- Home

- »

- Specialty Polymers

- »

-

Textile Chemicals Market Size & Share Analysis Report, 2030GVR Report cover

![Textile Chemicals Market Size, Share & Trends Report]()

Textile Chemicals Market Size, Share & Trends Analysis Report By Process, By Product (Coating & Sizing Chemicals, Colorants & Auxiliaries), By Application (Apparel, Technical Textiles), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-108-5

- Number of Pages: 170

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

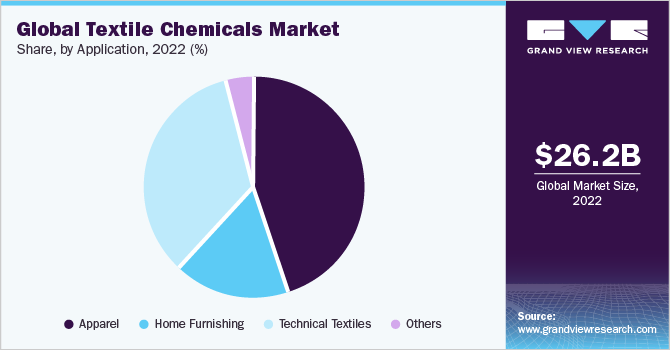

The global textile chemicals market size was estimated at USD 26.16 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. This growth is attributable to a growing demand for apparel, technical textiles, home textiles, and others. With the growing population, the demand for clothes and other textile products is expected to increase, thus fueling the production capacities of this industry. But at present, global trade is getting more complicated due to recession in various countries, resulting in currency fluctuations. Other major challenges faced by the textile industry include the Eurozone crisis and Britain post-BREXIT.

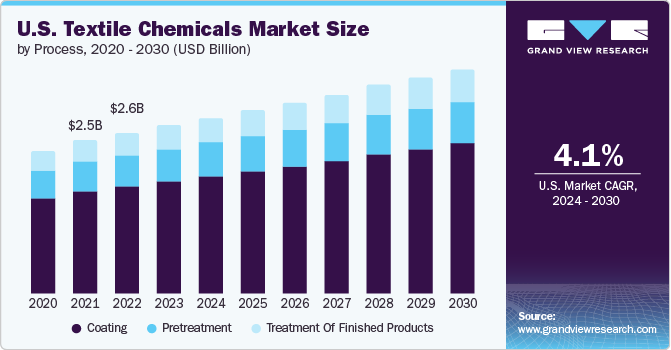

According to the American Chemistry Council, the chemicals industry in the U.S. is expected to witness an increase in volume consumption due to growing demand for chemicals from the automotive, construction, and consumer goods industries. However, the chemicals industry in the country is projected to reach its pre-pandemic level by 2023.

This is expected to create opportunities for the manufacturers of textile chemicals to set up their production facilities or to collaborate with local players in the U.S. For instance, in June 2021, Archroma partnered with Van Horn, Metz & Co. Inc., a specialty raw material distributor in the country, for the distribution of Mowilith emulsions.

Upsurges in the real estate sector, changing fashion trends, and inclination toward home décor and furnishing have driven the growth of the textile industry in the recent past. However, with the growing application scope, consumer preferences toward bio-chemicals with similar properties are also projected to drive the growth of the market. Moreover, the growing consumption of technical textiles in the automotive sector is expected to bolster the growth of the market in the long run.

Process Insights

The coating process dominated the market with a revenue share of more than 68% in 2022. This is attributable to increasing demand for coating chemicals with the ability to provide additional properties including waterproofing, fire resistance, stain repellence, and others.

The coating process segment is expected to continue its dominance in the market during the forecast period. In the coating process, coating protection chemicals are mainly consumed to cater to the increasing demand for flame retardant, UV protection, and other protective coatings, which is anticipated to create an increasing demand for these chemicals in the coming years.

Denim finishing agents such as enzymes, softeners, anti-back staining agents, and bleaching agents are highly utilized in the denim finishing process in the textile industry. The consumption of finishing agents is anticipated to grow at a faster rate owing to increasing demand for high-quality finishing with aesthetic, and soft handling fabrics.

Additionally, efficient pretreatment of fabric is the basis of reproducible uniform results in all successive processes such as printing and dyeing. In the pretreatment process, it is important to remove all the accompanying and interfering substances from the fabric. Along with the de-sizing, scouring, and bleaching, other pretreatment processes include optical brightening, alkalizing, and mercerizing.

Around 90% of chemicals and auxiliaries are used for the pretreatment process such as de-sizing, scouring, and bleaching. These chemicals make the fabric hydrophilic and ready for wet processing, which is further anticipated to propel the demand for textile chemicals.

Product Insights

Coating and sizing chemicals dominated the market with a revenue share of more than 36% in 2022. This is attributable to growing demand from geotextiles, automotive, outdoor wear, and aerospace applications. The global demand for sizing chemicals is expected to increase during the forecast period for efficient sizing of fabrics during the finishing treatment.

Dextrin, wheat starch, corn starch, gelatin, etc. are the most used natural paste. Water-soluble polymers such as carboxymethyl cellulose, polyvinyl alcohol, acrylates, and modified starch, also known as textile sizing chemicals or agents, are used to protect yarns to withstand mechanical stress during weaving.

Colorants and auxiliaries accounted for a revenue share of more than 12% in 2022. Colorants can be dyes or pigments, which impart colors to textiles. Dyeing of a fabric involves several steps, which are singeing, de-sizing, padding, scouring, bleaching, mercerizing, printing, and finishing.

Moreover, chemical finishing enables textiles to become oil-repellent, water-repellent, flame-retardant, and antistatic. With the increasing demand for customized and aesthetically attractive products, the demand for finishing agents is anticipated to surge globally. This is expected to lead to the growth of the product market chemicals during the forecast period.

Application Insights

Apparel application dominated the market with a revenue share of more than 44% in 2022. This is attributable to several factors such as rising disposable incomes, the growing millennial and Gen Z population who are getting influenced by social media and fashion icons, and the growing e-commerce industry.

Growth in textile raw material production is also expected to increase, which, in turn, is likely to contribute to the growth of apparel production. For instance, fiber production in India grew from 1.44 million tons in 2019 to 2.4 million tons in 2020, according to India Brand Equity Foundation (IBEF). Increasing apparel production is expected to increase the demand for the product in apparel for pretreatment, dyeing, and printing applications.

A wide range of textile chemicals is used in apparel production, including mercerizing agents, peroxide stabilizers, dyes, dispersants, leveling agents, soaping agents, thickeners, binders, softeners, and pretreatment chemicals. Players in the apparel industry are adopting environment-friendly processes, which include non-toxic chemicals. For instance, in November 2021, Cosmo Specialty Chemicals introduced a hydrophilic block silicone emulsion. The non-toxic and eco-friendly product improves softness properties in several applications.

Furthermore, the technical textiles market is on a growth trajectory in the countries from Asia Pacific. The product is likely to witness high demand from Medtech, Buildtech, and Protech applications. An increase in public infrastructural projects by governments in their economic revival packages is expected to boost the demand for Buildtech, subsequently increasing the demand for products.

Regional Insights

Asia Pacific dominated the market with a revenue share of more than 57% in 2022. This is attributed to rapid urbanization, economic resilience during the COVID-19 pandemic, and modernization of textile and chemical manufacturing processes.

According to the World Trade Statistical Review 2021, three of the top four apparel exporters in 2020 in the world were countries of Asia Pacific that is, China, Vietnam, and Bangladesh. The growing apparel production in the region is expected to fuel the growth of the product market in the Asia Pacific during the forecast period.

Furthermore, Europe is characterized by the presence of several major economies such as Germany, the UK, France, Spain, Italy, and Russia. Supportive policies, an increase in wages, and increasing employment opportunities are some of the factors contributing to the economic growth of the region.

The impact of COVID-19 on the Europe textiles industry was severe which negatively impacted the growth of the product market in Europe. However, favorable government support, the adoption of digitalization and sustainability, and the creation of robust supply chains are anticipated to improve the growth of the market in Europe during the forecast period.

Key Companies & Market Share Insights

The market is highly competitive owing to the presence of many manufacturers with a global presence. The spread of COVID-19 has accelerated the technological transformation that had already begun. Digitalization and the use of artificial intelligence and the Internet of Things (IoT) in manufacturing processes have been at the forefront of the strategies of companies.

For instance, in January 2021, Solvay S.A. announced that it will begin using blockchain technology for developing a circular economy. The technology will be used to store, exchange, develop, and trace information related to products, right from their feedstock producers to end-users.

Market participants are also engaged in adopting strategic initiatives such as new product launches, acquisitions, and others. For instance, In May 2023, Dystar announced its eco-advanced indigo dyeing which aims to reduce energy consumption by up to 30% and water usage by up to 90% during the production process. Some prominent players in the global textile chemicals market include:

-

Kiri Industries Ltd.

-

OMNOVA Solutions Inc.

-

German Chemicals Ltd.

-

AB Enzymes

-

Organic Dyes and Pigments

-

Govi N.V.

-

Resil Chemicals Pvt. Ltd.

-

LANXESS

-

Dow

-

BASF SE

-

Huntsman International LLC

-

Kemira Oyj

-

The Lubrizol Corporation

-

Archroma

-

Omya United Chemicals

-

BioTex Malaysia

-

Fibro Chem, LLC

-

Evonik Industries AG

-

Ethox Chemicals, LLC

-

Solvay S.A

Recent Developments

-

In June 2023, Archroma collaborated with Somelos to maka advancements in sustainable cotton processing by including a finishing process, and water-saving dye for non-generation of wastewater. The purpose is to focus on maintaining sustainability in the textile sector by the development of eco-friendly solutions to save resources, and contribute towards a clean environment.

-

In June 2023, Dow partnered with P&G China to enable the recycling of air capsule e-commerce packaging. The purpose is to make advancements in the use of sustainable textile chemicals by ensuring recycle packaging, and environment friendly solutions.

-

In May 2023, Evonik Industries AG launched TEGO®Cycle additives for the transformation of plastic waste into valuable plastics. Additives like odour absorbers, antifoams, processing aids, and wetting agents all cater to the recycling of textile chemicals.

-

In April 2023, LANXESS introduced sustainable based light-colour sulphur carriers. These are based on textile chemicals, and appropriate for being used in metalworking lubricants

-

In October 2022, BASF SE planned to establish a joint venture with Hannong Chemicals for commercializing the production of non-ionic surfactants in Asia Pacific. The joint venture resulted in supplying non-ionic textile chemical surfactant products to both organizations, ultimately making them available to Asia Pacific customers.

-

In February 2022, Lubrizol Corporation developed a sustainable and high performing ESTANE® TPU solution for the application of vegan synthetic leather. This technology comprises sustainable textile chemicals that contributes towards clean air in the interior or vehicles.

-

In October 2021, Kemira Oyj introduced an advanced polymer technology for overcoming challenges in recycled board and paper. These are chemicals that are widely used in the textile sector for improving machine efficiency and cleanliness.

-

In March 2021, the Textile Effects division of Huntsman International LLC partnered with Sciessent for enabling sustainable odour, and microbe resistant textiles suitable for home textiles, outwear, active wear, and other products.

Textile Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.45 billion

Revenue forecast in 2030

USD 36.95 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, product, application, region

Country scope

U.S.; Canada; Mexico; Germany; Italy; France; UK; Spain; Russia; Poland; Turkey; China; Japan; India; South Korea; Vietnam; Indonesia; Thailand; Philippines; Brazil; Argentina; Peru; South Africa; Saudi Arabia; Morocco; Tunisia; Kenya; UAE; Egypt

Key companies profiled

Kiri Industries Ltd.; OMNOVA Solutions Inc.; German Chemicals Ltd.; AB Enzymes; Organic Dyes and Pigments; Govi N.V.; Resil Chemicals Pvt. Ltd.; LANXESS; Dow; BASF SE; Huntsman International LLC; Kemira Oyj; The Lubrizol Corporation; Archroma; Omya United Chemicals; BioTex Malaysia; Fibro Chem; LLC; Evonik Industries AG; Ethox Chemicals, LLC; Solvay S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Textile Chemicals Market Report Segmentation

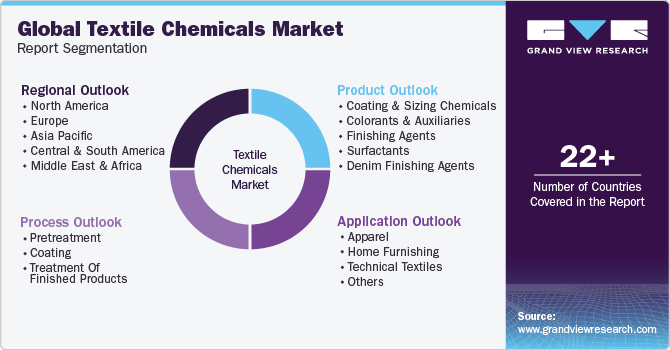

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global textile chemicals market report based on process, product, application, and region:

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pretreatment

-

Desizing Agents

-

Bleaching Agents

-

Scouring Agents

-

Others

-

-

Coating

-

Anti-Piling

-

Water Proofing

-

Protection

-

Water Repellant

-

Others

-

-

Treatment of Finished Products

-

Softening

-

Stiffening

-

Others

-

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coating & Sizing Chemicals

-

Colorants & Auxiliaries

-

Dispersants/levelant

-

Fixative

-

UV absorber

-

Others

-

-

Finishing Agents

-

Repellent and release

-

Flame retardants

-

Antimicrobial or anti-inflammatory

-

Others

-

-

Surfactants

-

Wetting Agents

-

Detergents & Dispersing Agents

-

Emulsifying Agents

-

Lubricating Agents

-

-

Denim Finishing Agents

-

Enzymes

-

Resins

-

Softeners

-

Defoamers

-

Bleaching Agents

-

Curesh Resistant Agents

-

Anti-back Staining Agents

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Sportswear

-

Outerwear

-

Innerwear

-

Others

-

-

Home Furnishing

-

Furniture

-

Drapery

-

Carpet

-

Others

-

-

Technical Textiles

-

Agrotech

-

Buildtech

-

Geotech

-

Medtech

-

Mobiltech

-

Packtech

-

Protech

-

Indutech

-

Others

-

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Poland

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Vietnam

-

Indonesia

-

South Korea

-

Thailand

-

Philippines

-

-

Central & South America

-

Brazil

-

Argentina

-

Peru

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Morocco

-

Tunisia

-

Kenya

-

UAE

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global textile chemicals market size was estimated at USD 26.16 billion in 2022 and is expected to reach USD 27.45 billion in 2023.

b. The global textile chemicals market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 36.95 billion by 2030.

b. Coating & sizing chemicals dominated the textile chemicals market in 2022. This is attributable to the growing product demand from geotextiles, automotive, outdoor wear, and aerospace applications.

b. Some key players operating in the textile chemicals market include Dow, Huntsman International LLC, The Lubrizol Corporation, Archroma, Evonik Industries AG, and Solvay S.A.

b. Key factors that are driving the textile chemicals market growth include high demand from the rapidly growing apparel industry, rise in disposable incomes along with increased penetration of the organized retail sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."