- Home

- »

- Medical Devices

- »

-

U.S. Physician Groups Market Size And Share Report, 2030GVR Report cover

![U.S. Physician Groups Market Size, Share & Trends Report]()

U.S. Physician Groups Market Size, Share & Trends Analysis Report By Practice Type (Single specialty Group, Multi-specialty Group), By Practice Size (5 to 10, 50+ physicians), By Ownership, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-134-8

- Number of Pages: 78

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Market Size & Trends

The U.S. physician groups market size was estimated at USD 309.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.13% from 2023 to 2030. The physician group practice involves one or more physicians operating as an organization to offer patient care services. These practices in the U.S. have grown significantly and changed in terms of composition, size, ownership, and management in the past decade. Recently, physicians have shifted towards large healthcare organizations from self-employed or part of small practices. Physicians are shifting from solo practices to more secure group practices owing to administrative and financial difficulties with the operation of a practice. Solo practicing involves managing various administrative tasks, such as billing, coding, insurance claims, and compliance with healthcare regulations. This administrative burden can be overwhelming for a single practitioner, leading to increased stress and reduced time for patient care.

According to the American Medical Association’s Physician Practice Benchmark Survey, the number of physicians working in private practices decreased by around 13% between 2012 and 2022. The shift from fee-for-service reimbursement models to value-based care models continues to drive the growth of physician groups. These models reward healthcare providers for delivering high-quality care and achieving better patient outcomes, encouraging collaboration and care coordination within physician groups. For instance, in February 2023, Lexington Clinic, a multi-specialty physician group in Kentucky, partnered with Agilon Health, Inc. to transition into a value-based primary care delivery system to enhance quality and care outcomes for Kentucky's Medicare patients.

The COVID-19 pandemic significantly impacted the U.S. market. Many physician groups experienced a decline in revenue during the pandemic due to canceled or postponed elective procedures and reduced patient visits. This was particularly challenging for smaller practices with limited financial reserves. This can be due to the closure of the programs to maintain social distancing to curb the spread of the virus. According to the American Medical Association, around 81% of the physicians surveyed reported declining revenue in July and August 2020. However, the pandemic accelerated the adoption of telemedicine, allowing physician groups to continue providing care remotely. This shift helped some groups maintain patient engagement and generate revenue during lockdowns.

Practice Type Insights

Based on the practice type, the market is bifurcated into single-specialty and multi-specialty. The multi-specialty segment dominated the market in 2022 with the largest revenue share of 57.6% and it is anticipated to grow at the fastest rate during the forecast period. Multispecialty groups offer a wide range of medical specialties and services at a single facility, providing patients with comprehensive healthcare. This eliminates the need for patients to visit multiple providers at different locations for their healthcare needs.

Moreover, these facilities are adopting several technologically advanced products to cater to the demand of the growing patient population in the U.S. These technologies improve patient care, streamline operations, and support data-driven decision-making. For instance, in May 2022, Integrated Medical Professionals PLLC, New-York based multi-specialty physician group, adopted aView 2 Advance HD Monitor and aScope 4 Cysto by Ambu Inc.

Practice Size Insights

Based on the practice size, the market is segmented into fewer than 5 physicians, 5 to 10, 11 to 24, 25 to 49, and 50+ physicians. The fewer than 5 physicians segment dominated the market in 2022 with the largest revenue share of 37.0%. This can be attributed to the autonomy and control over clinical decisions and practice management with the high quality of services through the smaller practices. However, the acquisition of small practices by private equity firms and the shift of physicians toward hospital settings is anticipated to drive the growth of the market over the forecast period.

The 50+ physicians segment is expected to witness the fastest CAGR of 6.48% over the forecast period. The rising growth of the segment can be attributed to the shift of physicians aged 40 years and above, towards the 50+ physician groups. According to the American Medical Association’s Physician Practice Benchmark Survey, around 38.1% of physicians aged 40 years worked in physician groups of size 50+ physicians.

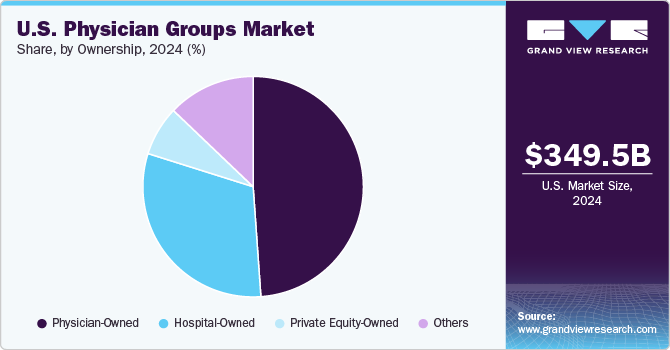

Ownership Insights

Based on the ownership, the market is bifurcated into physician-owned, hospital-owned, private equity-owned, and others segments. The physician-owned segment dominated the market in 2022 with the largest market share of 50.1%. This can be attributed to the high profit margins, economies of scale, and higher quality of services associated with these practices. However, the majority of physician-owned practices are now shifting towards private-equity firms due to the changing regulatory landscape in the country.

The private equity segment is anticipated to witness the fastest CAGR of 10.76% over the forecast period. This can be attributed to the growing preference for private equity firms in the physician groups in the U.S. Private equity investment can provide physician groups with capital, resources, and strategic support to expand their operations, invest in technology, and achieve economies of scale, contributing to market growth. For instance, in July 2022, Amazon Inc. entered into an agreement with One Medical, a primary care physician group in the U.S. The transaction will be estimated at USD 3.9 billion.

Regional Insights

Based on the region, the market is divided into Southeast, West, Midwest, Southwest, and Northeast. The Southeast region dominated the market with the largest market share of 23.4% in 2022. This can be attributed to the presence of many physician groups in the region, such as Covenant Health (Southern Medical Group), Southeast Medical Group, The Southeast Permanente Medical Group, Inc., and many others.

West region is anticipated to witness the fastest CAGR of 5.38% over the forecast period. The segment's high growth can be attributed to the increasing acquisition of physician practices by hospitals in the region. According to a study published in HealthAffairs in 2018, California is a heavily concentrated market, with more than 40% of the practices owned by hospital settings.

Key Companies & Market Share Insights

The market is fragmented and shifting towards consolidation owing to economies of scale, reduced administrative costs, and enhanced bargaining power with payers. The major companies are adopting various strategies to stay competitive, including the acquisition of small and large physician groups, partnerships with tech companies for the adoption of value-based care models, and many others. For instance, in April 2023, Optum Inc. acquired Crystal Run Healthcare, a New York-based multi-specialty physician group with more than 400 physicians in 30 locations in the U.S. Some prominent players in the U.S. physician groups market include:

-

Cleveland Clinic

-

The Permanente Medical Group

-

Optum, Inc.

-

Select Physical Therapy

-

HCA Florida Healthcare Physicians (HCA, Inc.)

-

University of Pittsburgh Physicians (UPMC Physicians)

-

NYU Langone Health Physicians (NYC University Physicians Network)

-

Northwestern Medical Group (Northwestern Medicine)

-

HealthCare Partners IPA (HealthCare Partners, MSO)

-

Northwell Health Physician Partners (Northwell Health)

-

RWJBarnabas Health Medical Group

-

Ascension

-

Penn Medicine Physicians (The Trustees of the University of Pennsylvania)

U.S. Physician Groups Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 461.1 billion

Growth rate

CAGR of 5.13% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Practice type, practice size, ownership, region

Country scope

U.S.

Key companies profiled

Cleveland Clinic; The Permanente Medical Group; Optum, Inc.; Select Physical Therapy; HCA Florida Healthcare Physicians (HCA, Inc.); University of Pittsburgh Physicians (UPMC Physicians); NYU Langone Health Physicians (NYC University Physicians Network); Northwestern Medical Group (Northwestern Medicine); HealthCare Partners IPA (HealthCare Partners, MSO); Northwell Health Physician Partners (Northwell Health); RWJBarnabas Health Medical Group; Ascension; Penn Medicine Physicians (The Trustees of the University of Pennsylvania)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Physician Groups Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. physician groups market report based on practice type, practice size, ownership, and region:

-

Practice Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Specialty Group

-

Primary Care

-

OB/GYN

-

Ophthalmology

-

Surgical

-

Psychiatry

-

Cardiology

-

Anesthesiology

-

Dermatology

-

Radiology

-

Emergency Medicine

-

Others

-

-

Multi-Specialty Group

-

Primary Care

-

OB/GYN

-

Ophthalmology

-

Surgical

-

Psychiatry

-

Cardiology

-

Anesthesiology

-

Dermatology

-

Radiology

-

Emergency Medicine

-

Others

-

-

-

Practice Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fewer than 5 Physicians

-

5 to 10

-

11 to 24

-

25 to 49

-

50+ Physicians

-

-

Ownership Outlook (Revenue, USD Billion, 2018 - 2030)

-

Physician-owned

-

Hospital-owned

-

Private Equity-owned

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Northeast

-

Southeast

-

Southwest

-

Midwest

-

West

-

Frequently Asked Questions About This Report

b. The U.S. physician groups market size was estimated at USD 309.1 billion in 2022 and is expected to reach USD 324.9 billion in 2023.

b. The U.S. physician groups market is expected to grow at a compound annual growth rate of 5.13% from 2023 to 2030 to reach USD 461.1 billion by 2030.

b. Multi-specialty segment dominated the U.S. physician groups market with a share of 57.6% in 2022 owing to the adoption of technologically advanced products and availability of multiple treatment options for several conditions.

b. Some key players operating in the U.S. physician groups market include Cleveland Clinic, The Permanente Medical Group, Optum, Inc., Select Physical Therapy, HCA Florida Healthcare Physicians (HCA, Inc.), University of Pittsburgh Physicians (UPMC Physicians), NYU Langone Health Physicians (NYC University Physicians Network), Northwestern Medical Group (Northwestern Medicine), HealthCare Partners IPA (HealthCare Partners, MSO), Northwell Health Physician Partners (Northwell Health), RWJBarnabas Health Medical Group, Ascension, Penn Medicine Physicians (The Trustees of the University of Pennsylvania).

b. Key factors that are driving the U.S. physician groups market growth include shift of physicians from solo practices to group practices, shift towards value-based care models, and rising government initiatives for the groups.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."