- Home

- »

- Advanced Interior Materials

- »

-

Stainless Steel Market Size & Trends Analysis Report, 2023GVR Report cover

![Stainless Steel Market Size, Share & Trends Report]()

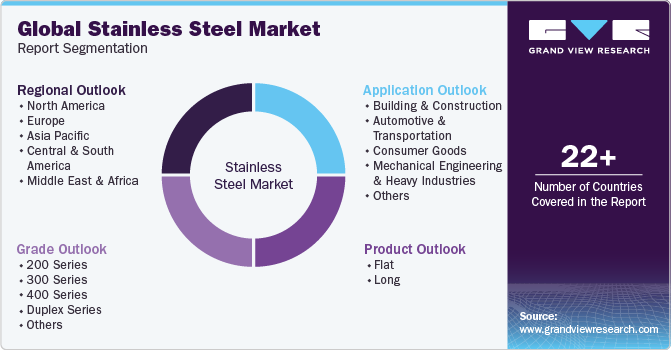

Stainless Steel Market Size, Share & Trends Analysis Report By Grade (200 Series, 300 Series, 400 Series, Duplex Series), By Product (Flat, Long), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-945-6

- Number of Pages: 133

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global stainless steel market size was valued at USD 111.44 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The private and public investments in infrastructure, as well as residential housing, is likely to provide a boost to the stainless steel demand. Stainless steel (SS) is an important material in industrial applications such as building & construction, infrastructure, railways, automotive & transportation, and process industries. Stainless steel has a unique edge over carbon steel as it has a combination of properties such as pliability, strength, corrosion resistance, aesthetic properties, low maintenance cost, and average product life cycle. These properties along with increasing penetration in numerous applications is anticipated to drive the market growth.

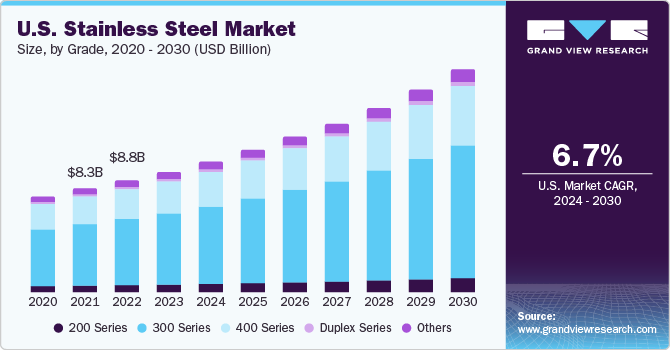

The U.S. stainless steel market is expected to be driven by demand in mechanical, chemical, and energy applications. These applications are diverse in range and include oil industry’s tubulars, heat exchangers, heat vessels, boiler used in power plants, furnace plants, and components used in processing machineries of pulp & paper, chemical and food & beverage industries.

Building & construction is one of the important applications of stainless steel. The segment accounted for a volume share of 11.3% in overall U.S. demand. For structural purpose, SS products are used in beams, columns, and general architectural applications. It is used in railings, roofing, lifts, staircases, swimming pool shades, canopies, and atriums among others.

In November, the Biden government introduced USD 2 trillion plan for infrastructure. It includes heavy fund allocation for repair and renovation of bridges, highways, EV charging facilities, airports, water infrastructure, communication networks, high-speed internets, clean energy & environment, and carbon reduction. This plan is likely to assist the SS demand for structural applications in infrastructure and construction.

Grade Insights

300 series was the largest segment in 2022 with a volume share of over 54.0% in 2022. Grade 303 in the series is used almost entirely for every part requiring polishing, grinding, and machining where good corrosion resistance is also compulsory. Its non-galling and non-seizing properties make it ideal for moving parts. Being an austenitic steel, it is very useful where low magnetic permeability is preferred. It has fairly good forming properties used for aircraft parts, as well as gears, valve trim, shafts, valves, and all types of screw machine products. It is also required for architectural purposes.

Grade 304 in the 300 series is specifically suited for all kinds of dairy equipment including containers, sterilizers, milking machines, homogenizers, and storage & hauling tanks, including railroad cars, milk trucks, valves, and piping. This 18-8 alloy is similarly operative in the brewing business where it is used in storage & railway cars, fermentation vats, yeast pans, and pipelines.

Duplex series SS is anticipated to grow at a highest CAGR of 9.5% over the forecast period, in terms of revenue. Superior properties of the product such as high strength, low weight, and high corrosion resistance particularly stress corrosion cracking is anticipated to drive product demand over the forecast period. The product finds applications in pharma, oil & gas, water desalination, and chemical & petrochemical industries.

Product Insights

Flat products accounted for a revenue share of over 73.0% in 2022 and is likely to dominate the market over the forecast period. Flat products mainly include sheets/coil and plates. SS flat products are widely used in mechanical parts and industrial tools along with construction and structural applications. These products are hot rolled and cold rolled and have properties such as corrosion resistance, high strength, and great thickness.

The demand for SS products is likely to be driven by growth of the automotive and transportation industry. Railways is one of the important applications, wherein corten steel is being replaced by stainless steel for coaches. This was mainly due to energy absorption capacity and high strength to weight ratio to improve the crash effectiveness of the coach.

Long products are widely used in industries such as textile, automotive, defense, shipbuilding, cement, fabrication, paper & pulp, and earth-moving machinery. Rounds bar is an important product in this category and can easily be machined and bent as per requirement. These products are used in grills, fasteners, and machining applications along with the production of parts for automotive and machinery & equipment.

Application Insights

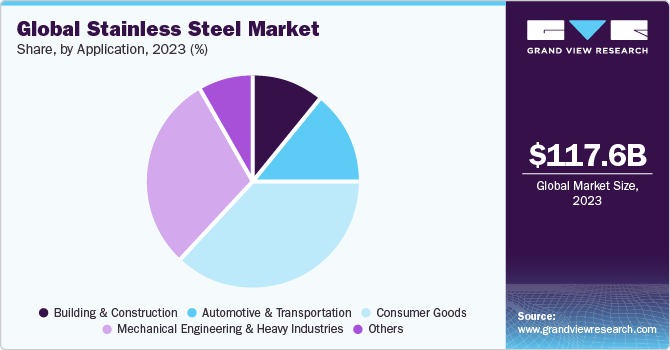

The consumer goods segment dominated the market and accounted for the largest revenue share of over 37.0% in 2022. The segment is projected to grow owing to increasing demand for washing machine & fridge parts, sinks, utensils, and many more. Characteristics such as easy fabrication, corrosion resistance, and aesthetic appeal are likely to contribute to the demand for consumer goods; thus, positively influencing the market growth.

The building & construction (B&C) segment witnessed a sizable impact in 2020 by the outbreak of the COVID-19 pandemic. Factors such as global financial crunch, supply disruptions, global demand, and decline in have affected the market dynamics in the B&C sector in recent times. For instance, as per data released EUROCONSTRUCT, construction output in European countries witnessed a decline of 5.1% in 2020 from the previous year.

The automotive & transportation segment also observed a significant decline in 2020 in terms of automotive production and sales. For instance, global automobile production declined by 16% in 2020 as per the International Organization of Motor Vehicle Manufacturers (OICA). The future demand for automobiles is likely to be driven by the need for private vehicles among consumers to avoid large crowd in public transportation.

Regional Insights

Asia Pacific dominated the regional segment and held the largest revenue share of over 68.0% in 2022 owing to the rapidly expanding defense, machinery, automotive, and shipbuilding industries in countries such as India, China, South Korea, and Japan. Foreign direct investment in energy and infrastructure is likely to provide opportunities for market vendors.

An increasing share of India and ASEAN countries in the demand of SS is likely to contribute to the expansion of the Asia Pacific stainless steel market. Per capita consumption in India, Vietnam, Thailand, and Indonesia is gradually increasing, which is likely to remain key contributing factor for the market growth. Additionally, the expansion of cold-rolled facilities is also expected to remain a vital factor for the growth of the market.

In terms of revenue, Europe is likely to grow at a CAGR of 6.6% from 2023 to 2030. Since the commencement of operations in 2021 after pandemic, Europe market witnessed recovery. For instance, as per the International Stainless Steel Forum (ISSF), SS melt shop production increased by around 11% on a y-o-y basis, through the first quarter of 2021. Increasing application in pre-engineered buildings is likely to drive market growth over the coming years.

Key Companies & Market Share Insights

Players in the stainless steel market are adopting several organic and inorganic growth strategies such as capacity expansion, mergers & acquisitions, and joint ventures, in order to maintain and expand their market share. For instance, in February 2021, the company announced a capex plan for its Odisha stainless steel plant worth Rs. 2000-3000 crore (~ USD 261.8-392.7 million) over the next few years. Some of the prominent players in the global stainless steel market include:

-

Acerinox S.A.

-

Aperam Stainless

-

ArcelorMittal

-

Baosteel Group

-

Jindal Stainless

-

Nippon Steel Corporation

-

Outokumpu

-

POSCO

-

ThyssenKrupp Stainless GmbH

-

Yieh United Steel Corp.

Recent Developments

-

In June 2023, ArcelorMittal in collaboration with John Cockerill, announced plans to develop the first in the world low-temperature, industrial-scale iron electrolysis plant – Volteron. The iron plates produced in the electrolysis process will be fabricated into steel.

-

In June 2023, Outokumpu entered into a collaboration with Boysen Group and Thyssenkrupp Materials Processing Europe for introducing the first in the world toward-zero stainless steel in the automotive sector.

-

In June 2023, Jindal Steel entered into a strategic collaboration with Dassault Systèmes for boosting its production process. This deal was aimed at enabling Jindal Stainless to handle end-to-end production and business functions between Hisar, Haryana, and Jajpur, Odisha, seamlessly.

-

In June 2023, Outokumpu announced plans to partner with Nordic Steel for introducing sustainable stainless steel in the Norwegian market. Circle Green by Outokumpu is the most sustainable stainless steel in the world with over 92% lower carbon footprint compared with the average in industry.

-

In March 2023, ArcelorMittal signed an agreement with Japan Bank for International Cooperation with the objective to strengthen their partnership in the manufacturing of steel and decarbonization.

-

In February 2023, Aperam announced a joint venture named Botanickel, along with the University of Lorraine, France. Botanickel was formed with the aim to pursue world leadership in the sustainable manufacturing of biosourced nickel for the stainless steel market.

-

In September 2022, a joint venture of ArcelorMittal and Nippon Steel Corporation, ArcelorMittal Nippon Steel India Limited announced plans to construct upstream and hot-rolling facilities in an unused land of Hazira steel mill. This initiative was aimed at meeting the escalating steel demand in the Indian market.

-

In March 2023, Jindal Stainless announced its collaboration with New Yaking Pte. Ltd. for the development of a Nickel Pig Iron smelter plant in Indonesia. This strategic initiative aimed at enhancing value for JSL’s stakeholders keen to acquire a stake in nickel supply to serve security of raw material for its stainless steel operations.

Stainless Steel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 117.63 billion

Revenue forecast in 2030

USD 197.29 billion

Growth rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Russia; China; India; Japan; South Korea; Brazil; GCC

Key companies profiled

Acerinox S.A.; Aperam Stainless; ArcelorMittal; Baosteel Group; Jindal Stainless; Nippon Steel Corporation; Outokumpu; POSCO; ThyssenKrupp Stainless GmbH; Yieh United Steel Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stainless Steel Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stainless steel market report based on grade, product, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

200 series

-

300 series

-

400 series

-

Duplex series

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flat

-

Long

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Consumer Goods

-

Mechanical Engineering & Heavy Industries

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global stainless steel market size was estimated at USD 111.44 billion in 2022 and is expected to reach USD 117.63 billion in 2023.

b. The global stainless steel market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 197.29 billion by 2030.

b. Based on region, Asia Pacific was the largest market with a revenue share of over 70% in 2022, owing to growth in consumer goods, marine, aerospace, and heavy industries

b. The key players operating in the stainless steel market include Acerinox S.A., Aperam Stainless, ArcelorMittal, Baosteel Group, Jindal Stainless, Nippon Steel Corporation, Outokumpu, POSCO, ThyssenKrupp Stainless GmbH and Yieh United Steel Corp.

b. Key factors that are driving the stainless steel market are investments in infrastructure and housing sectors along with rising consumer goods demand from developing economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The manufacturing sector has been worst hit with the current pandemic situation as manufacturers of non-essential goods have shut down their manufacturing facilities in compliance with the government norms for lockdown. We at GVR are trying to quantify the impact of this pandemic on the stainless steel market. Get your copy now to gain deeper insights on the same.