- Home

- »

- Advanced Interior Materials

- »

-

U.S. Agro Textile Market Size, Share & Trends Report, 2030GVR Report cover

![U.S. Agro Textile Market Size, Share & Trends Report]()

U.S. Agro Textile Market Size, Share & Trends Analysis Report By Material (Synthetic Fiber, Natural Fiber), By Type (Woven, Non-Woven, Knitted), By End-use (Shade Nets, Mulch Mats), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-111-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

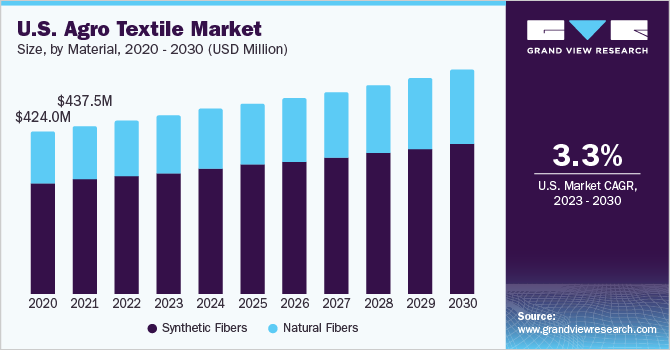

The U.S. agro textile market size was estimated at USD 451.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.3% from 2023 to 2030. The increasing demand for agro products has resulted in multiple uses of agro textiles such as boosting germination, in nurseries, protecting soil from moisture evaporation and erosion, safety from environmental and climatic factors such as hail, rain, and sunlight, and protection from living factors such as birds, insects, fungus, and other pests have helped increase the adoption of agro textiles in the U.S.

Agro textiles play a major role in various applications across agro-industries such as horticulture, farming, husbandry, and aquaculture in the form of protection, storage, and growth stimulation. Some products help in the protection from sunlight in the form of shade nets by controlling the amount of sunlight and mulch mats that help block the sunlight to reduce weed growth. Products such as anti-hail nets and windshields help protect crops from damage due to climatic factors.

Some agro-textile products such as insect nets and bird nets are used to protect crops from external animals and pests. Other products such as support nets that facilitate the growth of vertical plants, porous fabrics for irrigation, and ground covers for increasing crop production. Some products such as rootball nets and packaging materials help in easy and safe transport and storage of the produce to reduce damage and wastage. These factors are forecasted to drive the demand for agro textiles and their products in the U.S. market over the coming years.

Moreover, the U.S. population increased from 331.5 million in 2020 to 331.9 million in 2021, as per World Bank records. Whereas, the arable land within the country didn’t increase significantly. On the other hand, the demand for agricultural products is growing rapidly. This has led to the use of alternative methods for increasing agricultural yield to meet the product demand without compromising on quality or price.

The use of land for non-agricultural activities has increased, which is expected to decrease the availability of land for agricultural activities. However, alternative methods to increase production such as the use of fertilizers coupled with alternative farming techniques such as aquaponics have helped meet the rising food demand. Intensive use of available arable land is expected to result in a high degree of land degradation over time. This is expected to drive the adoption of agro textiles in farming applications over the forecast period.

Material Insights

The synthetic fiber segment dominated the market with the largest revenue share of 68.0% in 2022. The segment is projected to rise at a significant rate over the forecast period due to the growing demand for agricultural products in various industries and the need to increase their production. Synthetic fibers are resilient, strong, long-lasting, and resistant to most environmental issues including fungus and moisture. They are also less expensive than their natural counterparts and simpler to make and handle.

Monomers obtained from crude oil are used to make nylon. It is subsequently combined with other elements, such as acids, to create polymers, which are then extruded and spun into nylon fabric. Due to declining reserves, it is anticipated that the dependence on crude oil for the manufacturing of these fibers would have an impact on demand. The market is anticipated to be impacted by the increased attention being paid to the negative effects of utilizing petroleum-based goods. Insect meshes, fishing lines, mosquito nets, anti-fouling nets, and pallet covers are all made of nylon.

Natural fibers segment is forecasted to grow at the fastest CAGR of 3.1% over the coming years. Natural fibers include materials derived from natural sources including jute, wool, flax, hemp, and sisal. The increasing focus on the sustainability of products used by manufacturers and users has led to an increase in demand for natural fiber-based agro textiles. The increasing demand for organic substances is also expected to boost market growth.

Consumer focus on the sustainability of the manufacturing process and the environmental impact of synthetic fibers has increased the use of natural fibers in agro textiles. Natural fibers have high wet strength, high moisture retention, and are biodegradable. The easy and safe disposal of these textiles is expected to positively impact the growth of natural agro textiles.

Type Insights

The knitted agro textile segment dominated the U.S. market with the largest revenue share of 80.1% in 2022 and is expected to grow at the fastest CAGR of 3.5% in the coming years. The ease of handling knitted fabric and the versatility of textiles produced through knitting methods have contributed to a rise in product demand.

On weaving machines such as the Sulzer projectile machines, agricultural textiles are produced. Woven fabrics represent the optimal selection for applications involving moisture exposure, as they exhibit remarkable resistance to shrinkage and weathering caused by water. Their superior strength and thickness compared to alternative textiles make them well-suited for protective purposes, including packaging and floor coverings.

Non-woven fibers are made from various methods such as chemical bonding, thermally fusion, and mechanical entanglement. The manufacturing process consists of a web formation that imparts mechanical strength and later adds further properties according to the end-use of the fiber. Methods such as needle punching, stitch bonding, thermal bonding, chemical bonding, and hydro bonding are used to give mechanical integrity to the fabric before treating it to impart properties such as anti-static, anti-bacterial, and moisture resistance.

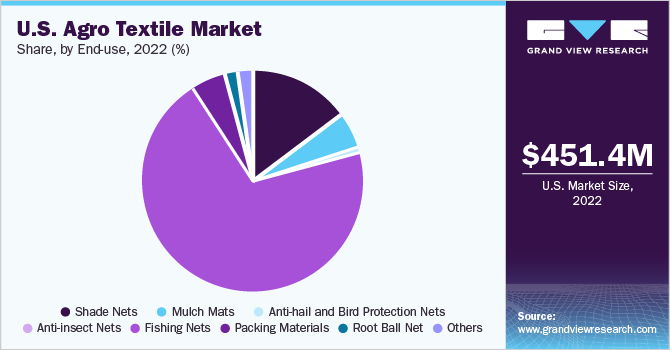

End-use Insights

Based on end-use, the fishing nets end-use segment dominated the market with a revenue share of 70.0% in 2022 and is expected to grow at the highest CAGR over the forecast period. Fishing nets are made from knitted fabric made of nylon or HDPE. The growing utilization of aquatic life in diverse industries such as nutraceuticals, pharmaceuticals, and cosmetics, coupled with the escalating seafood consumption, has fostered the expansion of aquaculture, consequently driving the growth of the fishing net market. Studies on the benefits of consuming marine products are expected to help the segment maintain its growth over the forecast period.

Fishing nets offer high tensile strength, high abrasion, low drag resistance, and high knot-breaking strength, and are suitable for capturing various types of fish. Different types of nets are available based on the types of fish, water bodies, and expected weight of caught fish. Some types of nets include bottom trawls, cast nets, drag nets, drift nets, fyke nets, and others.

Shade nets are made of UV-treated polyethylene material, which is hosted upon structures made of GI pipes, bamboo, iron, or wood. They help control the intensity of sunlight and heat on crops. They are available in different shade percentages, which only allow a certain percentage of sunlight to enter the area covered by the nets. Shade nets are also used to cover cattle sheds and aquaponic ponds. The increasing use of greenhouses by consumers and the adaptation of methods such as terrace farming are expected to be the major factors contributing to the increasing use of shade nets.

Key Companies & Market Share Insights

There are several players operating in the U.S. agro textile market. Technological development, easy availability of materials, and hassle-free installation processes are resulting in significant competition among the players. Agro textiles require different accessories for installation, wherein each accessory is manufactured with a separate set of raw materials. This facilitates the use of substitutes in the manufacturing process, thereby increasing the market competition.

Prominent suppliers are focusing on research & development activities to reduce operational costs; maximize the efficiency of production and storage; and enhance the quality of products to maintain their positions in the agro textile market. For instance, Beaulieu Technical Textiles introduced RECOVER, a durable, robust, and more environmentally friendly weed management option. Recycled materials were used in the creation of the new ground cover. The recycling facility in Beaulieu produces a total of 30% post-industrial trash, which is added throughout manufacturing This results in a decreased carbon footprint that has been calculated using a Cradle to Gate LCA, which reduces CO2 by up to 35%. Some prominent players in the U.S. agro textile market include:

-

TenCate Geosynthetics

-

Belton Industries, Inc

-

Mogul Co., Ltd.

-

Dewitt

-

Freudenberg Performance Materials

-

Siang May Pte Ltd.

-

Ludvig Svensson

-

Mink (Phorium)

-

Morenot

-

Garware Technical Fibers Ltd.

U.S. Agro Textile Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 465.7 million

Revenue forecast in 2030

USD 584.7 million

Growth rate

CAGR of 3.3% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

U.S.

Segments covered

Material, type, end-use

Key companies profiled

TenCate Geosynthetics; Belton Industries, Inc.; Mogul Co., Ltd.; Dewitt; Freudenberg Performance Materials; Siang May Pte Ltd.; Ludvig Svensson; Mink (Phorium); Morenot; Garware Technical Fibers Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Agro Textile Market Report Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. agro textilemarket report based on material, type, and end-use:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Synthetic Fiber

-

Natural Fiber

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Woven

-

Non-woven

-

Knitted

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Shade Nets

-

Mulch Mats

-

Anti-hail and Bird Protection Nets

-

Anti-insect Nets

-

Fishing Nets

-

Packing Materials

-

Root Ball Net

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. agro textile market size was estimated at USD 451.4 million in 2022 and is expected to reach USD 465.7 million in 2023.

b. The U.S. agro textile market is expected to grow at a compound annual growth rate of 3.3% from 2023 to 2030 to reach USD 584.7 million by 2030.

b. Knitted agro textile dominated the market with the largest revenue share of 80.1% in 2022 owing to ease of handling knitted fabric and the versatility offered by fabric produced by knitting processes

b. Some of the key players operating in the U.S. agro textile market include TenCate Geosynthetics, Belton Industries, Inc, Mogul Co., Ltd., Dewitt, Freudenberg Performance Materials, Siang May Pte Ltd., Ludvig Svensson, Mink (Phorium), Morenot, and Garware Technical Fibers Ltd.

b. The key factor which is driving U.S. agro textile market is the growing agricultural and aqua cultural industry in the country

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."