- Home

- »

- Advanced Interior Materials

- »

-

U.S. Geotextile Market Size, Share And Growth Report, 2030GVR Report cover

![U.S. Geotextile Market Size, Share & Trends Report]()

U.S. Geotextile Market Size, Share & Trends Analysis Report By Material (Natural, Synthetic), By Product (Woven, Non-woven, Knitted), By Application (Erosion Control, Reinforcement, Drainage System), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-112-1

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

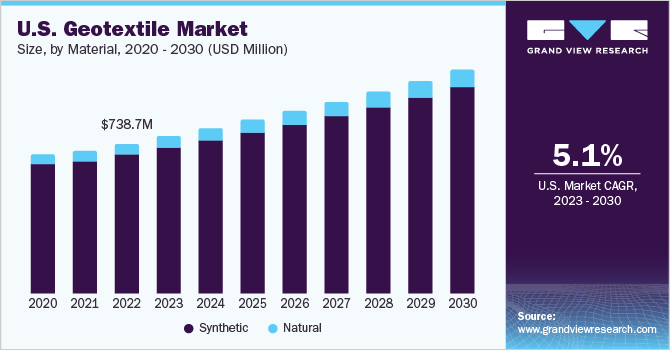

The U.S. geotextile market size was estimated at USD 937.6 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.0% from 2023 to 2030. The market is projected to be driven by the increasing product penetration in the civil engineering industry. In addition, they are used for preventing in-situ soil from being washed away into the drainage system. Geotextiles filter the drainage systems used in embankment dams, roads & highways, reservoirs, retaining walls, agriculture, and deep drainage trenches.

The market has seen a rapid rise in product demand since the 1990s, as end users are becoming more apparent with the use of technology, which has resulted in higher consumption of geotextiles for soil reinforcement, development of roadways and railways, erosion control, and drainage systems. In addition, the growing industrialization in the U.S. is expected to boost the demand for geotextiles in infrastructural projects.

The cost-effectiveness and longer lifespan of geotextiles compared to alternative materials, as well as increased environmental concerns about soil erosion, are expected to fuel product demand in the U.S. Initiatives by regulatory bodies and promotional policies have aided in increasing the awareness related to the benefits offered by the product. For instance, in 2022, geotextile tubes were used in New Jersey ocean city’s project to protect beaches from erosion caused by coastal storms. All these factors are contributing to the growing demand for geotextiles in the U.S.

Geotextiles are majorly manufactured using polyester, polypropylene, polyamide, and polyethylene fibers. However, commercially, synthetic fibers are commonly obtained from polypropylene and polyester owing to their superior properties compared to their counterparts. These polymers are petroleum-derived and commonly obtained from large refineries, whereas, natural fibers are obtained from jute and sisal.

Geotextiles are manufactured by using different technologies. In spunbond technology, the polymer is extruded to produce fine fibers with a diameter of 15 to 35 micrometers. The filaments are placed together on a conveyer belt in the form of a web, which is then bonded to manufacture spun-bonded nonwoven textiles. It is widely used in a variety of end uses for durable and disposable applications. The main applications of spunbonded nonwoven are in automobiles, furniture, civil engineering, hygiene, medical, packaging, and agriculture industries.

Geotextiles play a major role in various applications across agro-industries such as horticulture, farming, husbandry, and aquaculture in the form of protection, storage, and growth stimulation. The product also helps in the protection from sun, wind, and snow, while some control the infestation of insects, birds, and weeds. They also help protect the vital natural resources available in soil and water from various degradation processes. These products are effective in erosion control, stabilization of soil slopes, and increasing water retention capacity, which improves overall crop productivity.

Material Insights

Synthetic geotextiles accounted for the largest share in terms of revenue with 91.9% in 2022. The major synthetic polymers used for production are polypropylene, polyester, polyethylene, and polyamide. Polypropylene and polyester-based geotextiles are the most commonly used synthetic polymers for technical applications such as drainage systems, lining systems, asphalt overlays, and slit fences.

Key manufacturers of synthetic geotextiles include Fibertex Nonwovens A/S, TenCate Geosynthetics, TYPAR, Cell-Tek Geosynthetics, LLC, and HUESKER International. Cell-Tek Geosynthetics, LLC specializes in spunbonded nonwoven continuous filament polypropylene geotextiles, which are highly durable, strong, and weatherproof for drainage and separation applications.

The natural geotextile was the fastest growing segment in terms of revenue and is expected to grow at a CAGR of 4.7% over the forecast period. Natural fibers include materials derived from natural sources including jute, coir, and sisal. The increasing focus on the sustainability of products used by manufacturers and end users has led to an increase in demand for natural fiber-based geotextiles. The increasing demand for organic substances is also expected to boost market growth.

Man-made or synthetic geotextiles are based on petrochemical derivatives, which can harm the environment in many ways. Moreover, the depletion of natural resources has led to a rise in the prices of raw materials, making them expensive for end users. Therefore, the need for eco-friendly, renewable, and economically viable products is expected to increase consumers’ inclination to use natural geotextiles.

Product Insights

Non-woven geotextiles were the largest and fastest growing in the U.S. geotextile industry, in terms of revenue. This can be attributed to their unique properties such as absorbency, liquid repellency, and mechanical strength. In addition, the rising demand for non-woven geotextiles in the transport & infrastructure industry, on account of their high tensile strength and low cost, is expected to drive the demand for the product.

Woven geotextiles offer the interlocking of fabric strips to provide high modulus and stability. The material is cheap, has great strength, and is inexpensive, which is predicted to grow the market. Furthermore, woven geotextile materials can endure high tension, and their impermeable nature makes them excellent for reinforcement and separation. Polyethylene is used to make the bulk of woven geotextiles in the form of slit film, extruded tape, monofilament, and multifilament.

The primary application of woven geotextile is in the construction of roads and parking lots, which is expected to boost the woven geotextile market owing to its high load capacity. It has a high strength-to-weight ratio, which is helpful for protection against UV rays, mildew, soil chemicals, and insects. The slit-film woven geotextiles are efficient separators and provide speed erection for road construction projects and embankment projects owing to their increased life of paved and unpaved areas.

The knitted geotextiles segment is expected to grow with a CAGR of 3.0% in terms of revenue over the forecast period. Knitted geotextiles are warp-knitted fabrics made by interlocking a series of yarns together. The ease of handling knitted geotextiles and their versatility, in terms of their structure made by knitting methods, has led to an increase in product demand.

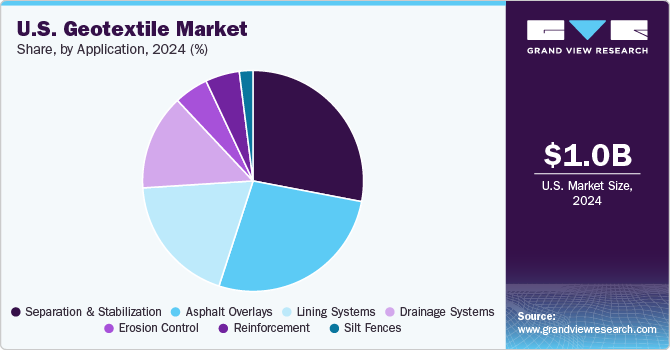

Application Insights

Separation & stabilization dominated the market, with 28.2% in terms of revenue, contributing to a major share of the total market in 2022. Geotextiles separate fine subgrade soil from the base material and add strength to the material. The product is used as a part of the foundation for laying roads to strengthen weak soil by holding it together and increasing the lifespan of the roads. These factors help end users reduce maintenance costs and enhance the performance of unpaved and paved surfaces.

The market for geotextiles in erosion control applications is predicted to increase significantly over the forecast period as it minimizes soil erosion caused by running water, waves, wind, moving ice, and other bank erosion forces. They are most often utilized to strengthen retaining walls, dams, and embankments on soft soils.

Geotextiles are used for reinforcement in a variety of applications, including dams, retaining walls, highways, and embankments over soft soils. When utilized as reinforcement or to improve soil stability, geotextile can greatly strengthen the earth's surface. When placed on sand, for example, it evenly distributes the load to prevent deformations. In addition, robust woven geotextiles can lessen the amount of fill needed for embankments and strengthen brittle subgrade soils.

Geotextiles are commonly employed in drainage systems. They have benefits over traditional soil filtration systems because they can act as a constant filter, require less excavation, have a more negligible impact on the environment, are easier to build, are of superior quality, and need significantly less material.

Key Companies & Market Share Insights

High consumer awareness, positive government outlook, and rising product penetration are resulting in the high demand for geotextiles in the U.S. In addition, the market is highly dynamic and exhibits intense competition owing to the presence of various small and medium-scale manufacturers. Key industry participants emphasize investments in research & development and product innovations to gain a competitive edge over other players.

Key players operating in the U.S. geotextile industry include Fibertex Nonwovens A/S, TenCate Geosynthetics, HUESKER International, and Terrafix Geosynthetics. These companies are continuously investing in various strategies to gain a competitive edge over other players. The strategies adopted by manufacturers include expansions, product launches, collaborations, and research & development activities

For instance, in August 2022, Willacoochee Industrial Fabrics, Inc. (WINFAB) announced the expansion of its nonwoven geotextile production line in Georgia, U.S. The expansion was aimed to diversify the company’s capabilities in manufacturing. Some prominent players in the U.S. geotextile market include:

-

Fibertex Nonwovens A/S

-

TenCate Geosynthetics

-

NAUE GmbH & Co. KG

-

Officine Maccaferri SpA.

-

Propex Operating Company, LLC

-

AGRU America, Inc.

-

HUESKER International

-

TYPAR

-

Terrafix Geosynthetics

-

Belton Industries

U.S. Geotextile Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.29 billion

Growth rate

CAGR 4.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

U.S.

Segments covered

Material, product, application

Key companies profiled

Fibertex Nonwovens A/S, TenCate Geosynthetics, NAUE GmbH & Co. KG, Officine Maccaferri SpA., Propex Operating Company, LLC, AGRU America, Inc., HUESKER International, TYPAR, Terrafix Geosynthetics, Belton Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Geotextile Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. geotextile market report on the basis of material, product, and application:

-

Material Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

Natural

-

Synthetic

-

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

Non-woven

-

Woven

-

Knitted

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

Erosion Control

-

Reinforcement

-

Drainage Systems

-

Lining Systems

-

Asphalt Overlays

-

Separation & Stabilization

-

Silt Fences

-

Frequently Asked Questions About This Report

b. The U.S. geotextile market size was estimated at USD 937.6 million in 2022 and is expected to reach USD 974.7 million in 2023.

b. The U.S. geotextile market is expected to grow at a compound annual growth rate of 4.0% from 2023 to 2030 to reach USD 1.29 billion by 2030.

b. Synthetic geotextiles accounted for the largest share in terms of revenue with 91.9% in 2022 on account of its high durability, strength, moisture-resistant properties and they are easier to handle & manufacture and are cheaper than their natural counterparts.

b. Some of the key players operating in the U.S. geotextile market include Fibertex Nonwovens A/S, TenCate Geosynthetics, NAUE GmbH & Co. KG, Officine Maccaferri SpA., Propex Operating Company.

b. The key factor which is driving U.S. geotextile market is rising civil engineering and construction activities due to rapid urbanization and industrialization across the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."