- Home

- »

- Specialty Polymers

- »

-

Specialty Chemicals Market Size, Share & Trends Report, 2030GVR Report cover

![Specialty Chemicals Market Size, Share & Trends Report]()

Specialty Chemicals Market Size, Share & Trends Analysis Report By Product (Institutional & Industrial Cleaners, Flavor & Fragrances, Food & Feed Additives), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-868-8

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Specialty & Chemicals

Report Overview

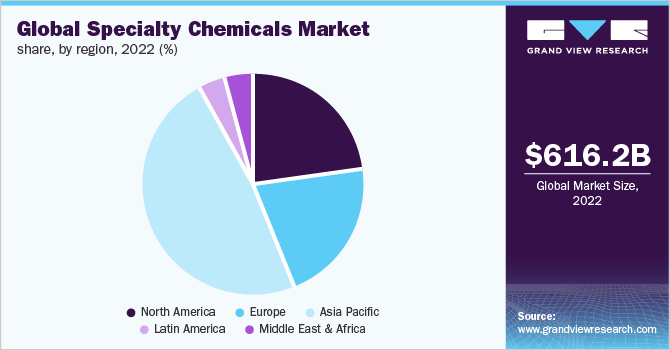

The global specialty chemicals market size was valued at USD 616.2 billion in 2022 and is anticipated to witness a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This is attributed to the growing demand for construction, water treatment, and electronics chemicals, along with advancements in process technology and trade liberalization. The growth of specialty chemicals is also attributed to the growing demand for pharmaceuticals, food and feed additives, and flavors and fragrances, among others. The demand for flavoring agents has increased as processed food and beverages have become more prevalent in developed nations. Further, rising customer preference for novel flavors and fragrances in food products is estimated to contribute to market growth.

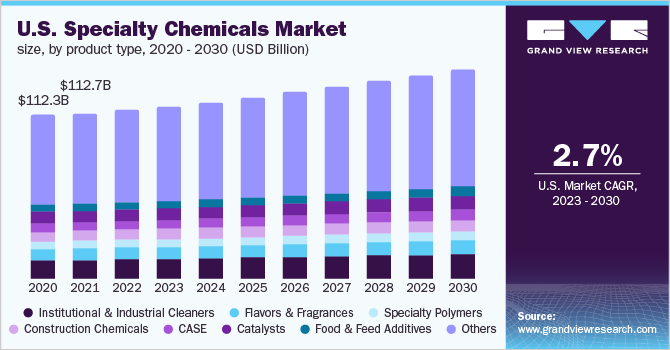

In the U.S., the market for specialty chemicals is anticipated to witness notable growth over the forecast period. High product opportunities are suspected from various end-use industries, including water treatment, automobiles, and electronics. Growth in these industries is expected to have a positive impact on specialty chemicals demand over the coming years. Furthermore, rising demand for personal care products, detergents, as well as crop protection chemicals and cleaning products, will fuel specialty chemicals demand over the forecast period.

The outbreak of the Covid-19 pandemic has led to disruptions in the overall specialty chemicals value chain worldwide. The temporary shutdown of chemicals production plants globally, coupled with the restricted movement of goods for the first and second quarters of 2020, reflected a downfall in chemical production and demand. The demand from end-use industries highly prejudices the consumption and production of specialty chemicals.

The European geopolitical conflict caused an increase in oil costs, which affected the price of producing chemicals. The market for specialty chemicals is projected to be significantly impacted by rising oil prices. From the manufacturer’s viewpoint, rising energy prices resulted in higher chemical prices and somewhat eroded profits. The import and export of raw materials across regions, particularly in the European region, were impacted by supply interruptions, impacting the specialty chemical market.

Product Insights

The other product segment dominated the market with the highest revenue share of 26.7% in 2022. The other segment includes other specialty chemicals, such as lubricating oil additives and surfactants, to name a few. The segment growth can be primarily attributed to the increasing awareness regarding the benefits of specialty chemicals among consumers. In addition, the growth of end-use industries is expected further to accelerate the market growth over the forecast period.

Specialty surfactants are used with commodity surfactants as surfactants, which are essential ingredients in a wide range of domestic and industrial products. Fast-growing niche applications for specialty surfactants include high-performance, small-volume products such as alkyl polyglycosides, sulfosuccinates, and others, wherein they act as surfactants and commodity surfactants. The growth of automotive, metalworking, and other end-use industries is expected to drive the demand for lubricating oil additives, which, in turn, is expected to augment the segment growth over the forecast period.

The institutional and industrial cleaners segment is expected to grow over the forecast period. These cleaners are the most significant industrial consumer of surfactants. They are the critical components used in general-purpose cleaning, commercial floor, surface, and where ease and efficiency, hygiene, technical performance, and food safety are essential characteristics.

The industrial and institutional cleaning sector is rapidly growing and diversifying owing to the recurring nature of the regulatory requirements, products, and services for cleanliness and hygiene. The primary driver for industrial and institutional cleaning products is the requirement for eco-friendly, effective, and less labor-intensive cleaning products, wherein surfactants act as wetting agents, detergents, foaming agents, dispersants, and emulsifiers.

Regional Insights

Asia Pacific dominated the market with the highest revenue share of 48.5% in 2022. This is attributed to economic progress, industrialization, and growth of major end-use sectors. China and India are the major countries contributing to the growth of the specialty chemicals market in the Asia Pacific. The demand for additives in the region is influenced by food and beverages, personal care and cosmetics, and pharmaceutical applications. China, India, and Japan are the key manufacturing countries in the region, with China as the global manufacturing leader, which also leads to product market growth.

In Middle East & Africa region, the market is estimated to expand at a CAGR of 3.6% by 2030. This growth is attributed to the increasing demand for cosmetic Chemicals in the cosmetic industry in countries including the U.A.E., Kuwait, and Saudi Arabia are estimated to stimulate its industry penetration. A young and dynamic population, along with high purchasing power, is expected to contribute to the market growth over the forecast period.

Additionally, the food and beverage sector in the Middle East region has been ripe with several growth opportunities for international investors. Reliance on food trade, international tastes, changing consumer preferences and lifestyles, strategic geographic position, and gulf food programs have substantially contributed to the development of the food and beverages industry in the region, which is further estimated to trigger the demand for specialty chemicals over the predicted years.

The presence of significant manufacturers such as Cargill, Incorporated, General Mills, and Kraft Foods is expected to surge the demand for specialty chemicals in the Latin America region over the forecast period. Automotive, transportation, chemical processing, and construction are expected to be the other key consumers of specialty polymers, coatings, adhesives, sealants, plastic additives, lubricants, and others. Major manufacturers of synthetic lubricants in Latin America are Exxon Mobil Corporation, Royal Dutch Shell plc, Petrobras, and YPF.

Key Companies & Market Share Insights

The manufacturing companies offer their specialty chemical products via suppliers and distributors directly to end-use industries such as oil and mining, catalysts, consumer chemicals, and others. These chemicals are either manufactured using the batch process in batch chemical plants directly used by end-use industries to produce product as per defined quantities and specifications.

Companies such as Saudi Arabian Oil Co., SABIC, Farabi Petrochemicals Co., Total, and Chevron Corporation are the key end users of specialty chemical products across regions including Asia Pacific, Europe, and North America. These finished products are supplied to major end-use markets such as automotive, construction, electronics and electrical, pulp and paper, water treatment, pharmaceuticals, and consumer products at both regional as well as national levels. Some of the prominent players in the specialty chemicals market include:

-

Solvay

-

Evonik Industries AG

-

Clariant AG

-

Akzo Nobel N.V.

-

DuPont

-

Kemira Oyj

-

Lanxess

-

Croda International Plc

-

Huntsman International LL

-

The Lubrizol Corporation

-

Albemarle Corporation

Specialty Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 641.5 billion

Revenue forecast in 2030

USD 914.4 billion

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; Brazil; South Africa; Saudi Arabia

Key companies profiled

Solvay; Evonik Industries AG; Clariant AG; Akzo Nobel N.V.; DuPont; Kemira Oyj; Lanxess; Croda International Plc; Huntsman International LL; The Lubrizol Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Chemicals Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global specialty chemicals market report on the basis of application and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Specialty Polymers

-

Institutional & Industrial Cleaners

-

Electronic Chemicals

-

Rubber Processing Chemicals

-

Flavors & Fragrances

-

Construction Chemicals

-

Food & Feed Additives

-

Cosmetic Chemicals

-

Oilfield Chemicals

-

Mining Chemicals

-

Pharmaceutical & Nutraceutical Additives

-

Plastic Additives

-

Printing Inks

-

CASE (Coatings, Adhesives, Sealants & Elastomers)

-

Specialty Pulp & Paper Chemicals

-

Specialty Textile Chemicals

-

Catalysts

-

Water Treatment Chemicals

-

Corrosion Inhibitors

-

Flame Retardants

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global specialty chemicals market size was estimated at USD 616.2 billion in 2022 and is expected to reach USD 641.5 billion in 2023.

b. The global specialty chemicals market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 914.4 billion by 2030.

b. Asia Pacific dominated the specialty chemicals market with a share of 48.5% in 2022. This is attributable to rising demand from China & India from prominent end-use industries including pharmaceuticals & nutraceuticals, personal care & cosmetics, automotive and electrical & electronics.

b. Some key players operating in the specialty chemicals market include Solvay AG, Evonik Industries AG, Clariant AG, Akzo Nobel N.V., BASF SE, Kemira Oyj, LANXESS AG, Croda International Plc, Huntsman International LLC, The Lubrizol Corporation, Albemarle Corporation.

b. Key factors that are driving the market growth include growing consumer preference for tailored specific products coupled with significant investments in technological advancements and product innovations for the development of custom-made products for target applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Halted manufacturing activities across various end-use industries has led to weakened demand for specialty polymers. The prevailing macroenvironment due to the pandemic shall register indications of recovery depending on the course of COVID-19's prevalence and subsequent resuming of manufacturing activities. The report will account for Covid19 as a key market contributor.