- Home

- »

- Sensors & Controls

- »

-

Soil Moisture Sensor Market Size, Industry Report, 2019-2025GVR Report cover

![Soil Moisture Sensor Market Size, Share & Trends Report]()

Soil Moisture Sensor Market Size, Share & Trends Analysis Report By Sensors, By Connectivity (Wired, Wireless), By Application (Agriculture, Residential, Forestry, Research Studies), By Region, And Segment Forecasts, 2020 - 2025

- Report ID: GVR-4-68038-056-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Semiconductors & Electronics

Report Overview

The global soil moisture sensor market size was valued at USD 173.6 million in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 14.0% from 2019 to 2025. Increasing the adoption of these sensors by the agricultural sector to enhance the farm’s productivity and reduce water consumption is expected to drive market growth over the forecast period. Moreover, this product also helps in avoiding the irrigation issues through constant monitoring, which in turn is spurring the growth of the market. The introduction of new technologies that aid residential owners to monitor soil moisture condition of potted plants, vegetable gardens, and lawns are also expected to drive the market.

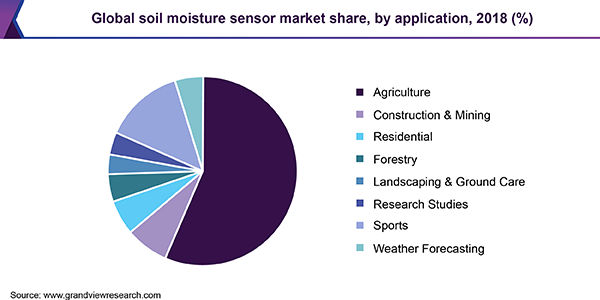

The demand for low-cost sensors such as tensiometers and granular matrix, especially in the residential sector for maintaining lawns is driving the growth of the market. These products play a crucial role in maintaining the lush green lawn, which, in turn, is driving their adoption in the residential segment. The devices accounted for more than 45% of the revenue share in the year 2018. The use of soil moisture sensors by the weather forecasters to offer accurate weather readings and forecasts is another prominent factor driving the market. The segment is estimated to register a considerable growth during the forecast period.

The increasing demand for soil moisture sensors in the building and construction sector is also estimated to drive market growth in the coming years. This product is extensively preferred before initiating the construction project for wetland detection. The imminent need for the measurement of water content at the construction sites is driving the market growth. On the flip side, lack of awareness among farmers regarding the benefits offered by the sensors, lack of availability of skilled labor, and preference for traditional farming practices, especially in emerging economies, is hampering the overall growth of the market.

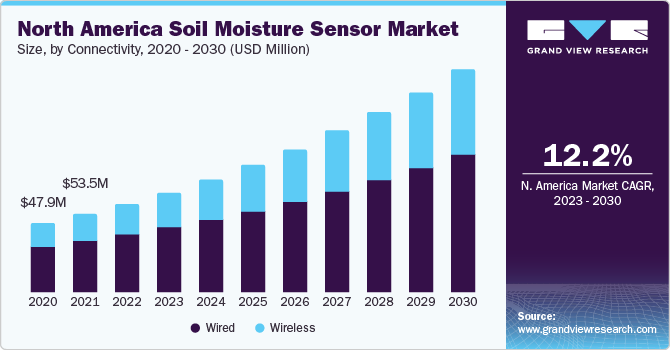

North America held the largest market share in 2018 owing to the relatively greater adoption of mechanized farm practices and a multitude of research and development in the field of wireless sensor technology. Additionally, the farmers in the region have relatively greater awareness regarding the benefits associated with the use of soil moisture sensors. Also, the farmers have been receiving ample support to adopt mechanized farming practices from organizations like the Environmental Protection Agency (EPA), The Nature Conservancy, and the National Research Council.

Soil Moisture Sensor Market Trends

Soil moisture sensors enable farmers to make accurate decisions while planning for various agricultural activities. Low-cost sensors such as gypsum blocks, tensiometers, and probes are widely adopted across applications such as agriculture, residential, research studies, forestry, landscaping, and ground care. The simple, flexible, and inexpensive nature of a tensiometer facilitates direct measurement of soil water tension. It measures soil water tension in wet as well as moist soil. The tension is measured between soil particles and water molecules. The adoption of a tensiometer for the measurement of moisture has increased due to the sensor's easy measurement and accuracy for an exact measurement of tension in soil.

Several technologies are involved in the digitalization of a farm. However, the most important among them are sensors used to measure metrics such as rainfall, water levels, soil moisture, and livestock data on the ground and remotely using a drone. Soil moisture sensors are used to measure the volumetric water content in the soil. They measure the water content using soil properties such as dielectric constant, electrical resistance, and interaction with neutrons as a proxy for the moisture content. These sensors are used in various applications such as construction, mining, sports, weather forecasting, agriculture, and research studies.

The availability of skilled laborers to use soil moisture sensors is low and poses one of the significant barriers across various applications. The use of soil moisture sensors in small and medium-sized farms can be a complicated task owing to the traditional farming practices adopted by farmers. Unskilled laborers in farms and construction sites are likely to face specific issues regarding the physical installation of soil moisture sensors. The improper installation of soil moisture sensors leads to an incorrect reading of the water content in the soil, subsequently incurring losses. The air gaps beside the sensor are expected to contribute to the low dielectric of air for measurement, resulting in underestimating volumetric water content. Moreover, the accuracy and positioning of soil moisture sensors affect the performance of soil moisture-based surface drip irrigation scheduling systems.

Sensors Insights

Soil water potential sensors dominated the market in 2018 and accounted for a market share exceeding 65.0%. The segment is further segregated into gypsum blocks, tensiometers, and granular matrix sensors. They are low cost, easy to use, provide accurate measurement, and require little maintenance. Tensiometers are used to measure tension between soil particles and water molecules and held the largest share of the segment in 2018. Tensiometers can be easily integrated into an irrigation system, need relatively minimal maintenance, and are used when the water requirement for a specific crop is high.

Volumetric soil moisture sensors are expected to exhibit substantial growth over the forecast period since they offer more accurate and instant data to farmers and require limited calibration during the time of installation. Capacitance sensors, probes, and time-domain transmissometer (TDT) sensors are different volumetric sensors available in the market. Capacitive sensors measure the moisture level in the soil through capacitive sensing rather than the resistive sensing. The device avoids is made of corrosion-resistant material, thereby, avoiding corrosion. The Time Domain Transmissometry (TDT) sensors are also estimated to portray a significant CAGR in the forthcoming years. They are durable, consume less power, and efficiently limit the effect of noise to achieve higher accuracy and average measurement across the entire length of the probes. The afore-mentioned benefits offered has increased its adoption among end-users over the last few years.

Connectivity Insights

Wired sensors dominated the soil moisture sensor market in 2018 and accounted for the revenue share of over 65.0%. The problems associated with this product include maintenance cost, labor cost, and inflexibility concerning remote accessibility. They are considered ideal for experiments in courses like horticulture, agricultural science, botany, biology, and environmental science.

The wireless soil moisture sensor segment is projected to exhibit the highest growth rate over the forecast period. They are increasingly used to measure volumetric water content in the soil, remotely. French company Kerlink entered into a partnership with Sensoterra (Netherlands) to allow the farmers to make data-controlled land-management decisions and consequently reduce their water consumption by 30 percent. Using Kerlink’s Low Power Wide Area Network (LoRaWAN)-based IoT platform, Sensoterra is expected to launch new wireless soil moisture sensors across North America, Europe, and the Asia Pacific. The accurate measurement of moisture conditions helps farmers to increase yield, maintain soil health, and enhance water conservation. Therefore, this product is expected to drive the market over the forecast period.

Application Insights

Soil moisture sensors find applications across an array of industries and verticals, including agriculture, construction and mining, residential, forestry, landscaping and ground care, research studies, sports, and weather forecasting. The agriculture segment dominated the market in 2018 and accounted for a market share of over 55.0%. Increasing the use of sensors in agricultural lands has enabled farmers to reduce water consumption and increase overall food production. These benefits are expected to drive the segment in the coming years. Moreover, increasing the focus of governments across various nations towards water conservation to improve the quality of crops is driving the market.

In a bid to ensure and maintain lush outfield, market growth has surged in the sports segment. For example, the sensors are increasingly used for the maintenance of the golf turfs. Factor such as investment made by the governments for the betterment of the sports grounds and need for controlled grass growth on sports outfields is mainly responsible for the segment growth.

Regional Insights

North America dominated the market in 2018. The dominance can be credited mainly to the relatively greater adoption of sensors across the agriculture and sports segments. The U.S. is house to a large number of soil moisture sensor manufacturers such as Campbell Scientific, Inc., and The Toro Company. Stringent environmental regulations and rising adoption of precision farming and yield monitoring practices by large and small farm owners to upsurge the productivity of fields is expected to drive the market.

Asia Pacific region is estimated to register the highest CAGR during the forecast period owing to increasing awareness regarding the usage of soil moisture sensors among farmers. Besides, the availability of huge arable land in countries such as China and India is expected to increase the utilization of soil moisture sensors. Furthermore, the rising concern of soil health in the region is positively impacting the growth of the market. Countries such as Japan, India, Australia, and China are expected to generate considerable revenue owing to the favorable government policies and rising disposable income of farmers.

Moreover, consistent efforts of the European government to promote sustainable economic growth and significant investments in promoting the development of the agriculture industry are contributing to the growth of the regional market. Similarly, the increasing emphasis and inclination towards sport activities have led to the development of sports infrastructure across the country.

Key Companies & Market Share Insights

Major market players are focusing on strengthening their product portfolio in a bid to sustain its leading market position. For instance, in August 2017, The Toro Company announced the launch of wireless sensor technology, namely the ‘Turf Guard Soil Monitoring System’. The newly launched system consists of an advanced wireless mesh network technology that monitors the soil temperature, moisture level, and salinity level.

The Toro Company has also announced the launch of its Toro Precision soil sensor for residential applications. This wireless sensor continuously measures soil moisture. Soil sensing technology is widely used by high-end commercial landscapes and golf courses to reduce water waste. Some of the prominent players in the soil moisture sensor market include:

-

Toro Company (U.S.)

-

Campbell Scientific Inc. (U.S.)

-

Spiio (U.S.)

-

Sentek (Australia)

-

METER Group, Inc. USA (U.S.)

-

Irrometer Company, Inc. (U.S.)

-

Acclima Inc. (U.S.)

-

IMKO Micromodultechnik GmbH (Germany)

-

Spectrum Technologies, Inc. (U.S.)

-

E.S.I. Environmental Sensors Inc. (Canada)

Flow Computers Market Report Scope

Report Attribute

Details

The market size value in 2020

USD 224.64 million

The revenue forecast in 2025

USD 433.33 million

Growth Rate

CAGR of 14.0% from 2020 to 2025

The base year for estimation

2019

Historical data

2014 - 2018

Forecast period

2020 - 2025

Quantitative units

Revenue in USD million and CAGR from 2020 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sensors, connectivity, application, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; Australia; Brazil

Key companies profiled

Toro Company (U.S.); Campbell Scientific Inc. (U.S.); Spiio (U.S.); Sentek (Australia); METER Group, Inc. USA (U.S.); Irrometer Company, Inc. (U.S.); Acclima Inc. (U.S.); IMKO Micromodultechnik GmbH (Germany); Spectrum Technologies, Inc. (U.S.); E.S.I. Environmental Sensors Inc. (Canada)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global soil moisture sensor market report based on sensors, connectivity, application, and region:

-

Sensors Outlook (Revenue, USD Million, 2014 - 2025)

-

Volumetric Soil Moisture Sensors

-

Capacitance

-

Probes

-

Time Domain Transmissometry (TDT)

-

-

Soil Water Potential Sensors

-

Gypsum Blocks

-

Tensiometers

-

Granular Matrix

-

-

-

Connectivity Outlook (Revenue, USD Million, 2014 - 2025)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Agriculture

-

Construction and Mining

-

Residential

-

Forestry

-

Landscaping and Ground Care

-

Research Studies

-

Sports

-

Weather Forecasting

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global soil moisture sensor market size was estimated at USD 197.08 million in 2019 and is expected to reach USD 224.64 million in 2020.

b. The global soil moisture sensor market is expected to grow at a compound annual growth rate of 14.0% from 2019 to 2025 to reach USD 433.33 million by 2025.

b. North America dominated the soil moisture sensor market with a share of 30.6% in 2019. This is attributable to greater adoption of these sensors across the agriculture and sports segments in the region.

b. Some key players operating in the soil moisture sensor market include he Toro Company (U.S.), Campbell Scientific Inc. (U.S.), Spiio (U.S.), Sentek (Australia), METER Group, Inc. USA (U.S.); Irrometer Company, Inc. (U.S.); Acclima Inc. (U.S.); IMKO Micromodultechnik GmbH.

b. Key factors that are driving the market growth include increasing adoption of soil moisture sensors among farmers to enhance the farm’s productivity and reduce water consumption.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Artificial Intelligence (AI), Virtual Reality (VR), and Augmented Reality (AR) solutions are anticipated to substantially contribute while responding to the COVID-19 pandemic and address continuously evolving challenges. The existing situation owing to the outbreak of the epidemic will inspire pharmaceutical vendors and healthcare establishments to improve their R&D investments in AI, acting as a core technology for enabling various initiatives. The insurance industry is expected to confront the pressure associated with cost-efficiency. Usage of AI can help in reducing operating costs, and at the same time, can increase customer satisfaction during the renewal process, claims, and other services. VR/AR can assist in e-learning, for which the demand will surge owing to the closure of many schools and universities. Further, VR/AR can also prove to be a valuable solution in providing remote assistance as it can support in avoiding unnecessary travel. The report will account for Covid19 as a key market contributor.