- Home

- »

- Medical Devices

- »

-

Surgical Robots Market Size, Share & Trends Report, 2030GVR Report cover

![Surgical Robots Market Size, Share & Trends Report]()

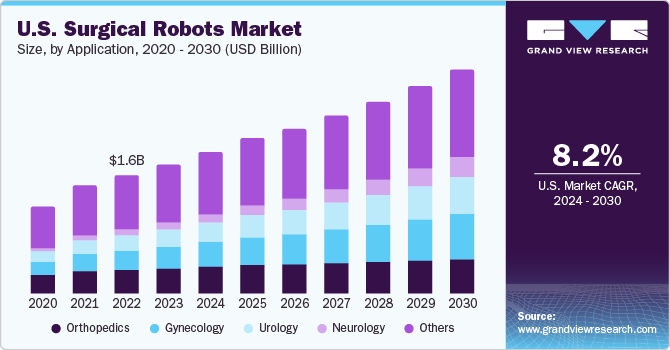

Surgical Robots Market Size, Share & Trends Analysis Report By Application (Neurology, Urology, Orthopedics, Gynecology), By End-use (Inpatient, Outpatient), By Region (North America, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-811-4

- Number of Pages: 118

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Surgical Robots Market Size & Trends

The global surgical robots market size was estimated at USD 4.31 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.5% from 2024 to 2030. The shortage of physicians and surgeons across the globe and the increasing adoption of automated instruments used for surgery are the major factors driving market growth. Furthermore, growing prevalence of bone degenerative diseases and rising number of hip & knee replacement surgeries due to increasing cases of arthritis & osteoporosis are anticipated to drive market growth. For instance, according to the Agency for Healthcare Research and Quality report, over 4,50,000 hip replacement surgeries are performed yearly in the U.S.

Market Dynamics

Increasing number of knee and hip replacement surgeries is one of the key factors anticipated to drive adoption of surgical robots in healthcare industry. Some major disorders that affect joints are various types of arthritis, bone degenerative diseases, and osteoporosis. Rising prevalence of these conditions has led to an increase in the number of patients requiring knee and hip replacement surgeries.

As per the Australian Institute of Health and Welfare (AIHW) statistics, the total knee replacement rate for osteoarthritis has increased by about 38% from 2005-2006 to 2017-2018. Some of the major disorders that affect joints are various types of arthritis, bone degenerative diseases, and osteoporosis. The rising prevalence of these conditions has led to an increase in the number of patients requiring knee and hip replacement surgeries. According to the International Congress for Joint Reconstruction in March 2018, the number of primary total hip replacement and total knee replacement procedures is projected to reach 635,000 (171.0% increase) & 1.28 million (189.0% increase), respectively, by 2030 and 1.23 million (330.0% growth) & 2.60 million (382.0% growth), by 2060.

According to an article published by The Regents of the University of California in March 2017, total hip replacements are expected to increase by almost 200%, and total knee replacements performed in the U.S. are expected to increase by more than 600% by 2030 compared to 2005. This, in turn, is driving the adoption of surgical robots, thereby aiding market growth. Furthermore, the postoperative functional outcome for patients is one of the significant drivers of global market growth. Robotic surgery supports surgeons in performing complicated procedures with greater flexibility, precision, and control as compared to conventional surgeries.

In addition, benefits associated with these surgical procedures include low pain & blood loss, shorter recovery period, lower risk of infections at the surgical site, and smaller or less noticeable scars, thereby aiding market growth. For instance, according to a study published by the Hip and Knee Society comparing the 90-day care costs between patients who received a Mako total knee replacement and patients who underwent conventional knee surgery, the cost of care for patients receiving treatment using Mako was USD 2,400 lesser than for patients who received conventional knee replacement. The study also revealed that a reduction of 33% in 90-day readmissions was observed in patients receiving treatment using Mako.

Application Insights

By application, the other applications segment, which includes the surgical robots used in oncology, laparoscopy, and other general surgical procedures, accounted for the largest revenue share of 44.76% in 2023. The growing usage of robots for cancer treatment procedures and increasing demand for minimally invasive laparoscopic surgeries are key factors that contributed to the segment’s high share. The neurology segment is expected to register the fastest CAGR of 17.6% from 2024 to 2030. A rising adoption of robots in neurosurgeries, owing to the benefits provided by them over traditional surgery techniques, will boost the segment's growth.

Neurosurgery is anticipated to be one of the most delicate and complex surgical specialties owing to the limited mobility required by the small surgical fields of advanced minimally invasive techniques. Other factors that are anticipated to drive the segment growth are rising prevalence of neurological disorders and demand for minimally invasive techniques for performing delicate brain surgeries. For instance, the ROSA ONE Brain robotic platform is extensively used by surgeons while performing minimal invasive brain procedures.

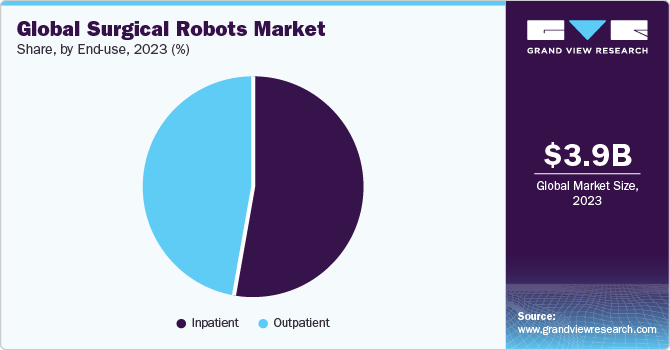

End-use Insights

The inpatient facilities segment accounted for the largest revenue share of 53.21% in 2023. Inpatient facilities, such as hospitals, usually have the financial resources and high patient volume to justify the investment in costly surgical robotic systems. In addition, they possess the infrastructure and skilled personnel necessary to operate and maintain these advanced technologies. The trust and credibility associated with hospitals also significantly attract patients and surgeons toward robotic-assisted surgeries, consolidating the dominance of inpatient facilities in the market. Moreover, surgeons and healthcare professionals in inpatient settings increasingly embrace and integrate surgical robots into their surgical practices to enhance patient care.

The outpatient segment is expected to witness the fastest CAGR of 9.7% from 2024 to 2030 Outpatient facilities, such as Ambulatory Surgical Centers (ASCs) and surgical centers, often emphasize shorter hospital stays and quicker recovery, aligning with the advantages offered by surgical robots. Patients prefer outpatient surgeries as they usually involve less disruption to their daily lives and potentially lower the treatment costs. Moreover, regulatory frameworks and reimbursement policies are evolving to support the integration of surgical robots into outpatient facilities, further fueling their growth.

Regional Insights

North America held the largest share of 49.9% in 2023, mainly due to improvements in surgeries and healthcare facilities for various disorders. Higher favorable outcomes as compared to open surgeries and shorter periods of hospitalization & recovery for children are boosting the demand for robotic-assisted surgeries, which is expected to boost market growth. Furthermore, improvements in the miniaturization of instruments are likely to allow optimal working conditions in limited space, which is expected to fuel market growth.

Asia Pacific is anticipated to grow at a lucrative CAGR of 14.1% from 2024 to 2030.Asia Pacific is expected to witness high GDP growth over the coming years, mainly led by growth in India, China, Singapore, Indonesia, and Australia. A rise in government initiatives undertaken to encourage healthcare providers and other healthcare organizations to adopt technologically advanced medical devices & systems is another key factor expected to drive market growth.

Key Companies & Market Share Insights

Key companies are increasingly focusing on introducing innovative technologies and entering into various strategic collaborations with orthopedic centers & other industry players to acquire new capabilities in surgical robots to maintain their competitive edge. Companies are also undertaking other strategies such as new product launches and collaborations & partnerships. Moreover, rising demand for automated surgical instruments globally is likely to promote the entry of new companies into the market. Furthermore, these companies have plans to expand their robotic systems' applications to include spine, shoulder, and other surgical procedures in the near future.

Key Surgical Robots Companies:

- Intuitive Surgical

- Medrobotics Corporation

- Medtronic

- Renishaw plc

- Smith and Nephew

- Stryker Corporation

- THINK Surgical, Inc.

- Transenterix (Asensus Surgical, Inc.)

- Zimmer Biomet

Recent Developments

-

In January 2021, DePuy Synthes (Johnson & Johnson) received FDA approval for its VELYS robotic system, improving its offerings with the ATTUNE TOTAL knee system. The entrance of major manufacturers, such as DePuy Synthes, into the robotic surgical domain, indicates a continuous and promising trend in the adoption of robotics for joint replacement surgeries

-

In January 2022, Smith & Nephew acquired Engage Surgical, which is involved in manufacturing cementless knee systems in the U.S. This acquisition improved its position in meniscal tear solutions and other knee arthroscopy devices

-

In August 2023, Stryker launched a direct patient marketing campaign aimed at enhancing patient engagement and education. The campaign is designed to reach patients directly & provide information about Stryker's innovative medical solutions, with a focus on joint replacement procedures. By fostering better patient understanding & awareness, Stryker aims to empower individuals to make informed decisions about their healthcare, ultimately improving their overall experience and outcomes

Surgical Robots Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.31 billion

Revenue forecast in 2030

USD 7.42 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

November 2023

Quantitative units

Revenue in USD million/billion, volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific;; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Smith & Nephew; Medrobotics; TransEnterix Surgical, Inc.; Intuitive Surgical; Renishaw plc; Medtronic; Stryker Corporation; Zimmer Biomet; THINK Surgical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Robots Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the surgical robots market report on the basis of application, end-use, and region.

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Orthopedics

-

Hip

-

Knee

-

Spine

-

Others

-

-

Neurology

-

Urology

-

Gynecology

-

Others

-

-

End-use Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Inpatient

-

Outpatient

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical robots market size was estimated at USD 4.31 billion in 2023 and is expected to reach USD 4.31 billion in 2023.

b. The global surgical robots market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 7.42 billion by 2030.

b. North America dominated the surgical robots market with a share of 49.9% in 2023. This is attributable to the increasing number of hospitals that are opting for robot-assisted surgeries, high healthcare spending by the U.S. government, and growing robotic investments in the region.

b. Some key players operating in the surgical robots market include ISmith & Nephew; Medrobotics; TransEnterix Surgical, Inc.; Intuitive Surgical; Renishaw plc; Medtronic; Stryker Corporation; Zimmer Biomet and THINK Surgical, Inc., and others.

b. Key factors that are driving the surgical robots market growth include the shortage of physicians and surgeons all over the globe and the increasing adoption of automated instruments used for surgery.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."