- Home

- »

- Electronic Devices

- »

-

Vacuum Cleaner Market Size & Share Analysis Report, 2030GVR Report cover

![Vacuum Cleaner Market Size, Share & Trends Report]()

Vacuum Cleaner Market Size, Share & Trends Analysis Report By Product (Canister, Central, Drum, Robotic, Upright, Wet & Dry), By Distribution Channel, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-046-0

- Number of Pages: 187

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Semiconductors & Electronics

Report Overview

The global vacuum cleaner market was valued at USD 12,501.0 million in 2022 and is expected to expand at a CAGR of 9.9% from 2023 to 2030. Reduction in the time left for doing household chores due to the Work from Home (WFH) model is one of the key factors driving the demand for vacuum cleaners in the residential sector. Changing lifestyles, high disposable incomes, a growing working population, rising purchasing power, and ease of usage are other significant factors catalyzing the market's growth worldwide.

The emergence of robotic vacuum cleaners, which can clean an area without human intervention, is also expected to work in the market’s favor, driving market growth. For instance, in April 2022, Xiaomi launched a new sweeping robotic vacuum named Mijia, which helps deep clean and remove tough stains without human intervention. The device controls through Xiao AI voice commands or the Mijia app. With the help of this app, the user can connect the robot vacuum to other smart home devices.

Modern-day vacuum cleaners serve as a time-efficient and convenient solution to most cleaning tasks. The demand for all-sized innovative cleaning devices is soaring, encouraging manufacturers to develop products featuring the latest technology. For instance, in February 2022, Travelodge, U.K.’s largest hotel brand, partnered with Killis, a cleaning equipment manufacturer, to introduce an innovative robot vacuum cleaner, “robovac buddy,” in their hotel. The robot has advanced features and the latest technology inbuilt, which would help the housekeeping team to clean the room thoroughly, including under the bed, public spaces, hotel hallways, and bar cafes.

Besides, in September 2021, realme, a Chinese smartphone company, launched two new smart technology vacuum robots, “realme tech-life robot vacuum” and “realme tech-life handheld vacuum.” Both devices have advanced cleaning features with a LiDAR navigation system for effectively cleaning and mapping the floor. They can also be connected to Alexa or Google Assistant and are voice-controlled. Moreover, companies are focusing on elevating the cleaning experience through digital capabilities with personalized recommendations and smartphone app-based cleaning solutions.

An exponential rise in demand for vacuum cleaners was observed in both the residential and commercial sectors in 2020, primarily owing to the increased demand to maintain hygiene in hospitals and homes amid a surge in COVID-19 cases. Several companies have reported an increase in revenues in these sectors, whereas the demand for vacuum cleaners in the industrial sector witnessed a decline owing to the closure of industrial units globally.

The increased influence of social media and online sales platforms has emerged as one of the most important growth drivers of the market. Social media platforms have been instrumental in increasing awareness about the need to maintain hygiene along with rolling out information about technologically advanced products and new launches. For instance, in February 2022, Dyson, a Singapore-based technology company, launched Dyson V12 Detect slim vacuum with cord-free laser detection technology. The device has a green laser diode and an inbuilt LCD screen to detect dust. It also has a conical brush bar that helps clean the elevated buttons and door handles and sanitizes surfaces, vital in preventing COVID-19 transmission.

The vacuum cleaner industry is undergoing significant changes, driven by changing customer dynamics and innovative technologies. Cleaning is becoming smart with the implementation of smart applications and robotic technologies to create new value from data emerging from different industry verticals. Apart from digitally enhanced products, companies are focusing on developing sustainable products with low emissions and noise.

For instance, in July 2021, Hencon BV, a supplier of mobile equipment for heavy industries, launched “EVY,” a sustainable smart cleaning vacuum cleaner to clean the pot room. The device has a suction working pressure of 0.3 bar with a 1.2 m3 hopper capacity, and the dust collected and separated with a very fine filtration is then ready for re-use. It ensures that it delivers a healthier, environmentally friendly, and cleaner surrounding.

Furthermore, to capitalize on the sales opportunity during the pandemic, several key players have introduced products such as steam cleaners that would be used to disinfect surroundings. The introduction of these products helped companies to increase their revenues.

Product Insights

The canister vacuum cleaner segment dominated in 2022 with a market share of more than 25%. The development of canister vacuum cleaners equipped with a HEPA filter, which has a significantly low risk of causing pulmonary side effects such as allergies and asthma, is expected to work in favor of the segment’s future growth prospects.

For instance, in February 2022, PUPPYOO, a developer and manufacturer of vacuum cleaners, launched its T12 Plus Rinse vacuum cleaner, which has the advanced feature of a 6-stage HEPA filter to prevent air pollution. This technology on the motor's rear and front sides avoids dust by trapping it as small as 0.3 microns with an attached 0.42 L magnetic bin that is easy to empty. The additional features of the vacuum cleaner include a spin mopping brush, a smart LED display and auto-adjusting suction up to 185 air watts.

The robotic segment is expected to witness an increase in demand during the next few years. New cleaning requirements and demands have emerged in response to COVID-19 to free up the human workforce so that they can attain other duties, especially in hospitals. Such demands have necessitated that the commercial sector adopts autonomous or robotic vacuum cleaners.

Features such as automatic charging, smart home trend, and voice-activated commands powered by digital voice assistants such as Amazon Alexa and Google Assistant are attracting residential clients and end-users. Moreover, advanced features such as navigation technology, voice control, and remote control, allow these devices to help users save time and reduce human assistance.

For instance, in February 2022, Midea, a prominent provider of home appliances, launched an innovative auto-dust robot vacuum cleaner, “Midea S8+,” which offers an automatic dust collection station. The device has an inbuilt LDS navigation system and a multi-map function, which allows the device to scan the whole house to clean the spaces without repeating any area. The additional feature of the vacuum cleaner includes upgraded sensors for smart detection, different cleaning modes, Wi-Fi connectivity, and voice support. It can also be connected to Google Assistant or Alexa and MSmartLife app.

Distribution Channel Insights

The online distribution channel segment held a revenue share of more than 56.0% in 2022. The growth can be attributed to the implementation of lockdown of varying stringency worldwide to curb the spread of COVID-19. Since cleaning became an essential part of the daily routine across all application sectors, companies moved to sell their products virtually.

The virtual product demonstration and selling process contributed profoundly to the segment’s growth in 2021 and is expected to remain a key contributor in 2022 as well. The need to globalize the digital sales process and create a seamless customer experience is likely to further contribute to the segment’s future growth prospects.

For instance, in February 2022, Fantasia Trading LLC (eufy), which develops smart-home devices, added its eufy cordless handheld vacuum cleaner for sale on Amazon to provide an improved and seamless customer experience. With the product being digitally sold, it has been easy for the customers to compare the performance and buy it. Amazon customers have described the eufy vacuum cleaner as the best for everyday use.

Though the revenue for offline distribution channels declined in 2020, several companies opened new distribution centers to broaden their regional presence and standardize supply chain activities. For instance, in February 2021, Dyson, a Singapore-based technology company to expand its regional presence, launched a demo retail store in Mumbai, India, to let people experience, test, and buy the product. Further, the pandemic-induced-stay at home trend-led the company to increase sales by planning to open more stores in Chennai and Bengaluru.

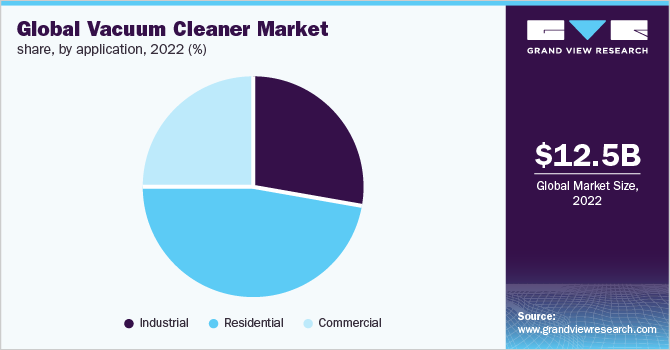

Application Insights

The residential segment dominated the vacuum cleaner market growth in 2022 by capturing a revenue share of more than 46.0%. The implementation of the WFH model across regions has confined people to their homes, necessitating the timely management of daily routine tasks. This has increased the demand for home appliances, especially cleaning equipment.

Increasing incidences of allergy and asthma caused due to the dust and dirt in residential settings, coupled with the need to keep homes disease-free, are expected to drive the demand for residential vacuum cleaners. Furthermore, the rising availability of advanced products, which can capture the tiniest of impurities efficiently, is driving the market growth in residential applications.

For instance, in March 2022, ECOVACS, a Chinese robotics company, launched its new “DEEBOT X1 OMNI,” a robotic vacuum cleaner with a natural language processing technology that takes direct command and speech without any smart device. It has an auto-cleaning station that auto washes, empty the dirt, dries the mop, and refills with clean water. The device has a large capacity of a 4L water tank and cleans the tiniest of impurities up to 360 m2, and removes 99.9% of dust particles.

COVID-19 impacted the industrial and commercial business sectors due to the long-term closure of manufacturing plants, shopping malls, restaurants, and other commercial spaces. As a result, the revenue for the industrial and commercial sectors declined in 2020. However, in the commercial sector, the hospital segment witnessed promising growth, chiefly owing to the labor shortage in hospitals and the need to maintain hygiene.

Moreover, the rising need to keep hospitals clean to avoid cross-contamination and infections and maintain a healthy environment for the medical staff, patients, and visitors is anticipated to drive the demand for vacuum cleaners. For instance, in March 2022, Creative Newtech Limited launched a robotic vacuum cleaner, “Dustor,” built with LiDAR technology.

The device maps the space and then cleans the surfaces and corners that a human eye cannot see and can also be used at any time per the set schedule and accessed from anywhere at convenience. Dustor is designed to clean the healthcare facilities to avoid infection and maintain a healthy atmosphere and higher hygiene awareness.

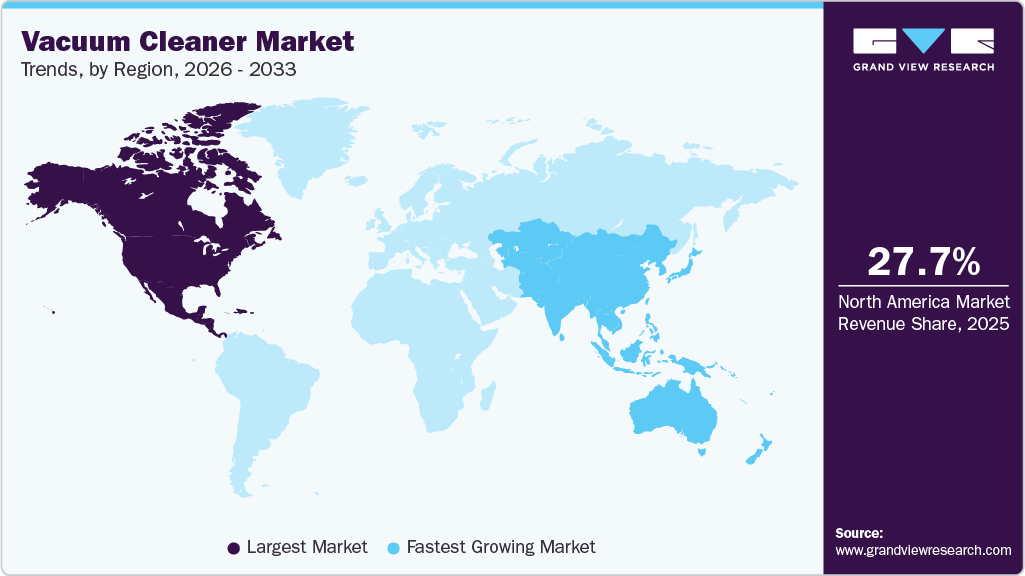

Regional Insights

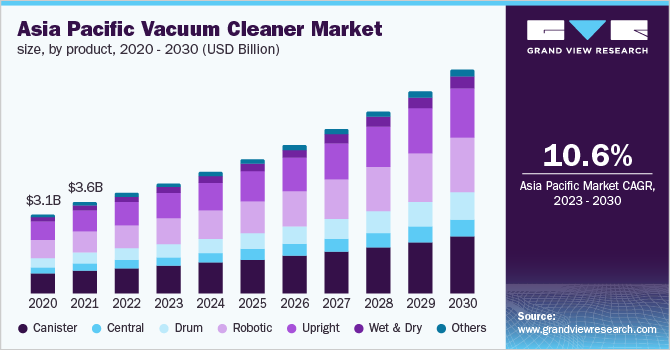

Asia Pacific dominated the global vacuum cleaner market in 2022, with China being one of the prominent markets. The strong presence of regional companies, availability of low-cost products, and the high purchasing power of consumers are some of the key factors driving demand for vacuum cleaners in the region. The increasing electrification of rural areas and the wide usability of online sales channels in developing countries such as India are aiding the demand for vacuum cleaners.

For instance, in April 2022, Panasonic Holdings Corporation, which provides consumer electronics products, launched “MC-YL633,” a dry vacuum cleaner for convenient cleaning solutions. The vacuum cleaner has an 18L dust tank capacity with a high suction power of 2000W motor and would be sold across the country at an affordable price as per the requirement of Indian consumers.

The sales of vacuum cleaners are expected to elevate globally in the near future, especially in Europe, due to the ease of lockdowns and the opening of academic institutions in major parts of the region. The need for maintaining high hygiene standards to prevent and reduce the spread of COVID-19 is expected to compel several institutions, including schools and businesses, to invest in vacuum cleaners.

For instance, in December 2021, Brain Corporation., a provider of robotic AI software, partnered with Alfred Kärcher SE & Co. KG (Karcher), a cleaning technology company, to launch “KIRA CV 60/1” an autonomous commercial vacuum cleaner. The vacuum cleaner is built with advanced features for easy cleaning and navigating; it includes cloud-connected AI software, advanced sensors and cameras, and HEPA-rated vacuum bags. “KIRA CV 60/1 is designed to vacuum in large buildings such as offices, schools, convention centers, and airports.

Several companies faced challenges in Europe in the first and second quarter of 2020 due to heavy restrictions imposed in larger consumer markets of Italy and France. Nevertheless, the revenue growth in the Asia Pacific market improved in the second half of 2020 as governments relaxed restrictions in several countries.

Key Companies & Market Share Insights

The COVID-19 pandemic has persuaded market players to restructure their businesses and operations. Dyson manufactured ventilators for COVID-19 patients. Moreover, to curb financial losses during the crisis, several players implemented pay cuts and reduced organizational headcount. The current industry trend shows OEMs focusing on developing energy-efficient, environment-friendly, and smart vacuum cleaners that are easy to use and can be remotely controlled at any time through a mobile app.

For instance, in August 2021, Viomi Technology Co., Ltd, which develops IoT-enabled home products, unveiled the “Viomi V3 Max” robot vacuum with LiDAR-based technology and environment friendly that delivers effective and efficient cleaning. The Viomi V3 Max helps remove crumbs, water stains, dirt, and dust from surfaces and floors. Further, with the help of navigation and 360° LiDAR mapping, it can store five multi-store maps and has a controllable voice feature using Alexa and Google Home.

Market players are investing heavily in research and development activities to develop and offer intelligent, portable, and lightweight vacuum cleaners. For instance, in April 2022, Guangdong Joy Intelligent Technology Co., Ltd (LeSheng Smart), a household cleaning appliances company, announced its completion of A+ financing for USD 200 million.

The funds were used for research, development, and testing centers for cleaning appliances such as car vacuum cleaners, sweeping robots, handheld vacuum cleaners, and ground cleaning tools. The practice of striking strategic partnerships with industry vendors is further helping market players in getting a competitive edge. Some of the prominent players in global Vacuum Cleaner market include;

-

Alfred Karcher SE & Co. KG

-

BISSELL Inc.,

-

CRAFTSMAN

-

DEWALT

-

Dyson

-

ECOVACS

-

Emerson Electric Co.

-

Haier Group

-

iRobot Corporation

-

Neato Robotics, Inc.

-

Nilfisk Group

-

Panasonic Holdings Corporation

-

Snow Joe LLC

Vacuum Cleaner Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13,647.3 million

Revenue forecast in 2030

USD 26.44 billion

Growth rate

CAGR of 9.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Alfred Karcher SE & Co. KG; BISSELL; CRAFTSMAN; DEWALT; Dyson; Ecovacs; Emerson Electric Co.; Haier Group; iRobot Corporation; Neato Robotics, Inc. Nilfisk Group; Panasonic Corporation; Snow Joe LLC

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vacuum Cleaner Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Vacuum Cleaner Market report based on the product, distribution channel, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Canister

-

Central

-

Drum

-

Robotic

-

Upright

-

Wet & Dry

-

Others

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Manufacturing

-

Food & Beverages

-

Pharmaceuticals

-

Construction

-

Others

-

-

Residential

-

Commercial

-

Hospital

-

Retail Stores

-

Hospitality

-

Shopping Malls

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global vacuum cleaner market size was estimated at USD 12,501.0 million in 2022 and is expected to reach USD 13,647.3 million in 2023.

b. The global vacuum cleaner market is expected to grow at a compound annual growth rate of 9.9% from 2023 to 2030 to reach USD 26.44 billion by 2030.

b. The Asia Pacific region dominated the global vacuum cleaners market in 2022, with China being one of the leading markets.

b. Key players in the vacuum cleaner market include LG Electronics; Haier Group Corp; Miele & Cie. KG; Samsung Electronics Co., Ltd.; Bissell Inc.; Panasonic Corporation; iRobot Corporation; and Koninklijke Philips N.V., among others.

b. Key factors driving the vacuum cleaner market growth include retail avenues, online channels, and effective marketing campaigns on high awareness of hygiene and the availability of model variants.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global electronics devices market (including consumer electronics and industrial electronics devices) is expected to be impacted significantly by COVID-19 as China is one of the major suppliers for the raw materials (used to manufacture devices) as well as the finished products. The industry is on the brink of facing a reduction in production, disruption in supply, and price fluctuations. While this can vastly encourage local manufacturers to step up and address the growing demand, the scarcity of raw material can still pose a challenge to this industry. The sales of prominent electronic companies is expected to be affected in the near future. The report will account for COVID-19 as a key market contributor.