- Home

- »

- Homecare & Decor

- »

-

Toys And Games Market Size, Share & Growth Report, 2030GVR Report cover

![Toys And Games Market Size, Share & Trends Report]()

Toys And Games Market Size, Share & Trends Analysis Report By Application (Up To 0-8 Years, 9-15 Years), By Distribution Channel (Online, Offline), By Product (Preschool Toys, Electronic Games), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-209-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global toys and games market size was estimated at USD 308.21 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030. The industry is expanding due to various factors, such as parents’ increased interest in green toys, the resurgence of conventional toys & video games, awareness about the cognitive benefits of building toys, and the rising popularity of mobile-based gaming. The market is also expected to be driven by the increased popularity of traditional recreational activities among younger generations. Millennials’ growing predilection for old-school games at social gatherings is likely to propel the market growth over the forecast period. Companies are actively shifting their product offerings by launching e-stores and retailing products through e-commerce platforms, such as Amazon, Walmart Online, and eBay, among other regional platforms.

This is largely because online platforms have emerged as a viable and cost-effective alternative to physical marketing and sales. People stayed at home owing to the lockdown and looked for indoor games online. Curtis McGill and Scott Houdashell’s toy companies’ Amazon sales increased by 4,000% year over year in March 2020, while their Walmart in-store sales increased by 100%. The demand for dolls remains high due to their appeal to children and collectors alike. Iconic dolls, like Barbie, play a significant role in driving this demand, as they have established a strong brand presence, diverse product lines, and cultural significance, capturing the imagination and preferences of generations of consumers.

Mattel, a U.S.-based toy manufacturer that also sells Barbies, reported sales of about USD 2.3 billion for its doll division. Barbie alone garnered sales of around USD 1.679 billion, or 73% of the dolls category, and about 27% of the whole revenue. Games and toys that incorporate STEM concepts and challenges provide a valuable learning experience for children while also being entertaining and enjoyable. This has led to an increase in the production and sales of STEM-related games and toys in the market. In April 2023, Ambessa Play, a social enterprise producing STEM products for children partnered with Pentagram to launch a DIY wind-up flashlight kit after gathering feedback from parents for “screen-free” toys. The product was launched on Kickstarter and was made available till the end of April.

Application Insights

The 15 years and above age group recorded the largest market share of 49.60% in 2022. This segment is mainly driven by the emergence of the ‘kidult’ section in the Toys And Games industry. In the UK, the adult and teen category represented 27% of the total toy sales in 2020, up by 16% since 2016, according to ToyNews Media. The 0-8 age group segment is expected to grow at a CAGR of about 4.7% in the forecast period. Young children’s natural inclination for play and the influence of modern parenting approaches contribute to segment growth.

Key industry players are responding to this demand by launching innovative products that cater to children's developmental needs. A division of Candle Media called Moonbug Entertainment announced the global release of CoComelon HugMees in February 2023. It was a new line of plush toys named, Squishmallows from the renowned plush company, Jazwares. These goods provide a special method for kids to enjoy and engage with favorite characters as CoComelon is a popular show among toddlers all around the world. Characters in the collection include JJ, a crowd favorite, and his closest friends Cody, Nico, Nina, Cece, and Bella.

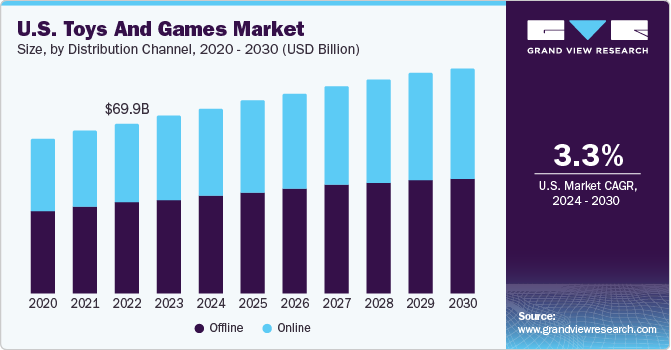

Distribution Channel Insights

The offline channel dominated the global market in 2022 with a share of about 51% of the overall revenue. Consumers often prefer shopping for toys and games in physical stores as it allows them to see, touch, and interact with the products before making a purchase, providing a tangible and immersive experience that online shopping may not offer. Nintendo, a Japanese company, inaugurated its largest store to date in Osaka in November 2022. Following locations in Tokyo and New York, this was the company's third official store and its largest in Japan. The company's ambition to enter merchandising and diversify outside its traditional core of video game and console sales includes the opening of the store.

The online distribution channel segment is estimated to record the fastest CAGR of 4.8% during the forecast period. Aggregators and manufacturer-hosted e-commerce websites are part of the online segment. Manufacturers have recognized the channel’s potential and are hosting shopping websites to better serve customer demands while increasing profit margins. To accommodate the increased demand for e-commerce, companies, such as Hasbro and Mattel, extended their direct-to-consumer businesses. Similarly, FAO Schwarz and Hamley’s of London, two key players, are also pursuing digital opportunities. With an eBay shop, Hamley’s of London increased its online footprint, giving its whole variety of toys and games to eBay’s 28 million UK users.

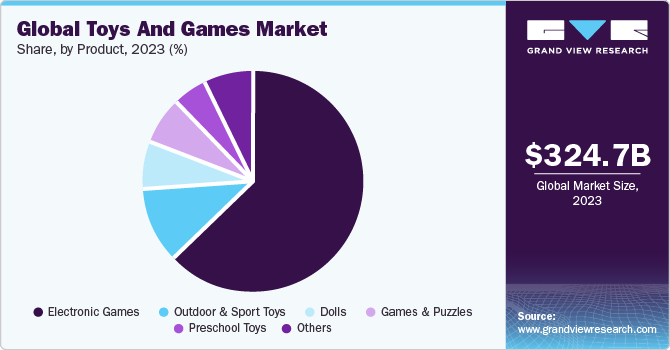

Product Insights

The electronic games segment dominated the market with the largest revenue share of about 63.35% in 2022. Consumer spending on video content, Virtual Reality (VR) items, and video game tournaments has increased significantly with technological developments. Due to reasons, such as the proliferation of mobile and online gaming, as well as the move from physical to digital software distribution, the market is seeing exponential growth. Many toymakers invested heavily in content production centered around their flagship products, used the content as lead generators, and created interactive play experiences to add value to their physical products because of the shift from products to a more service-oriented model that has transformed many industries.

The games and puzzles segment is forecasted to register the fastest CAGR of about 7.2% during the forecast period. According to NDP, the popularity of board games has resulted in a 48% increase in sales year to date (2021). Board games have seen a renaissance at home, from chess to Chutes and Ladders and Exploding Kittens. Moreover, the launch of many innovative and unique puzzles has also been playing a crucial role in the growth of the segment. In January 2021, Theory11, in collaboration with Star Wars, launched ‘The Mandalorian’ playing cards. The premium deck features custom artwork on each card, illustrating Aces, Jokers, and court cards with characters from the show, like Mando, Baby Yoda, IG-11, Moff Gideon, and Cara Dune.

Regional Insights

In 2022, Asia Pacific accounted for the largest revenue share of more than 41%. With the presence of more than half of the world's population and the economies of nations like China and India expanding, there are abundant chances for market expansion in this area. The world's greatest producer and exporter of children's items and toys is China. The Associated Press described China's heightened industry activity post-lockdown in a March 2023 report. The indexes for output, export, and new orders all rose, and the official China Federation of Logistics & Purchasing returned to levels that suggest expanding activity. Middle East and Africa are projected to grow at the fastest rate of about 10.0% during the forecast period.

Market players in the Middle East and Africa region are responding to the rising demand for toys and games by expanding their product offerings and establishing a stronger presence in the region. They are increasing their distribution networks, collaborating with local retailers, and introducing culturally relevant toys to cater to the specific preferences and needs of consumers in these markets. For instance, in October 2022, LEGO Group opened its new store in the Mall of Africa located in South Africa. The Great Yellow Brick Company, the South African licensee for the Lego Certified Store concept, established the initial four locations in 2018 and 2019 and is currently looking to expand its physical retail footprint to further the reach of the Lego brand. With its vibrant colors, digital displays, and distinctive Lego pieces, this new store is intended to provide a more sophisticated and engaging shopping experience.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key players focus on strategies, such as mergers & acquisitions, innovation, and new product launches, to enhance their market share:

-

In June 2023, Mattel, Inc. announced a new collection of Barbie dolls inspired by the highly anticipated film release, Barbie. Barbie the Movie dolls have looks that fans will recognize from the film, representing the distinctive fashions of Barbie, Ken, and new characters. From their first-look costumes to the matching sets they wore in the movie; the collection recreates the Barbiecore and Ken-ergy persona from the feature film

-

In January 2023, Buffalo Games partnered with London-based indie games company Big Potato to distribute each other’s products in the UK and the U.S. Buffalo Games’ Chuckle & Roar line of toys and games will debut in the UK through Big Potato on Amazon and with a few select retail partners

Some of the prominent players in the global toys and games market include:

-

Dream International Limited

-

VTech Holdings Limited

-

The LEGO Group

-

Sanrio Company, Ltd.

-

Playmates Toys Limited

-

JAKKS Pacific, Inc.

-

Mattel, Inc.

-

Hasbro

-

Konami Holdings Corporation

-

Bandai Namco Holdings Inc.

Toys And Games Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 324.66 billion

Revenue forecast in 2030

USD 439.91 billion

Growth rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Dream International Ltd.; VTech Holdings Ltd.; The LEGO Group; Sanrio Company, Ltd.; Playmates Toys Ltd.; JAKKS Pacific, Inc.; Mattel, Inc.; Hasbro; Konami Holdings Corp.; Bandai Namco Holdings Inc.

Customization scope

Free report customization (equivalent Up to 0–8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

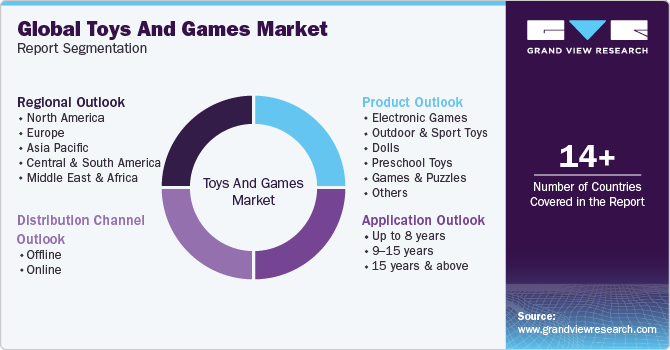

Global Toys And Games Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global toys and games market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Electronic Games

-

Outdoor & Sport Toys

-

Dolls

-

Preschool Toys

-

Games & Puzzles

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Up to 0–8 years

-

9–15 years

-

15 years & above

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global toys and games market size was estimated at USD 308.21 billion in 2022 and is expected to reach USD 324.66 billion in 2023.

b. The global toys and games market is expected to grow at a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 439.91 billion by 2030.

b. The offline distribution channel dominated the global toys and games market with a share of 52% in 2022. This is attributable to the increase in product visibility at physical stores and flexible working hours where supermarkets or hypermarkets thereby ensuring maximum access.

b. Some key players in the global toys and games market include Lego; Mattel Inc.; Namco Bandai; Hasbro; Toy Quest, Sanrio Company Ltd., Konami Corporation, Integrity Toys, Inc., and Jakks Pacific.

b. Key factors that are driving the toys and games market growth include increasing launch of educational games, commercialization of favorite movies and cartoon characters, and an increasing number of video game tournaments and spending on video games.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The home care & decor industry has been witnessing inconsistent growth, since the Covid 19 outbreak. As a result of the ongoing pandemic crisis, there has been a drop in the overall performance of discretionary products such as decorative fixtures, bedding products, to name a few. The virus outbreak has, however, led to substantial growth in categories such as cleaning and hygiene products. Prominent growth in the e-commerce business is also one of the positive influences of the outbreak, wherein companies are focusing on expanding their distribution networks to online channels in order to cater to the surging consumer demand. Our team is diligently working towards accounting these factors in our report with the aim of providing you with the up-to-date, actionable market information and projections.