- Home

- »

- Pharmaceuticals

- »

-

Vaccine Contract Manufacturing Market Size Report, 2025GVR Report cover

![Vaccine Contract Manufacturing Market Report]()

Vaccine Contract Manufacturing Market Analysis Report By Vaccine Type (Attenuated, Inactivated, Subunit, Toxoid, DNA), By Workflow (Downstream, Upstream), By Application (Human, Veterinary), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-087-3

- Number of Pages: 144

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Healthcare

Report Overview

The global vaccine contract manufacturing market size was valued at USD 1.8 billion in 2016 and is projected to grow at a compound annual growth rate (CAGR) of 9.3% from 2018 to 2025. At present, apart from the safety and effectiveness of inoculations, the number of products developed per year is also an important factor to consider while planning the manufacturing process. This is mainly due to an increase in the number of countries demanding the introduction of vaccines. The pharmaceutical industry needs to address this rising global demand to cater to the growing population of varied age groups.

This increase in demand reflects growth in awareness about vaccination and its benefits in developing countries. This has led to the expansion of routine immunization programs and the introduction of new inoculations. With a renewed understanding of the complexity and capital requirement for production, companies have begun considering contract services for vaccine manufacturing.

Massive investments in facilities, equipment, and skilled labor in countries seeking to augment or localize inoculation supply are among factors expected to positively influence the adoption of contract services. Moreover, certain low-resource countries lack equipment and skilled labor for production, which further compels them to form partnerships with contract manufacturers to meet market demand.

With a paradigm shift toward cell-based vaccine production, several contract vendors have been observed to enhance their production strategies for producing cell culture inoculations. Hence, an increased number of producers are opting for contract services owing to maturity in outsourcing services.

Growth in the number of pipeline products has boosted the demand for outsourcing services to reduce the timeline for their entry. Smaller as well as larger firms consider outsourcing a cost-effective approach to improve product pipeline and enhance their share in the biopharmaceutical industry. Hence, a robust pipeline and lack of adequate capacity are anticipated to drive the adoption of these services in the future.

However, few large firms consider outsourcing risky due to loss of strategic control and limited management control. Owing to this, large pharma companies choose to maintain their manufacturing operations in-house. This factor is expected to hinder the global adoption of contract services throughout the forecast period.

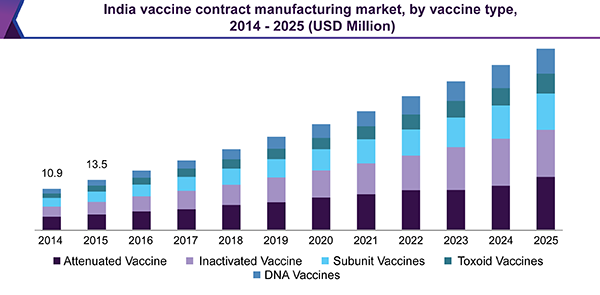

Vaccine Type Insights

Attenuated vaccines accounted for the major share owing to their ability to elicit strong cellular and antibody responses. Moreover, a relatively large number of products licensed for oral or intranasal administration are attenuated, contributing to the dominance of this segment. These offer lifetime immunities with just one or two doses. In addition, proper handling conditions, especially with respect to maintenance as well as storage, will continue to drive the segment.

Inactivated inoculations also accounted for a significant share in 2016, as these are safer and relatively more stable than other types. With several products in various phases of clinical research, DNA vaccines are expected to grow at a lucrative pace. With respect to future potential, they hold great promise in alleviating a number of illnesses. The subunit segment is anticipated to witness steady growth over the forecast period owing to ongoing research for the development of recombinant subunit vaccine against Hepatitis C virus.

Workflow Insights

Vaccine production requires skilled personnel for upstream as well as downstream processing. Contract manufacturing organizations (CMOs) are providing producers expertise and innovative technologies to accelerate the entire production chain. Between the two processes, the downstream segment dominated the market in 2016. This can be attributed to the fact that downstream processing demands robust and sophisticated equipment for efficient product recovery.

As downstream processing includes product recovery and purification steps, it requires immense attention and capital. Hence, a high requirement for enhanced biotechnological tools, capital, and skilled personnel for recovery of the vaccine as the final product is a major factor that has boosted the growth of the segment over the past years.

Downstream workflow is also driven thanks to various research initiatives being undertaken in the field. For instance, the research project conducted by the Max Plank Institute for the development of complete downstream processing for influenza virus is focused on developing chromatographic methods to ensure purity and optimal yields of vaccines.

The upstream process is expected to emerge as the fastest-growing segment in the vaccine contract manufacturing market thanks to rapid advancements in bioprocessing techniques. Moreover, the introduction of single-use technologies in upstream processing by CMOs is expected to enhance the growth of the segment.

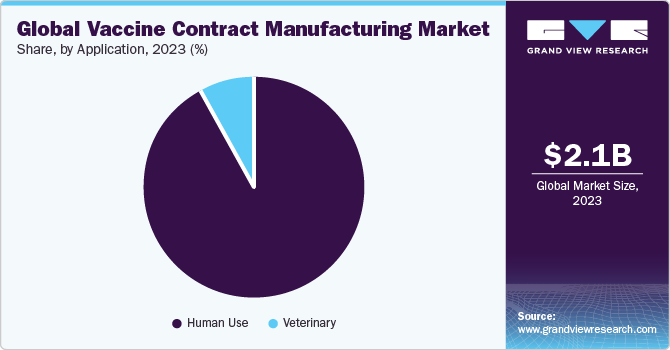

Application Insights

The usage and effectiveness of inoculations is not only limited to humans, but to animals as well. The human-use segment captured the largest share in 2016. Widespread vaccination coverage against a wide range of illnesses in humans has led to this segment acquiring the dominant spot in the market.

However, it has been observed that vaccination plays an important role in improving veterinary health as well as preventing diseases in animals. This is sure anticipated to significantly drive the use of CMOs for animal inoculation production. Vaccination reduces the need for antibiotics to treat animals. Moreover, with growth in the human population, demand for animal-based food continues to grow. Hence, the importance of vaccination in the meat-production industry is also expected to increase. These factors are likely to stoke the growth of the segment.

Regional Insights

North America accounted for the largest share in this market mainly due to the widespread manufacturing of vaccines in the region, coupled with the growing presence of a substantial number of biopharmaceutical facilities. State and other laws pertaining to the development of vaccines and other biologics in North America, particularly in the U.S. and Canada, are expected to significantly impact the progress of contract manufacturing organizations (CMOs) and contract research organizations (CROs) in the field.

The Asia Pacific market for contract manufacturing organizations and contract research organizations involved in the development of inoculations is growing at a significant pace. APAC is also expected to emerge as the fastest-growing regional market for research, development, and manufacturing of inoculations. This can be attributed to factors such as recent regulatory changes, improving infrastructure in several developing countries, and the presence of numerous potential study subjects.

Key Companies & Market Share Insights

Some of the key market players are Lonza; FUJIFILM Diosynth Biotechnologies U.S.A., Inc.; Ajinomoto Althea, Inc.; Merck KGaA; Cytovance Biologics; Catalent, Inc.; IDT Biologika GmbH; Albany Molecular Research, Inc.; PRA Health Sciences; ICON plc.; Pharmaceutical Product Development, LLC; Cobra Bio; and Paragon Bioservices, Inc.

Acquisition of emerging and small players and facility expansion are among key business strategies likely to be undertaken by these companies to retain as well as enhance their share in the market over the forecast period.

Recent Developments

-

In July 2023, Merck announced the expansion of its lab space and production capacity to manufacture cell culture media in Lenexa, Kansas, U.S. It also planned to further accelerate the manufacturing of new dry powder media utilized in processes such as vaccine manufacturing, gene therapy, and others.

-

In June 2023, FUJIFILM Corporation announced the opening of its commercial office in Tokyo. The facility was aimed at providing enhanced sales and customer support services for contract development and manufacturing services for biologics and advanced therapies to Asia-based pharmaceutical and biotechnology companies.

-

In June 2023, Lonza acquired Synaffix B.V. for the development of antibody-drug conjugates (ADCs). The acquisition was aimed to strengthen Lonza’s bioconjugates offering integrated with Synaffix’s technology. It was planned to further expand their Center of Excellence for bioconjugate technology development.

-

In June 2023, Lonza and Vertex Pharmaceuticals Incorporated announced a strategic partnership to scale up manufacturing and support commercial production of Vertex’s T1D cell therapy portfolio. They planned to further co-invest to build a dedicated new facility in Portsmouth, New Hampshire (US).

-

In April 2023, FUJIFILM Diosynth Biotechnologies announced the acquisition of 41 acres of land adjacent to its existing state-of-the-art campus in Research Triangle Park (RTP), North Carolina. The new facility was developed with the objective of accelerating production capability for manufacturing and development of biologics.

-

In March 2023, Cytovance Biologics, Inc. collaborated with Phenotypeca Limited to provide optimised Saccharomyces cerevisiae strains for biopharmaceutical manufacturing. The partnership accelerated Cytovance Biologics’ leadership in manufacturing microbial-derived active pharmaceutical ingredients (API) and expanded Phenotypeca’s commercial reach.

-

In March 2023, IDT Biologika collaborated with CanVirex, a biotechnology company for the development of an anti-cancer therapeutic treatment. The collaboration was aimed at manufacturing the oncolytic measles virus-based therapeutics under cGMP conditions by utilizing IDT’s state-of-the-art manufacturing infrastructure.

-

In January 2023, Ajinomoto Co., Inc. entered into an agreement with Exelixis, Inc. to discover and develop novel Antibody-Drug Conjugates for the treatment of cancer. The Exelixis was aimed at utilizing Ajinomoto’s AJICAP technology to develop advanced multiple ADCs with higher efficacy and lower toxicity.

-

In January 2023, Catalent signed a development and license agreement with Ethicann Pharmaceuticals Inc. to develop Ethicann’s clinical drug pipeline using Catalent’s Zydis® orally disintegrating tablet (ODT) technology. This was aimed to ensure improved patient acceptance and convenience.

-

In December 2022, Merck collaborated with Mersana Therapeutics, Inc. to discover novel ADCs utilizing Mersana’s Immunosynthen STING-agonist ADC platform. The collaboration was planned with the intent to extend the reach of Mersana’s Immunosynthen platform with the potential to benefit patients

Vaccine Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.8 billion

Revenue forecast in 2025

USD 4.0 billion

Growth Rate

CAGR of 9.3% from 2017 to 2025

Base year for estimation

2016

Historical data

2014 - 2016

Forecast period

2017 - 20265

Quantitative units

Revenue in USD million and CAGR from 2017 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Vaccine type, workflow, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; France; China; India; Brazil; South Africa

Key companies profiled

Lonza; FUJIFILM Diosynth Biotechnologies U.S.A., Inc.; Ajinomoto Althea, Inc.; Merck KGaA; Cytovance Biologics; Catalent, Inc.; IDT Biologika GmbH; Albany Molecular Research, Inc.; PRA Health Sciences; ICON plc.; Pharmaceutical Product Development, LLC; Cobra Bio; Paragon Bioservices, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global vaccine contract manufacturing market report on the basis of vaccine type, workflow, application, and region:

-

Vaccine Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Attenuated

-

Inactivated

-

Subunit-based

-

Toxoid-based

-

DNA-based

-

-

Workflow Outlook (Revenue, USD Million, 2014 - 2025)

-

Downstream

-

Fill & Finish Operations

-

Analytical & QC studies

-

Packaging

-

-

Upstream

-

Mammalian Expression Systems

-

Bacterial Expression Systems

-

Yeast Expression Systems

-

Baculovirus/Insect Expression Systems

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Human Use

-

Veterinary

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Multiple therapeutic regimens are being followed across the globe in attempts to come up with a reliable treatment for Covid-19. One line of treatment includes the use of hydroxychloroquine, while a second treatment line focuses to use antiviral drugs used in the disease management of HIV. Both these approaches have surged demand from advanced antivirals and antimalarial drugs. This impacts the drug manufacturers as an off label indication for these drug classes has to be worked upon. At the moment, the WHO has not prescribed any of these approaches, neither they have commented if one is better than the other. The report will account for Covid19 as a key market contributor.