- Home

- »

- Advanced Interior Materials

- »

-

Thermal Paper Market Size, Share & Growth Report, 2030GVR Report cover

![Thermal Paper Market Size, Share & Trends Report]()

Thermal Paper Market Size, Share & Trends Analysis Report By Application (POS, Tags & Label, Lottery & Gaming), By Region (Asia Pacific, North America, Middle East & Africa, Europe), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-690-5

- Number of Pages: 108

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

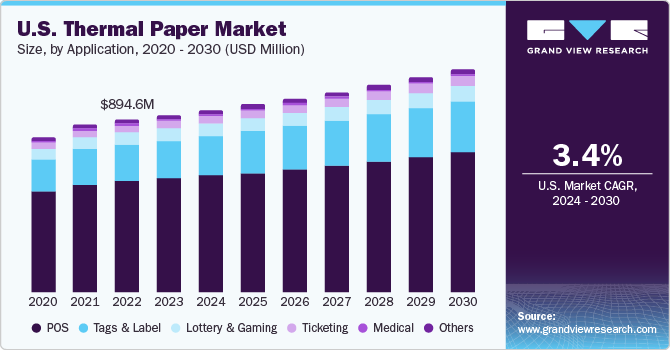

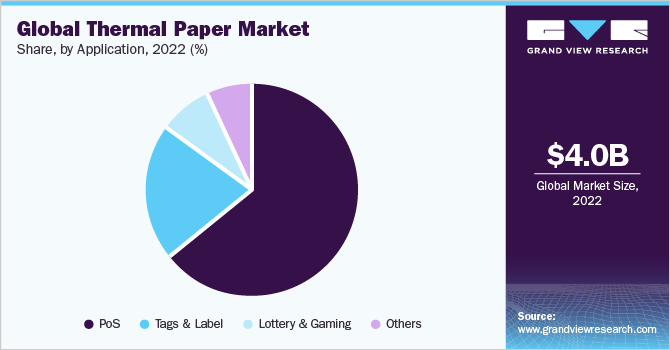

The global thermal paper market size was estimated at USD 4.01 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. The product demand is expected to be driven by the rising use of POS terminals in warehouses and retail stores. A favorable business environment due to improved government policies and rising domestic consumption for pharmaceutical and food and beverage products in South Asian countries is expected to boost market growth. The presence of paper manufacturers in countries, such as China, is also expected to have a positive effect on the growth of the market.

The market is expected to grow at a reduced rate due to the increasing digitalization of the transaction process, decreasing the need for printing at POS terminals. In addition, innovation in terms of internal substitution is also expected to hamper the growth of the industry. However, rising e-commerce usage is expected to boost the demand for thermal paper in the form of labels and tags. Thermal paper is expected to remain a preferred choice among buyers, particularly in warehouses, which are more prone to contamination caused to the labeling of their finished products on account of exhibiting the aforementioned properties.

Thermal paper can also be used to manufacture durable, secure, and high-performance RFID tags on account of providing enhanced performance in terms of durability and high thermal stability. The rising demand for RFID tags and labels is likely to propel the use of thermal paper on account of exhibiting properties, such as high durability and good temperature resistance. Expanding retail stores and chains in developing economies, such as India and China, is expected to positively impact the use of POS terminals, augmenting the growth of the market. In addition, government initiatives to boost the food and pharmaceutical industry in emerging economies are expected to boost the use of thermal paper in packaging and labeling end-uses.

The market has a strong presence of various raw material suppliers engaged in offering base paper to thermal paper manufacturers. The growing use of recycled fibers in manufacturing the base product is also expected to boost market growth. In addition, a significant level of integration across the value chain exists among major players where they manufacture and supply the end product to consumers via direct sales channels. Industry participants are continuously trying to improve their procurement practices through responsible sourcing and are proactively making changes in the supply chains.

Procurement initiatives are reviewed and resolved by a dedicated team when the sourcing needs are specified, the contract is drafted, and during the tendering process. In addition, industry participants have started obtaining data, such as financial stability and carbon emission, from various suppliers for the pre-qualification process. Standards set by the FDA in terms of labeling and packaging food are expected to positively impact the use of thermal papers, especially in e-commerce supply chains. However, the rising use of electronic receipts in monetary transactions and purchases is expected to hamper the industry growth.

Application Insights

The POS application segment dominated the global market in 2022 with a revenue share of 64.3%. The increasing use of consumer goods has led to the expansion of retail stores across the globe, leading to a rise in demand for thermal paper in POS terminal transactions. Thermal paper is used in various end-uses, such as retail stores, supermarkets, and warehouses, and industrial and logistical end-uses, such as packaging and labeling. In addition, the low cost of production due to factors, such as inkless printing and easy maintenance of the printing equipment, has augmented the end-user preference for thermal papers.

Thermal paper is preferred by users, such as warehouses, for labeling and tagging due to their preference for using RFID tags, which are durable and secure compared to other tagging alternatives. The popularity of leisure gaming activities, especially in economies where tourism plays an important role, is expected to boost market growth. However, online ticketing platforms and services are expected to hamper the market growth for thermal paper in gaming in the forecast period. The thermal paper also finds application in printing lottery tickets, coinless slots, sportsbooks, and totes.

Regional Insights

Asia Pacific accounted for the largest share of 34.2% of the global revenue share in 2022 due to the expansion of retail chains in the region as a result of the rising consumer preference for easily accessible consumer goods. Moreover, the increasing industrial activities in the region have led to a rise in product demand in labeling applications. The rising market for FMCG goods in developing economies has to lead an expansion in the production capacities for these goods. This has led to an increase in the number of transactions at retail stores.

Such factors have led to a significant increase in demand for thermal paper for the production of labels, tags, and POS receipts, boosting market growth. Europe accounted for a significant share of the global market in 2022. The increasing adoption of thermal paper in the region in various end-uses, such as supplement packaging and labeling and the gaming industry, is expected to boost market growth. The rising focus on sustainable products in Europe is expected to affect the production and use of thermal paper as manufacturers shift focus towards alternative production methods.

In addition, the regulations set by governing bodies in Europe will help in the adoption of eco-friendly coatings, such as powder and waterborne, in the production of thermal paper. The Central & South America region is expected to witness significant growth over the forecast period due to rising industrial activities. In addition, increased industrial and manufacturing capacities in countries, such as Chile and Peru, will enhance warehousing activities, thereby boosting product demand.

Key Companies & Market Share Insights

The industry has a small number of players with an established global presence leading to a competitive rivalry. Key players are engaged in implementing various marketing strategies, such as mergers & acquisitions and expansion of production capacities and product portfolios. For instance, Jujo Thermal Limited added new grades of products to its portfolio in 2019.

This has benefitted the company in gaining a stronger market position. Major players have a strong local presence in terms of production units in various regions to support an efficient consumer supply chain. The high degree of forward and backward integration of dominant players persists in the market, which has intensified the rivalry and competition, thus making entry for new players difficult. Some prominent players in the global thermal paper market include:

-

Oji Holdings Corp.

-

Appvion Inc

-

Koehler Group

-

Mitsubishi Paper Mills Ltd.

-

Hansol Paper Co. Ltd.

-

Gold Huasheng Paper Co. Ltd.

-

Henan Province JiangHe Paper Co. Ltd.

-

Thermal Solutions International Inc.

-

Iconex LLC

-

Twin Rivers Paper Company

-

Rotolificio Bergamasco Srl

-

Jujo Thermal Ltd.

Recent Development

-

In April 2022, Jujo Thermal Ltd. announced its plans for new product names for its direct thermal papers.

-

In April 2023, Koehler Paper and Nissha collaborated to launch sustainable Metivo® advanced packaging paper using Koehler Nexplus® barrier paper.

Thermal Paper Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.15 billion

Revenue forecast in 2030

USD 5.56 billion

Growth rate

CAGR of 4.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

Oji Holdings Corp.; Appvion Inc.; Koehler Group; Mitsubishi Paper Mills Ltd.; Hansol Paper Co. Ltd.; Gold Huasheng Paper Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

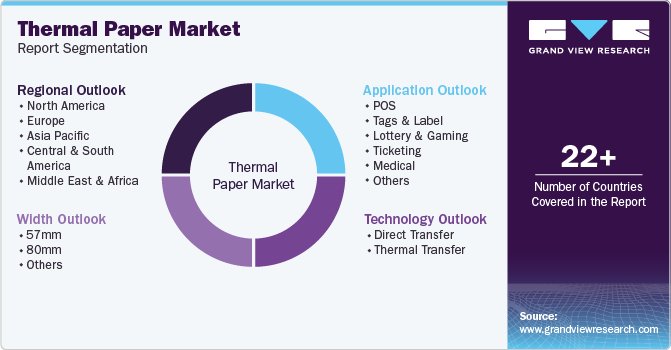

Global Thermal Paper Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global thermal paper market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

POS

-

Tags & Label

-

Lottery & Gaming

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the thermal paper market include Oji Holdings Corporation, Appvion Inc, Koehler Group, Mitsubishi Paper Mills Limited, Hansol Paper Co. Ltd., and Gold Huasheng Paper Co. Ltd.

b. The key factors that are driving the thermal paper market increasing usage of POS terminals for monetary transactions due to the expansion of e-commerce and packaging industry.

b. The global thermal paper market size was estimated at USD 4.01 billion in 2022 and is expected to reach USD 4.15 billion in 2023.

b. The thermal paper market is expected to grow at a compound annual growth rate of 4.2% from 2023 to 2030 to reach USD 5.56 billion by 2030.

b. POS dominated the thermal paper market with a share of 64.3% in 2022 due to the expansion of retail chain stores in countries, resulting in increased monetary transactions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for Covid19 as a key market contributor.