- Home

- »

- Processed & Frozen Foods

- »

-

U.S. Cold Storage Market Size & Share Report, 2030GVR Report cover

![U.S. Cold Storage Market Size, Share & Trends Report]()

U.S. Cold Storage Market Size, Share & Trends Analysis Report By Warehouse Type, By Construction Type (Bulk Storage, Production Stores, Ports), By Temperature Type, By Application, By State, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-451-2

- Number of Pages: 75

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

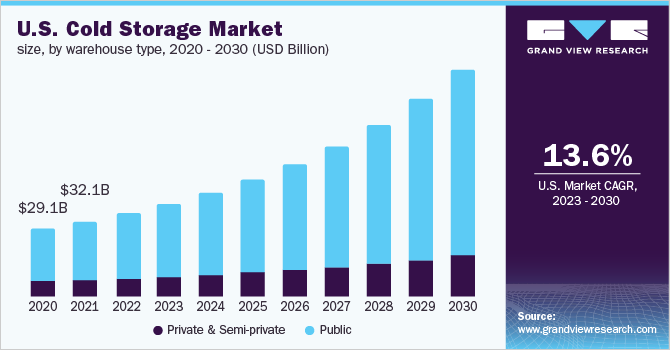

The U.S. cold storage market size was valued at USD 35.56 billion in 2022 and is expected to expand at a CAGR of 13.3% from 2023 to 2030. The growth can be attributed to several critical factors, such as technological advancements in packaging, processing, and storage of perishable food products and temperature-sensitive items. The market has also benefitted significantly from the stringent government regulation toward the production and supply of temperature-sensitive products. The industry is poised for unprecedented growth in the next seven years owing to growing organized retail sectors in the emerging economies which will create opportunities for the service providers over the forecast period.

Growing demand for connected trucks, high-cube refrigerated trailers, and vehicles that facilitate cross-product transportation is likely to drive demand for cold chain services. Ever-increasing health consciousness among consumers has inspired healthier eating habits and resulted in a rising demand for quality food packaging and storage solutions. Outsourcing services have been gaining popularity among businesses owing to factors such as increasing competition, a rapid rise in operational costs, and stringent quality standards. Numerous benefits of outsourcing these services, such as reduced operational costs, improved flexibility, higher efficiency, and expertise, have also encouraged its widespread adoption.

Service providers in the U.S. cold storage market have enhanced their efforts to protect temperature-controlled products from potential tampering or malicious actions. Securing the facility encompasses not only refrigerated warehouses but employees and visitors as well. This has resulted in increasing demand for the adoption of monitoring components such as telematics and telemetry devices, sensors, data loggers, and networking devices. Such components significantly improve the performance and efficiency of refrigerated storage and transportation.

Industry players are relying on RFID and Automatic Identification and Data Capture (AIDC) for enhancing the efficiency of the order fulfillment process. The growing penetration of Bluetooth technology and RFID sensors, across the logistics industry, is expected to spur the adoption of AIDC technology. Furthermore, cold storage operators focus on maximizing their throughput and order accuracy by using robotics applications, high-speed conveyor systems, and automated materials handling equipment. These technological advancements are in turn expected to boost the growth of the market over the forecast period.

Warehouse Type Insights

In terms of revenue, the public segment dominated the market with a share of 78% in 2022, owing to its significant adoption among consumers on leased or short terms purposes at affordable costs. Based on the warehouse type, the market has been categorized into two segments, namely private & semi-private and public. A public warehouse is operated as an independent business or third-party provider that offers various services, such as handling, warehousing, and transportation for a fixed or variable fee. Public warehouses are also known as duty-paid warehouses that can be owned by an individual or some agency.

Given the massive costs associated with the construction and maintenance of warehouses, only big companies can afford to own and maintain their private warehouses. However, the companies are increasingly constructing private warehouses as they offer significant benefits, such as flexibility, greater control over cost, and the ability to make decisions regarding the overall activities and priorities of the facility. Moreover, due to increased international trade and consumer spending, cold storage operating profits have risen dramatically in the last five years. Low-interest rates have also enabled operators to finance new constructions. The private and semi-private segment is expected to portray a significant CAGR of 11.1% from 2023 to 2030.

Construction Type Insights

The production stores segment held the largest share in 2022 and is estimated to grow at the highest CAGR exceeding 15.6% from 2023 to 2030. This growth is attributed to the growing emphasis on the protection of goods, which include raw materials as well as finished food products throughout the production process in a plant. The bulk storage segment is also expected to proliferate over the forecast period. Bulk storage warehouses are suitable for storing fruits and vegetables in large volumes. They can also be used to extend the availability of other bulk materials such as flour, cooking ingredients, and canned goods while protecting them from spoilage and keeping them away from direct sunlight.

Constructing refrigerated warehouses near ports can help simplify the customs procedures associated with the import and export of temperature-sensitive products. Improvements in efficiency and automation have widened the gap in operating performance between older and newer cold storage facilities. In the past few years, operators in the industry have implemented new technologies, such as high-speed doors, energy-efficient walls, automated cranes, and cascade refrigeration systems, to increase efficiency and reduce operating costs. For instance, the adoption of automated cranes has enabled operators to pile goods at greater heights, leading to an increase in the average building height of newer facilities.

Temperature Type Insights

The frozen segment accounted for the largest share exceeding 81% in 2022. Increasing awareness about convenience food among individuals has led to a shift in their preference for ready-to-cook meals. Moreover, consumers are increasingly opting for frozen food owing to its support for microwave cooking and ease of use in terms of packing techniques. These trends have significantly contributed to the rise in the adoption of frozen foods, thereby leading to segment growth. However, the chilled segment is anticipated to witness a notable shift in growth over the forecast period.

Based on temperature type, the market is segmented into chilled and frozen cold storage The warehouses falling under the chilled segment maintain their storage temperature in the ranges of above -5°C. They are used to store fresh fruits & vegetables, eggs, dry fruits, milk, and dehydrated foods, among others. Meanwhile, the warehouses falling under this segment maintain their temperature in the range from -10 to -20°F. They are used to store frozen vegetables, fish, meat, seafood, and other products.

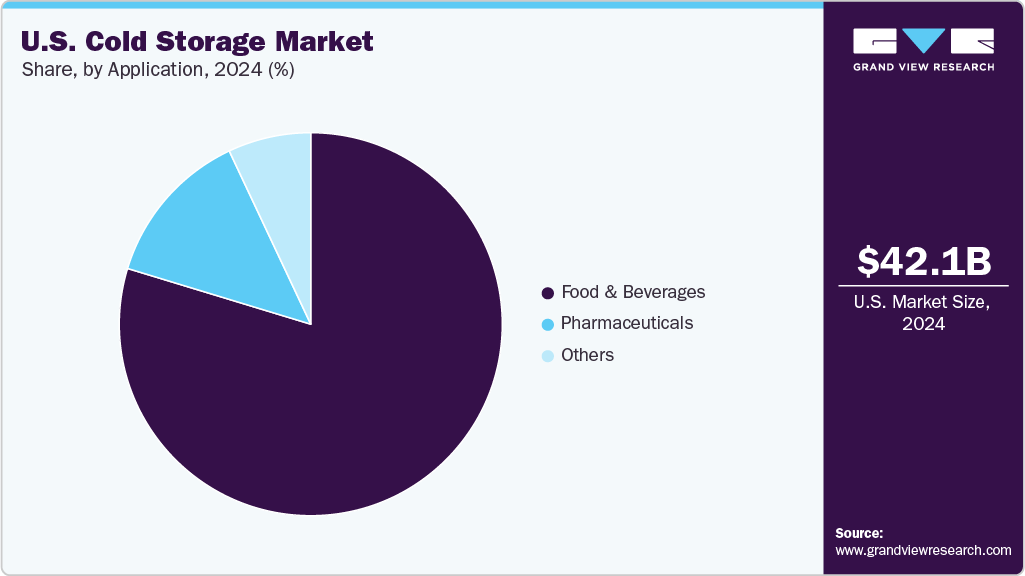

Application Insights

In terms of revenue and market share, the fish, meat & seafood application segment captured the largest market share of 36% in 2022. Based on application, the market is categorized into fish, meat & seafood; fruits & vegetables; dairy; processed food; and pharmaceuticals. The processed food segment is projected to witness highest growth of 16.9% from 2022 to 2030 owing to high demand of processed food products due to its several advantages such as immediate consumption, easy cooking, easy handling, and storage. Moreover, continuously changing lifestyle, increased safety, and growing need for easy convenience majorly drives the adoption of processed food. The adoption of processed food is also increased owing to excellent marketing and innovative packaging offered by the providers which further fuels the growth of the market.

The increasing demand for perishable products and fast delivery requirements associated with the e-commerce-based food and beverage delivery market has led to a significant boost in cold chain operations. The processed food segment is expected to witness the highest CAGR over the forecast period owing to the continued improvements in food packaging materials. However, the growing incidence of food and pharmaceutical counterfeiting has resulted in the introduction of stringent government regulations regarding production and supply chains. These regulations are impelling industry incumbents to develop rigorous practices, and service providers are making investments in improving their infrastructure to obtain safety certifications.

States Insights

California held the largest share in terms of revenue in 2022 and is projected to maintain its dominance in the market from 2023 to 2030. The significant share is attributed to the state’s 400 million cubic feet of cold storage space, which serves a large user base. California represents the highest number of facilities, which can be attributed to its large population and the significant need for these facilities. All the facilities in this state are regulated by the California Department of Public Health, Food and Drug Branch.

Florida, Washington, and Texas are some of the leading states in the market, which held a significant market share in 2022. North Carolina and South Carolina are some of the highest-growing markets which are expected to witness a CAGR of over 15.2% and 14.7%, respectively, from 2023 to 2030. The cold storage companies are also finding lucrative opportunities in North Dakota and Virginia among other states. Developments in transportation facilities, technological advancements, and increased adoption of frozen foods have proliferated demand for refrigeration and storage, leading to market growth.

Key Companies & Market Share Insights

The key industry players engage in implementing several recent developments, such as setting up new facilities to offer avenues for increased profitability through improved customer relationships. Along with this, the companies are actively focused on expansion through mergers and acquisitions. For instance, Americold acquired Cloverleaf Cold Storage, Lanier Cold Storage, Portfresh Logistics, Zero Mountain Cold Storage Warehousing, and Zero Mountain Transportation Logistics in the past few years. As such, the companies are staying ahead of the competition through acquisitions and geographic expansions. Some prominent players in the U.S. cold storage market include:

-

Americold

-

AGRO Merchants Group North America

-

Burris Logistics

-

Henningsen Cold Storage Co.

-

Lineage Logistics Holdings, LLC

-

Nordic Logistics

-

Preferred Freezer Services

-

VersaCold Logistics Services

-

United States Cold Storage

-

Wabash National Corporation

U.S. Cold Storage Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 35.56 billion

Revenue forecast in 2030

USD 96.90 billion

Growth Rate

CAGR of 13.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Warehouse type, construction type, temperature type, application, state

Country scope

The U.S.

Key companies profiled

Americold Logistics LLC; Lineage Logistics; Burris Logistics; Wabash National; United States Cold Storage

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country and state levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. cold storage market report based on warehouse type, construction type, temperature type, application, and states:

-

Warehouse Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Private & Semi-private

-

Public

-

-

Construction Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Bulk Storage

-

Production Stores

-

Ports

-

-

Temperature Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Chilled

-

Frozen

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Fruits & Vegetables

-

Dairy

-

Fish, Meat & Seafood

-

Processed Food

-

Pharmaceuticals

-

-

State Outlook (Revenue, USD Million, 2017 - 2030)

-

Maine

-

Massachusetts

-

Vermont

-

New Jersey

-

New York

-

Pennsylvania

-

Delaware

-

Florida

-

Georgia

-

Maryland

-

North Carolina

-

South Carolina

-

Virginia

-

Illinois

-

Indiana

-

Michigan

-

Ohio

-

Wisconsin

-

Alabama

-

Kentucky

-

Mississippi

-

Tennessee

-

Iowa

-

Kansas

-

Minnesota

-

Missouri

-

Nebraska

-

North Dakota

-

South Dakota

-

Arkansas

-

Louisiana

-

Oklahoma

-

Texas

-

Arizona

-

Idaho

-

New Mexico

-

Utah

-

California

-

Oregon

-

Washington

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cold storage market size was estimated at USD 35.56 billion in 2022 and is expected to reach USD 39.72 billion in 2023.

b. The U.S. cold storage market is expected to grow at a compound annual growth rate of 13.3% from 2023 to 2030 to reach USD 96.90 billion by 2030.

b. The public segment dominated the U.S. cold storage market with a share of 78% in 2022. This is attributable to the need of companies to improve productivity and efficiency of cold storage facilities, which can be addressed by automation.

b. Some key players operating in the U.S. cold storage market include Americold Logistics, LLC; AGRO Merchants Group North America, Burris Logistics, Cloverleaf Cold Storage, Henningsen Cold Storage Co., Lineage Logistics Holdings, LLC.

b. Key factors that are driving the U.S. cold storage market growth include technological advancements in packaging, processing, and storage of perishable food products and temperature-sensitive items.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The automotive & transportation industry is amongst the most exposed verticals to the ongoing COVID-19 outbreak and is currently amidst unprecedented uncertainty. COVID-19 is expected to have a significant impact on the supply chain and product demand in the automotive sector. The industry's concern has moved on from being centered on supply chain disruption from China to the overall slump in demand for automotive products. The demand for commercial vehicles is expected to plummet with the shutdown of all non-essential services. Furthermore, changes in consumer buying behavior owing to uncertainty surrounding the pandemic may have serious implications on the near future growth of the industry. Meanwhile, liquidity shortfall and cash crunch have already impacted the sales of fleet operators, which is further expected to widen over the next few months. We are continuously monitoring the COVID-19 pandemic, and assessing its impact on the growth of the automotive & transportation industry. The report will account for Covid19 as a key market contributor.