- Home

- »

- Medical Devices

- »

-

U.S. Oral Solid Dosage Contract Manufacturing Market Report 2030GVR Report cover

![U.S. Oral Solid Dosage Contract Manufacturing Market Size, Share & Trends Report]()

U.S. Oral Solid Dosage Contract Manufacturing Market Size, Share & Trends Analysis Report By Product Type (Tablets, Capsules), By Mechanism (Controlled-, Immediate-release), By End-user, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-122-8

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

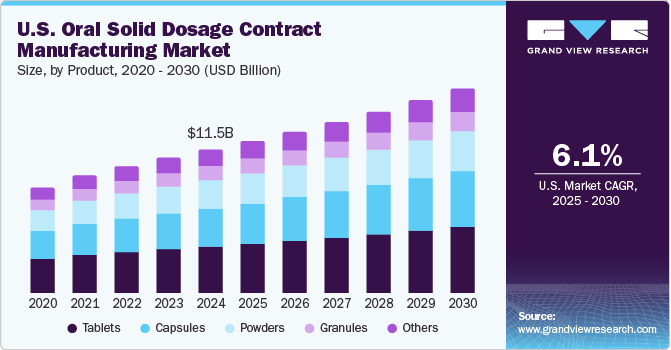

The U.S. oral solid dosage contract manufacturing market size was estimated at USD 10.20 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030.Advancements in drug delivery technology and increasing investments by Contract Development and Manufacturing Organizations (CDMOs) to enhance Oral Solid Dosage (OSD) development are major factors driving market growth. Technological advancements pertaining to the development and bulk manufacturing of OSD forms are the primary factors fast-tracking the commercialization of these products. Currently, a diverse array of dosage forms is accessible in the market. Nutraceutical and pharmaceutical industries consistently strive to develop OSD forms due to their ease of handling and consumption, and favorable adherence among patients.

Oral Solid Dosage (OSD) medications have exhibited substantial potential in alleviating COVID-19 symptoms. Pharmaceutical companies expedited the research, development, and distribution of pharmaceuticals to overcome the disease and address its signs. While significant attention globally was directed toward vaccine prospects, an alternative avenue displayed encouraging results, such as small-molecule OSD treatments such as hydroxychloroquine and azithromycin. Originally designed for less prevalent conditions such as malaria, these OSD medications gained immense traction as their efficacy against COVID-19 symptoms gained recognition.

Moreover, increasing demand for outsourcing OSD manufacturing among pharmaceutical companies has compelled contract manufacturers to expand their manufacturing facilities to support this growing demand. These expansions are made across the globe to increase their penetration in the OSD industry. Furthermore, the rising demand for generic drugs is also a key factor, given that many generics are OSD products. For instance, in April 2020, CoreRx, Inc., a CDMO, opened a new product development center in Clearwater, Florida to manufacture oral and topical dosage formulations.

Product Type Insights

Based on product type, the tablets segment accounted for the largest market share of 32.13% in 2022. Solid dosage products, particularly tablets, are considered economical, which is anticipated to promote segment growth. Furthermore, the tablet segment continues to embrace new technologies, such as continuous manufacturing and 3D printing, for further improvement in the efficiency of manufacturing processes, aiding segment growth. For instance, in May 2023, an Ohio-based contract manufacturer, The Technology House (TTH), acquired an SLA 750 3D printer from 3D Systems to improve and streamline its manufacturing processes.

The capsules segment is anticipated to register lucrative growth during the forecast period. The adoption of capsules in Oral Solid Dosage (OSD) forms due to various advantages, such as ease of swallowing, faster disintegration, and convenient absorption, is expected to drive market growth. Capsules can disintegrate more quickly, resulting in a more rapid medication release and absorption. This is advantageous for medicines that need to start working quickly.

Mechanism Insights

The controlled release segment dominated the market and accounted for the largest revenue share of 51.81% in 2022. Recent advancements within the domain of oral controlled-release delivery systems, including dome tablets, dual drug tablets, intestinal patches, polymer nanosystems, and bioinspired delivery methods like exosomes have revolutionized the field, as Controlled-Release (CR) drug delivery systems maintain their pivotal role in disease treatment.

The immediate release segment is expected to advance at a substantial CAGR during the forecast period. The adoption of IR oral solid dosage forms has increased due to various factors that make them favorable for pharmaceutical developers and patients. IR formulations are made to rapidly release the active pharmaceutical ingredients (APIs) after consumption, immediately initiating the therapeutic effects. This is especially advantageous for drugs that need to provide instant relief or rapid symptom relief. Thus, the increasing adoption of IR dosage forms is expected to drive segment growth.

End-user Insights

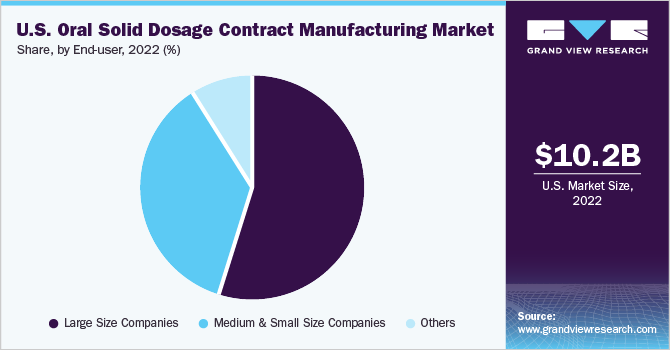

The large-size companies segment dominated the U.S. oral solid dosage contract manufacturing market with the highest revenue share of 54.77% in 2022. Large companies mostly prefer to avoid getting engaged in manufacturing difficulties and instead concentrate on their core skills, such as research, development, marketing, and distribution. Contract manufacturing allows them to concentrate on what they do best while leaving the manufacturing aspect to experts.

On the other hand, the medium and small size companies segment is expected to progress at a substantial CAGR during the forecast period. Research and development are frequently prioritized heavily by small- and medium-sized companies in order to introduce novel products to the market. Contract manufacturing allows them to delegate the manufacturing process, freeing up resources and time for R&D efforts.

Key Companies & Market Share Insights

Key companies undertake several strategic initiatives such as partnerships, expansions, new service launches, mergers, and acquisitions to maintain their position in the market. For instance, in January 2023, Aenova Group expanded its capsule filling capacity at the company’s Regensburg site by installing the state-of-the-art IMA Adapta 200 machine. In another instance, in May 2022, Catalent, Inc. announced an investment of USD 175 million to expand its flagship manufacturing facility for large-scale oral dose forms in Winchester, Kentucky. Some of the prominent players in the U.S. oral solid dosage contract manufacturing market include:

-

Catalent, Inc.

-

Lonza

-

AbbVie Inc.

-

Aenova Group

-

Adare Pharma Solutions

-

Boehringer Ingelheim International GmbH

-

Jubilant Pharmova Limited

-

Patheon Pharma Services

-

Recipharm AB

-

Corden Pharma International

-

Siegfried Holding AG

U.S. Oral Solid Dosage Contract Manufacturing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 16.42 billion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, mechanism, end-user

Country scope

U.S.

Key companies profiled

Catalent, Inc.; Lonza; AbbVie Inc.; Aenova Group; Adare Pharma Solutions; Boehringer Ingelheim International GmbH; Jubilant Pharmova Limited; Patheon Pharma Services; Recipharm AB; Corden Pharma International; Siegfried Holding AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Oral Solid Dosage Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. oral solid dosage contract manufacturing market report on the basis of product type, mechanism, and end-user:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powders

-

Granules

-

Others

-

-

Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Immediate Release

-

Delayed Release

-

Controlled Release

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Size Companies

-

Medium & Small Size Companies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. oral solid dosage contract manufacturing market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 16.42 billion by 2030.

b. The controlled release segment dominated the market with a share of 51.81% in 2022. Recent advancements within the domain of oral controlled-release delivery systems, including dome tablets, dual drug tablets, intestinal patches, polymer nano systems, and bioinspired delivery methods like exosomes, have revolutionized the field, as Controlled-Release (CR) drug delivery systems maintain their pivotal role in disease treatment, thus supporting its high shares.

b. The key market players offering U.S. oral solid dosage contract manufacturing services include Catalent, Inc., AbbVie Inc., Lonza, Recipharm AB, Thermo Fisher Scientific Inc (Patheon), etc.

b. Technological advancements pertaining to the development and bulk manufacturing of Oral Solid Dosage (OSD), increasing demand for outsourcing OSD manufacturing among pharmaceutical companies, and growing prevalence of chronic and infectious diseases are few of the major factors supporting the market growth.

b. The U.S. market size was estimated at USD 10.20 billion in 2022 and is expected to reach USD 10.88 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."