- Home

- »

- Biotechnology

- »

-

Spatial OMICS Market Size, Share & Growth Report, 2030GVR Report cover

![Spatial OMICS Market Size, Share, & Trends Report]()

Spatial OMICS Market Size, Share, & Trends Analysis Report By Technology (Spatial Transcriptomics, Spatial Genomics, Spatial Proteomics), By Product, By Workflow, By Sample Type, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-463-5

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Spatial OMICS Market Size & Trends

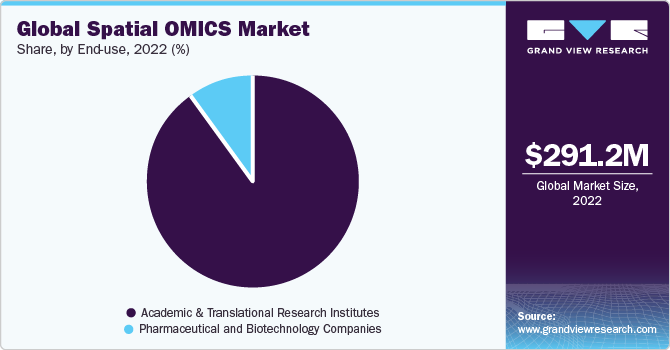

The global spatial OMICS market size was valued at USD 291.2 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. Spatial OMICS refers to a set of technologies that combine high-throughput molecular profiling with spatial information, enabling the analysis of biological samples in their spatial context. The market is driven by several factors, including the rising prevalence of a wide range of genetic illnesses, global advances in sequencing technologies, and increased financing for spatial OMICS research.

The market for spatial OMICS is anticipated to rise due to its increased usage in drug research and development and its potential as a tool for cancer diagnosis. For instance, in June 2023, Owkin Inc contributed USD 50 million and joined forces with NanoString Technologies, Inc. Research teams from European and American institutions and other organizations to use spatial omics technology for cutting-edge cancer research.

There have been notable advancements in technology, such as spatial proteomics, spatial transcriptomics & spatial genomics, which have improved the ability to analyze molecular information in tissues and cells at a spatial level. These technologies provide researchers with a more comprehensive understanding of complex biological systems. For instance, in February 2023, Curio Bioscience announced the introduction of Curio Seeker, the first high-resolution, whole-transcriptome spatial mapping kit, marking the start of the company's commercial activities.

The extensive research for understanding the COVID-19 infection has turned attention to the application of spatial transcriptomic and other omics studies. For instance, in October 2020, a group of researchers from the Massachusetts General Hospital used spatial transcriptomics technology to analyze the autopsy specimens obtained from around 24 COVID-19 patients to understand the SARS-CoV-2 infection. Several companies operating in the market offer various solutions for spatial OMICS studies. For instance, NanoString manufactured GeoMx Digital Spatial Profiler (DSP), which helps quantify around 1,800 RNA targets, including COVID-19 proteases and receptors. In addition, with the system, researchers generated large data sets of tissue images and molecular data obtained from COVID-19 decedents and compared them with the patients who passed away from similar diseases, such as MERS-CoV (2012), SARS-CoV, and other non-viral causes, which facilitated a better understanding of the COVID-19 infection.

Cancer immunotherapy is also one of the major drivers of the market. It is essential to conduct spatial multi-omics studies to understand the tumor immunogenicity of the complex tumor microenvironment. Companies are focusing on developing transformational approaches for cancer biomarker discovery. For instance, in March 2021, Akoya Biosciences, Inc. collaborated with the Bloomberg Center for Physics and Astronomy and Bloomberg-Kimmel Institute for Cancer Immunotherapy (BKI) at the Johns Hopkins University School of Medicine. This involved using Akoya’s Phenoptics multiplex immunofluorescence (mIF) platform by BKI for spatial profiling of tissue sections.

Product Insights

The consumables segment accounted for the largest market share in 2022, owing to the high utilization rate and launch of novel products. For instance, in March 2021, Bruker launched new consumables for the chemical cross-linking of proteins (XL-MS). The new PhoX cross-linker facilitates protein purification from XL-MS reaction complex mixtures. Moreover, the company plans to launch three cleavable cross-linkers for cleaving the cross-linkers generated in MS experiments.

The launch of new instruments is directly associated with the development of the consumables. Therefore, this drives the instruments as well as the consumables segment. In December 2020, NanoString announced the development of a spatial molecular imager (SMI). It is a next-generation spatial OMICS platform for multiplexed protein and RNA analysis for single cells in FFPE tissue samples.

The growth of the software segment is attributed to the extensive use of tools for the analysis of single-cell omics data. For instance, in January 2021, researchers from the U.S. used GLUER (inteGrative anaLysis of mUlti-omics at single-cEll Resolution). This tool integrated the imaging data with single-cell omics data. The new tool has proved efficient in accurately matching cells across a broad range of data modalities.

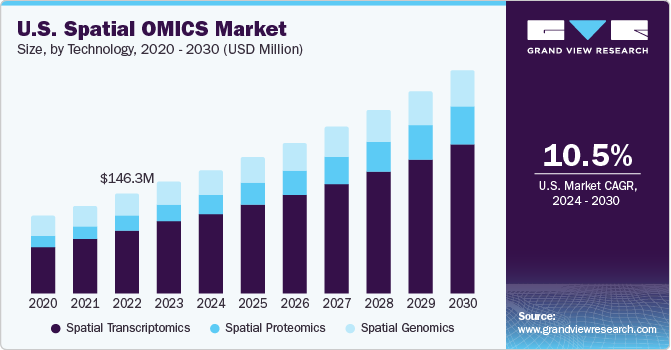

Technology Insights

The spatial transcriptomics segment dominated and held the largest market share in 2022. Continuous advancements in sequencing technologies have accelerated the transcriptomic study of single cells. For the comprehensive study of multicellular organisms, efforts are being taken to design novel solutions for high-throughput genomic analysis while maintaining the spatial information of the sample/tissue under observation or subcellular localization of analyzed DNA/RNA.

The development of various in-situ methods enhances the capabilities to explore spatial information in biological investigation. These methods have led to the convergence of function-oriented biochemistry and molecular genetics fields with structure-focused fields such as histology and embryology, thereby enabling spatially resolved molecular investigation of biological processes. For example, a combination of in-situ hybridization techniques with genetic tools helps explore the formation of gene expression gradients along with embryonic axes at different developmental stages. The gradient formation helps in understanding embryonic development and organ formation. The spatial genomics segment is expected to expand at the fastest CAGR throughout the forecast period. FISH is the most commonly used method for spatial genomics.

End-use Insights

The academic & translational research institutes segment accounted for the largest revenue share of around 90% in 2022. An increase in the adoption of spatial OMICS to translate real-time tissue responses to an external agent increases the technology’s adoption in academic & translational research. Academic & translational studies in the field of genomics help researchers and healthcare practitioners analyze the behavior of human tissues and cells from different individuals in different environments.

This vital information may lead to the evolution of new and better ways to prevent diseases. For instance, single-cell transcriptomics is useful for neuroscientists to understand cell types forming the brain. These methods help understand the spatial architecture of nervous tissues and evaluate the brain’s function. However, this further requires linking molecular cell types to physiological, morphological, and behavioral factors.

Spatially resolved transcriptomics methods are fundamental in filling this gap by localizing molecularly defined tissue or cell types with simultaneous activity, morphology, and connectivity detection. Therefore, most research organizations have launched study programs to leverage spatial transcriptomics applications in the neuroscience field. Some of these programs include the Human Cell Atlas Initiative, European Human Brain Project, and BRAIN Initiative launched by the NIH.

Workflow Insights

The instrumental analysis segment dominated the market and held the largest market share in 2022. The segment growth can be primarily attributed to substantial advancements in instruments such as microscopy and mass spectrometry. Mass spectrometry is one of the most promising tools for quantifying nucleic acid and proteins.

It has several advantages, such as high resolution, high speed, and high-throughput operations for protein profiling, which are later used for analyzing complex biological samples. This facilitates novel applications such as new drug development, biomarker discovery, and diagnostics.

The data analysis segment is expected to witness lucrative growth over the forecast period owing to the increasing integration of advanced computational solutions for generating detailed spatial information for omics studies. In addition, the development and launch of new platforms are contributing to the segment growth. For instance, in April 2021, Vizgen received a grant of USD 37 million to enhance the commercialization of its MERSCOPE platform.

Sample Type Insights

The formalin fixation and paraffin-embedding (FFPE) segment held the largest market share in 2022. FFPE is considered a standard sample type that is most used for the preservation of human tissue for clinical diagnosis, and hence it holds a major share of the global market. This technique is considered the best in researching tissue morphology for clinical histopathology and diagnostic purposes.

FFPE specimens are abundant in clinical tissue banks, contributing to the segment growth. However, they are incompatible with single-cell level transcriptome sequencing owing to RNA degradation and RNA damage during storage and extraction. Hence, researchers are focusing on new approaches for increasing the application of FFPE in spatial transcriptomic studies.

Regional Insights

North America dominated the spatial OMICS market and accounted for the largest share of over 45% in 2022. This can be attributed to the increasing prevalence of cancer, the growing demand for personalized medicine, well-developed healthcare facilities, and the availability of novel diagnostic techniques. The growing morbidity and mortality rates due to cancer and other metabolic, autoimmune, and inflammatory disorders have led to an increase in the need for developing novel therapies, thereby driving the market in this region.

The companies operating in North America are launching new initiatives and programs for discovering and increasing translational applications, further contributing to market growth. For instance, in March 2021, NanoString Technologies, Inc. launched the Technology Access Program (TAP), through which the company will analyze tissue samples of patients using the Spatial Molecular Imager platform and GeoMx Digital Spatial Profiler. Hence, such initiatives help in expanding spatial biology applications in the region.

Asia Pacific is expected to expand at the fastest CAGR of 9.1% over the forecast period. Companies are entering into agreements for expanding their biological research activities, which, in turn, will drive the adoption of omics tools in the region. For instance, in February 2021, ERS Genomics Limited granted access to its CRISPR/Cas9 patent portfolio to G+FLAS Life Sciences, Inc. - a South Korea-based biotechnology start-up. This agreement helped the company in developing genome editing applications with CRISPR/Cas9.

Key Companies & Market Share Insights

Prominent market players have adopted growth strategies to enhance their market presence. Companies are focusing on implementing growth strategies such as increasing product portfolio, technology development, partnership, and expanding marketing and distribution channels to improve their product reach and gain a competitive advantage. For instance, Bruker Corporation made a strategic investment in spatial biology in March 2021. With this investment, the company plans to expand and develop novel spatial analysis technologies to empower researchers to advance discovery and delve deeper into translational and life science research.

Key Spatial OMICS Companies:

- 10x Genomics

- Dovetail Genomics

- S2 Genomics, Inc.

- NanoString Technologies, Inc.

- Seven Bridges Genomics

- PerkinElmer, Inc.

- Bio-Techne

- Danaher Corporation

- IonPath, Inc.

- Millennium Science Pty Ltd.

- Akoya Biosciences, Inc.

- Fluidigm Corporation

- Diagenode Diagnostics

- Biognosys AG

- Rebus Biosystems

- Ultivue, Inc.

- Vizgen Corp.

- Bruker

- Brooks Automation, Inc.

Spatial OMICS Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 320.8 million

Revenue forecast in 2030

USD 558.0 million

Growth rate

CAGR of 8.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, workflow, sample type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

10x Genomics; Dovetail Genomics; S2 Genomics, Inc.; NanoString Technologies, Inc.; Seven Bridges Genomics; PerkinElmer, Inc.; Bio-Techne; Danaher Corporation; IonPath, Inc.; Millennium Science Pty Ltd.; Akoya Biosciences, Inc.; Fluidigm Corporation; Diagenode Diagnostics; Biognosys AG; Rebus Biosystems; Ultivue, Inc.; Vizgen Corp.; BioSpyder Technologies; Bruker; Brooks Automation, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spatial OMICS Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spatial OMICS marketmarket based on technology, product, workflow, sample type, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Spatial Transcriptomics

-

Spatial Genomics

-

Spatial Proteomics

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

By Mode

-

Automated

-

Semi-automated

-

Manual

-

-

By Type

-

Sequencing Platforms

-

IHC

-

Microscopy

-

Flow Cytometry

-

Mass Spectrometry

-

Others

-

-

-

Consumables

-

Software

-

Bioinformatics tools

-

Imaging tools

-

Storage and management databases

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Preparation

-

Instrumental Analysis

-

Data Analysis

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

FFPE

-

Fresh Frozen

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Translational Research Institutes

-

Pharmaceutical and Biotechnology Companies

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The spatial transcriptomics segment dominated the spatial OMICS market with a share of 65.05% in 2022. Continuous advancements in sequencing technologies have accelerated the transcriptomic study of single cells.

b. The global spatial OMICS market size was estimated at USD 291.20 million in 2022 and is expected to reach USD 320.78 million in 2023.

b. The global spatial OMICS market is expected to grow at a compound annual growth rate of 8.23% from 2023 to 2030 to reach USD 558.01 million by 2030.

b. Some key players operating in the spatial OMICS market include 10x Genomics; Dovetail Genomics; S2 Genomics, Inc; NanoString Technologies, Inc; Seven Bridges Genomics; PerkinElmer, Inc; Bio-Techne; Danaher Corporation; IonPath, Inc; Millennium Science Pty Ltd; Akoya Biosciences, Inc; Fluidigm Corporation; Diagenode Diagnostics; Biognosys AG; Rebus Biosystems; Ultivue, Inc; Vizgen Corp; BioSpyder Technologies; Bruker; and Brooks Automation, Inc.

b. Key factors that are driving the spatial OMICS market growth include the emerging potential of spatial omic analysis as a cancer diagnostic tool, the advent of the fourth generation of sequencing (in situ sequencing), and a rise in competitiveness amongst emerging players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."