- Home

- »

- Advanced Interior Materials

- »

-

U.S. Agricultural Fencing Market Size & Share Report, 2030GVR Report cover

![U.S. Agricultural Fencing Market Size, Share & Trends Report]()

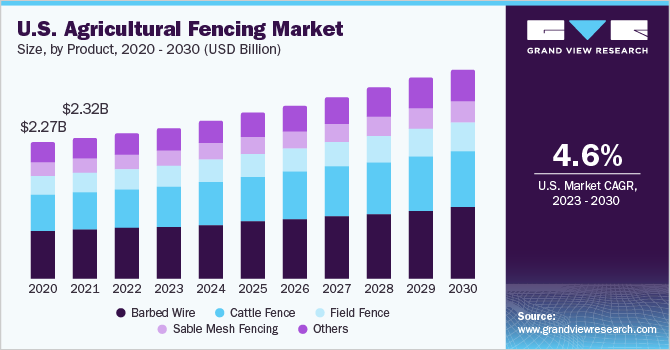

U.S. Agricultural Fencing Market Size, Share & Trends Analysis Report By Product (Barbed Wire, Cattle Fence, Field Fence), By Material (Metal, Wood), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-054-9

- Number of Pages: 78

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Market Size & Trends

The U.S. agricultural fencing market size was estimated at USD 2.40 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. The increasing consumer preference for farmland safety and security is expected to contribute to market growth.The growing demand for agricultural products has driven farmers to increase their yield and invest in infrastructure for the protection of their produce. Fencing serves as an effective means of protection as it provides defined boundaries to the fields/farms.

Fencing around agricultural grounds protects against intruders and trespassers and reduces the risks of theft of crops, animals and equipments. It also protects the wild animals from attacking the domesticate animals and keeps them safe while providing a secure area away from intruders for the animals to graze around the field. These factors are expected to be a major factor driving the demand for the product in agriculture fencing over the forecast period.

Fences are manufactured by galvanization, powder priming, and powder top coating methods that result in high durability, overall corrosion protection, maximum stability, enhanced functionality, and high aesthetic appeal of fences. Well-established metal suppliers such as National Fence Systems Inc., Guardian Fence Supplier, and Sogazco Inc. dominate the market.

The rising adoption of wood fencing in agricultural applications owing to easy repair & maintenance is a key factor driving the growth of the wood fencing market in agricultural fields. The surging disposable income coupled with the rising awareness related to the safety of farmland may catapult industry growth over the forecast period.

The continuous technological advancement in the agricultural fencing market has led to an increase in the number of new innovative products such as an Electric Security Fencing System. It is a form of wired barrier that deters animals and people from breaching a border by using electric shocks. The majority of electric fences are used to improve the security of sensitive regions such as military facilities, jails, and other security-sensitive locations.

High raw material price volatility becomes a major challenge for manufacturers to remain competitive and provide sustainable profitability. Raw material price volatility lay a greater impact on the quality of the finished products. Thus, manufacturers adjust to the volatile pricing of raw materials in order to acquire a share in the market or remain competitive which, in turn, is likely to hamper the market growth.

Product Insights

The barbed wire segment led the market and was estimated at a revenue share of 35.7% in 2022 and is forecasted to grow at a CAGR of 4.4% over the coming years. Barbed wires are fencing wires mainly manufactured from steel with pointy and sharp edges at regular intervals along the length of the fence. These are one of the oldest forms of fence used in the agricultural sector.

Cattle fences were the fastest growing segment with 4.8% CAGR for the time period from 2023 to 2030. These are used to secure perimeters around the field for cattle grazing and their protection from thieves & wild animals. These include high-tensile, woven steel wires which are held together with wooden or metal poles at regular distances. Some farmers prefer all-wood fencing for cattle, which is sturdier than metal wires.

Field fences are largely referred to as fences that are used to surround the perimeter of farms and fields. These are used to secure the agricultural premises and keep the yield and livestock safe. The agricultural lands in the U.S. are decreasing rapidly every year to make place for residential and commercial buildings. This is negatively affecting the demand for field fences in agricultural applications.

The stable mesh fence segment was valued at USD 241.1 million in 2022 and is expected to reach USD 347.7 million by 2030. This segment includes wood and metal fences which are used to contain horses. This fence category involves rail/plank fences, high tensile polymer fence, rubber fence and mesh wire fences. These are different from cattle fences as they need to be higher in size as horses can jump from smaller fences and not properly contained.

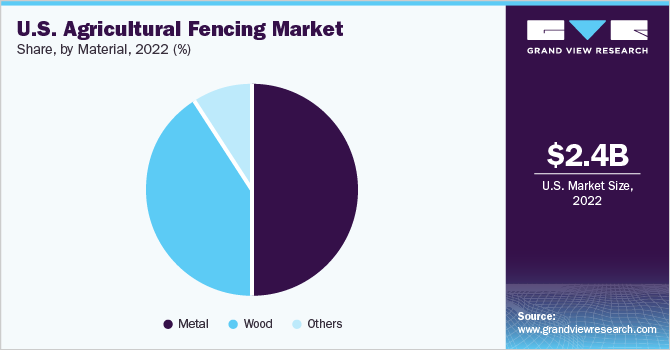

Material Insights

The metal segment was the largest and fastest growing market valued at USD 1.20 billion in 2022 and estimated to grow at a CAGR of 4.7% over 2023 to 2030. This segment includes the use of metals such as aluminum & iron and alloys like steel for agriculture fencing. This is attributed to the properties of metals including malleability and ductility, which enable these metals to be molded into thin wires and tubes to manufacture agriculture fencing.

Chain link is a type of metal fence that is highly popular in agricultural applications because of its affordable prices. This type of fence is also available in PVC coatings and is resistant to rust. Additionally, the growth of the metal fencing segment can be attributed to a growing interest in chain link, ornamental, and barbed wire fencing to mark boundaries and secure the perimeter of the farm.

Wood is largely used to make fencing for horses and pigs along with other larger farm animals. These are sturdier and more aesthetically appealing. These fences can be easily painted into any color and modified as per requirement. However, wood fences have a smaller service life in comparison to metal fencings, these require more maintenance in order to protect the wood from moisture and sunlight.

Plastic and composite fences are used due to its cost-effectiveness and advantages such as high durability, lightweight, low or no maintenance, and easy replacement over conventional wood and metal fences. However these are not ideal for agricultural applications in comparison to wood and metal fencing, hence their market demand is relatively low.

Key Companies & Market Share Insights

The U.S. agricultural fencing market is characterized by the presence of a large number of players, with established players leading the market developments. The agricultural fencing market in the U.S. is extremely competitive because of the vast number of companies. To retain their position in the fence industry, the major manufacturers in the United States are concentrating on research and development operations to lower operational costs, boost production and storage efficiency, and improve product quality.

The larger companies in the market are focused on research and product development & enhancement in order to maintain its edge over its competition. The larger companies are also investing in acquiring smaller companies with high production capacities and vast portfolios so as to eliminate their competition. Some prominent players in the U.S. agricultural fencing market include:

-

Bekaert

-

Red Brand.

-

BMD Inc.

-

Edge Wholesale Direct

-

Ramm Fence Systems, Inc.

-

Kencove Farm Fence Supplies

-

American Wholesale Fence Works

-

Oklahoma Steel & Wire, Inc.

-

Farm Fence Solutions, LLC.

-

Midwest Air Technologies Inc.

-

San Antonio Steel Company

-

Tornado Wire Ltd

-

ProFence LLC

-

STAY TUFF FENCE.

-

River Valley Fencing

U.S. Agricultural Fencing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.44 billion

Growth Rate

CAGR of 4.6% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material

Country scope

U.S.

Key companies profiled

Bekaert; Red Brand.; BMD Inc.; Edge Wholesale Direct; Ramm Fence Systems, Inc.; Kencove Farm Fence Supplies; American Wholesale Fence Works; Oklahoma Steel & Wire, Inc.; Farm Fence Solutions, LLC.; Midwest Air Technologies Inc.; San Antonio Steel Company; Tornado Wire Ltd; ProFence LLC; STAY TUFF FENCE.; River Valley Fencing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Agricultural Fencing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. agricultural fencing market based on product and material:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Barbed Wire

-

Cattle Fence

-

Field Fence

-

Sable Mesh Fencing

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Wood

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. agricultural fencing market size was estimated at USD 2.40 billion in 2022 and is expected to reach USD 2.49 billion in 2023.

b. The U.S. agricultural fencing market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 3.44 billion by 2030.

b. Metal fence segment dominated U.S. agricultural fencing market with a share of 50.3% in 2022. This is attributed to the malleability and ductility properties of metal, which enable these metals to be molded into thin wires and tubes to manufacture agriculture fencing.

b. Some of the key players operating in the U.S. agricultural fencing market include Bekaert, Red Brand., BMD Inc., Edge Wholesale Direct, Ramm Fence Systems, Inc., and Kencove Farm Fence Supplies.

b. The key factor which is driving U.S. agricultural fencing market is the increased pressure on agricultural producers to increase their output and take necessary steps for its protection.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."