- Home

- »

- Advanced Interior Materials

- »

-

U.S. Residential Remodeling Market Size & Share ReportGVR Report cover

![U.S. Residential Remodeling Market Size, Share & Trends Report]()

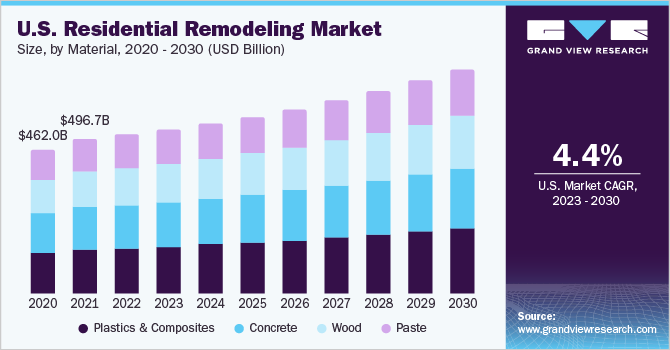

U.S. Residential Remodeling Market Size, Share & Trends Analysis Report By Material (Wood, Metal, Plastics & Composites, Concrete), By Application (Flooring, Walls, Ceilings), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-056-5

- Number of Pages: 76

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

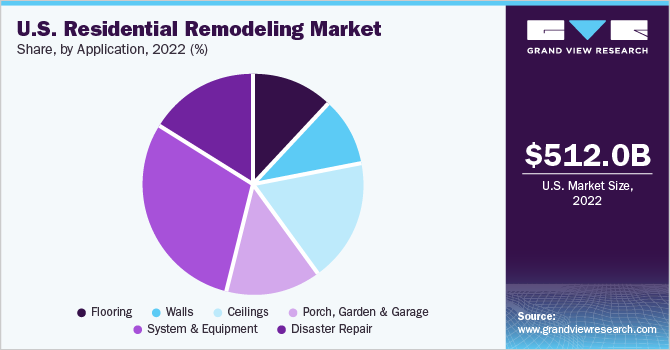

The U.S. residential remodeling market size was estimated at USD 512.01 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 4.4% from 2023 to 2030. The rising disposable income of residential homeowners and the shift toward aesthetically pleasing housing components are expected to drive market growth. Additionally, the shifting focus toward home automation systems, such as smart homes, better temperature control, and insulation from sound and vibration, among other factors, are also driving the growth of the residential remodeling industry.

U.S. residential remodeling has seen further growth in recent years due to increasing expenditure on lifestyle due to a rise in the standard of living and income. The rising rates in real estate have led to an increased focus on renovating properties owned by consumers rather than buying new houses. In addition, the increasing emphasis on changing the aesthetics of interiors and exteriors of houses has also helped boost the remodeling industry.

Plastic and composite construction materials are expected to register the highest growth due to the presence of a large number of products in various price ranges, with a wide variety of properties and suitability for specific applications. The shifting preference of consumers toward smart homes and increasing usage of appliances in households are expected to help the systems and equipment segment to register the highest growth rate over the forecast period.

The COVID-19 pandemic has played a major role in shifting the focus of users on the beautification of outdoor areas of their houses, including patios and vertical gardens, as the time they spend inside the house has increased, leading to an increased affinity towards such amenities. This has led to the growth porches, gardens, and garages segment.

The manufacturers of residential remodeling products have integrated their presence across the value chain to include dissembling older structures and installing new products. Companies provide services that include analyzing the existing structure and finding a suitable solution to rebuild the structure in line with customers’ requirements. Companies such as Jenkins Restorations take account of the damage to the building due to natural calamities, fire, and water and adjust the repair and residential remodeling work accordingly.

The development of alternative residential remodeling materials, such as carbon fiber support systems and resin sealants, that can help in the repairing and strengthening of existing structures without the deconstruction of the building has benefited the industry. In addition, the development of home systems that can help in safety and easy home maintenance, such as insulation systems, security systems, and temperature control, has also helped the industry grow.

Material Insights

The wood material segment accounted for a 23.1% share of the U.S. residential remodeling market in terms of revenue in 2022. The usage of wood as a construction material is expected to increase in the U.S. over the forecast period. This is because wood is easy to use and eco-friendly. It helps in reducing greenhouse emissions during construction activities, as well as from the constructed buildings. Additionally, wooden components used in buildings are easier to replace than other materials such as concrete.

Metal remodeling materials majorly consist of stainless steel, aluminum, and copper. Metals are widely used for developing frames, pipes, and structural fittings used in construction applications. Properties offered by metals, including their high strength, increased reusability, and less maintenance, make them preferable to other materials such as wood and concrete. However, rising demand for metals from other industries such as automobiles, electronics, and aerospace can hinder the growth of the metal segment.

In 2022, the plastics and composites segment held a share of 29.3% of the overall residential remodeling in terms of revenue. Composites offer high abrasion resistance and increased strength. They are lightweight and stiff, making them a preferable choice for refurbishing existing building structures. Additionally, the rising focus of consumers on the aesthetics of houses, including fake ceilings and attractive house interiors, is increasing spending by consumers on remodeling projects.

The concrete segment is projected to grow at a CAGR of 4.2% in terms of revenue during the forecast period. The growth of this segment can be attributed to the fact that concrete is an important material used in the construction industry. It is used extensively in the structural and foundational parts of buildings.

Application Insights

The flooring segment is projected to grow at a CAGR of 4.1% in terms of revenue during the forecast period. The growth of this segment can be attributed to the rising demand for aesthetically pleasing décor in households in the country. The rising expendable income of upper-middle-class families in the U.S. has also led to the surged beautification of residential buildings in the country.

The walls segment is projected to witness significant growth over the forecast period owing to advancements in technologies such as decorative insulation panels that have led to the development of exterior and interior walls that reduce the energy consumption of residential buildings. Moreover, the increasing inclination of the population of the U.S. toward aesthetically pleasing walls also contributes to the growth of the walls segment.

The ceilings segment is expected to witness growth due to the increased adoption of modern ceiling solutions in the country that offer improved insulation and enhance the interiors of residential buildings. The growth of this segment can also be attributed to the surged deployment of modern eco-friendly ceiling solutions that help in noise cancellation and thermal insulation of buildings.

The porches, gardens, and garages segment has witnessed significant growth in recent years owing to the increase in expendable income of house owners that has led them to spend money on developing luxury areas such as decks and gardens in their homes. Additionally, the rising usage of automobiles in the U.S. has resulted in a surged requirement for developing fully functional, remodeled garages.

Key Companies & Market Share Insights

The U.S. residential remodeling materials industry is characterized by the presence of various small- and large-scale vendors, resulting in a moderate level of concentration in the market. The surging requirement for reliable and precise remodeling solutions is fueling the growth of U.S. residential remodeling. Key manufacturers of residential remodeling in the U.S. focus on offering suitable and innovative remodeling materials that are rigid and durable.

Most of the players in residential remodeling have focused on forwarding integration by providing maintenance services to their products and manufacturing. The residential remodeling companies also focus on providing customizations via online portals and on-site personnel and using both online and offline distribution networks to connect with their customers. Weyerhaeuser Company is an example of a completely integrated supply chain that produces its raw materials and manufactures products and other third-party products. Some prominent players in the U.S. residential remodeling market include:

-

Ganahl Lumber

-

Trex Company, Inc.

-

ACE Hardware

-

Jenkins Restorations

-

Carbon Fiber Support

-

Rhino Carbon Fiber

-

JES Foundation Repair

-

Fortress Stabilization Systems

-

West Fraser Timber Co, Ltd.

-

Georgia Pacific LLC

-

Weyerhaeuser Company

-

Michael and Son Services

-

Boise Cascade Company

-

James Hardie Industries plc

-

Nichiha USA

-

Louisiana Pacific Corporation

-

Lowe’s Companies, Inc.

-

State Farm Insurance

U.S. Residential Remodeling Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 720.68 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application

Country scope

U.S.

Key companies profiled

Ganahl Lumber; Trex Company, Inc.; ACE Hardware; Jenkins Restorations; Carbon Fiber Support; Rhino Carbon Fiber; JES Foundation Repair; Fortress Stabilization Systems; West Fraser Timber Co, Ltd.; Georgia Pacific LLC; Weyerhaeuser Company; Michael and Son Services; Boise Cascade Company; James Hardie Industries plc; Nichiha USA; Louisiana Pacific Corporation; Lowe’s Companies, Inc.; State Farm Insurance

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Residential Remodeling Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. residential remodeling market report based on material and application:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Metal

-

Plastics & Composites

-

Concrete

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Flooring

-

Walls

-

Ceilings

-

Porch, Garden and Garage

-

System & Equipment

-

Disaster Repair

-

Frequently Asked Questions About This Report

b. The U.S. residential remodeling market size was estimated at USD 512.05 billion in 2022 and is expected to reach USD 528.70 billion in 2023.

b. The U.S. residential remodeling market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 720.68 billion by 2030.

b. Plastics and composites material segment dominated the market and accounted for more than 29.3% revenue share of the market by 2030 owing to the availability of a wide range of products and differing properties of the material to choose.

b. Some of the key players operating in the U.S. residential remodeling market include Ganahl Lumber, Trex Company, Inc., ACE Hardware, Jenkins Restorations, Carbon Fiber Support, Rhino Carbon Fiber, JES Foundation Repair, Fortress Stabilization Systems, West Fraser Timber Co, Ltd., Georgia Pacific LLC, and Weyerhaeuser Company.

b. The key factors driving the U.S. residential remodeling market include rising disposable income of home owners and the shift towards aesthetically pleasing housing components and home automation systems such as smart homes, better temperature control, and insulation from sound.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."