- Home

- »

- Biotechnology

- »

-

U.S. Medical Device Manufacturers Market Size Report, 2028GVR Report cover

![U.S. Medical Device Manufacturers Market Size, Share & Trends Report]()

U.S. Medical Device Manufacturers Market Size, Share & Trends Analysis Report By Type (Diagnostic Imaging, Consumables, Patient Aids, Orthopedics), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-3-68038-032-3

- Number of Pages: 55

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

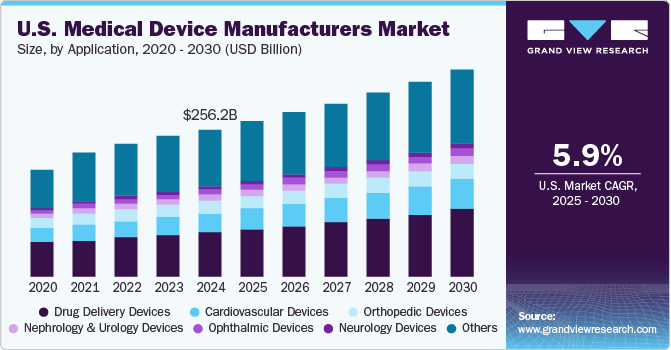

The U.S. medical device manufacturers market size was valued at USD 176.7 billion in 2020 and is anticipated to exhibit a compound annual growth rate (CAGR) of 5.0% over the forecast period. The rising prevalence of chronic diseases and the increasing geriatric population in the country are the key market drivers. The onset of chronic diseases is more commonly prevalent between the age group of 45 and 54 years. Consumable medical devices and patient aids, such as gloves, syringes, masks, PPE kits, infrared thermometers, pulse oximeter, and testing kits, observed a sudden upsurge in demand owing to the COVID-19 pandemic. The scenario set off lucrative opportunities for both existing players and new entrants.

However, medical devices used in elective procedures, such as bariatric surgeries, joint replacement surgeries, and cosmetic surgeries, experienced a decline in demand. The market recovery can be expected from mid-2021 onwards with favorable government initiatives to re-launch elective procedures. There has been a recent increase in demand for minimally invasive surgeries and this is consequently expected to drive the market for medical device suppliers. Minimally invasive surgeries involve smaller incisions, shorter hospital stay, rapid wound healing, lesser pain & surgical wounds, and lower risk of complications than open surgeries. They also aid in controlling healthcare costs.

According to the ASPS annual plastic surgery statistics report, there were more than 17.7 million surgical and minimally-invasive cosmetic procedures performed in the United States in 2018, a number that has risen steadily over the past five years. Such factors will boost the market over the forecast period. Since injectable pens are mostly used in diseases such as arthritis, diabetes, osteoporosis, growth hormone deficiency, and anaphylaxis, the increasing prevalence of these diseases is expected to drive the market for injectable devices. Favorable reimbursement policies, such as the U.S. Medicare system, have been playing an important role in the growth of the bronchoscopes market.

COVID19 impact: Consumables segment exhibit a lucrative growth rate of 9.3% in 2020 as compared to 5.4% in 2019

Pandemic Impact

Post COVID Outlook

General Motors received an order of $489.4 million to deliver 6,132 ventilators by mid-2020. GM collaborated with Ventec Life Systems to increase its production.

The U.S. medical device manufacturers market is projected to expand with a CAGR of 5.0% from 2021 to 2028

The FDA is collaborating with manufacturers of ventilators, ventilator accessories, and other respiratory devices to better understand the current supply chain issues related to the COVID-19 outbreak and to help mitigate any widespread shortages of these devices.

The rising prevalence of chronic diseases and the increasing geriatric population in the country will augment the market over the forecast period

Medical devices used in elective procedures, such as bariatric surgeries, joint replacement surgeries, and cosmetic surgeries, experienced a decline in demand. However, consumable medical devices and patient aids, such as gloves, syringes, masks, PPE kits, infrared thermometers, pulse oximeter, and testing kits, observed a sudden upsurge in demand owing to the COVID-19 pandemic

The U.S. medical device market is projected to grow by 5.5% from 2020 to 2021 with a decrease in adverse impacts of the COVID-19 pandemic.

Some of the bronchial procedures for which reimbursements are available are bronchial or endobronchial biopsy, transbronchial lung biopsy, bronchoalveolar lavage, and rigid and flexible bronchoscopy. The favorable reimbursement structure is expected to fuel market growth. Other factors that boost market growth include rising cases of lifestyle-associated health conditions, accidents, and sports injuries. Growing demand for effective emergency care and increasing adoption of mobile surgery centers are also expected to drive the market during the forecast period.

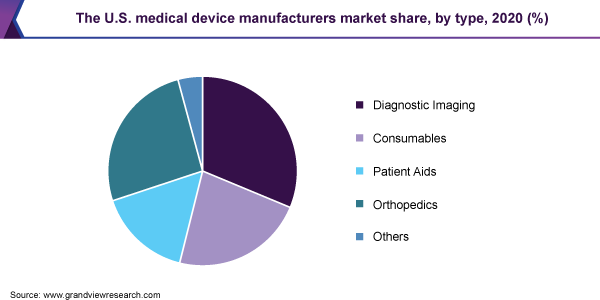

Type Insights

The diagnostic imaging segment captured the largest market share of over 31% in 2020 owing to the high demand for accurate diagnostic methods and devices. Chronic diseases accounted for a significant share of the country’s healthcare expenditure, as they require long-term medical care. Healthcare organizations are therefore looking for options to reduce healthcare costs. In recent years, the category of imaging equipment has witnessed several new product launches and currently has a large number of devices in the pipeline.

The incidence of chronic diseases is increasing globally, and early diagnosis can be extremely crucial in determining treatment plans. The presence of state-of-the-art medical devices within the U.S. region attracts a lot of foreign patients, thereby sustaining the investment by hospitals and healthcare providers into the segment. Furthermore, an increase in the number of sports and trauma injuries is boosting demand for orthopedic devices, leading to market growth.

Favorable reimbursement structure leads to higher adoption of medical devices among patients in the U.S., leading to the growth of the market for medical device suppliers. For instance, CMS (Center for Medicare & Medicaid Services) announced the Primary Cares Initiative (PCI) in 2019. It is a set of new payment models to help primary care providers transition to performance-based risk.

Key Companies & Market Share Insights

New product launches, technological advancements, and capacity expansion are few strategic initiatives undertaken by key players to achieve competitive advantage. New technologies, such as 3D printing, can be used to increase production to meet the sudden upsurge in product demand due to the global coronavirus pandemic. The U.S. government is spending heavily to overcome the shortfalls in medical devices, such as pulse oximeter and N95 respirators.

For instance, General Motors received an order of $489.4 million to deliver 6,132 ventilators by mid-2020. GM collaborated with Ventec Life Systems to increase its production. In April 2017, Abbott and Alere amended the terms of their merger agreement for the former’s acquisition of the latter to expand Abbott’s global presence and leadership in diagnostics. Some of the key players in the U.S. medical device manufacturers market include:

-

3M Healthcare

-

Abbott

-

Baxter International, Inc.

-

B. Braun Melsungen AG

-

GE Healthcare

-

Johnson & Johnson Services, Inc.

-

Medtronic PLC

-

Boston Scientific Corp.

Recent Development

-

In June 2023, Baxter International Inc. launched the Hillrom Progressa+ bed for the ICU in the U.S. The device is equipped with features that benefit nurses in caring for patients.

-

In November 2022, Medtronic plc launched an extended infusion set, labeled for up to 7-day wear for insulin pumps. The device improves the chemical and physical stability of insulin and lowers the risk of infusion set occlusion.

-

In June 2022, Abbott announced the development of a continuous glucose-ketone monitoring system. The device regularly monitors glucose levels in the blood in one sensor.

U.S. Medical Device Manufacturers Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 186.5 Billion

Revenue forecast in 2028

USD 262.4 Billion

Growth rate

CAGR of 5.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type

Country Scope

The U.S.

Key companies profiled

3M Healthcare; Abbott; Baxter International, Inc.; B. Braun Melsungen AG; GE Healthcare; Johnson & Johnson Services, Inc.; Medtronic PLC; Boston Scientific Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the U.S. medical device manufacturers market report on the basis of type:

-

Type Outlook (Revenue, USD Billion, 2016 - 2028)

-

Diagnostic Imaging

-

Consumables

-

Patient Aid

-

Orthopedics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. medical device manufacturers market is estimated at USD 176.7 billion in 2020 and is expected to reach USD 186.5 billion in 2021.

b. The U.S. medical device manufacturers market is expected to grow at a compound annual growth rate of 5.0% from 2021 to 2028 to reach USD 262.4 billion in 2028.

b. The diagnostic imaging segment dominated the U.S. medical device manufacturers market with a share of 31.0% in 2020. This is attributable to the growing demand for accurate diagnostic methods and devices, an increase in the number of sports and trauma injuries is boosting demand for orthopedic devices, leading to market growth.

b. Some key players operating in the U.S. medical device manufacturers market include 3M, Abbott Laboratories, Baxter International, Boston Scientific Corporation, B. Braun Melsungen, GE Healthcare, Johnson and Johnson, and Medtronic.

b. Key factors driving the U.S. medical device manufacturers market growth include rising cases of chronic disease, favorable reimbursement policies, and increasing adoption of mobile surgery centers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."