- Home

- »

- Advanced Interior Materials

- »

-

U.S. Glass Curtain Wall Market Size & Share Report, 2030GVR Report cover

![U.S. Glass Curtain Wall Market Size, Share & Trends Report]()

U.S. Glass Curtain Wall Market Size, Share & Trends Analysis Report By System Type (Unitized, Stick), By End-use (Residential, Commercial, Public), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-118-5

- Number of Pages: 60

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

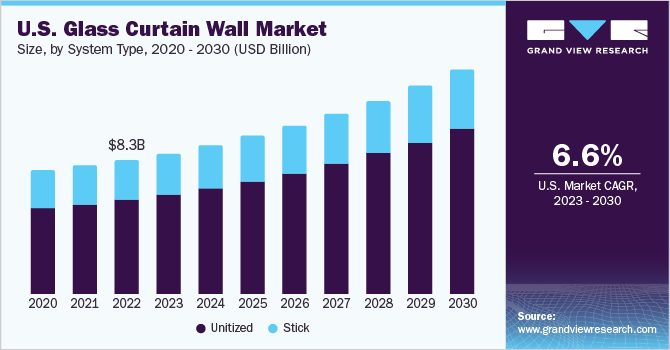

The U.S. glass curtain wall market size was estimated at USD 8.26 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. The growth of the market in the country can be attributed to the rising construction activities and the incorporation of modern architecture. Increasing demand for energy-efficient buildings, driven by sustainability initiatives and cost savings, is fueling the adoption of glass curtain walls. Moreover, the emphasis on modern architectural designs and the visual impact of transparent facades are attracting developers and architects. Urbanization and population growth are creating opportunities for the utilization of glass curtain walls in the construction of high-rise buildings and commercial spaces in the country.

The U.S. construction industry has experienced significant growth owing to urbanization, population growth, and infrastructural developments. The demand for commercial, residential, and industrial buildings has surged, fostering the adoption of modern construction techniques and materials. Glass curtain walls have gained popularity as an architectural solution, providing numerous advantages such as ample natural light, enhanced aesthetics, and improved energy efficiency. These systems are designed to minimize heat transfer, improve the energy efficiency of a building, and reduce its environmental footprint. Additionally, glass curtain walls can incorporate solar panels, further contributing to green building initiatives and reducing reliance on traditional energy sources.

The cost of glass curtain walls can be relatively high compared to alternative building facade options such as window walls. The specialized manufacturing processes, high-quality materials, and installation requirements contribute to the overall cost. This cost factor can limit the adoption of glass curtain walls, particularly in projects with tight budgets or cost-sensitive markets. Moreover, the market for glass curtain wall products is being influenced by the challenges faced by the construction industry as a whole, which is experiencing significant pressure due to a shortage of skilled and qualified laborers in the country. Lack of labor results in a significant lengthening of installation time, resulting in a surge in cost.

Key glass curtain wall manufacturers in the U.S. are adopting various growth strategies to keep up with the rising demand from various end-use applications. To gain further access to the global and regional markets, companies are forward integrating along their value chain. Most key market players are focusing on enhancing their distribution channels by renewing their existing marketing contracts and forming new agreements with local distributors to gain a competitive advantage.

The manufacturers of glass curtain walls often work with distributors and suppliers specializing in construction materials and building products. These distributors act as intermediaries, purchasing glass curtain wall systems from manufacturers and reselling them to contractors, architects, and other stakeholders in the construction industry. Distributors offer convenience and broader market reach for manufacturers, as they have established networks and customer bases.

System Type Insights

The unitized system type dominated the U.S. glass curtain wall market and accounted for a revenue of USD 5.80 billion in 2022. The increasing demand for modern and aesthetically appealing building designs in the U.S. is expected to increase the utilization of glass curtain walls. Unitized systems offer flexibility in design options, allowing architects to create visually striking facades.

The increasing investment in the construction of high-rise buildings in the U.S., such as 98 Red River Street by KPF, Austin, Texas, U.S.; Waldorf Astoria Miami by SSA/Carlos Ott, Miami, Florida, U.S.; Seattle Tower by ODA, Seattle; and Washington, U.S. is also expected to drive the segment growth over the forecast period. Some major upcoming construction projects in the U.S., including MSG (Madison Square Garden) Sphere, Fontainebleau, Amazon HQ2, and others, are expected to present opportunities to manufacturers of glass curtain walls.

The market for stick glass curtain walls in the U.S. is expected to grow at a CAGR of 5.0% over the forecast period. Stick glass curtain wall systems are commonly used in commercial buildings such as office complexes, shopping malls, hotels, and retail outlets. Their aesthetic appeal and customization options make them a popular choice for modern architectural designs. The launch of various construction projects in the U.S. related to commercial and residential buildings to offer leisure facilities is projected to favor the growth of the segment.

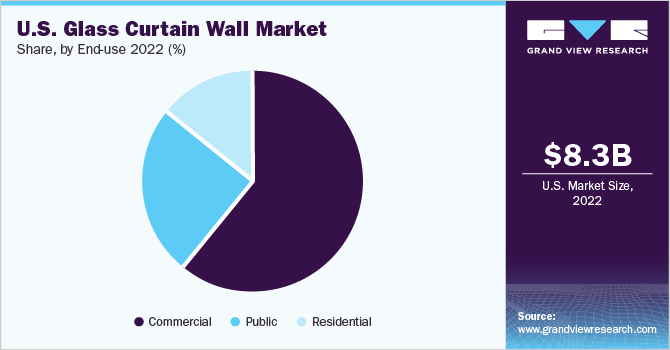

End-use Insights

The commercial end-use segment of the U.S. glass curtain wall market is expected to expand at the highest CAGR of 6.1% over the forecast period. Glass curtain walls have been a popular architectural choice for commercial buildings in recent years due to their aesthetic appeal and energy efficiency. The demand for glass curtain walls in the U.S. has been influenced by various factors, including economic conditions, construction activities, and sustainability trends. Strong economic conditions and increasing construction spending on commercial buildings are likely to drive the glass curtain wall market in the U.S.

The demand for glass curtain walls in public end-use is expected to grow at a significant rate over the forecast period. Increasing construction activities and a rise in spending on public infrastructure, including healthcare facilities, airports, and hotels, are some factors driving the growth of the segment. Recent modifications to federal funding programs in the U.S. have significantly expanded the scope of airport development plans throughout the country. Moreover, a growing emphasis on environmental responsibility and sustainable building practices is expected to boost the market over the coming years.

Increasing residential development in the U.S. continues to raise the demand for supplies such as walls, windows, and doors, and it also generates the demand for clean, sophisticated, and unique appearances in residential buildings. Glass curtain walls offer a modern and elegant aesthetic that appeals to homeowners seeking contemporary architectural designs. The sleek and transparent nature of glass curtain walls can create a visually striking appearance, enhancing the overall appeal and value of residential properties. Such factors lead to drive the demand for glass curtain walls in the segment.

Key Companies & Market Share Insights

The U.S. glass curtain wall market is characterized as highly competitive owing to the presence of both regional and multinational players. The key players are investing in improving the quality of their products, technology advancements, and enhancing their manufacturing capacities. They are also carrying out regional expansions to strengthen their presence in the market.

Product quality, technical innovation, design capability, project management expertise, pricing, and customer service are factors affecting competition in this market. Companies that are able to distinguish themselves through these elements and provide distinctive value propositions typically obtain a competitive advantage in the market. Additionally, the importance of sustainability and energy efficiency has grown throughout the sector, driving competition for the production of ecologically friendly curtain wall systems. Some prominent players in the U.S. glass curtain wall market include:

-

Viracon

-

Apogee Enterprises Inc.

-

Guardian Industries

-

Trulite

-

Kawneer (U.S.)

-

YKK AP America Inc.

-

Accura Systems, Inc.

-

Technical Glass Products

-

Kalwall

-

Lockheed Architectural Solutions, Inc.

U.S. Glass Curtain Wall Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 13.80 billion

Growth rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

System type, end-use

Country scope

U.S.

Key companies profiled

Viracon; Apogee Enterprises Inc.; Guardian Industries; Trulite; Kawneer (U.S.); YKK AP America Inc.; Accura Systems, Inc.; Technical Glass Products; Kalwall; Lockheed Architectural Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Glass Curtain Wall Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. glass curtain wall market report based on system type and end-use:

-

System Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Unitized

-

Stick

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Public

-

Frequently Asked Questions About This Report

b. The U.S. glass curtain wall market size was estimated at USD 8.26 billion in 2022 and is expected to reach USD 8,682.9 million in 2023.

b. The U.S. glass curtain wall market is expected to grow at a compound annual growth rate, a CAGR of 6.6% from 2023 to 2030, to reach USD 13.80 billion by 2030.

b. The unitized segment of the U.S. glass curtain wall market accounted for the largest revenue share of 70.2% in 2022. Unitized systems offer flexibility in design options, allowing architects to create visually striking facades, thus making it favorable option.

b. Some key players operating in the U.S. glass curtain wall market include Viracon, Apogee Enterprises Inc., Guardian Industries, Trulite, Kawneer (U.S.), YKK AP America Inc., and Accura Systems, Inc.

b. Key factors that are driving the market growth include the growing population, rising per capita income, and ongoing urbanization in the U.S. are expected to surge the number of residential, commercial, and mixed-use construction projects in the country in the coming years, thereby positively influencing the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."