmbH

-

Carl Cloos Schweisstechnik GmbH

-

OTC DAIHEN Inc.

-

Illinois Tool Works Inc.

-

Panasonic Industry Co., Ltd.

-

Coherent, Inc.

-

ESAB

-

Polysoude S.A.S.

-

Kemppi Oy.

-

CRUXWELD

Welding Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19,715.8 million

Revenue forecast in 2030

USD 27,765.7 million

Growth rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; France; Germany; Italy; Spain; U.K.; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Lincoln Electric; ACRO Automation Systems Inc; AIR LIQUIDE; ARCON - Mitco Weld Products Pvt. Ltd.; Voestalpine Böhler Welding Group GmbH; Carl Cloos Schweisstechnik GmbH; OTC DAIHEN Inc.; Illinois Tool Works Inc.; Panasonic Industry Co., Ltd.; Coherent, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Welding Equipment Market Segmentation

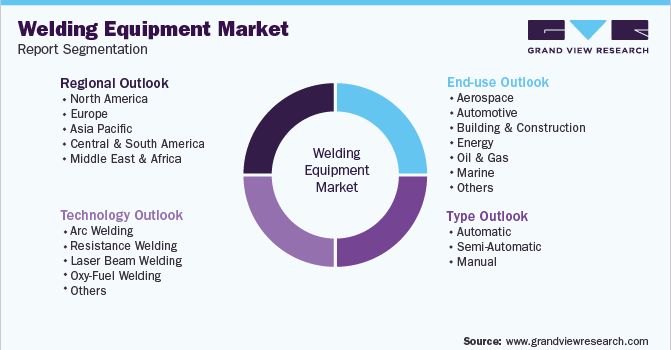

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global welding equipment market report based on type, technology, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Semi-Automatic

-

Manual

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Arc Welding

-

Shielded Metal/Stick Arc Welding

-

MIG

-

TIG

-

Plasma Arc Welding

-

Others

-

-

Resistance Welding

-

Laser Beam Welding

-

Oxy-Fuel Welding

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Automotive

-

Building & Construction

-

Energy

-

Oil & Gas

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global welding equipment market size was estimated at USD 18,831.6 million in 2022 and is expected to reach USD 19,715.8 million in 2023.

b. The global welding equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 27,765.7 million by 2030.

b. Asia Pacific dominated the welding equipment market with a revenue share of 36.1% in 2022. Asia Pacific welding equipment market is expected to exhibit the highest growth rate on account of the robust automotive industry in addition increasing demand for electric and hybrid cars is expected to further benefit the demand for welding equipment.

b. Some of the key players operating in the welding equipment market include Lincoln Electric, ACRO Automation Systems, Inc, AIR LIQUIDE, ARCON - Mitco Weld Products Pvt. Ltd., voestalpine Böhler Welding Group GmbH, Carl Cloos Schweisstechnik GmbH, OTC DAIHEN Inc., among others.

b. The key factors that are driving the welding equipment market include the growing demand for welding equipment across applications such as shipbuilding, offshore exploration, oil & gas, aerospace, automotive, construction, and energy.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Artificial Intelligence (AI), Virtual Reality (VR), and Augmented Reality (AR) solutions are anticipated to substantially contribute while responding to the COVID-19 pandemic and address continuously evolving challenges. The existing situation owing to the outbreak of the epidemic will inspire pharmaceutical vendors and healthcare establishments to improve their R&D investments in AI, acting as a core technology for enabling various initiatives. The insurance industry is expected to confront the pressure associated with cost-efficiency. Usage of AI can help in reducing operating costs, and at the same time, can increase customer satisfaction during the renewal process, claims, and other services. VR/AR can assist in e-learning, for which the demand will surge owing to the closure of many schools and universities. Further, VR/AR can also prove to be a valuable solution in providing remote assistance as it can support in avoiding unnecessary travel. The report will account for Covid19 as a key market contributor.