- Home

- »

- Animal Feed and Feed Additives

- »

-

Vietnam Animal Feed Additives Market Size, Industry Report, 2025GVR Report cover

![Vietnam Animal Feed Additives Market Size, Share & Trends Report]()

Vietnam Animal Feed Additives Market Size, Share & Trends Analysis Report By Product (Antibiotics, Vitamins, Antioxidants, Amino Acids Feed Enzymes,), By Application, By Region, And Segment Forecasts, 2014 - 2025

- Report ID: 978-1-68038-434-5

- Number of Pages: 84

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Specialty & Chemicals

Report Overview

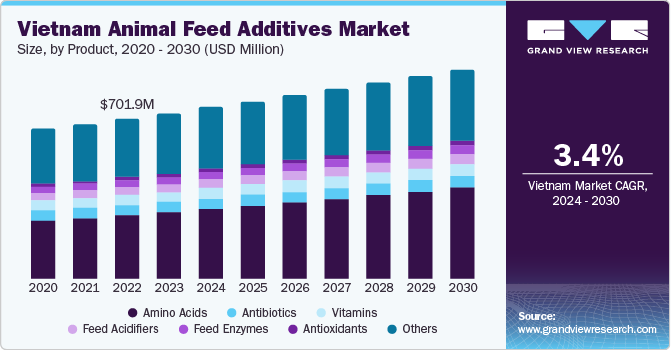

The Vietnam animal feed additives market size was estimated at USD 652.3 million in 2018 and is expected to grow at a CAGR of 3.7% over the forecast period. Additives consumption in poultry feed is expected to provide significant opportunities to market participants. Unlike other Southeast Asian nations where poultry consumption is dominant, Vietnam meat consumption has been dependent on pork, with high poultry consumption.

However, changing lifestyles and growing processed food industries are expected to drive meat consumption shifts towards white meat products such as poultry and fish. Changing meat consumption patterns could provide market participants with significant opportunities regarding application development over the forecast period.

Amino acids in themselves are a wide range of protein products necessary for proper animal raising. Some of the significant amino acids include lysine, methionine, threonine, and tryptophan. Lysine is predominantly used in the pork industry while methionine is extensively utilized by the poultry industry.

Amino acids emerged as the second-largest feed additive type in 2018 and accounted for 28.01% of the overall market. Rising awareness concerning to benefits of feed additives in tandem with some significant outbreak of diseases has encouraged increased utilization of additives in animal feed. Amino acids act as protein building blocks for the health of the application.

Meat consumption in Vietnam witnessed growth at 9.4% in 2009, which can be attributed to changing lifestyle and shift from traditional farming to industrial farming. Increasing meat consumption is expected to drive the demand for animal feed. According to MARD, animal feed demand was 19.7 million tons in 2010, wherein domestic manufacturing accounted for 11 million tons.

Product Insights

The ability of antibiotics to promote growth in livestock is one of the prominent factors that helped in developing its market in Vietnam. Increasing pork and poultry consumption coupled with concerns regarding influenza viruses affecting them have been driving animal feed antibiotics to demand in Vietnam.

Due to strict quality inspection, the market is anticipated to grow moderately. Furthermore, according to the Ministry of Agriculture and Rural Development, Vietnam will impose a ban on all types of antibiotics from 2020 in the livestock farming, thereby affecting the antibiotic market in animal feed in the country.

The primary reason for the slow growth rate in the vitamin market for feed additives is that they are only used in cases where the application is deficient, and the natural vitamins present in the feed prove insufficient. Vitamins are also additionally given to animals for improving reproductively and for increased resistance to diseases.

Application Insights

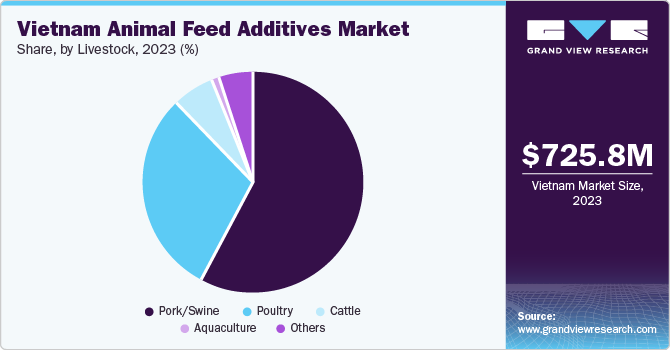

In 2018, the pork feed segment accounted for a major market share in the animal feed additives market. Some of the major pork-consuming regions across the globe include Asia Pacific, North America, and Europe. China, Canada, Brazil, and the U.S. are the major consumers and producers of swine animal feed. Vietnam is one of the prominent pork-consuming countries in Asia followed by China.

Vietnam’s pig herd is one of the largest in Southeast Asia. Owing to their role in agricultural production systems, their economic function, and their contribution to human nutrition, they are of great importance. Developing the pork industry in Vietnam is expected to trigger the country’s demand for animal feed additives in the future.

Vietnam has witnessed a huge amount of investment in its livestock industry in the past couple of years as most of the firms have their base in foreign countries but have formed joint ventures in Vietnam. Also, many of these firms are exporting poultry products that contribute to earning the required foreign currency for Vietnam. Thus, the growing poultry sector is anticipated to fuel the animal feed additives market in Vietnam.

Cattle feed is anticipated to rapidly gain market share in the country due to the high demand for exclusive beef products. It is categorized by a large number of beef imports to satisfy the demand for superior quality products. The Vietnamese animal feed sector is considered to be one of the fastest-growing sectors. However, the industry is still trying to fulfill the demand for animal feed whereas, the remaining is covered by imported feed.

Key Companies & Market Share Insights

Vietnam animal feed additives market is highly dominated by overseas organizations that are releasing for than 70% of the market share. Advanced technologies, tax incentives, greater capital resources, and overseas backhand support have been the competitive advantages for multinational companies to dominate the market, consequently affecting the profits of domestic producers.

Moreover, cheaper imports from China in line with the ASEAN-China Free Trade Agreement along with low taxation in the ASEAN Free Trade Area have impeded domestic production as animal farmers have shown an inclination toward the above-mentioned importing trends. Though production volumes have slightly increased, decline, in terms of value, can be largely attributed to cheaper production costs that are beneficial to multinational corporations.

Vietnam Animal Feed Additives Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 655.1 million

Revenue forecast in 2025

USD 816.4 million

Growth Rate

CAGR of 3.7% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Vietnam

Country scope

Vietnam

Key companies profiled

Vedan VietNam Enterprises Co., Ltd., Cargill, Incorporated, BASF SE, Kemin Industries, Inc., Olmix Group, Hong Ha Nutrition JSC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the reportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the Vietnam Animal Feed Additives market report based on product and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Antibiotics

-

Vitamins

-

Antioxidants

-

Amino Acids

-

Feed Enzymes

-

Feed Acidifiers

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Pork/Swine

-

Poultry

-

Cattle

-

Aquaculture

-

Others

-

Frequently Asked Questions About This Report

b. Key factors that are driving the Vietnam animal feed additives market growth include increasing meat consumption and growing demand for amino acids in swine and poultry feed.

b. The global Vietnam animal feed additives market size was estimated at USD 655.1 million in 2019 and is expected to reach USD 679 million in 2020.

b. The global Vietnam animal feed additives market is expected to grow at a compound annual growth rate of 3.7% from 2019 to 2025 to reach USD 816.4 million by 2025.

b. The pork segment dominated the Vietnam animal feed additives market with a share of 57.8% in 2019. This is attributable to the increasing demand for pork meat in countries such as China, U.S., and Germany.

b. Some key players operating in the Vietnam animal feed additives market include Vedan VietNam Enterprises Co., Ltd., Cargill, Incorporated, BASF SE, Kemin Industries, Inc., Olmix Group, Hong Ha Nutrition JSC.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Restrictions on manufacturing activities due to the advent of the COVID-19 pandemic shall cause a slump in the supply of feed, as well as its additives. The current stagnation in supply is, in turn, detrimental against the backdrop of ever-increasing demand for essential food products such as dairy and meat. The report will account for Covid19 as a key market contributor.