- Home

- »

- Animal Health

- »

-

Veterinary Software Market Size, Share, Growth Report 2030GVR Report cover

![Veterinary Software Market Size, Share & Trends Report]()

Veterinary Software Market Size, Share & Trends Analysis Report By Practice Type (Small Animals, Equine), By Product (Imaging Software, PMS), By Delivery Mode (On-premise, Cloud/Web-based), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-621-9

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Veterinary Software Market Size & Trends

The global veterinary software market size was estimated at USD 847.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. Increasing demand for practice management systems (PMS) from veterinary practitioners is a key contributor to the market growth. In addition, growing awareness regarding the benefits of the use of software solutions and an increasing number of clinical visits by pet owners are expected to boost the adoption of software solutions in veterinary practices in the coming years. The animal health industry is impacted by an increase in companion pet ownership and concerns over pet health. A growing focus on the efficiency and safety of livestock production is also another growth propeller.

Developers of PMS systems offer complete solutions for the management of a veterinarian’s office including maintaining schedules and records. As per the data published by the American Veterinary Medical Association in 2022, there were approximately 78,717 clinical veterinarians in U.S. North America practicing privately. This number is further expected to increase over the forecast period. This increase in the number is anticipated to propel the demand for these solutions for managing operations in clinics and reference laboratories. The outbreak of COVID-19 is estimated to have a considerable impact on the growth of the market.

In most regions, veterinary services are considered essential services and remain functional even during the lockdown. This has contributed notably to the continuation of revenue generation across veterinary practices, in turn, leading to the growth of this market. The COVID-19 pandemic brought drastic changes to patients’ normal routines with lockdown and social distancing measures across the world. Understandably due to loneliness and disturbed mental health experienced by most of the population during the pandemic, the adoption of companion animals witnessed an upsurge. For instance, as per the June 2021 PDSA PAW report, between March 2020 and May 2021, 2.0 million individuals in the UK kept pets.

Accordingly, the need for veterinary software was very strong during the pandemic as a result of the high adoption rate, and it is anticipated that this trend will continue over the forecast period. For example, according to the Japan Pet Food Association survey, there has been a 10% increase in dog and cat ownership in 2022, as compared to the previous year. There were an estimated 426 million dogs and 432 million cats being kept as pets in Japan as of October 2022. This resulted in an increase in the demand for virtual pet care visits during the pandemic and thus high adoption of veterinary software solutions.

Product Insights

The practice management software segment accounted for the largest share of over 75.0% in 2022 due to the growing demand from consumers and the cost-effective nature of these systems. These systems help practitioners support and record different standards of care protocols, and healthcare recommendations, and keep track of the patient's health with invoicing and billing, resource management, inventory tracking, and overall management of treatment procedures. Such benefits of PMS are anticipated to propel the segment growth over the forecast period. PMS helps deliver better animal health care by offering efficient solutions for workflow management in veterinary care facilities.

For instance, in April 2022, DaySmart Software’s practice management system for veterinarians collaborated with LifeLearn Inc. The ClientEd a pet medical education library that promotes effective client training for veterinary practices was launched LifeLearn Inc. The users of DaySmart Vet were able to search ClientEd's collection of 2,100+ veterinary handouts, the bulk of which cover the medical, surgical, and behavioral needs of dogs and cats. The growing adoption of information systems in healthcare practices has significantly changed the way of care delivery to patients over the past decades. Novel veterinary practice management software permits hospitals and clinics to directly access results from diagnostic labs, hence bringing down the treatment time considerably and making life easier for pet proprietors.

Such sharing of data through the web also advances treatment efficiency and brings down the possibility of a medical error. Moreover, the introduction of technologically advanced software that offers solutions in one platform for all processes in veterinary clinics is expected to contribute to the increasing adoption rate. Cloud-based practice management systems are the best examples of technologically advanced and cost-efficient software solutions for pet health practices. The veterinary field has been following the paths of the human healthcare sector, which further supports the overall market growth. In addition, the practice management software segment is primarily driven by the growing animal health expenditure across the globe, the rising pet population, an increase in the number of veterinary practitioners, and the high demand for animal-derived food products, coupled with the availability of pet insurance. The introduction of innovative solutions that offer accurate and rapid results is also expected to fuel the adoption of PMS.

Delivery Mode Insights

The cloud/web-based segment dominated the market in 2022 and is anticipated to grow at the fastest CAGR of 9.49% from 2023 to 2030. Cloud solutions can easily scale up or down to accommodate the needs of veterinary practices of all sizes. This makes it accessible to both small, independent clinics and large, multi-location veterinary hospitals. This software often includes advanced analytics & reporting features, allowing veterinarians to analyze patient data, track trends, and make more informed decisions about patient care & practice management. They can improve the client experience by facilitating online appointment scheduling, email or SMS reminders, and patient portals where clients can access their pet's records & communicate with the practice.

Moreover, the deployment of cloud-based solutions is expected to change the dynamics. These services offer a single platform through which patients, researchers, and practitioners access medical information. These platforms minimize the risk of data theft by offering a secure platform for sharing information and enabling veterinarians to keep track of information. This is further expected to boost the adoption of cloud/web-based services over the following years. For instance, in May 2022, a novel cloud-based veterinary operating system (vOS) called Covetrus Pulse was released by Covetrus, allowing veterinarians more time to spend with the animals under their care by easily connecting them to the technology they need to run their procedures.

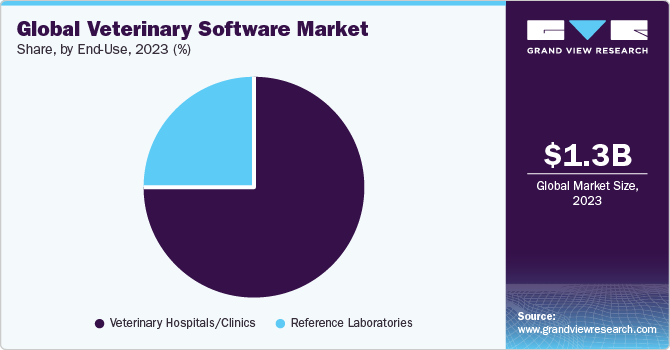

End-use Insights

The hospitals/clinics segment dominated the market and held a revenue share of over 50% in 2022. The adoption of these services is driven by technological advancements in pet care and this is anticipated to serve as a growth opportunity. These advancements include the advent of efficient information management systems and pet owner mobile technology. A high focus on innovation in animal health has given rise to certain measures that are being implemented or in the process of implementation, which are fueling the market growth prospects.

The reference laboratories segment is expected to witness significant growth in the coming years. These labs are developing various technologies for the detection and monitoring of various diseases. Government animal welfare authorities and policymakers are encouraging farmers through targeted incentives for the adoption of veterinary care practices for food-producing species. This increases the demand for animal healthcare facilities. Government organizations are increasingly involved in issuing guidelines for the promotion of reference laboratories globally, which is expected to contribute to market growth.

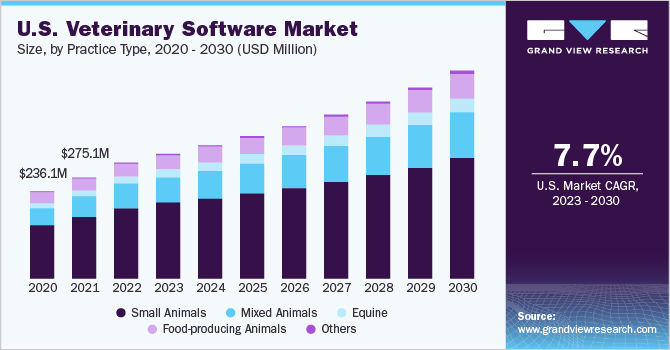

Practice Type Insights

The small animals segment held the dominant market share of over 60.00% in 2022. The segment includes revenue from veterinary practice providers primarily delivering care to small companion animals, such as dogs and cats. Small animal PMS is a specialized tool designed to help veterinarians & veterinary clinics efficiently manage their daily operations and provide quality care. Growing product developments, software integration, and expanding practice management potential in small animal practices are the main drivers of the segment's growth.

For instance, according to a report from the Veterinary Hospital Managers Association (VHMA) from 2021, the demand for pet care has increased, and with it, the need for more sophisticated tools, procedures, and, most crucially, systems & software. Using more sophisticated and integrated software to run pet animal practices professionally has been approved and acknowledged by veterinarians, cites VHMA. As a result, leading companies are launching cutting-edge products in the market due to the increasing interest of veterinarians in software administration in small animal practices.

Regional Insights

North America held the largest revenue share of over 40.0% in 2022 and is expected to maintain its position throughout the forecast period. The presence of well-established companies, advanced healthcare IT infrastructure, and the high spending capacity of pet owners are responsible for the largest revenue share of this region. There are substantial opportunities for the implementation of PMS in this region, which offers lucrative opportunities for investors in this industry. The increasing volume of pet health organizations, such as the World Small Animal Veterinary Association, coupled with the rising pet care expenditure by individuals and governments, is further expected to boost the market growth in this region.

Moreover, the growing mergers and acquisition activities among key players for product portfolio expansion boost the market growth. For instance, in November 2022, Patterson Companies, Inc. agreed to acquire nearly all assets of Relief Services for Veterinarians Practitioners and Animal Care Technologies. The latter company offers cutting-edge solutions to veterinary practices through data extraction & conversion, staffing, and video-based training services. Post the acquisition, Patterson Veterinary would offer these solutions as part of its portfolio. Asia Pacific is anticipated to register a lucrative CAGR of over 10.0% during the forecast period due to the growing demand for veterinary practice management, as a result of a continuously growing livestock population, demand for animal-derived food products, and rising pet adoption in the region.

In February 2023, the healthcare operations of FUJIFILM Healthcare Asia Pacific Pte. Ltd. were expanded in Thailand. The firm introduced a complete portfolio of diagnostic imaging and informatics solutions, supported by advanced medical image analysis and artificial Intelligence (AI), as part of its One-stop, Total Healthcare Solution. Due to the enlarged diagnostic product selection, veterinarians can identify pet diseases with greater accuracy & efficiency. Such factors are likely to drive the market growth in Asia Pacific over the forecast period.

Key Companies & Market Share Insights

The key companies are concentrating on strategic initiatives, such as M&As, collaborations, new delivery mode development, and geographical expansions. In August 2023, Hippo Manager collaborated with Aspiritech to enhance Hippo Manager's veterinary software development and enable further reliability, productivity, & overall user experience. In May 2022, Covetrus, launched Ascend, a robust, cloud-based Practice Management software designed to help veterinary practices across the UK, EMEA, and Asia Pacific. Ascend is anticipated to enhance productivity by simplifying internal communication and cooperation, thereby easing the task for both workers and clients. Some of the key players in the global veterinary software market include:

-

IDEXX Laboratories, Inc.

-

Hippo Manager Software, Inc.

-

Antech Diagnostics, Inc. (Mars, Inc.)

-

Esaote SpA

-

Henry Schein, Inc.

-

Patterson Companies, Inc.

-

ClienTrax

-

Digitail Inc

-

Vetspire LLC (Thrive Pet Healthcare)

-

DaySmart Software

-

VitusVet

-

Nordhealth AS

-

Covetrus

-

Animal Intelligence Software

-

Technology Partner Innovations, LLC (NaVetor)

Veterinary Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 918.72 million

Revenue forecast in 2030

USD 1.59 billion

Growth rate

CAGR of 8.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, practice type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; Switzerland; Sweden; Russia; Poland; Ireland; India; China; Japan; Australia; South Korea; Indonesia; Thailand; Philippines; Malaysia; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Iran; Turkey; Isarel

Key companies profiled

IDEXX Laboratories, Inc.; Hippo Manager Software, Inc.; Antech Diagnostics, Inc. (Mars, Inc.); Esaote SpA; Henry Schein, Inc.; Patterson Companies, Inc.; ClienTrax; Digitail Inc.; Vetspire LLC (Thrive Pet Healthcare); DaySmart Software; VitusVet; Nordhealth AS; Covetrus; Animal Intelligence Software; Technology Partner Innovations, LLC (NaVetor)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Software Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary software market report on the basis of product, delivery mode, practice type, end-use, and regions:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Practice Management Software

-

Imaging Software

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud/Web-based

-

-

Practice Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Mixed Animals

-

Equine

-

Food-producing Animals

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals/Clinics

-

Reference Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Ireland

-

Russia

-

Switzerland

-

Sweden

-

Poland

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Philippines

-

Malaysia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Israel

-

UAE

-

Iran

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global veterinary software market size was estimated at USD 847.5 million in 2022 and is expected to reach USD 918.72 million in 2023.

b. The global veterinary software market is expected to grow at a compound annual growth rate of 8.2% from 2023 to 2030 to reach USD 1.59 billion by 2030.

b. North America dominated the veterinary software market. The presence of well-established companies, advanced healthcare IT infrastructure, and high spending capacity of pet owners are responsible for the largest revenue share of this segment.

b. Some key players operating in the veterinary software market include . IDEXX Laboratories, Inc., Hippo Manager Software, Inc., Esaote SpA, Henry Schein, Inc. Patterson Companies, Inc., ClienTrax, DaySmart Software, VitusVet.

b. Key factors that are driving the veterinary software market growth include increasing demand for Practice Management Systems (PMS) from veterinary practitioners and growing awareness about the benefits of the use of software solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."