- Home

- »

- Medical Imaging

- »

-

Ultrasound Device Market Size, Share & Growth Report 2030GVR Report cover

![Ultrasound Device Market Size, Share & Trends Report]()

Ultrasound Device Market Size, Share & Trends Analysis Report By Portability (Handheld, Compact), By Application (Cardiology, Radiology), By Product, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-814-5

- Number of Pages: 190

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global ultrasound device market size was estimated at USD 9.42 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.21% from 2023 to 2030. The market growth is anticipated to be driven by the rising use of ultrasound equipment for diagnostic imaging and treatment, as well as the rising prevalence of chronic and lifestyle-related diseases. A few of the major factors influencing the market include the increased demand for minimally invasive surgery and developments in ultrasound imaging technology. Ultrasound is considered one of the most valuable diagnostic tools in medical imaging when compared to other diagnostic imaging systems since it is both faster and less expensive. In addition, as it does not use magnetic fields or ionizing radiation, it is safer than other imaging technologies. Both diagnostic and therapeutic uses for ultrasonic medical devices are extensive. Specific therapeutic applications of ultrasound, from oncology to cardiology, have grown in popularity.

The development of wireless transducers, app-based ultrasound technology, fusion with CT/MR, laparoscopic ultrasound, and the expansion of ultrasound device applications in 3D imaging and shear wave elastography are expected to keep the market booming shortly. For instance, in March 2023, KronosMD, INC., a division of Kronos Advanced Technologies Inc., confirmed its acquisition of all current and future properties and patents related to its planned breakthrough 3D ultrasonic dentistry imaging and diagnostic equipment. As the transaction approaches completion, it has the goal to boost the industrialization of the S-WAVETM system and S-WAVETM ultrasonic imaging equipment.

In addition, it is anticipated that market expansion is expected to be aided by the introduction of artificial intelligence (Al) to systematize time-consuming tasks such as quantification and selecting the best image slice from a 3-D dataset. Most new systems at all levels are going to include higher levels of AI in the future. Many high-end ultrasound systems already have some level of artificial intelligence.

Currently, the manufacturers are focusing on expansion of the ultrasound devices in radiology. Radiologists still utilize 2-D ultrasound imaging for examinations even though 3-D/4-D volume imaging in obstetrics and gynecology and 4DUS imaging is used to visualize heart wall movements. Manufacturers and scientists have driven interest in the market due to improvements in imaging quality and workflow as well as growing awareness of radiation dose issues with other imaging modalities. Real-time ultrasound imaging can be very important in the emerging field of fusion imaging. Due to radiologists' predilection for modalities like CT and MRI, ultrasound fusion imaging is less well-established in the radiology industry. Radiologists are now concentrating more on the market due to recent developments in ultrasound imaging technology and growing radiation exposure concerns.

The COVID-19 pandemic has led the healthcare sector to face enormous difficulties. As installations were delayed and manufacturers had to concentrate on producing COVID-critical devices, there was an uneven demand for the market during the pandemic. However, due to the handheld ultrasound device's effectiveness in treating patients in need of critical care in crowded hospitals, as well as its portability, speed, and usability, it was in high demand.

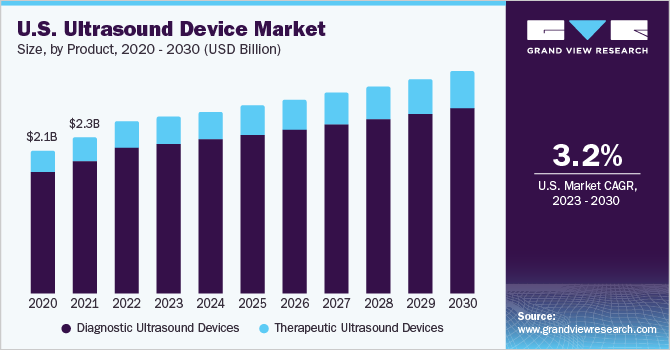

Product Insights

In terms of product, the diagnostic ultrasound devices segment held the largest revenue share of more than 84.37% in 2022 owing to the wide range of applications in obstetrics, cardiology, and oncology. The demand for diagnostic ultrasound devices is also anticipated to increase due to technology improvements and the rising prevalence of various lifestyle-related diseases. The regulatory approvals of the ultrasound devices are the main driver of the segment's growth. For instance, in September 2022 , Koninklijke Philips N.V. declared that the Food and Drug Administration 510(k) approval was successfully awarded for its cutting-edge 5000 Compact Series, the company's most recent tiny ultrasonic system. This most recent authorization enhances ultrasound accessibility efficiency by utilizing the latest advances in Philips ultrasound technology generated to provide cart-based high-quality images in small format, involving an array of ultrasound diagnosis remedies that cater to the requirements of many medical areas of expertise, such as medical care, obstetrics, general imaging, cardiology, and gynecology. The rising need for advanced diagnostic instruments, such as miniaturized 2D and 3D/4D, is also expected to fuel the global market for diagnostic ultrasound devices. It is further divided into 2D, 3D/4D, and Doppler segments.

The therapeutic ultrasound devices segment is anticipated to register the fastest CAGR of 4.88% during the forecast period. This segment is further divided into high-intensity focused ultrasound and extracorporeal shockwave lithotripsy. The high-intensity focused ultrasound segment held the largest revenue share in 2022 and is expected to grow at a significant rate over the forecast period since it is highly effective in treating cancers and other related disorders. As per the WHO 2022 report, globally, there were an estimated 20 million new cases of cancer and 10 million deaths from cancer.

Application Insights

In terms of application, the radiology segment held the largest revenue share of more than 22.31% in 2022. The increasing application of artificial intelligence in the field of radiology boosts the segment growth. Moreover, the growing mergers and acquisitions among the industry's key players for expanding the product portfolio drive the market growth. For instance, in February 2023 , GE HealthCare disclosed the execution of a contract to purchase Caption Health, Inc., a privately held artificial intelligence health services company that develops medical devices that help in early disease diagnosis, including the application of artificial intelligence to assist in scanning for ultrasounds. Ultrasonic investigations can be made simpler and more quickly with Caption artificial intelligence tools, allowing a greater number of medical professionals to undergo basic echocardiography evaluations. This device is capable of identifying indications of diseases such as cardiac failure in patients at risk throughout healthcare facilities, the home, and alternate places of care, thereby saving hospitalizations and enabling better medical results.

The obstetrics/gynecology segment is anticipated to grow at the fastest rate of over 4.89% over the forecast period. Obstetrics and gynecology have been transformed by ultrasound technology. During pregnancy, obstetric ultrasonography is used to monitor fetal development and check maternal health. Gynecological ultrasound is used to identify problems such as ovarian cysts, uterine fibroids, and endometriosis by seeing the female reproductive organs. For instance, in June 2022 , Mindray launched the ultrasonic machine, Imagyn I9, created to cater to the special needs of busy OB/GYN settings. This device was developed to meet the rigorous standards set by OB/GYN facilities. The recently released system includes a completely free-floating interface for users, enhanced transducer ports, and unique E-Ink keys, both featuring an emphasis on accessibility and ergonomics in the OB/GYN arena.

End-use Insights

In terms of end-use, the hospitals segment held the largest revenue share of over 40.37% in 2022 and is further expected to maintain its lead over the forecast period. The segment growth can be attributed to the extensive use of ultrasound devices in hospital settings and an increase in the number of patients visiting hospitals with various lifestyle-related disorders. The introduction of portable systems is expected to fuel the demand for ultrasound devices in OPD as well as in-patient departments.

Furthermore, the rise in the adoption of technologically advanced imaging systems and the increasing mergers and acquisitions between hospitals and market players are likely to boost the demand for new installations in the coming years. For instance, in 2020, Philips signed a multi-year contract to support the expansion and improvement of Zhejiang University's First Affiliated Hospital, one of China's leading hospitals. This contract comprises Ultrasound, Image-Guided Therapy, Monitoring Analytics & Therapeutic Care systems, which combine clinical research and education.

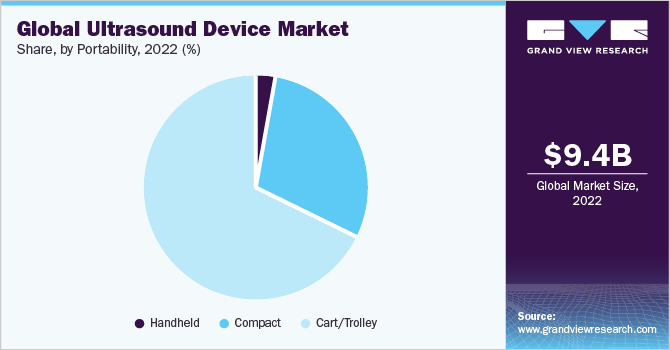

Portability Insights

In terms of portability, the cart/trolley-based ultrasound devices segment held the largest revenue share of over 67.83% in 2022. By transporting the device to the patient's location, whether it's an Intensive Care Unit (ICU) or an emergency department, cart/trolley ultrasounds completely avoid the issue of transferring critical patients. Furthermore, it aids in rapid diagnosis, treatment decision-making, and administration, all of which contribute to increased patient recovery and satisfaction.

The handheld ultrasound devices segment is anticipated to register the fastest growth rate of 5.71% during the forecast period. Handheld devices are in high demand due to the growing trend of home healthcare and remote patient monitoring. During the COVID-19 pandemic, handheld ultrasound devices have proven to be efficient in monitoring critically ill patients, and thus since the pandemic, the demand for handheld ultrasound devices has only been accelerating. Technological advancements are further expected to expand the market size. For instance, in January 2023, a novel cordless handheld ultrasonic device called the PocketPro H2 was introduced by Konica Minolta Healthcare Americas, Inc. for application in point-of-care settings for general screening. With the PocketPro H2, offering an entirely novel form of versatility and cost in ultrasound imaging, Konica Minolta Healthcare, teamed up with Healcerion to offer it across the United States to use it for both human and animal purposes.

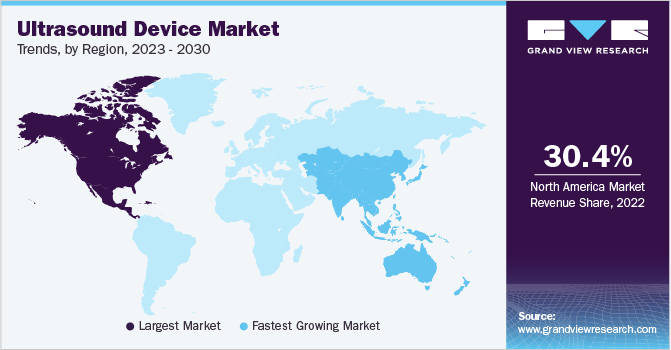

Regional Insights

Based on region, North America dominated the market in 2022 with the largest revenue share of over 30.04%. Over the forecast period, the region is expected to grow at a significant rate. The presence of a significant number of market competitors in the region and the increasing number of cancer cases are some of the key factors contributing to the regional market growth. Furthermore, increasing incidence of cancer cases drives the market growth in this region. For instance, as per the National Journal of Health Statistics, in 2023, in the United States, 195,831 additional cases of cancer and 60,982 fatalities due to cancer are anticipated. Furthermore, increasing expenditure on health care, greater understanding of various methods of diagnosis, and favorable policies for reimbursement are projected to drive market expansion in this area.

In Asia Pacific, the market is estimated to register the fastest CAGR of 4.88% during the forecast period owing to the increased demand for better imaging devices. Furthermore, market players are adopting different strategies to mark their presence in the region. Factors such as low research costs, less stringent regulatory guidelines, and increased government funding for the development of the research and development sector in the respective countries are making the region attractive for research studies. Moreover, rapidly developing economies and improving healthcare services in Southeast Asian countries, such as China, Japan, and India, are expected to propel growth.

Key Companies & Market Share Insights

The major players are working to improve their product offerings by upgrading their products, taking advantage of important cooperation activities, and exploring acquisitions and government clearances to expand their customer base and gain a larger share of the overall market. For instance, in March 2023, Siemens Healthineers announced the evolution of the Acuson Sequoia Flagship series of ultrasound devices at the European Congress of Radiology (ECR), 2023, in Vienna. With an estimated growth rate of 6.3% to reach a value of 9.0 billion dollars by 2026, Ultrasound is one of the fastest-growing global markets. Additionally, in February 2023, Boston Imaging launched the Hera W10 Elite, the exclusive model of the Hera platform for obstetrics and gynecology, which provides clinicians with powerful artificial intelligence (AI) tools and clinical applications to enhance the diagnostic experience. Boston Imaging is the U.S. headquarters for marketing, sales, and distribution of all Samsung digital radiography and ultrasound systems. Some prominent players in the global ultrasound device market include:

-

Koninklijke Philips N.V.

-

GE Healthcare

-

Siemens Healthineers AG

-

Canon Medical Systems

-

Mindray Medical International Limited

-

Samsung Medison Co., Ltd.

-

FUJIFILM SonoSite, Inc.

-

Konica Minolta Inc.

-

Esaote

Ultrasound Device Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.80 billion

Revenue forecast in 2030

USD 13.07 billion

Growth rate

CAGR of 4.21% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, portability, applications, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Koninklijke Philips N.V.; GE Healthcare; Siemens Healthineers AG; Canon Medical Systems; Mindray Medical International Limited; Samsung Medison Co. Ltd.; FUJIFILM SonoSite, Inc.; Konica Minolta Inc.; Esaote

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultrasound Device Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ultrasound device market report based on product, portability, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Ultrasound Devices

-

2D

-

3D/4D

-

Doppler

-

-

Therapeutic Ultrasound Devices

-

High-intensity Focused Ultrasound

-

Extracorporeal Shockwave Lithotripsy

-

-

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Compact

-

Cart/Trolley

-

Point-of-Care Cart/Trolley Based Ultrasound

-

Higher-end Cart/Trolley Based Ultrasound

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Obstetrics/Gynaecology

-

Radiology

-

Orthopaedic

-

Anaesthesia

-

Emergency Medicine

-

Primary Care

-

Critical Care

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centres

-

Research Centres

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ultrasound device market size was estimated at USD 9.42 billion in 2022 and is expected to reach USD 9.80 billion in 2023.

b. The global ultrasound device market is expected to grow at a compound annual growth rate of 4.21% from 2023 to 2030 to reach USD 13.07 billion by 2030.

b. North America dominated the ultrasound device market with a share of 30.04% in 2022. This is attributable to the presence of a significant number of market competitors in the region and the increasing number of cancer cases.

b. Some key players operating in the ultrasound device market include Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG, Canon Medical Systems, Mindray Medical International Limited, Samsung Medison Co., Ltd., FUJIFILM SonoSite, Inc., Konica Minolta Inc., and Esaote

b. Key factors that are driving the ultrasound device market growth include an increase in the adoption of ultrasound devices for diagnosis and treatment, rising demand for minimally invasive procedures, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With Covid-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for Covid19 as a key market contributor.