- Home

- »

- Advanced Interior Materials

- »

-

Structural Steel Market Size, Share & Growth Report, 2030GVR Report cover

![Structural Steel Market Size, Share & Trends Report]()

Structural Steel Market Size, Share & Trends Analysis Report By Application (Non-residential (Industrial, Commercial, Offices, Institutional), Residential), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-503-8

- Number of Pages: 175

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

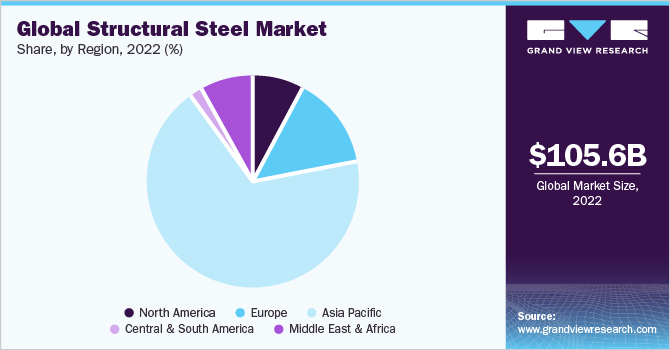

The global structural steel market size was valued at USD 105.57 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. Infrastructural developments, in both developing as well as developed countries, are anticipated to remain primary factors driving the demand for structural steel. The growing housing needs, as a result of the increasing population across the globe, is also among the key factors driving the product demand. As per the projections estimated by the United Nations, the global population will reach 11.2 billion by 2100, which, in turn, is expected to augment the demand for new houses, thus, indirectly contributing to the growth of the market. The growing preference for sustainable materials is driving the market in the U.S.

Structural steel is considered a green construction material due to its recyclability and thus, a rising number of green buildings in the country is anticipated to propel market growth in the coming years. According to the World Green Building Council, LEED-certified buildings use 11% less water and 25% less energy in the U.S. Furthermore, green buildings help reduce harmful impacts on the environment, hence, focus on their construction is increasing in the country.

California holds the major share in the overall green buildings segment in the U.S., in terms of area, and the state is expected to achieve zero net energy by 2030. The market growth was, however, obstructed in 2020 owing to the COVID-19 pandemic. According to the World Steel Association, the demand for finished steel declined by 2.4% in 2020. The pandemic led to factory shutdowns and a shortage of labor, which disrupted the supply chain. The confinement measures froze consumption activities, which reduced demand.

As the economies recovered from the COVID-19 impact, they increased the expenditure on infrastructural developments, which is expected to boost the market growth. For instance, in October 2020, the Mexican government announced a USD 14.2 billion infrastructure investment plan along with private sector companies for 29 projects as part of the Economic Recovery Agreement amid the COVID-19 pandemic.

Application Insights

Based on application, the non-residential held the largest revenue over 54.0% in 2022, of the global market. It is estimated to expand further at the fastest CAGR over the forecast period owing to the increasing spending on healthcare facilities, data centers, big-box retail stores, stadiums, airports, and manufacturing facilities. The segment is further divided into industrial, commercial, offices, and institutional.

The industrial sub-segment accounts for the maximum share in the non-residential segment. Structural steel is majorly used in industrial buildings due to its extreme strength, which is beneficial not only for structural integrity but also for subsiding the potential impact of repairs. It is also ideal for building large bridges owing to its high durability and excellent strength-to-weight ratio, which ensures withstanding the weight of cars and pedestrians.

The residential application segment accounted for the second-highest revenue share in 2022. The product is widely utilized in housing and residential buildings owing to its lightweight and high-strength characteristics, which minimizes the load on the foundation and reduces sub-structure costs.

In addition, due to its excellent flexibility and adaptability in modular construction, it can be dismantled and moved easily, thus maintaining the asset value of buildings. Structural steel can be used in various ways in residential buildings ranging from a single-family house to a big mixed-space building. Moreover, it also provides environmental benefits as it is 100% recyclable with no degradation.

Regional Insights

Asia Pacific held the largest revenue share of over 68.0% of the global market in 2022 and is anticipated to maintain its dominance at the fastest CAGR in the forecast period. Increased investments in the housing and commercial sectors of the developing economies, such as China and India, are anticipated to prove fruitful for market growth.

Furthermore, Southeast Asia is one of the emerging regions in the global market. There is a need for huge investments to reduce the infrastructure gap in this region. From 2000, Japan has financed projects worth USD 230 billion, while China invested around USD 155 billion for the improvement of infrastructure in the Southeast Asian region. Such investments are expected to augment the product demand over the coming years.

North America is anticipated to register a CAGR of 3.5%, in terms of revenue, over the forecast period. The region suffered a heavy economic loss, especially in the U.S. and Mexico, due to the COVID-19 pandemic. However, the construction industry in this region has witnessed significant recovery since 2021. The aging of infrastructure is expected to remain a key factor for rising product demand in the region.

Middle East & Africa is expected to grow at a considerable CAGR over the forecast period. The region is anticipated to witness a plethora of projects in the coming years, which is expected to propel market growth. Some of the projects include the Development of Residential Villas in Bahrain, Construct Volumetric Modular Assembly Plants Factory, and King Fahad Medical City Expansion in Saudi Arabia.

Key Companies & Market Share Insights

The market is fragmented with the presence of various small- and large-scale companies operating in different parts of the world. Companies focus on acquisitions and capacity expansions to broaden their presence worldwide. For instance, in July 2021, ArcelorMittal announced to upgrade its plant in Spain to a zero-carbon emissions facility. The plant is expected to produce 1.6 million tons of zero-carbon-emissions steel annually by 2025. Some prominent players in the global structural steel market include:

-

Arcelor Mittal S.A.

-

Baogang Group

-

Evraz plc

-

Gerdau S.A

-

Nippon Steel Corporation

-

JSW Steel Limited

-

Tata Steel Limited

-

SAIL

-

POSCO

Recent Development

-

In July 2023, ArcelorMittal did a strategic investment in CHAR Technologies under the XCarb™ Innovation Fund Accelerator Program. Alongside, ArcelorMittal started product testing at Canadian steel plants. This will support their global expansion in the development of industrial infrastructure and R&D collaboration.

-

In June 2023, Nippon Steel Corporation started selling ZEXEED™ Checkered Sheet, which was launched in which launched in October 2021. By leveraging the superior corrosion resistance of the ZEXEED Checkered Sheet, it has found an array of applications such as factory floors, parking lot floors, social and industrial infrastructure facilities, and inspection ports and stairs.

Structural Steel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 110.74 billion

Revenue forecast in 2030

USD 162.46 billion

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Russia; Turkey; Poland; China; Japan; Taiwan; India; Hong Kong; Thailand; Malaysia; Singapore; Vietnam; Philippines; Australia; New Zealand; Indonesia; Brazil; Chile; Colombia; UAE; Saudi Arabia; Iran; South Africa

Key companies profiled

Arcelor Mittal S.A.; Baogang Group; Evraz plc; Gerdau S.A; Nippon Steel Corporation; JSW Steel Limited; Tata Steel Limited; SAIL; Wuhan Iron & Steel (Group) Corp; Hunan Valin Iron & Steel Group Co., Ltd.; Hyundai Steel Co., Ltd. (HSC); Hebei Steel Group; Benxi Beiying Iron & Steel Group Co. Ltd.; Baosteel Group Corporation; Bohai Steel Group Co. Ltd.; Anyang Iron & Steel Group Co. Ltd.; Anshan Iron & Steel Group Corporation; POSCO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Structural Steel Market Report Segmentation

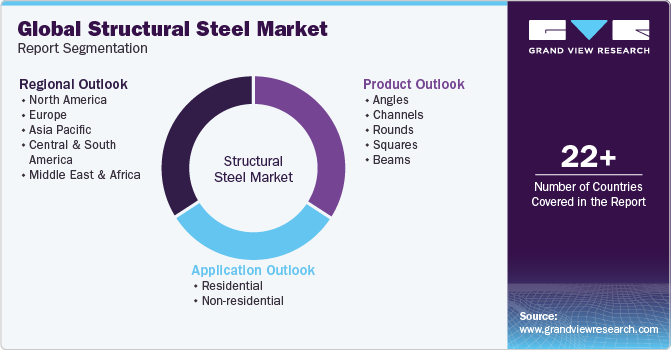

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global structural steel market report on the basis of application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Residential

-

Non-residential

-

Industrial

-

Commercial

-

Offices

-

Institutional

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Russia

-

Turkey

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

Taiwan

-

Hong Kong

-

Thailand

-

Malaysia

-

Singapore

-

Indonesia

-

Vietnam

-

Philippines

-

India

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Chile

-

Colombia

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

Iran

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global structural steel market size was estimated at USD 105.57 billion in 2022 and is expected to reach USD 110.74 billion in 2023.

b. The global structural steel market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 162.46 billion by 2030.

b. Based on the application segment, non-residential held the largest revenue share of more than 54.0% in 2022 owing to increasing demand for high-quality construction material in industrial, commercial, offices, and institutional buildings.

b. Some of the key players operating in the structural steel market include ArcelorMittal, Baosteel Group, Evraz plc, Gerdau S.A., JSW Steel, POSCO, Nippon Steel Corporation, Tata Steel, and SAIL.

b. Growing efforts towards infrastructural developments coupled with rising spending in the residential sector across various countries are anticipated to augment structural steel market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The manufacturing sector has been worst hit with the current pandemic situation as manufacturers of non-essential goods have shut down their manufacturing facilities in compliance with the government norms for lockdown. We at GVR are trying to quantify the impact of this pandemic on the structural steel market. Get your copy now to gain deeper insights on the same.