- Home

- »

- Advanced Interior Materials

- »

-

U.S. UPF Sun Protective Clothing Market Size Report, 2030GVR Report cover

![U.S. UPF Sun Protective Clothing Market Size, Share & Trends Report]()

U.S. UPF Sun Protective Clothing Market Size, Share & Trends Analysis Report By Product (Hats & Caps, Shirts, T-shirts, Jackets, & Hoodies, Pants & Shorts, Swimwear), By End-use (Men, Women), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-106-1

- Number of Pages: 169

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Market Size & Trends

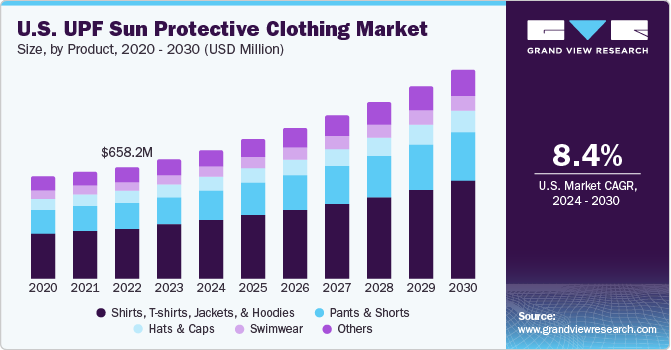

The U.S. UPF sun protective clothing market size was estimated at USD 658.2 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. The market is expected to witness growth due to the rising prevalence of skin cancer in the U.S. Increasing awareness regarding the benefits of using UPF sun-protective clothing to avoid the harmful effects of UV exposure is expected to drive the market growth. According to the U.S. Department of Health & Human Services, skin cancer is the most common form of cancer in the country. The most common types of skin cancer cases reported in the U.S. are basal cell and squamous cell carcinoma. The rapidly rising cases of melanoma over the past few decades have been a concern in the U.S.

Significantly, for females above the age of 50 years, the number of patients diagnosed with this disease increased by 1% each year in the country from 2015 to 2019. Excessive exposure to UV radiation and the use of indoor tanning treatment methods increase the risk of skin cancer. These factors have surged the demand for UPF sun-protective clothing in the U.S., thereby leading to the growth of the market in the country.

The research activities conducted by government organizations and cancer foundations show that most skin cancers among citizens of the U.S. and deaths caused by the same are due to overexposure to UV radiation. These are preventable if adequate measures are taken by the masses. Using sunscreens that block the UV rays is ideal to prevent skin cancer. However, sunscreens wear off after some time and require to be reapplied frequently over the day as directed by the sunscreen manufacturers. Therefore, consumers prefer sun-protective clothing as an alternative to sunscreens that have significant adoption potential in the U.S. over the forecast period. The rising number of skin cancer cases in the country primarily drives the growth of the market in the U.S.

Rapid technological advancements in medical science have increased awareness among the masses in the U.S. regarding the harmful effects of the sun. Moreover, it has led to a surge in demand for sun-protection methods such as applying sunscreens on the body and wearing UPF sun-protective clothing in the country. For instance, Patagonia has utilized UV-resistant coatings on some of its garments to enhance their sun protection capabilities while maintaining their performance and appearance. Innovations in nanotechnology have enabled companies like Patagonia to apply micro-sized particles to fabrics, providing enhanced UV protection without compromising comfort and breathability.

In conclusion, the U.S. market is characterized by constant technological advancements that enhance the UV-blocking capabilities, comfort, and aesthetics of these garments. It is a result of rising consumer awareness of risks associated with UV radiation, and technology-driven approaches that will likely remain at the forefront of this growing market over the forecast period.

According to the data provided by the Skin Cancer Foundation, the annual expenditure for treating skin cancer in the U.S. is estimated to reach approximately USD 8.1 billion in 2023. This significant financial burden encompasses approximately USD 4.8 billion allocated for nonmelanoma skin cancer cases and approximately USD 3.3 billion designated for the treatment of melanoma. Consequently, high medical expenditure costs in the U.S. are prompting the masses to in safeguarding their skin from the harmful effects of the sun. This, in turn, contributes to the demand for sun-protective clothing in the U.S. as it acts as an effective and convenient solution.

Product Insights

In terms of product, the shirts, t-shirts, jackets, and hoodies segment held the largest market share of 45.0% in 2022. Shirts, t-shirts, jackets, and hoodies offer high coverage and protection for the torso from harmful sun rays. Moreover, sun protection products, such as sunscreen, which are usually greasy, lead to discomfort for end-users. Furthermore, mineral-based chemical-free sunscreen products with better efficiency that offer protection against prolonged exposure to harmful sun rays are expensive.

However, sun-protective apparel such as t-shirts, shirts, hoodies, and jackets provide sun protection without any hassle and are comparatively cheaper. These products offer comfort, wearing ease, and additional protection from sun rays during daytime outdoor activities. Increasing consumer inclination for stylish clothing with enhanced performance & comfort is driving UPF sun protective clothing manufacturers to invest heavily in R&D for optimum product offerings.

The pants & shorts segment is anticipated to grow at a CAGR of 8.4% over the forecast period. UPF sun protective clothing products, such as pants and shorts, are more beneficial than sunscreen owing to their ease, comfort, and effectiveness when exposed to harmful sun rays. For instance, according to The Skin Care Foundation, over 9,500 people are diagnosed with skin cancer every day. Furthermore, the number of deaths related to melanoma cases has increased by 4.4% in 2023. Thus, increasing skin cancer can further drive the demand for pants & shorts over the projected period.

A majority of these products are resistant to chlorine and salt water and help keep the wearer cool in a hot environment. Increased awareness regarding the serious impact of harmful sun rays leading to illnesses, such as skin cancer, is encouraging the market players to offer innovative and advanced products to customers. This, in turn, is anticipated to propel the product demand in the U.S. over the forecast period.

Hats & caps are used for face and neck protection against harmful sun rays. These products are available in various types, including visors, wide-brim hats, everyday hats, traveler hats, explorer hats, and shade caps, and in a wide range of colors, sizes, and design specifications. The aforementioned factor is likely to propel the product demand in the U.S. over the forecast period.

End-use Insights

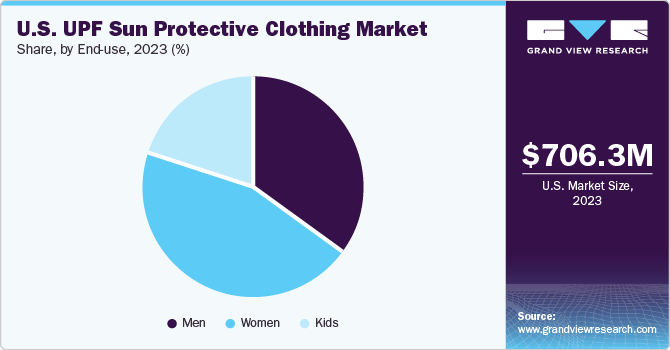

In terms of end-use, the women's segment held a revenue share of 45.0% in 2022 in the U.S. This can be attributed to increased awareness regarding the harmful effects of UV rays on human skin and the availability of a wide range of stylish sun-protective clothing options. The market offers a diversified range of products such as shirts, t-shirts, pants, shorts, gloves, arm protector sleeves, swimwear, face masks, and hoodies. These aforementioned factors are anticipated to propel the market growth over the forecast period.

As per the American Cancer Society, skin cancer cases among women increased from 39,200 cases in 2018 to 42,120 cases in 2023. Furthermore, the number of lymphoma cases also increased from 39,930 cases in 2021 to 40,320 cases in 2022. Increasing cases of skin cancer are anticipated to propel the U.S. market over the forecast period. In addition, according to the American Academy of Dermatology Association 2022 report, women had a rapid rise in skin cancer cases than men. These aforementioned factors are anticipated to further propel the market growth over the forecast period.

The men's segment is anticipated to register a CAGR of 8.4% from 2023 to 2030 on account of increased awareness regarding the advantages of using sun-protective apparel. The segment is likely to propel owing to increasing product variation in sun-protective apparel for men in terms of patterns, designs, colors, and sizes.

The kids segment is anticipated to witness the fastest CAGR of 8.8% over the forecast period. Increasing instances of sunburn among children on account of overexposure to harmful UV rays are anticipated to augment the demand for UPF sun-protective clothing in the U.S. over the forecast period. Kid's segment offers products that are widely available for girls, boys, and babies. UPF sun protective products, such as sunscreen, usually contain chemicals that can be harmful to the sensitive skin of kids and toddlers. Increasing awareness among parents regarding the benefits of using UPF sun protective apparel for their kids during various outdoor activities, such as beachside relaxing, casual outings, traveling, and playing, is anticipated to propel the product demand in the U.S.

Key Companies & Market Share Insights

Key companies in the U.S. market continuously adopt new business strategies, actively launch innovative and technologically advanced products, and collaborate with other players and government authorities. Key players in the UPF sun protective clothing market include Coolibar Sun Protective Clothing, Columbia Sportswear Company, Coolibar Inc., and Cabana Life. These market players employ different strategies, such as mergers & acquisitions, introducing new products, and geographic expansion, to strengthen their market presence.

For instance, in June 2023, Claudent launched new stylish UPF clothing that offers sun protection. The clothing fabric has a UPF 50 rating, which blocks 98% of the sun’s UV rays and allows only 2% penetration. Regular T-shirts, on the other hand, allow 20% of UV radiation to reach the skin. Some prominent players in the U.S. UPF sun protective clothing market include:

-

Coolibar Sun Protective Clothing

-

Summerskin

-

Solumbra

-

UV Skinz, Inc.

-

Solbari Sun Protection

-

Cabana Life

-

Columbia Sportswear Company

-

Little Leaves Clothing Company

-

IBKUL

-

Nozone Clothing US

U.S. UPF Sun Protective Clothing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.23 billion

Growth rate

CAGR 8.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments Covered

Product, end-use

Country Scope

U.S.

Key companies profiled

Coolibar Sun Protective Clothing; Summerskin; Solumbra; UV Skinz, Inc.; Solbari Sun Protection; Cabana Life; Columbia Sportswear Company; Little Leaves Clothing Company; IBKUL; Nozone Clothing US

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. UPF Sun Protective Clothing Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. UPF sun protective clothing market report based on product, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hats & Caps

-

Shirts, T-shirts, Jackets, & Hoodies

-

Pants & Shorts

-

Swimwear

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Kids

-

Frequently Asked Questions About This Report

b. U.S. UPF sun protective clothing market size was estimated at USD 658.2 million in 2022 and is expected to reach USD 706.3 million in 2023.

b. U.S. UPF sun protective clothing market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.2% from 2023 to 2030 to reach USD 1.23 billion by 2030.

b. The shirts, t-shirts, jacket, and hoodies product segment of the product held the largest market share of 45.0% in 2022. Shirts, t-shirts, jackets, and hoodies, offer high coverage and protection for torso from harmful sun rays.

b. Some of the key players operating in U.S. UPF sun protective clothing market include Coolibar Sun Protective Clothing, Summerskin, Solumbra, UV Skinz, Inc., Solbari Sun Protection, Cabana Life, Columbia Sportswear Company, Little Leaves Clothing Company, IBKUL, Nozone Clothing US.

b. Key factors that are driving the U.S. UPF sun protective clothing market growth include increasing prevalence of skin cancer and other skin related diseases, dyes, fabrics, stretch & weaving of the garment, and treatments, weight, and wetness of the apparel.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The shortage in supply of raw materials from Chinese manufacturers has resulted in a severe demand-supply gap. The manufacturers are further expected to be stranded on raw material orders owing to the logistics industry being significantly impacted due to lockdown amid COVID-19. However, the producers are expected to move away from China aiming to reduce the future risks that would affect the business and to reduce the manufacturers' cluster in a single country in order to smoothen the supply chain. The report will account for Covid19 as a key market contributor.