- Home

- »

- Advanced Interior Materials

- »

-

Steel Pipes & Tubes Market Size And Share Report, 2030GVR Report cover

![Steel Pipes & Tubes Market Size, Share & Trends Report]()

Steel Pipes & Tubes Market Size, Share & Trends Analysis Report By Technology (Seamless, ERW), By Application (Oil & Gas, Power Plant, Automotive & Transportation, Mechanical Engineering), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-640-0

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range:

- Industry: Advanced Materials

Steel Pipes & Tubes Market Size & Trends

The global steel pipes & tubes market size was estimated at USD 185.47 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3.7% in terms of revenue from 2023 to 2030.Rising construction of new petrochemical plants worldwide is expected to boost the consumption of steel pipes & tubes over the forecast period. Steel pipes & tubes are utilized in piping systems, pressure tubes, and heat exchangers in the chemicals & petrochemicals industry. Thus, increasing investment in the construction of petrochemical plants is expected to benefit market growth. For instance, in December 2022, Essar Group announced its plan to invest ~USD 4,905.4 million for a petrochemical complex in Odisha, India. The oil-to-petrochemical complex is anticipated to have an annual production capacity of 7.5 million tons.

The U.S. is one of the largest producers of oil & gas in the world. According to the U.S. Energy Information Administration, the crude oil proved reserves increased by 14.8% on a y-o-y basis (as of December 2021), reaching 41.2 billion barrels. The wet natural gas reserves witnessed an increase of 32.1%, reaching 625.4 trillion cubic feet. The country’s share in global oil production was around 14.5% in 2021. These shares are expected to increase over the forecast period.

As of June 2023, when Russia and OPEC+ countries have announced production cuts, the U.S. crude oil production is anticipated to rise to 12.61 million barrels per day in 2023. One of the major oil producers in the U.S., Exxon Mobil, announced its aim to double its production from the U.S. shale holdings over five years with the help of advanced technologies.

Similarly, in June 2022, Chevron Corporation announced ramping of its production in the onshore Permian basin from 700k to 1 million barrels per day by 2025. As of March 2023, despite labor shortages, the company is on track for this expansion. In addition, the global crude oil proved reserves increased by 1.3% on a y-o-y basis (as of December 2022), reaching 1,757 billion barrels. Thus, increasing investment in oil production is likely to augment the need for steel pipes & tubes for transportation and other operational purposes over the forecast period.

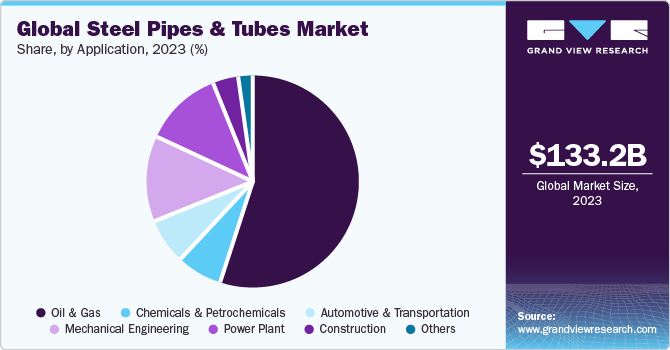

Application Insights

Based on application, the oil & gas segment held the largest market share of over 57% of global revenue in 2022. The product is largely consumed in oil country tubular goods (OCTG), distribution, process piping, and other applications in the oil & gas sector. Increasing investment in the cross-country oil and gas transportation pipeline network is expected to propel the demand for steel pipes & tubes across the forecast period.

For instance, in September 2022, the Nigeria-Morocco Gas Pipeline Project (NMGP) signed a deal with Morocco, and the Economic Community of West African States (ECOWAS) to construct a 5,600 km pipeline, which will deliver gas from Nigeria to 13 countries of West Africa through Morocco. Thus, a project of this kind is expected to propel the market growth over the forecast period.

In terms of revenue, the chemicals & petrochemicals segment is anticipated to grow at a CAGR of 3.9% from 2023 to 2030. Steel pipes & tubes are increasingly being used in petrochemical plants for process refining owing to their characteristics, such as strong corrosion and oxidation resistance.

The construction industry segment is another vital end-use for the market where steel pipes & tubes are used for building structures, foundations, balconies, railings, and many more. Rapid urbanization and industrialization, especially in developing economies, are anticipated to augment the segment growth over the forecast period.

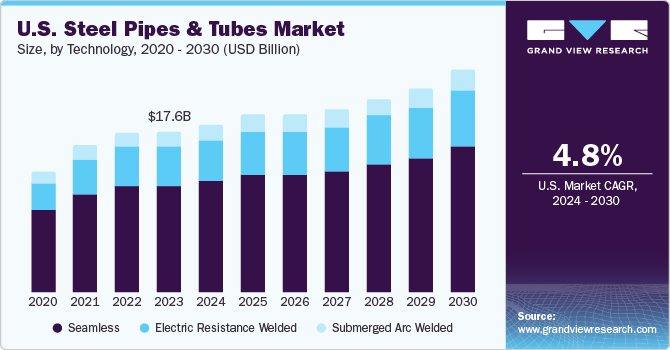

Technology Insights

Based on technology, the seamless segment held a revenue share of over 67% in 2022. Steel billets are heated after being perforated to form the tubular section, which is used to produce seamless. Seamless is used in a variety of sectors, including power generation, oil & gas, and chemicals & petrochemicals.

The electric resistance welded (ERW) segment is gaining prominence in the market due to its modest performance and low price. The segment is anticipated to be driven by plans for fertilizer, oil & gas, and power companies to construct transportation pipelines. For instance, in December 2021, Indian Oil Corporation (IOCL) announced an investment of INR 9,028 crore (USD 1,105.6 million) for setting up a new crude pipeline from Mundra (Gujrat) to Panipat (Haryana), India.

Submerged arc welded (SAW) is another crucial segment of the market. SAW primarily competes with ERW and seamless, mainly in the product range of 16 inches to 24 inches. However, SAW is the best pick for pipelines that are above 24 inches. Different types of SAW include longitudinal type (LSAW) and spiral type (SSAW).

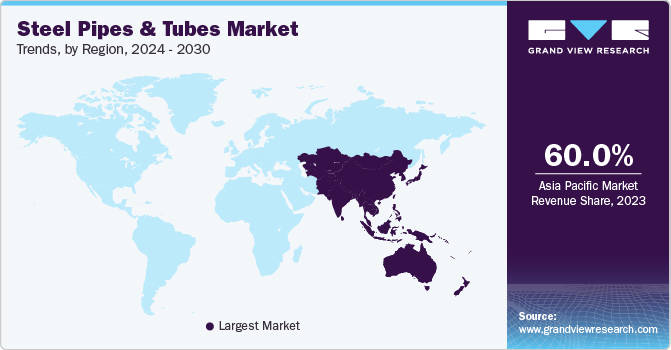

Regional Insights

Asia-Pacific dominated the market with a revenue share of over 64% in 2022. The large share is attributed to countries like China, South Korea, India, and Japan, which are the major consumers of steel pipes & tubes due to the presence of the huge manufacturing and petrochemical sectors.

The Middle East & Africa region is anticipated to witness moderate growth over the forecast period, owing to rising investment by private players in setting up of new petrochemical plants. For instance, in November 2022, Alujain Corporation received a nod from Saudi Arabia’s Ministry of Energy for establishing a new petrochemicals project in Yanbu Industrial City.

Central & South America is anticipated to witness a CAGR of 2.0%, in terms of revenue, over the forecast period. The demand in the region is projected to increase as a result of growing investments in oil and gas projects. For instance, in September 2022, PETRONAS, a Malaysia-based oil & gas company, and YPF, Argentina’s state oil company, agreed to construct a Liquefied Natural Gas plant in Vaca Muerta, Argentina. The project is expected to be built with an initial investment of USD 10 million.

Key Companies & Market Share Insights

The global market is fragmented in nature, with the presence of various key players such as ArcelorMittal, Nippon Steel Corporation, ThyssenKrupp AG, Tata Steel, and Hyundai Steel, as well as a few medium and small regional players operating in various parts of the world. Companies are also focused on collaborations, mergers & acquisitions, and joint ventures to broaden their product portfolio and regional presence. For instance, in July 2022, Tenaris signed a USD 460 million deal to take over Benteler, a U.S.-based steel pipe producer. This acquisition is expected to help Tenaris expand its manufacturing capacity and serve its customers more efficiently.

Key Steel Pipes & Tubes Companies:

- ArcelorMittal

- United Steel Corporation

- Nippon Steel Corporation

- Tata Steel

- Rama Steel Tubes Limited

- Steel Authority of India Limited

- Jindal Steel & Power Ltd.

- Hyundai Steel

- ThyssenKrupp AG

Steel Pipes & Tubes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 171.78 billion

Revenue forecast in 2030

USD 247.90 billion

Growth rate

CAGR of 3.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; France; Italy; China; India; Japan; Indonesia; Philippines; Brazil; Saudi Arabia

Key companies profiled

ArcelorMittal; United States Steel; Nippon Steel Corporation; Tata Steel; Jindal Steel & Power Ltd.; Rama Steel Tubes Limited; Steel Authority of India Limited (SAIL); Hyundai Steel; ThyssenKrupp AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

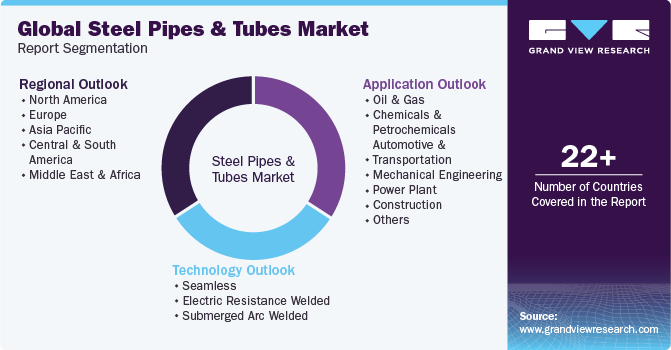

Global Steel Pipes & Tubes Market Report Segmentation

This report forecasts revenue and volume growth at country & regional levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global steel pipes & tubes market report based on technology, application, and region.

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Seamless

-

Electric Resistance Welded

-

Submerged Arc Welded

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemicals & Petrochemicals

-

Automotive & Transportation

-

Mechanical Engineering

-

Power Plant

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Philippines

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global steel pipes & tubes market size was estimated at USD 185.47 billion in 2022 and is expected to drop down to USD 171.78 billion in 2023.

b. The steel pipes & tubes market is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 247.90 billion by 2030.

b. Oil & gas dominated the steel pipes & tubes market with a revenue share of over 57.0% in 2022, owing to incessant oil & gas production and rising drilling activities in various countries.

b. Some of the key players operating in the steel pipes & tubes market include ArcelorMittal, United States Steel, Nippon Steel Corporation, Tata Steel, Jindal Steel & Power Ltd. (JSPL), Rama Steel Tubes Limited, and Steel Authority of India Limited (SAIL).

b. The key factors that are driving the steel pipes & tubes market include an increase in petroleum E&P activities in the U.S., Indonesia, Venezuela, China, Nigeria, and Canada and rising installation capacities of powerplants in various countries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for Covid19 as a key market contributor.