- Home

- »

- Advanced Interior Materials

- »

-

U.S. Steel Merchant And Rebar Market Size Report, 2020-2027GVR Report cover

![U.S. Steel Merchant And Rebar Market Size, Share & Trends Report]()

U.S. Steel Merchant And Rebar Market Size, Share & Trends Analysis Report By Product (Merchant Bar, Rebar), By Application (Construction, Infrastructure, Industrial), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-137-3

- Number of Pages: 75

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Advanced Materials

Report Overview

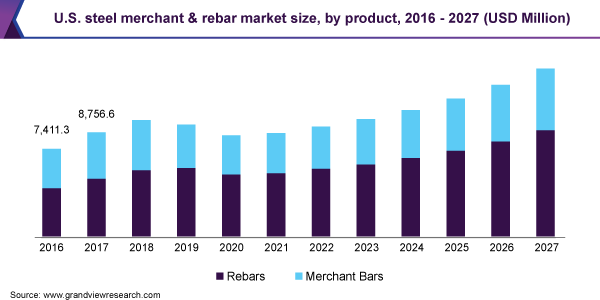

The U.S. steel merchant and rebar market size was valued at USD 9.4 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2020 to 2027. Increased focus on infrastructure development through public & private investments in the U.S. is likely to drive the market in the long run. In 2020’s economic budget, the U.S. government announced plans to invest nearly USD 1 trillion for the improvement of infrastructure under the long-term surface transportation reauthorization bill. Products, such as rebars and merchant bars, are used in the construction of highways, bridges, water systems, warehouses, airports, etc.

The outbreak of COVID-19 has brought economic disruptions in the U.S. Governments and various businesses have taken essential steps through the reduction of personal interactions to mitigate the risks associated with it. However, due to the halting of various business activities and weak performance of end-use sectors, the product demand is expected to witness a decline of 5.6% in 2020.

However, in the long run, the market is expected to grow with moderate momentum. As per the Congressional Budget Office, the degree of social distancing is projected to decline by over 60% in the second half of 2020 from April 2020 peak. This, in turn, is likely to assist in social activities and increase production in the manufacturing industry.

Also, the long-term outlook of the U.S. economy looks positive and economic output is anticipated to observe a growth of 2.1% from 2025 to 2030. This is projected to push the demand for building materials in the construction sector over the forecast period.

U.S Steel Merchant And Rebar Market Trends

The U.S. economic growth heavily relies on its huge infrastructure industry. In recent years, rising maintenance costs of infrastructure have affected the country’s economic growth. Several civil engineers in the country have raised issues regarding bridges and water infrastructure safety. The rising demand for the up-gradation and modernization of the infrastructure has pushed the government to increase its spending on infrastructure.

For instance, in November 2021, the U.S. Congress passed a Bipartisan plan to upgrade the infrastructure of the U.S. such as airports, water systems, power infrastructure, railways, roadways, and bridges. This USD 1 trillion up-gradation plan is anticipated to be finished by 2025, which is expected to augment the consumption of steel merchant & rebar in the country across the forecast period

Similarly, growing investment in the construction industry by the government and the private players has propelled the construction activities in the country. In February 2022, the overall construction spending in the U.S. was USD 1,704 billion, which is 11.2% higher than in February 2021. The expansion of the construction industry is expected to be a key contributor to the rapid growth of the steel merchant & rebar market in the country.

Owing to the increase in demand for the steel rebar in the country, key players in the steel industry are investing to set up new plants. For instance, in April 2022, Nucor Steel announced that they are planning to invest USD 350 million to set up a new steel rebar plant in North Carolina, U.S. The expansion in production indicates rising product demand in the country.

Several organizations, private companies, and research institutes are engaged in developing solutions to increase the life span of structures in order to reduce the manufacturing cost of structures. This is projected to positively aid the demand for fiber reinforced polymer rebars (FRP). FRP rebars can reduce the life-cycle & maintenance cost and improve the life expectancy of structures. FRP rebars have observed a slow but positive demand in the country.

Steel rebars can be replaced with FRP rebars owing to their higher lifespan and increasing metal processing costs over the coming years. For instance, as per FRP manufacturer Pultron Composites, Sydney North Side Storage Tunnel was projected to have a lifespan of 60 years in harsh conditions using steel rebars. However, after redesigning with FRP rebars, its lifespan rose to 100 - 110 years.

Product Insights

Rebars was the largest segment in 2019 and accounted for a volume share of over 60% in 2019. Mild and deformed are two types of rebars, which are used in construction applications to provide reinforcement and support to structures. Mild steel rebars are now increasingly replaced with deformed ones, as these products exhibit high strength and are useful in increasing the lifespan and strength of construction structures.

Deformed steel rebars have better malleability and ductility, toughness, high yield strength, corrosion, and earthquake resistance. These products are economical and have a wide range of applications, including industrial structures, commercial and residential buildings, and bridges, among others.

In terms of revenue, the merchant bars segment is projected to witness a growth rate of 4.5% from 2020 to 2027. Merchant bars include angles, channels, flats, rounds, and beams and are used in structural applications in the construction sector as well as in automotive, shipbuilding, rail, appliances, heavy machinery, mining, agriculture, tools, and original equipment manufacturing.

Application Insights

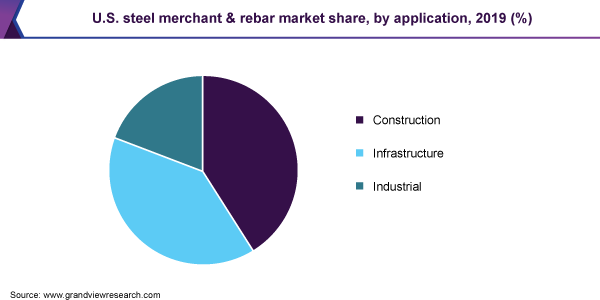

The construction application accounted for a revenue share of over 41% in 2019. Short-term estimates by the American Institute of Architects indicate an 11% y-o-y decline in non-residential construction in the U.S. The demand for merchant & rebars is expected to decline in 2020 on account of the halting of construction activities in the first half of 2020 due to the widespread outbreak of COVID-19.

However, the market is likely to witness moderate recovery in the second half of 2020 on account of acceleration in residential construction activities. For instance, in July 2020, total housing production in the U.S. increased by 22.6% from the previous month. This was also supported by low interest rates and an increase in the number of buyers in low-density areas.

The development of infrastructure plays a crucial role in the economic growth of the U.S. The Department of the Treasury in the U.S. carried out a study of 40 key proposed infrastructure projects to substantiate the economic importance of infrastructure. As per this study, the completion or availability of these 40 projects can provide economic benefits of up to USD 500 billion to 1 trillion to the country.

Country Insights

The U.S. is expected to register a CAGR of 5.2% in terms of revenue from 2020 to 2027 The growth is attributed to the large-scale investment in the infrastructure and residential & commercial construction in the country by the government & private players, which is anticipated to increase consumption of the steel merchant and rebar in the country from 2020 to 2027.

Rising demand from the commercial and residential sectors is inspiring construction firms to enhance their presence in the south region of the U.S. This is expected to fuel the demand for steel merchant & rebar market in the country over the forecast period.

Texas is the key state in the southern U.S. Rising investment in the infrastructure industry is expected to propel the demand for steel merchant and rebar in the state. For instance, in November 2021, the U.S. government announced that Texas is going to receive USD 35.44 billion over five years for infrastructure development.

The Northeast U.S region is characterized by extensive urbanization, a high population, and high per capita spending. The maturing infrastructure in the region has pushed the need for its up-gradation and renovation, which is expected to propel the demand for steel merchant & rebar in the region over the coming years.

Key Companies & Market Share Insights

Key players in the market are devising strategies to enhance their capacities through mergers & acquisitions. For instance, in July 2020, CMC Steel completed the acquisition of AZZ’s rebar business. AZZ produces galvanized rebar, which is known as ‘GalvaBar’. This product is produced using galvanization of zinc coating on the final product. This move is projected to assist the former to improve its market share in concrete reinforcement. Some of the prominent players in the U.S. steel merchant and rebar market include:

-

Gerdau S.A.

-

Nucor

-

CMC Steel

-

Steel Dynamics Inc.

-

Schnitzer Steel Industries, Inc.

-

Nippon Steel Corp.

-

JFE Steel Corp.

U.S. Steel Merchant And Rebar Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 8.5 billion

Market volume in 2020

13,674.2 kilotons

Revenue forecast in 2027

USD 14.1 billion

Volume forecast in 2027

19,939.5 kilotons

Growth Rate

CAGR of 5.2% from 2020 to 2027 (Revenue-based)

Base year for estimation

2019

Actual estimates/Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2020 to 2027

Report coverage

Revenue and volume forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Gerdau S.A.; Nucor; CMC Steel; Steel Dynamics, Inc.; Schnitzer Steel Industries, Inc.; Nippon Steel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the U.S. steel merchant and rebar market report based on product and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Rebars

-

Merchant Bars

-

Angles

-

Channels

-

Rounds

-

Flats

-

Beams

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Construction

-

Infrastructure

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. steel merchant & rebar market size was estimated at USD 9,438.4 million in 2019 and is expected to reach USD 8,533.7 million in 2020.

b. The U.S. steel merchant & rebar market is expected to grow at a compound annual growth rate of 5.2% from 2020 to 2027 to reach USD 14,143.1 million by 2027.

b. Construction dominated the U.S. steel merchant & rebar market with a volume share of 40.4% in 2019, owing to long term demand for rebars in single and multi-family dwellings.

b. Some of the key players operating in the U.S. steel merchant & rebar market include Nucor, Gerdau S.A., Nippon Steel Corporation, JFE Steel Corporation, and CMC Steel.

b. The key factors that are driving the U.S. steel merchant & rebar market include increased focus of local and regional governments to improve the country’s infrastructure and moderate but study growth in the residential construction sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."