- Home

- »

- Advanced Interior Materials

- »

-

U.S. Commercial Heating Equipment Market Report, 2023GVR Report cover

![U.S. Commercial Heating Equipment Market Size, Share & Trends Report]()

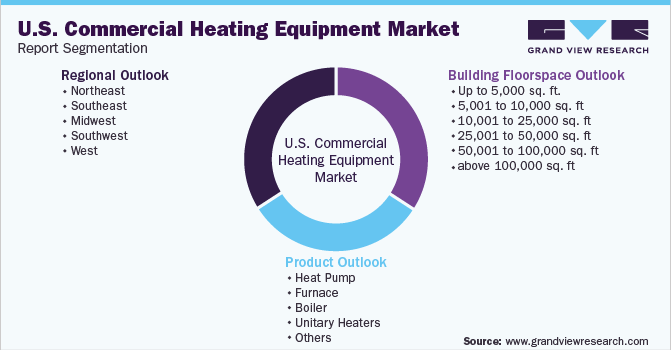

U.S. Commercial Heating Equipment Market Size, Share & Trends Analysis Report By Product (Heat Pump), By Building Floorspace, By End-use (Residential, Industrial, Commercial), By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-051-8

- Number of Pages: 152

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Report Overview

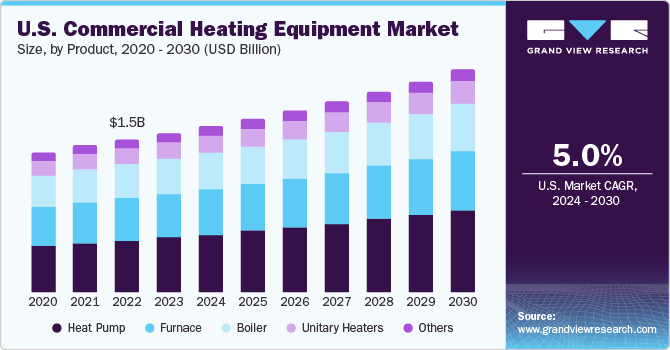

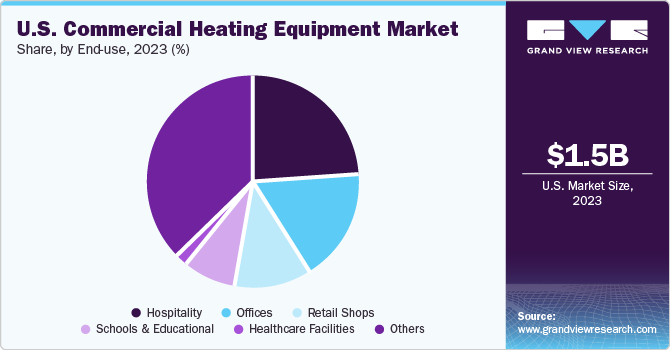

The U.S. commercial heating equipment market size was valued at USD 1.34 billion in 2022 and is anticipated to grow at a compounded annual growth rate (CAGR) of 4.8% from 2023 to 2030. Increasing commercial construction spending along with growing demand for highly energy-efficient heating solutions is projected to drive the demand for heating equipment in the U.S. Furthermore, favorable government initiatives such as rebates and incentives for the installation of highly energy-efficient heating products such as heat pumps are projected to have a positive impact on the market. The market for commercial heating equipment in the U.S. is characterized by a moderate degree of backward integration carried out by original equipment manufacturers (OEMs) for in-house production of components to fulfill quality standards and meet demand fluctuations. Players such as Carrier Corporation, Ingersoll-Rand Plc, Daikin Industries, Ltd., and Johnson Controls, Inc. operating in this market manufacture and design components in-house to reduce their dependency on external suppliers and ensure adherence to quality standards.

The Government of the U.S. has become highly conscious of the problems linked with the usage of fossil fuels. As such, it is promoting the usage of environment-friendly alternatives for these fuels. Various standards are currently being introduced in the country to lessen the environmental footprint of the construction industry. When both, direct and indirect emissions are considered, buildings have a relatively substantial carbon footprint. According to International Energy Agency, in 2021, the use of fossil fuels in buildings accounted for approximately 8% of global energy-related and process-related carbon dioxide emissions, with approximately 19% resulting from the generation of heat and electricity used in buildings or commercial spaces and an approximately 6% resulting from the manufacturing of steel, cement, and aluminum used in buildings and construction applications.

Rising construction spending in the U.S., coupled with maintenance & replacement operations related to commercial heating equipment, is anticipated to fuel the demand for energy-efficient heating solutions. The construction industry in the U.S. focuses on the development of sustainable and energy-efficient buildings. Furthermore, Leadership in Energy and Environmental Design (LEED) is a green building certification system established by the U.S. Green Building Council (USGBC) that focuses on increasing energy consumption to lessen the environmental impact of excessive energy usage. These factors are expected to drive the demand for commercial heating equipment in the U.S.

The replacement of existing commercial heating equipment with energy-saving solutions is expected to be one of the major factors influencing the growth of the market in the country. Surging space heating requirements in the U.S. are projected to propel the demand for energy-efficient heating solutions, thereby increasing the demand for certified commercial heating equipment in the country.

The cost of establishing heating systems varies according to the type of equipment and its capacity. Heat pumps with a high heating seasonal performance factor (HSPF) and Seasonal Energy Efficiency Ratio (SEER) rating are typically expensive. Their energy-efficient versions reduce energy bills and operational costs, but they necessitate large initial investments.

Technological advancements in heating equipment such as improved energy efficiency, hybrid technology, etc. lead to improved performance, reduced cost, and increased energy efficiency. Thus, several heating equipment users are replacing old equipment with new heating equipment that delivers higher energy efficiency and performance. Further, factors such as government incentives & rebates, increased energy efficiency, and reduced operating costs are critical for the adoption of commercial heating equipment.

Product Insights

The heat pump product segment led the market and accounted for 34.1% of the market revenue share in 2022. Heat pumps are widely used in regions that require moderate heating and cooling. Heat pumps are also known as two-way air conditioners because they help extract heat from cold outdoors with the help of an electrical system and discharge that heat inside the house. In summer, the operations of a heat pump are reversed, which helps keep the interiors cooler by extracting heat from indoors.

Commercial heat pump systems are confined to heat supply temperatures ranging from up to 80°C but industrial operations are frequently built for heat supply temperatures ranging from 100°C to 200°C. In addition, heat pumps are the ideal design choice for commercial applications that require heat pump energy yield at temperatures up to 80°C. Commercial heat pump systems provide the necessary plant benefits for any application requiring delivery performance, energy savings, and high-temperature output.

Furnaces are utilized in establishments that require high-temperature heating. Furnaces heat the air and use ducts to circulate it throughout the facility. A propane furnace is a versatile machine that can meet the heating requirements of any commercial building. Smaller capacity propane furnaces may even be eligible for Energy Star's Most Efficient certification, which corresponds to energy savings of 20% or more over a normal furnace. In addition to high-efficiency equipment, appropriately sized furnaces contribute to efficiency by lowering energy expenditures and extending equipment life. Heat for the furnace can be provided directly by burning fuel, electricity, or induction heating. Propane furnaces are versatile, in terms of both kind and capacity, making them suitable for a wide range of commercial buildings. Gas and electric furnaces are the most common in commercial applications.

Boilers heat water and transmit hot water or steam for a variety of applications. Steam is delivered to steam radiators via pipes; hot water can heat air via a coil. Water heating, power generation, cooking, central heating, and sanitation are among the applications of boilers. Commercial boilers use combustible fuel to heat water, converting the liquid water into steam, which is then dispersed to provide heating in a building or other structure. These aforementioned factors are expected to drive the demand for boilers in the coming years. For instance, Ideal Commercial provides wall-hung, floor-standing, and modular condensing commercial boilers in compact designs.

Unitary heaters are commonly utilized in the commercial sector to address the space heating needs of small complexes or rooms. Unitary heaters have a low starting cost and an easy installation procedure. These reasons are expected to fuel market growth in the coming years. For instance, Warren Technologies provides unitary heaters in various sizes, shapes, and configurations that can be field mounted in any brand of air conditioning system.

Building Floorspace Insights

Building floorspace up to 5,000 sq. ft. segment accounted for 42.2% of the U.S. commercial heating equipment revenue share in 2022. Stores, schools, offices, places of worship, libraries, hospitals, gymnasiums, museums, clinics, and warehouses are all examples of commercial structures. Commercial building design, construction, use, and demolition have an impact on the environment, worker productivity, and community well-being. Increasing commercial building floor space of up to 5,000 square feet will demand more commercial construction which will further propel the demand for heating equipment as they assist in reducing energy waste while lowering operating costs and improving comfort.

In the U.S., there are 5.6 million commercial buildings with 51 billion square feet to 87 billion square feet of floor space. According to the U.S. Energy Information Administration, there are 5.6 million commercial structures with a combined 87 billion square feet of floor space in the country, which represents an increase of 3.8 million commercial buildings in 2021. More structures are needed due to an increasing population and shifting consumer demands.

Around 45% of building emissions are currently caused by heating equipment, which sources more than 55% of its total energy needs from fossil fuels. Three-quarters of the carbon emissions reductions required in the construction sector under the Sustainable Development Scenario can be accomplished through the broad adoption of technologies such as the electrification of heating equipment. For instance, targeting buildings larger than 10,000 square feet for electrification will have a significant influence on lowering carbon emissions because they make up 82% of total commercial floor space in the U.S.

Regional Insights

West region market accounted for a 23.0% share of U.S. commercial heating equipment revenue in 2022. The region accounts for a share of approximately half of the overall land of the U.S. According to the U.S. Census data, the four fastest-growing populous states of the country in 2021, including California, Washington, Colorado, and Oregon, are in the Western region. The domestic population growth of approximately 143,082 individuals and positive net foreign migration of approximately 38,347 people have also made these states populous in the U.S. This increasing population of the Western region of the country is augmenting the growth in the number of commercial spaces in this region that require heating equipment in large numbers.

The Southwestern region of the country witnesses topographical extremes such as heat and cold waves that have a significant impact on its weather. For instance, Texas has mild winters and witnesses warm weather that fuels the adoption of heating equipment in the state. Heat pumps are widely used for both, heating and cooling purposes in the Southwestern region of the U.S. depending on the weather conditions. Moreover, as these pumps transport heat instead of producing it, they perform well in mild temperatures such as 30 degrees and above. Heat pumps are more energy-efficient than furnaces which reduces their monthly operating costs. This leads to the surged installation of heat pumps in commercial spaces such as malls, offices, hotels, hospitals, and public centers in this region of the country.

Major commercial spaces such as manufacturing plants, and research and development centers, which are major consumers of commercial heating equipment in the U.S., are headquartered in the Midwest region of the country. Public and private universities in the Midwest, including Northwestern University, the University of Chicago, Iowa State University, the University of Michigan, Ohio State University, the University of Illinois at Chicago, DePaul University, and Kansas State University are also key consumers of commercial heating equipment in the Midwest of the U.S. Thus, the presence of a large number of commercial spaces and the surge in commercial projects in this region is expected to drive the demand for commercial heating equipment in the Midwest of the U.S. over the forecast period.

Several industry sources predict that the commercial sector in Florida comprising retail outlets, schools, and malls, grew rapidly in 2022. The improvements in ports and infrastructure in Florida are expected to enhance its economic growth and increase commercial traffic in the state. Additionally, the National Association of House Builders reports that construction projects in the southeastern U.S. grew at an annual rate of 6% between 2019 and 2020. The surge in commercial construction projects in the Southeast of the country has fueled the demand for the installation of commercial heating equipment, thereby leading to the growth of the market in this region over the forecast period.

Key Companies & Market Share Insights

The U.S. commercial heating equipment market is characterized by the presence of a large number of players, with established players leading the market trends. The majority of these companies focus on forward integration by providing their products directly to end-users across different industry verticals. Some of these companies are expanding their reach to connect with their customers across regions easily.

For instance, Ingersoll-Rand plc acquired Air Dimensions Inc. specializing in the precision and science technologies sector. The acquisition will help expand the company portfolio and extend former company’s reach in highly attractive end markets such as emission monitoring, utility and chemical processes, and biogas. Some prominent players in the U.S. commercial heating equipment market include:

-

Carrier Corporation

-

Mitsubishi Electric Corporation

-

Emerson Electric Co.

-

Ingersoll-Rand Plc

-

Daikin Industries, Ltd.

-

Rheem Manufacturing

-

Lennox International

-

Johnson Controls, Inc.

-

Robert Bosch GmbH

-

Viessmann Group

U.S. Commercial Heating Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.13 billion

Growth Rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, building floorspace, region

Country scope

U.S.

Region Scope

Northeast, Southeast, Midwest, Southwest, West

Key companies profiled

Carrier Corporation; Mitsubishi Electric Corporation,;Emerson Electric Co.; Ingersoll-Rand Plc; Daikin Industries, Ltd.; Rheem Manufacturing, Lennox Inernational; Johnson Controls, Inc.; Robert Bosch GmbH; Viesmann Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Commercial Heating Equipment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. commercial heating equipment market based on product, building floorspace, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Heat Pump

-

Furnace

-

Boiler

-

Unitary Heaters

- Others

-

-

Building Floorspace Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 5,000 sq. ft.

-

5,001 to 10,000 sq. ft

-

10,001 to 25,000 sq. ft

-

25,001 to 50,000 sq. ft

-

50,001 to 100,000 sq. ft

-

above 100,000 sq. ft

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Northeast

-

New York

-

Pennsylvania

-

-

Southeast

-

Florida

-

-

Midwest

-

Illinois

-

Ohio

-

-

Southwest

-

Texas

-

-

West

-

California

-

-

Frequently Asked Questions About This Report

b. The U.S. commercial heating equipment market size was estimated at USD 1.34 billion in 2022 and is expected to reach USD 1.52 billion in 2023

b. The U.S. commercial heating equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 2.13 billion by 2030

b. Heat pump dominated the U.S. commercial heating equipment market with a revenue share of 34.1% in 2022. When compared to traditional heating or cooling equipment, heat pumps can provide an identical level of area conditioning at a fourth of the operational cost.

b. Some of the key players operating in the U.S. commercial heating equipment market include Carrier Corporation, Mitsubishi Electric Corporation, Emerson Electric Co., Ingersoll-Rand Plc, Daikin Industries, Ltd., Rheem Manufacturing, Lennox International, Johnson Controls, Inc., Robert Bosch GmbH, Viessmann Group

b. The key factors that are driving the U.S. commercial heating equipment market include Increasing commercial construction spending along with growing demand for highly energy efficient heating solution is projected to drive the demand for heating equipment in the U.S.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."