- Home

- »

- Food Additives & Nutricosmetics

- »

-

Squalene Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Squalene Market Size, Share & Trends Report]()

Squalene Market Size, Share & Trends Analysis Report By Source (Animal, Amaranth Oil, Synthetic), By End-use (Pharmaceuticals, Nutraceuticals), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-991-3

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

The global squalene market size was valued at USD 134.76 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 10.9% from 2023 to 2030. Increasing consumption of natural ingredients in the personal care and cosmetics sector is expected to emerge as the major factor driving the demand. Squalene is translucid, emits a low odor, and offers moisturizing properties. These qualities make it one of the most preferred emollients in the world. Additionally, the absence of toxicity, makes it one of the most widely used elements in personal care applications. Squalene oil is also utilized in the cosmetics industry to fight free radicals that damage the skin and accelerate the aging process.

The product is used as a moisturizing and cleansing ingredient in cosmetic and personal care products such as lotions, hair conditioners, bath oils, lipsticks, creams, and foundations. Furthermore, the surge in demand for natural and organic ingredients is expected to have a positive impact on the market.

Another factor that fuels market expansion is the rising demand for squalene in several vaccines. It is a vital component of vaccinations including the COVID-19 vaccines as it is extremely effective in boosting the immune response.

Squalene product, used in vaccines and pharmaceutical products is a purified version of fish oil, which is extracted from sharks. A report published by the International Trade of Endangered Species states that five shark species are in danger of extinction. This is anticipated to significantly reduce the animal-based squalene and drive plant- and synthetic-based sources.

The squalene industry also benefited from the rising interest in nutritional supplements, the expansion of the cosmetics sector, and the prevalence of cancer and cardiovascular disorders. New renewable sources for squalene manufacturing along with appealing marketing and packaging techniques give market participants additional lucrative opportunities.

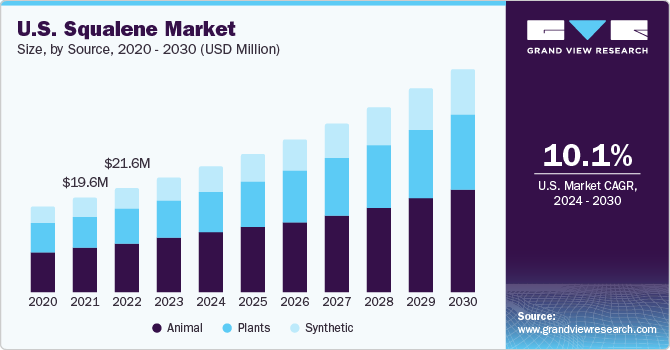

The U.S. is the largest producer and consumer of squalene in North America. The market is expected to grow significantly over the forecast period owing to the growth of the cosmetics industry in the country. The growth can be attributed to a high penetration rate of global cosmetic brands and an increase in the demand for beauty care products and beauty clinics owing to expanding working women population in the country.

Squalene is majorly extracted from shark liver oil and olive oil. Olive oil is a major source of extraction in the U.S. owing to the restrictions imposed on poaching of marine animals under the Marine Mammal Protection Act Policies (MMPA) that prohibits the take of marine mammals, including hunting, collecting, capturing, harassing, or killing them in the waters and by the citizens of the U.S. on the high seas.

The act also makes it unlawful to import marine mammals and items derived from marine mammals into the country without the necessary permits. This could lead to an increase in the use of plant-based or synthetically manufactured squalene over animal-based in the U.S. in the coming years.

Source Insights

The plant segment dominated the market with a revenue share of over 82.3% in 2022. This is attributed to the declining population of sharks, increasing awareness among people regarding animal welfare and protection, and regulatory frameworks imposed by various governments for the protection of marine animals.

Plants are alternatives to sharks for the extraction of squalene as they can be grown and harvested sustainably. For example, the monkey Jack, or Artocarpus lakucha is an Asian plant that produces 10%-20% squalene, equivalent to its dry weight capacity. Squalene can also be extracted from its leaves having high purity.

As per the International Olive Council (IOC) report, world olive oil production may reach 3,214, 500 tons, 2.9% more than the previous crop year due to the high cultivation of olive trees in this region. Naturally, squalene is majorly found in olives, amaranth, and rice bran. The highest amounts of the product are found in olives depending upon the cultivator, extraction technology, and level of oil refining. Extra virgin unrefined olive oil contains higher concentrations of the product as compared to refined olive oils.

Shark squalene is obtained from the liver oil of freshly preserved livers of numerous species of deeper water sharks as they have higher product content. It requires around 3000 sharks to extract just one ton of squalene, hence excessive catching of these animals led to a dramatic decline in the population of certain species as around 2.7 million deep-sea sharks are poached every year due to the wide application in the cosmetic industry.

Deep-sea shark liver oil has been the primary and highest concentration of naturally occurring source of squalene, owing to its properties such as healing wounds and fighting infections as it stimulates a key innate immune cell in wound healing and tissue repairing.

To protect these sharks and shift the manufacturers to use plant-based squalene sources, several laws were imposed. In India, extraction, possession, or trade-in 10 elasmobranchs is completely prohibited as they are listed in India's Wildlife (Protection) Act, 1972.

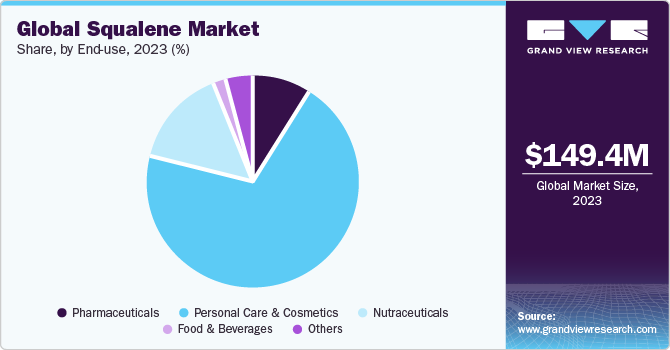

End-Use Insights

The personal care and cosmetics segment dominated the global market with over 70.1% share in 2022. The growth in this segment can be attributed to the usage of squalene in a variety of cosmetic products meant for skin care and hair care.

Squalene is used in a variety of cosmetic products meant for sun care, skincare, and hair care. Approximately 70-80% of the total squalene produced globally is consumed by the cosmetics industry. Multinational cosmetic companies such as L’Oréal, Unilever, and St. Botanica have already started to shift from shark liver oil-based to plant-based squalene for use in their personal care products and cosmetics owing to its exceptional properties, along with less extinction risk posed by them to sharks.

In 2021, L’Oréal acquired U.S.-based ‘Youth to the people’, which has branches in Canada, the U.S., Australia, and some European countries. The brand offers skincare products developed from plant extracts. This acquisition helped L’Oréal use plant-based squalene in its cosmetic products rather than shark-based.

Regional Insights

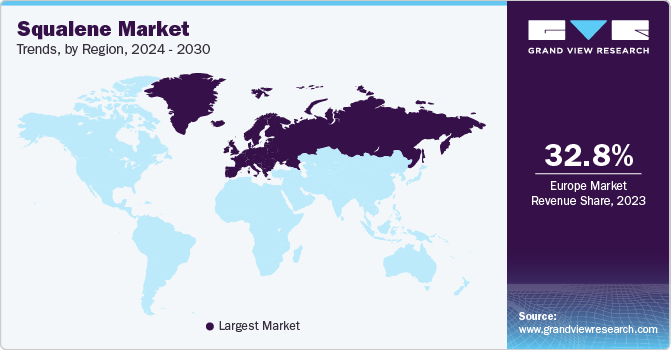

Europe dominated the market in 2022 with a revenue share of over 32.9%, followed by the Asia Pacific region. This is attributed to the large-scale production of olive oil, which is a major plant-based source of squalene, and increased demand for the product from major economies such as Germany, France, the U.K., Italy, and Spain, in the region.

As of 2022, Europe accounted for a significant share of olive oil production. Italy, France, and Spain are a few among the nine producing member countries in the region. Spain accounts for more than half of the total area under olive groves in Europe. Squalene manufacturers in this region are switching to the production of plant-based squalene from shark-based ones.

According to the European Federation of Pharmaceutical Industries and Association (EFPIA), the pharmaceutical industry had one of the largest research and development budgets in France in 2021. It accounted for a 9.8% share of overall pharmaceutical revenues in 2021.

Pharmaceutical manufacturers in France are continuously investing in research and development activities for producing innovative and effective medicines developed from bio-based ingredients to ensure environmental safety. This, in turn, is expected to lead to the increased consumption of plant-based squalene in the pharmaceutical industry in the country over the forecast period.

Germany imported approximately 85 tons of olive oil in 2020 owing to increasing demand for olive oil from health-conscious consumers and surging usage of plant-based squalene in various end-use industries such as personal care products and cosmetics, nutraceuticals, and pharmaceuticals. Companies such as L’Oréal in Germany have switched from the usage of animal-derived to plant-derived squalene in their products.

The growth of the market in the Asia Pacific can be attributed to the easy availability of raw materials, cheap labor, low costs of setting up manufacturing units, and the expansion of the end-use industries such as personal care products and cosmetics, pharmaceuticals, nutraceuticals, and food & beverages in the region that utilize squalene.

Key Companies & Market Share Insights

The market is fragmented and competitive with the presence of several players. Major players are clustered in the European and North American regions, whereas several small players are clustered in the Asia Pacific, mainly in India, China, and Japan, as the region offers easy access to shark liver oil and olive oil, which are essential raw materials for the production of the product. Some prominent players in the global squalene market include:

-

Amyris, Inc.

-

Sophim SAS

-

Henry Lamotte Oils GmbH

-

efpbiotek

-

Vestan Limited

-

Kuraray Co., Ltd.

-

Croda International Plc

-

AASHA BIOCHEM

-

Arbee

-

Oleicfat, s.l.

-

Kishimoto Special Liver Oil Co., Ltd.

Squalene Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 149.4 million

Revenue forecast in 2030

USD 307.88 million

Growth rate

CAGR of 10.9 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; Benelux; China; India; Japan; South Korea; Vietnam; Thailand; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Amyris, Inc.; Sophim SAS; Henry Lamotte Oils GmbH; efpbiotek; Vestan Limited; Kuraray Co., LTD.; Croda International Plc; Aasha Biochem; Arbee; Oleicfat; s.l., Kishimoto Special Liver Oil Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Squalene Market Report Segmentation

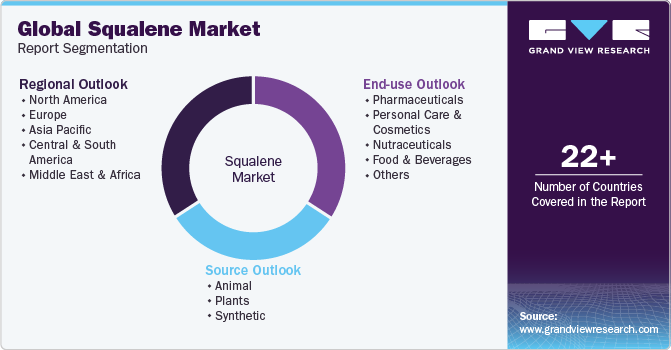

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global squalene market report based on source, end-use, and region:

-

Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Animal

-

Shark Liver Oil

-

Other Animals

-

-

Plants

-

Amaranth Oil

-

Olive Oil

-

Rice Bran Oil Plants

-

Other Amaranth Oil

-

-

Synthetic

-

-

End-Use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Nutraceuticals

-

Food & Beverages

-

Other End-uses

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

Russia

-

Benelux

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Thailand

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global squalene market size was estimated at USD 134.76 million in 2022 and is expected to reach USD 149.4 million in 2030.

b. The global squalene market is expected to grow at a compounded annual growth rate (CAGR) of 10.9% from 2023 to 2030 to reach USD 307.88 million by 2030.

b. Plant segment dominated the market which accounted for a market share of 82.34% in 2022. This is attributed to the declining population of sharks, increasing awareness among people towards animal welfare and protection, and regulatory frameworks imposed by the government for the protection of marine animals.

b. Some prominent players in the global squalene market include Amyris, Inc., Sophim SAS, Henry Lamotte Oils GmbH, efpbiotek, Vestan Limited.

b. Increasing consumption of natural ingredients in personal care & cosmetics is expected to emerge as the major factor driving the demand.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Weaker consumer demand for lifestyle and wellbeing products due to social restrictions and lockdown policies shall have a negative impact on the demand patterns of cosmetic ingredients and certain categories of food additives. However, easing restrictions and public discourse about restarting economic activities in the consumer goods marketspace indicates that, the recovery of demand is imminent. The report will account for COVID-19 as a key market contributor.