- Home

- »

- Advanced Interior Materials

- »

-

U.S. Textile Market Size, Share And Trends Report, 2030GVR Report cover

![U.S. Textile Market Size, Share & Trends Report]()

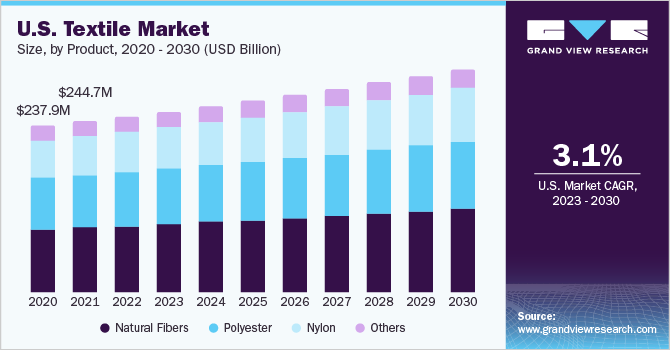

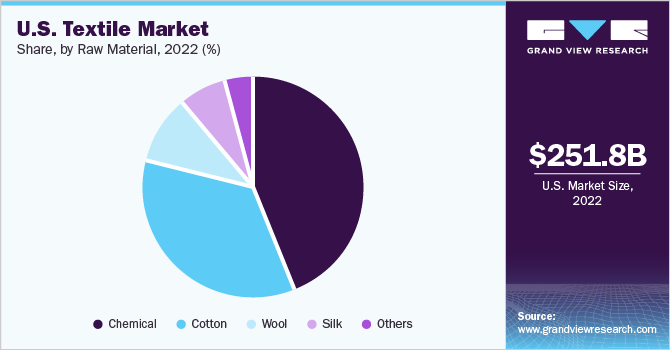

U.S. Textile Market Size, Share & Trends Analysis Report By Raw Material (Cotton, Wool, Silk), By Product (Natural Fibers, Polyester, Nylon), By Application (Household, Technical, Fashion), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-115-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The U.S. textile market size was estimated at USD 251.79 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.1% from 2023 to 2030. Fashion is gaining increasingly higher importance in the lifestyle of consumers. This can be attributed to the constant exposure to advertisements that results in impulsive buying among consumers, which is contributing to the growth of the textile market in the U.S. Fashion brands are exploring alternatives for traditionally used standard materials. This is due to frequent exposure to marketing, which causes impulsive purchases. Companies are investing heavily in R&D focused on material science for innovative fibers, fabrics, and textiles, among others, to design and manufacture enhanced fashionable clothing that serves additional purposes such as moisture resistance, odor resistance, and others.

Fashion brands launch stylish clothes specific to venues such as airport wear, swimwear, casual wear, and party wear. This is anticipated to result in increased production of apparel & clothing, thereby driving the demand for textiles in the U.S.

Additionally, the rising importance of employee safety at the workplace is considered to be the driving force for the growth of the personal protective textile market in the U.S. In addition, various rules and regulations have been issued by governments related to employee safety and wellness. Mandatory policies implemented by agencies for companies to maintain the safety of workers in industries are projected to fuel the demand for protective textiles. These regulations mention the type of protective textile required for protection in different industrial or commercial settings.

However, the manufacturing of textile products has the potential to impact the environment negatively. Increased use of chemicals, generation & disposal of waste, increased use of water, and emission of carbon dioxide are factors resulting in rising environmental pollution in the U.S. Water consumption by the clothing and apparel manufacturing industries is high and is estimated to cause stress on the available natural resource. In addition, the increasing amount of carbon dioxide emitted from the textile industries is estimated to pose a threat to the environment. Consequently, the implementation of stringent environmental safety norms by the U.S. government is likely to restrain the expansion of the textile market in the U.S. over the forecast period.

Natural fibers include cotton, linen, flax, silk, hemp, and wool. They are biodegradable and renewable, and hence, are eco-friendly. Surging demand for natural fibers from the apparel and fashion industries is expected to be the key driver for the growth of the natural fibers segment of the U.S. textile market over the forecast period.

Product Insights

Based on product, the U.S. textile industry is categorized into natural fibers, polyester, nylon, and others. The natural fiber segment led with the highest revenue share of 38.0% in 2022. Good drape, excellent luster, and increased softness offered by natural fibers are expected to play a key role in their increasing usage in manufacturing fabric worldwide. However, these fibers are costlier than synthetic fibers. This can act as an obstacle to the growth of the natural fibers segment.

Natural fibers are derived from animals, vegetables, and minerals and are knitted, woven, or bonded to form fabrics. As such, they are not harmful to the environment and are not dependent on petroleum and fossil fuels for their development, which is expected to increase the demand for natural fibers over the coming period.

The nylon segment is expected to grow at the highest CAGR of 3.5% over the forecast period. It has high resilience, superior elasticity, excellent luster, and low moisture absorbency. As such, it is used in apparel, home furnishing, and many other applications. Surging demand for synthetic fibers from the textiles industry is expected to be one of the major factors driving the growth of the nylon segment in the U.S. market.

The others segment is further categorized into spandex, acrylic fibers, and microfibers, as well as polyethylene (PE)-, polypropylene (PP)-, aramid-, and polyamide-based fibers. These fibers are processed to produce fabrics that are further used to develop different types of clothes and apparel. They exhibit superior strength, excellent smoothness and softness, and increased elasticity.

Application Insights

Based on application, the fashion segment led the market with the largest revenue share of 75.7% in 2022. This segment is further categorized into purses, ties & clothing accessories, and clothes. In the upcoming years, the rise of the fashion section of the U.S. textile market is anticipated to be driven by customers' rising desire for crease-free suits and shirts as well as high-quality dyed and printed materials.

Apparel was the leading segment in the fashion textile industry in the U.S. in 2022. The growth of this segment of the market can be attributed to the constantly increasing adoption of casual wear, formal wear, and fashionable clothes by consumers of all age groups across the country. Denim, lycra, cotton, silk, and polyester fabrics are highly increasingly for manufacturing fashion textiles and clothing.

Textiles are used to manufacture a wide array of ties & clothing accessories such as belts, scarves, mufflers, handkerchiefs, hats, caps, gloves, and cufflinks. The segment is mainly divided into hosiery, socks, sportswear, underwear, handbags, and others. The change in consumer preferences, especially in the men’s fashion industry, regarding the use of thin and printed ties and low-cost accessories is expected to positively influence the growth of this segment over the forecast period.

The technical application segment is expected to grow at the fastest CAGR of 3.9% from 2023 to 2030. The demand for technical textiles in the U.S. is driven by the rising need for high-performance and energy-efficient textiles and strict government restrictions regulating performance in various applications. Numerous end-use industries, such as automotive, aerospace, marine, protective gear, medical, and construction, are seeing a growing uptake of technical textiles. Because these businesses demand a number of technical benefits in textiles that standard textiles may not provide.

Raw Material Insights

Based on raw material, the U.S. textile market is segmented into cotton, chemical, wool, silk, and others. The chemical segment led with the largest revenue share of 44.3% in 2022 and is anticipated to grow at a significant CAGR in the forthcoming years.

Chemicals play an important role in the fabric industry. Notably, fabrics made with 100% natural fibers contain around 27% chemicals by weight. Acetic acid, oxalic acid, sulfuric acid, and soda ash are some of the chemicals used in the textile industry. These chemicals are categorized as pretreatment chemicals, textile dyeing chemicals, printing chemicals, finishing chemicals, and antistatic agents. They can be used on both, natural as well as synthetic fibers, as dyeing and finishing agents to improve their appearance. The growing importance of the aesthetic appeal of clothes is expected to drive this segment.

The silk segment is projected to grow at the highest CAGR of 5.1% over the forecast period. Silk is considered to be the most luxurious fabric exhibiting high luster. Besides, properties such as high strength, elasticity, and absorbency have made silk one of the widely used materials in the textile market. According to the International Sericultural Commission, China, India, Uzbekistan, and Brazil were the major producers of silk, while the U.S., Italy, and Japan were the major consumers of silk.

Key Companies & Market Share Insights

The textile market in the U.S. is intensely competitive, with companies increasing their product portfolio and expanding their production capacity to serve the increasing demand, particularly in developing regions. However, the industry’s fragmented nature is expected to prevent investments by prospective companies over the forecast period.

Companies including INVISTA S.R.L. adopted expansion strategies to strengthen their market position and have a competitive edge over others. For instance, in December 2021, Huesker Group announced a partnership with ABB, a technology pioneer with headquarters in Switzerland, to automate its geotextile production process. These robots will help with tasks such as handling and palletizing heavy yarn reels. The demand for geosynthetic textiles in the U.S. has been expanding rapidly as a result of innovations and developments. Some prominent players in the U.S. textile market include:

-

INVISTA S.R.L.

-

IBENA Inc.

-

Belton Industries, Inc.

-

Dewitt

-

TenCate

-

Mogul Co., Ltd.

-

Siang May Pte Ltd.

-

terrafix Geosynthetics

-

HUESKER International

-

Morenot

U.S. Textile Market Report Scope

Attribute

Details

Market size value in 2023

USD 259.15 billion

Revenue forecast in 2030

USD 320.40 billion

Growth rate

CAGR of 3.1% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, volume in million tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

U.S.

Segments covered

Raw materials, product, application

Key companies profiled

INVISTA S.R.L.; IBENA Inc.; Belton Industries, Inc.; Dewitt; TenCate; Mogul Co., Ltd.; Siang May Pte Ltd.; terrafix Geosynthetics; HUESKER International; Morenot

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Textile Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. textilemarket report based on product, raw material, and application:

-

Product Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Natural Fibers

-

Polyester

-

Nylon

-

Others

-

-

Raw Material Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Cotton

-

Chemical

-

Wool

-

Silk

-

Others

-

-

Application Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Household

-

Bedding

-

Kitchen

-

Upholstery

-

Towel

-

Others

-

-

Technical

-

Construction

-

Transportation

-

Protective

-

Medical

-

Others

-

-

Fashion

-

Apparel

-

Ties & Clothing

-

Handbags

-

Others

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. textile market size was estimated at USD 251.79 billion in 2022 and is expected to reach USD 259.15 billion in 2023.

b. The U.S. textile market is expected to grow at a compound annual growth rate of 3.1% from 2023 to 2030 to reach USD 320.40 billion by 2030.

b. Fashion application dominated U.S. textile market with a share of 75.7% in 2022 owing to increasing disposable income among the middle income population in the U.S.

b. Some of the key players operating in the U.S. textile market include INVISTA S.R.L., IBENA Inc., Belton Industries, Inc., Dewitt, TenCate, Mogul Co., Ltd., Siang May Pte Ltd., terrafix Geosynthetics, HUESKER International, and Morenot

b. The key factor which is driving U.S. textile market is increasing use of textile in application such as technical and fashion applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."