- Home

- »

- Next Generation Technologies

- »

-

Virtual Machine Market Size, Share & Trends Report, 2030GVR Report cover

![Virtual Machine Market Size, Share & Trends Report]()

Virtual Machine Market Size, Share & Trends Analysis Report By Type, By Organization Size, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-155-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

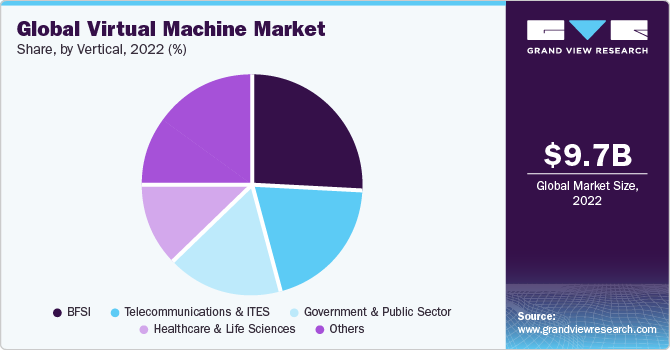

The global virtual machine market size was estimated at USD 9,706.3 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.1% from 2023 to 2030. The adoption of cloud computing services, including Infrastructure as a Service (IaaS) and Platform as a Service (PaaS), drives global market growth. Enterprises increasingly migrated their workloads to public and private clouds, creating a demand for virtualized resources. Many organizations were implementing hybrid and multi-cloud strategies, which involved using virtualization technologies to manage workloads seamlessly across various cloud platforms and on-premises data centers. The rise of edge computing has led to the deployment of virtual machines (VMs) at the edge of networks to support low-latency organization sizes and data processing.

Edge computing is a distributed computing paradigm that brings computing resources closer to the data source or end-user to reduce latency, improve real-time processing, and enhance the overall user experience. One of the primary drivers for deploying VMs at the edge is to minimize latency. VMs can run on edge servers or devices, processing data locally instead of sending it to a centralized data center or cloud. This is critical for autonomous vehicles, augmented reality (AR), and Internet of Things (IoT) devices, where a small delay in data processing can have significant consequences.

In addition, advancements in virtualization technologies have played a crucial role in making shared cloud environments more secure and essential for organizations entrusting their sensitive data and workloads to cloud service providers. Security remains a top priority as virtualization evolves in response to emerging threats and regulatory requirements. For instance, virtualization platforms have added features to help users comply with industry-specific regulations and conduct security audits, making it easier to demonstrate the security and compliance of VMs.

Type Insights

The system virtual machine segment dominated the market with a share of over 64.5% in 2022. System virtualization involves running multiple operating systems simultaneously on a single physical machine, allowing for better resource utilization and isolation between virtualized environments. System virtualization enables efficient resource allocation and management. Virtual machines can be dynamically provisioned and scaled to match the workload's requirements, optimizing resource utilization. Many organizations use system virtualization to consolidate their data center infrastructure. By running multiple virtual machines on a single physical server, they can reduce hardware costs, space requirements, and power consumption.

Process virtualization has gained significant attention and adoption with containerization technologies such as Docker and Kubernetes. Containers encapsulate individual processes and their dependencies, making it easier to deploy and manage organization sizes consistently across different environments. Process virtualization, especially in containers, has seen remarkable growth and adoption in recent years. Organizations across various industries leverage this technology to streamline organization size development, improve resource utilization, and enhance deployment flexibility. The growth of the process virtual machine segment within the virtualization market is expected to continue as more organization sizes and workloads embrace containerization and similar process isolation technologies.

Organization Size Insights

The SMEs segment dominated the market with a revenue share of 72.8% in 2022. Small and Medium Enterprises (SMEs) often have limited IT budgets and resources. Virtualization allows them to maximize their existing hardware investments by running multiple VMs on a single physical server, reducing the need for additional hardware. The growth of virtualization in the SMEs segment is driven by the need for cost-effective IT solutions that enhance resource utilization, flexibility, and scalability. Virtualization technologies provide SMEs with the means to compete effectively, streamline operations, and support their business goals while managing limited resources effectively.

Large enterprises can achieve cost savings through server consolidation. Running multiple VMs on a single physical server can reduce hardware, energy, and maintenance costs while improving resource utilization. Moreover, VMs enable large enterprises to allocate computing resources more efficiently. Workloads can be dynamically scaled up or down to match demand, ensuring optimal performance and resource utilization. Virtualization provides agility and flexibility, allowing large enterprises to deploy new organization sizes or services quickly, adapt to changing business needs, and scale resources as required.

Vertical Insights

The Banking, Financial Services, and Insurance (BFSI) segment led the market with a revenue share of 26.5% in 2022. The BFSI sector is actively adopting virtualization technologies. Virtualization in the BFSI segment offers benefits, such as cost reduction, enhanced security, scalability, and improved disaster recovery. Moreover, the BFSI sector was increasingly moving toward cloud-based virtualization solutions in the same year. Cloud virtualization offers flexibility, cost-efficiency, and the ability to scale resources up or down as needed. It also allows financial institutions to focus on core banking and financial services rather than managing on-premises infrastructure.

The government & public sector is expected to grow considerably over the forecast period. This sector is actively adopting virtualization technologies to modernize IT infrastructure, improve efficiency, and enhance service delivery. Moreover, given the sensitive nature of government data, cybersecurity is a top priority. Virtualization solutions are employed to create secure, isolated environments for different agencies, helping minimize the risk of data breaches and cyberattacks. Governments worldwide focus on digital transformation initiatives. Virtualization plays a critical role in these efforts, enabling the development of digital services, data analytics, and citizen engagement platforms.

Regional Insights

North America led the market with a share of over 36.0% in 2022. The market in North America has been experiencing several notable growth trends, driven by evolving technology, increased adoption of virtualization, and changing business needs. North American businesses, including small- and large-scale enterprises, have been rapidly adopting cloud-based virtualization solutions. This trend encompasses IaaS and PaaS offerings, allowing organizations to scale resources and reduce the need for on-premises infrastructure.

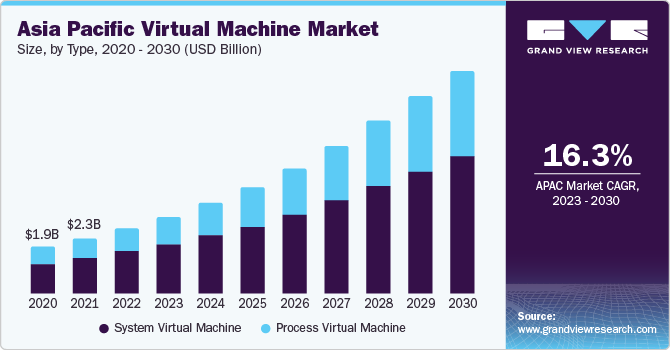

Asia Pacific was experiencing significant growth. The market dynamics were influenced by various factors, including technological advancements, increased digitization efforts, and evolving business needs. The region also witnessed increased cloud adoption across enterprises of all sizes. Organizations embraced IaaS, PaaS, and Software as a Service (SaaS) solutions, leading to a growing demand for VMs in cloud environments.

Key Companies & Market Share Insights

The market is characterized by strong competition with a few major worldwide competitors owning a significant market share. The major focus of key players is on developing new products and further collaborations with other pioneers functioning in the market.

Key Virtual Machine Companies:

- Amazon.com Inc.

- Citrix Systems Inc.

- Hewlett Packard Enterprise LP

- Huawei Technologies Co. Ltd.

- International Business Machine Corporation

- Microsoft Corporation

- Oracle Corporation

- VMware Inc.

- Parallels Inc.

- Red Hat Inc.

Virtual Machine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11,277.6 million

Revenue forecast in 2030

USD 30,122.3 million

Growth rate

CAGR of 15.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Market revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, organization size, vertical, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; China; India; Japan; Australia; South Korea; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Amazon.com Inc.; Citrix Systems Inc.; Hewlett Packard Enterprise LP; Huawei Technologies Co. Ltd.; International Business Machine Corp.; Microsoft Corp.; Oracle Corp.; VMware Inc.; Parallels Inc.; Red Hat Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

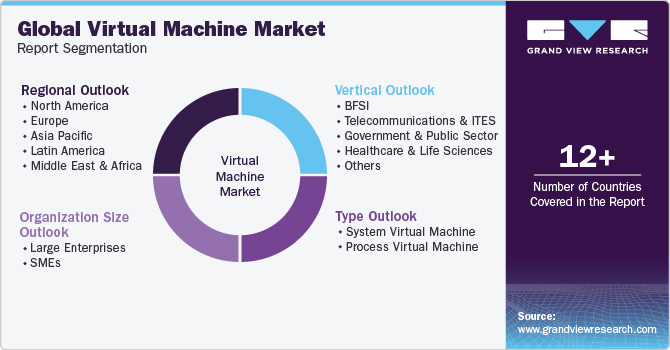

Global Virtual Machine Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the latest trends in each sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the virtual machine market report based on type, organization size, vertical, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

System Virtual Machine

-

Process Virtual Machine

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Telecommunications & ITES

-

Government & Public Sector

-

Healthcare & Life Sciences

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."