- Home

- »

- Advanced Interior Materials

- »

-

Tools Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Tools Market Size, Share & Trends Report]()

Tools Market Size, Share & Trends Analysis Report By Type (Hand Tools, Power Tools), By Sales Channel (In-Store, Online), By End-Use (DIY, Industrial and Commercial), By Region, And Segment Forecasts, 2023 To 2030

- Report ID: GVR467467

- Number of Pages: 0

- Format: Electronic (PDF)

- Historical Data: ---

- Industry: Advanced Materials

Tools Market Size & Trends

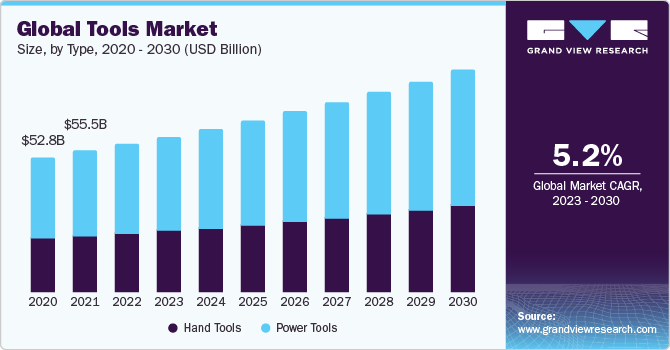

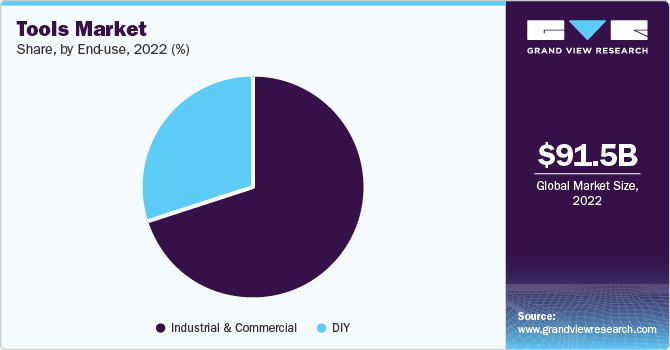

The global tools market was valued at USD 91.5 billion in 2022 and is expected to grow at a CAGR of 5.2% over the forecast period. The increasing product demand from various industries such as construction, furniture, metal fabrication, repair & renovation, and others is predicted to boost the growth of the market over the forecast period. The product is used in several applications such as hammering, drilling, grinding, sawing, and others in these industries. The industry has witnessed significant technological advancements, with the introduction of cordless power & smart equipment, and improved materials and designs.

The global market experienced disruptions in its supply chain due to COVID-19 lockdowns and restrictions. This impacted the availability of raw materials and components, leading to delays in manufacturing and product shortages. Demand for the product was mixed. While the construction and manufacturing sectors experienced slowdowns, the DIY and home improvement segments saw increased demand as people spent more time at home during lockdowns. With physical stores closed or operating with restrictions, there was a noticeable shift towards online sales and e-commerce channels.

According to projections by the United Nations, the global population is anticipated to grow from 8 billion in 2023 to 9.7 billion by the year 2050. Significant contributions to this growth are expected to come from countries in Asia and Africa, leading to increased urbanization and resulting in overcrowding in cities worldwide. To address this, the construction of new buildings and public infrastructure will become a necessity. In March 2023, the Indian government reviewed a proposal to construct eight new cities across the country to alleviate the burden of population.

Furthermore, residential and commercial structures such as shopping centers, hospitals, schools, and various other facilities are being erected globally. Throughout the construction process, a wide range of both large and small power and manual tools, including drills, saws, wrenches, demolition equipment, hammers, and others, are used extensively. Moreover, once these buildings are completed, garden equipment like shears, pruning tools, digging equipment, blowers, lawnmowers, and others are utilized for the establishment and maintenance of gardens. This is expected to fuel the demand for products in the coming years.

Type Insights

Based on the type, the market is segmented into power tools and hand tools. The power tools segment held the largest market share in 2022. Power devices or machines are designed to perform tasks using electrical, pneumatic, hydraulic, or other power sources. They are distinct from hand equipment, which require manual effort to operate. Also, they are often more efficient and can handle tasks that would be physically demanding or time-consuming with hand equipment. While hand equipment relies on human effort and physical force to perform various tasks. They include screwdrivers, pliers, hammers, saws, chisels, and others.

Sales Channel Insights

On the basis of sales channel, the market is segmented into in-store and online. The in-store segment held the largest market share in 2022. In-store sales take place in physical retail outlets, such as hardware stores, home improvement centers, specialty shops, and department stores. These locations offer a physical space where customers can visit to browse, select, and purchase the products. One of the main advantages of in-store sales is that customers can physically interact with the products.

Online retailers can offer an extensive range of tools, including a variety of brands, models, and specialty items. This allows customers to access a broader selection than most physical stores. Online shoppers can easily compare prices and read reviews from other customers, facilitating informed purchase decisions. This transparency can lead to competitive pricing.

End-Use Insights

Based on end use, the tools market is segmented into DIY and industrial & commercial. The industrial and commercial segment held the largest market share in 2022. The construction and infrastructure sectors are major drivers for the market, as they create demand for a wide range of equipment from basic hand tools to heavy machinery. The products are essential for various manufacturing processes, and the growing industrialization across the globe is fueling the demand for specialized tools and equipment. Also, the increasing popularity of DIY projects at home and in small businesses is boosting the demand for the products.

Regional Insights

North America dominated the largest market share in 2022. Construction activities are surging in major North American cities. For instance, according to the U.S. Census Bureau, the spending in the construction sector has increased from USD 1,200 billion in January 2017 to around USD 1,600 billion in January 2023. The manufacturing industry in North America, including automotive and aerospace manufacturing, relies heavily on specialized tools and machinery. This sector's continued growth is fueling the demand for precision equipment. Additionally, the region has a strong culture of DIY (do-it-yourself) projects. Many homeowners and hobbyists invest in a wide range of equipment for home improvement and renovation projects, contributing to the growth of the market.

Key Companies & Market Share Insights

Key players operating in the market include Robert Bosch GmbH, Stanley Black, Armstrong tools Inc., Makita Corporation, Hilti Corporation, Husqvarna Group, and others. Large multinational corporations dominate the market with their diversified product portfolios. These companies may own multiple brands and subsidiaries, offering a wide range of products. The following are some instances of such initiatives.

In March 2023, Robert Bosch GmbH announced to introduce over 100 new products across its four business segments, which include power, garden, accessories, and measuring tools.

In February 2023, Dynabrade Inc. announced the acquisition of Global Abrasive Products Inc. (GAP). GAP is a distributor of the abrasive products established through the merger of three companies Duraline Abrasives, Future Abrasives, and Pres-On Abrasives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."