- Home

- »

- Advanced Interior Materials

- »

-

Long Steel Products Market Size And Share Report, 2030GVR Report cover

![Long Steel Products Market Size, Share & Trends Report]()

Long Steel Products Market Size, Share & Trends Analysis Report By Product (Rebars, Wire Rods, Sections, Tubes), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-856-5

- Number of Pages: 117

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Long Steel Products Market Size & Trends

The global long steel products market size was valued at USD 751.49 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2030. The market is likely to be driven by the increasing demand for long steel products from the construction and infrastructure industry across the globe. The huge demand coming from the building and construction industry is due to the growing need for residential properties with the rise in population. The rise in infrastructure projects globally such as metro projects, railway bridges, highways, and mega city projects have contributed to the share of long steel products in construction.

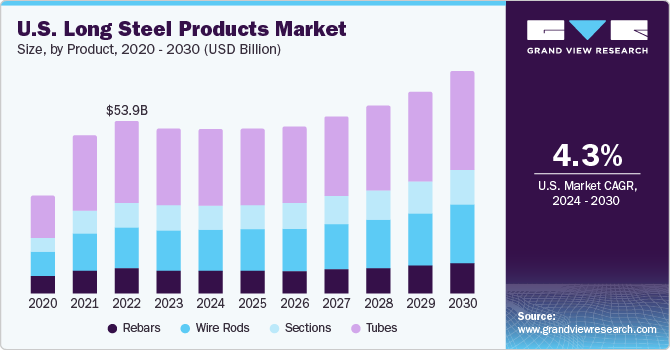

The government of the U.S. has taken several initiatives to enhance the production of steel long products in the country. One such initiative is the imposition of tariffs on imports from countries such as Brazil, Russia, Mexico, which has helped the government to boost the business of local manufacturers and encourage investments (both domestic as well as foreign investments) in the U.S. steel industry. Additionally, the government of the U.S. has invested in infrastructure development projects for the construction of highways, bridges, and railways that require significant volumes of long steel products.

Furthermore, these are increasingly used in this industry for providing structural support. Moreover, they are affordable and easily available. They are versatile, durable, offer high strength, and are 100% recyclable. They can be used in warehouses, high-rise buildings, industrial buildings, bridges, etc. Rising investments in the construction of smart cities, industrial, and residential buildings drive the growth of the market.

However, the ongoing Russia-Ukraine conflict has significantly impacted the situation, as they are one of the primary producers of steel and the conflict has affected the global supply chain.Moreover, the rise in energy prices and sea freight rates have also played a significant role in surging the costs of rebar globally. These factors have led domestic manufacturers to raise their prices.

The fluctuations in raw material prices have an impact on the costs of finished products. Additionally, significant geopolitical events, demand variations, and raw material price surges over time have slowed the growth of the market worldwide. The fluctuations in global costs act as restraints for the growth of long steel products market

Product Insights

Rebars held the largest revenue share of over 34.0% in 2022 of the global market and it is expected to continue its dominance over the forecast period as a result of growing construction activities. For instance, in India, various social programs are being carried out by the government, including the Pradhan Mantri Awas Yojana, for developing new housing units for the masses. Under the Pradhan Mantri Awas Yojana, the construction of approximately 12.3 million houses has been sanctioned till Feb 2023.

Wire rods segment is substantially gaining traction with a CAGR of 5.8% worldwide over the forecast period. Apart from construction and automotive, wire rods have a wide range of applications in various other industries such as aerospace, railways, and energy.

They are commonly used as raw materials for the production of various types of wires such as low-carbon, high-carbon, and alloy wires. These wires are used in applications such as fencing, barbed wire, cable, and welding electrodes. These rods are also used to manufacture fasteners such as screws, nails, and bolts that are used in manufacturing and construction applications. In the electrical industry wire rods are used in the production of electrical wires, cables, and conductors that are used in the transmission and distribution of electrical power.

The production of steel tubes is a critical aspect of many industries, including oil and gas, automotive, construction, and aerospace. The demand for tubes is increasing globally owing to the increasing application in the end-use industries. The tubes are in high demand because they are versatile and have a wide range of applications across various industries. Some of the major industries that require them in large quantities include construction, oil & gas, automotive, manufacturing, and aerospace, among others.

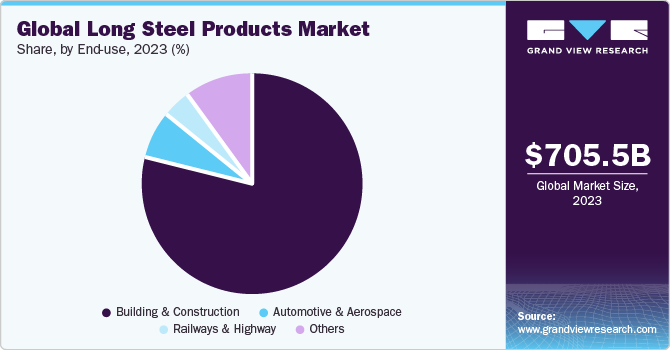

End-use Insights

Based on end use, building and construction was the largest segment, accounting for a volume share of over 79.0% in 2022. Long steel products are extensively used in the real estate sector for different applications. Steel rebar binds well with the concrete. It has a similar thermal coefficient as that of concrete. As such, it is mostly used for the development of building foundations, slabs, and dams.

With the overall increase in the GDP of developing countries such as India, Indonesia, and Mexico, growth can be observed in real estate, railroads, ports, airports, and electricity sector. In emerging economies like Brazil, South Africa, and Egypt, the demand for low-cost houses is increasing due to a surge in the disposable income of citizens and the easy availability of housing loans. Thus, growth in construction industry is aiding the market growth.

The automotive and aerospace is another vital segment of the market. Automobiles with four-wheel chassis use long steel sections while two-wheelers employ steel pipes with high thicknesses. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), global production of vehicles increased by 3.1% in 2021 compared to 2020. Increase in the production of vehicles will have a significant impact on the market.

Further, the product demand is propelling in the aerospace industry due to the need for lightweight, strong, and cost-effective materials that can be used in safety-critical components. In addition, the increased use of composite materials is further propelling the demand for these products in the aerospace industry. Long steel products, such as steel bars, tubes, and wire, are used in the production of composite parts to provide added strength and durability.

Regional Insights

Asia Pacific held the largest revenue share of over 65.0% in 2022 of the global market. The segment growth is anticipated to spur owing to the rising population and increasing infrastructural developments in the region. Further, growth in other end-use industries such as automotive, railways, and highways is further aiding the demand for market

In terms of revenue, Asia Pacific is projected to expand at a CAGR of 4.4% from 2023 to 2030. Some of the major growth drivers for construction industry in Asia Pacific are development of smart cities, industrial corridors, data centers, cold storage, and increasing demand for commercial space. The construction industry growth is closely linked to the market growth owing to the extensive use of rebars, sections, and wire rods.

Growing demand for steel products in Southeast Asia is encouraging domestic manufacturers to augment their production and reduce their dependence on imports. The region, which witnessed a surge of 41% in imports of finished products in 2021 from 2020, witnessed a decline in 2022. According to SEASI, the finished steel imports in Southeast Asia reduced by 4.3% in first half of 2022 dropping down to 21.9 million tons, whereas the exports increased by 7.2% reaching 11.1 million tons.

U.S. is the second-largest producer of long steel products in the world. Long steel products also have significant demand in the aerospace industry. They are used as raw materials for manufacturing critical components of aircraft and spacecraft, including landing gear, engines, and exhaust ducts. The surge in aircraft orders is anticipated to fuel the demand for these products in Europe over the forecast period as the key aircraft manufacturers such as Boeing and Airbus are based in this region.

Key Companies & Market Share Insights

The market growth has pushed key players to opt for strategic partnerships. For instance, in June 2022, Nucor Corporation entered into a strategic agreement to acquire Sovereign Steel Manufacturing LLC and Summit Utility Structures LLC, manufacturers of steel structures and metal poles for highway signage and utility infrastructure.

To remain in the competition, key companies enter into long-term supply contracts with end users. For instance, in July 2022, Arcelor Mittal announced the acquisition of the HBI plant of Voestalpine for USD 1 billion. The HBI plant is located in Texas in the U.S. Through this acquisition, Arcelor Mittal aims at adding 2 million tons of HBI capacity to its manufacturing portfolio. This is anticipated to help the former in lowering carbon emissions during its operations. Some of the key players in the long steel products market include:

-

Emirates Steel Arkan

-

Al-Rasheed Steel

-

Arabian Gulf Steel Industries (AGCI)

-

ArcelorMittal

-

Emirates Rebar Limited

-

Emirates Steel Arkan

-

Hamriyah Steel

-

Jindal Shadeed Steel

-

Rajhi Steel Industries

-

RAK Steel

-

Star International Steel

-

Union Iron and Steel

-

United Gulf Steel

-

Watania Steel Factory

Long Steel Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 704.44 billion

Revenue forecast in 2030

USD 1,011.9 billion

Growth rate

CAGR of 3.8% from 2023 to 2030

Market size in volume in 2023

899,191.1 kilotons

Volume forecast in 2030

1,285,803.7 kilotons

Growth Rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Country scope

U.S; Mexico; Germany; France; Italy; Russia; China; India; Japan; Indonesia; Philippines; Singapore; Thailand; Malaysia; Brazil; Bahrain; Kuwait; Oman; Qatar; Saudi Arabia; UAE; Ethi9opia; Tanzania; Mozambique; Rwanda; Zimbabwe; Kenya

Key companies profiled

Emirates Steel Arkan; Al-Rasheed Steel; Arabian Gulf Steel Industries (AGCI); ArcelorMittal; Emirates Rebar Limited; Emirates Steel Arkan; Hamriyah Steel; Jindal Shadeed Steel; Rajhi Steel Industries; RAK Steel; Star International Steel; Union Iron and Steel; United Gulf Steel; Watania Steel Factory

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Long Steel Products Market Report Segmentation

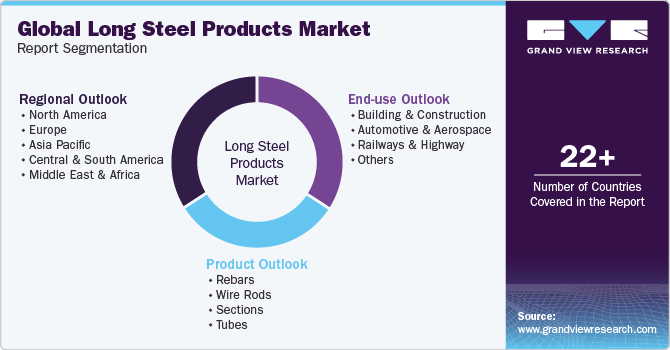

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the long steel products report on the basis of product, end-use, and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Rebars

-

Wire Rods

-

Sections

-

Tubes

-

-

End-use Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Aerospace

-

Railways & Highway

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Philippines

-

Singapore

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

Saudi Arabia

-

UAE

-

-

Africa

-

Ethiopia

-

Tanzania

-

Mozambique

-

Rwanda

-

Zimbabwe

-

Kenya

-

-

Frequently Asked Questions About This Report

b. The global long steel products market size was estimated at USD 751.49 billion in 2022 and is expected to reach USD 704.44 billion in 2023.

b. The global long steel products market is expected to grow at a compound annual growth rate of 3.8% from 2023 to 2030 to reach USD 1,011.9 billion by 2030.

b. Based on region, Asia Pacific accounted for the largest revenue share of more than 65.0% in 2022 of the overall market. The growth is witnessed owing to the upcoming residential and non-residential construction projects in the region.

b. Some of the key players operating in the long steel products market include. Emirates Steel Arkan, Al-Rasheed Steel, Arabian Gulf Steel Industries (AGCI), ArcelorMittal, Emirates Rebar Limited, Hamriyah Steel, and Jindal Shadeed Steel.

b. The key factors that are driving the long steel products market include growing demand for steel products in construction and automotive industries. Also, the rising government investments in infrastructure along with easy availability of home loans are further propelling market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."