- Home

- »

- Advanced Interior Materials

- »

-

Smart Label Market Size, Share & Analysis, Industry Report, 2018-2025GVR Report cover

![Smart Label Market Size, Share & Trends Report]()

Smart Label Market Size, Share & Trends Analysis Report By Technology (EAS, RFID), By Component (Transceivers, Memories), By Application, And By End-Use, By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-739-1

- Number of Pages: 170

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Advanced Materials

Industry Insights

The global smart label market size was valued at USD 4.21 billion in 2015 and is expected to witness a growth at a CAGR of over 14% from 2016 to 2025. A smart label acts as a responsive electronic device that is embedded in the object body as an identification slip. They are configured with chip, antenna, and bonding wires which help in real-time tracking of assets and goods

A smart label is designed to implement advanced technology which leads to advantageous features such as automated reading, quick identification, re-programmability, high tolerance, and reduced errors. As a result, it is being preferred over conventional bar code systems in retail, FMCG, and logistics industries. These are mostly made from plastics, paper, and fibers.

U.S. smart label market revenue, by application, 2014 - 2025 (USD Million)

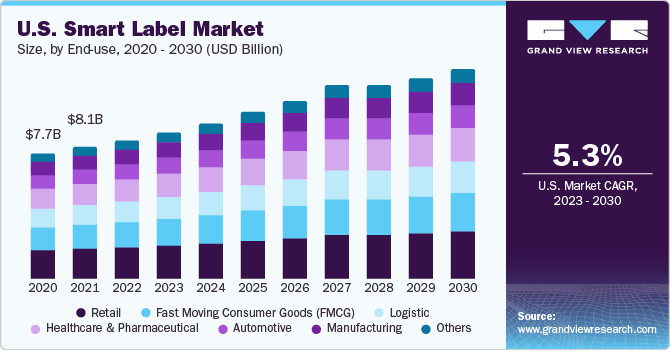

The U.S. was one of the major consumers of the global smart label market in the recent past. Improvement in inventory management, asset tracking, and consumer goods distribution has driven the market in the U.S. Retail inventory accounted to be the largest application segment of the market in the U.S. in 2015, followed by perishable goods.

A smart label is designed to receive, record, and transmit digital information which results in a significant reduction of total tracking time. Thus, rising industrial use of the aids to minimize human intervention and errors, owing to its accuracy and efficiency.

The smart label provides effective solutions for major challenges faced by retailers and manufacturers. This is widely used to prevent theft and shoplifting. Companies are investing to improve their anti-theft system in order to prevent revenue loss and inventory damage caused by shoplifting and theft. This, in turn, is expected to boost the demand over the forecast period.

Counterfeit is another key issue faced in numerous industries which leads to poor product performance, deterioration of brand, and threatened consumer safety. Increasing awareness in industry regarding the harmful effects of counterfeit is anticipated to further boost the demand, especially in the automotive and manufacturing industries.

Recent economic growth, rapid urbanization, and increasing per capita income in developing countries has propelled the demand in the recent past. However, the cost associated with installation of the smart label tracking systems is likely to hinder the market in growing economies. Furthermore, lack of uniformity in the standardization system and low susceptibility is predicted to obstruct the market growth over the forecast period.

Technology insights

RFID was estimated to be the most widely used technical variety in 2015, accounting for over 65% of global demand in 2015. Flexibility to be applied on several substrates, automatic data capture, information accuracy, and real-time tracking are the key benefits associated with RFID labels.

Usage of dynamic display labels is predicted to increase significantly on a dynamic display of product information and pricing would lead to easy price management and accuracy. The segment is projected to experience the fastest growth rate over the forecast period.

Smart Label Market Share Insights

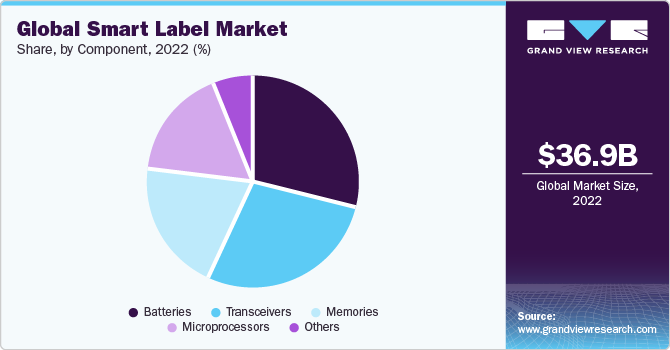

In terms of components, the major segments of the market include batteries, transceivers, memories, and microprocessors. The batteries segment is projected to dominate the market in 2025.

Memories are anticipated to exhibit the fastest growth rate among the component segments. Increasing usage in inventory management and asset tracking is estimated to drive the demand for this market segment over the forecast period.

Application insights

Retail inventory was the largest application segment of the smart label market in 2015, accounting for over 20% share of the global market. Protective measures taken by retailers to prevent shoplifting and theft are estimated to drive substantial demand in retail inventory application over the forecast period.

The perishable goods segment is likely to witness the fastest growth rate among the component over the next few years. Smart label is being widely used in threshold detection and shelf life monitoring of perishable goods such as food, beverages, and medicines.

End-user insights

The retail segment appeared to be the largest consumer of smart label constituting more than 18.0% share of the market in 2015. Logistics and Fast Moving Consumer Goods (FMCG) were the other key segments of the market in the recent past

Global smart label market volume, by end-user, 2015, (million units)

Healthcare & pharmaceuticals application is estimated to be the fastest-growing end-user segment of the market in 2015. Rising use in spoil detection of hospital goods, test samples, medical equipment, drugs is anticipated to bolster the demand in the healthcare & pharmaceutical industry.

Regional insights

Asia Pacific was the largest regional market accounting for over 35% of global demand in 2015. Rising disposable income coupled with rapid urbanization in developing regions has propelled the growth of retail, logistics, and FMCG industries in these regions. This, in turn, has led to growing demand for smart label in end-user industries.

Asia Pacific is anticipated to register the fastest growth, at an estimated CAGR of over 11% in terms of volume from 2016 to 2025 owing to the economic development in countries such as China, Japan, India, South Korea, Singapore, and Malaysia. North America is expected to account for a significant share of the market in 2025, on account of considerable demand in the U.S.

Competitive insights

The key players in the market include Avery Dennison Corporation, CCL Industries, Inc, Zebra Technologies Corporation, Alien Technology Inc, Intermec Inc, Checkpoint Systems, Inc. The companies primarily focus on expansion of product portfolio and production capacity. Major manufacturers are extensively investing in research and innovation to introduce products that can be used in specific applications.

Major manufacturers are focusing to strengthen their presence in emerging economies. The companies emphasize to enter into partnership collaboration and joint-ventures to increase their market shares.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2014 - 2015

Forecast period

2016 - 2025

Market representation

Revenue in USD Million & CAGR from 2016 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America & MEA

Country scope

U.S., Canada, UK, Germany, Japan, China, India, Brazil, Mexico

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Market segments covered in the reportThis report forecasts volume and revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. Grand View Research has segmented the global smart label market by technology, component, application, end-user, and region.

-

Technology Outlook (Volume, Million Units; Revenue, USD Million; 2014 - 2025)

-

Electronic Article Surveillance (EAS) Labels

-

Acousto-Magnetic (AM) EAS

-

Microwave EAS

-

Electro-Magnetic EAS

-

UHF, Gen 2 RFID EAS

-

-

RFID Labels

-

Low Frequency (LF) RFID

-

High Frequency (HF) RFID

-

Ultra-High Frequency (UHF) RFID

-

-

Sensing Labels

-

Position/Tilt Sensing Labels

-

Chemical Sensing Labels

-

Humidity Sensing Labels

-

Temperature Sensing Labels

-

-

Electronic Shelf/Dynamic Display Labels

-

Near Field Communication (NFC) Tags

-

-

Component Outlook (Volume, Million Units; Revenue, USD Million; 2014 - 2025)

-

Transceivers

-

Memories

-

Batteries

-

Microprocessors

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million; 2014 - 2025)

-

Retail Inventory

-

Perishable Goods

-

Electronic & IT Assets

-

Equipment

-

Pallets Tracking

-

Others

-

-

End-user Outlook (Volume, Million Units; Revenue, USD Million; 2014 - 2025)

-

Automotive

-

Fast Moving Consumer Goods (FMCG)

-

Healthcare & pharmaceutical

-

Logistic

-

Retail

-

Manufacturing

-

Others

-

-

Regional Outlook (Volume, Million Units, Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

MEA

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Artificial Intelligence (AI), Virtual Reality (VR), and Augmented Reality (AR) solutions are anticipated to substantially contribute while responding to the COVID-19 pandemic and address continuously evolving challenges. The existing situation owing to the outbreak of the epidemic will inspire pharmaceutical vendors and healthcare establishments to improve their R&D investments in AI, acting as a core technology for enabling various initiatives. The insurance industry is expected to confront the pressure associated with cost-efficiency. Usage of AI can help in reducing operating costs, and at the same time, can increase customer satisfaction during the renewal process, claims, and other services. VR/AR can assist in e-learning, for which the demand will surge owing to the closure of many schools and universities. Further, VR/AR can also prove to be a valuable solution in providing remote assistance as it can support in avoiding unnecessary travel. The report will account for Covid19 as a key market contributor.