- Home

- »

- Electronic & Electrical

- »

-

Smart Home Security Camera Market Size Report, 2030GVR Report cover

![Smart Home Security Camera Market Size, Share & Trends Report]()

Smart Home Security Camera Market Size, Share & Trends Analysis Report By Technology (Wired, Wireless), By Application (Doorbell Camera, Indoor Camera, Outdoor Camera), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-529-8

- Number of Pages: 171

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Smart Home Security Camera Market Trends

The global smart home security camera market size was estimated at a value of USD 7.37 billion in 2022 and is expected to grow at a CAGR of 19.2% from 2023 to 2030. Rise in the number of younger consumers buying homes and this set of homeowners is no longer content with traditional devices. This scenario has driven the penetration of new technologically advanced smart devices such as smart plugs, smart locks, smart light bulbs, and smart home security cameras, among others.

Technological advancements have been significantly driving the smart home security camera market. Smart cameras that notify users of any movements when no one is at home are gaining traction. An increasing number of younger consumers are buying homes and this set of homeowners is no longer content with traditional devices. This scenario has driven the penetration of new technologically-advanced smart devices such as smart plugs, smart locks, smart light bulbs, and smart home security, among others. The rising construction of smart homes-a combination of luxury and convenience-is also boosting the demand for smart home security cameras.

The rapid adoption of IoT in smart homes is also supporting market growth. Consumers are shifting from traditionally mountable Wi-Fi cameras to the deployment of smart home security cameras to increase the security of their premises. These advanced smart home security cameras offer several benefits, which boost their installation in many households across the region. The ease of installation and easy availability of smart home security cameras drive the product demand.

From smart lighting to smart thermostats, tech companies are making more intelligent products than ever before. The launch of new products with improved capabilities is favoring the market growth. Manufacturers have been focusing on developing new products for specific applications as there are varying demands based on the utilization and application of the devices.

Key players are taking the necessary steps to improve the accuracy and overall functionality of the devices. Although tech giants like Amazon, Google, and Apple are at the forefront, it is in the startup space where many of these new ideas and inventions are uncovered. For instance, in March 2020, Vivint Smart Home launched the Vivint Doorbell Camera Pro, an AI-powered doorbell camera that intelligently detects packages and actively helps protect them from porch pirates and other potential threats. The doorbell camera provides homeowners with peace of mind by helping to prevent crime before it happens.

Smart home tech startups are on the rise all over the world. However, like many other sectors, the majority of smart home tech companies are located in the U.S., which is home to 393 of such companies. Other leading countries include China, with 118, and the U.K. with 66. Germany and India also find themselves in the top-5 list, with 42 and 40 startups, respectively, as of 2021..

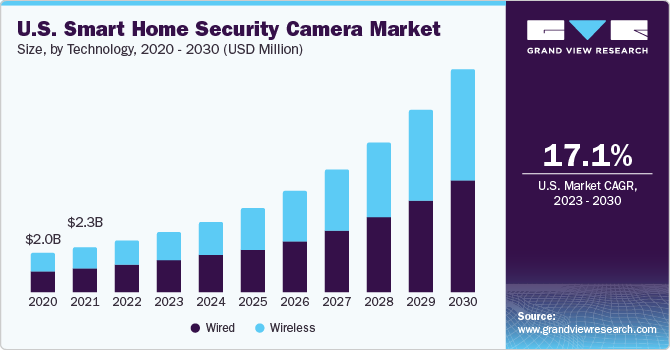

Technology Insights

In terms of value, the wired segment dominated the market with a share of over 50% in 2022. Package theft is at an all-time high according to the experts at Rensselaer Polytechnic Institute, with approximately 1.7 million shipments stolen or lost every day in the U.S. Furthermore, according to UNC Charlotte research (2013) on the habits and motivations of criminals, 83% admit that they specifically look for an alarm system, and 60% would change their minds if one was installed. In addition, as per Alarms.org, residences without a security system are 300 times more likely to be burgled. As a result, an increasing number of residents have been installing smart security cameras to discourage criminals and secure their homes.

The wireless segment is expected to register the highest CAGR of 19.8% from 2023 to 2030. Wireless technology-enabled security systems are one of the most significant advancements in home security solutions and IoT, with many homeowners preferring them for effective protection. For those that already use smart home products like Amazon Alexa, Google Assistant, and the like, smart cameras are a welcome addition to a broader smart home system.

Companies are constantly adding new features to wired cameras, such as improved night vision, two-way audio with echo cancellation, and customizable motion zones. Ring, a security camera producing company, for example, released the Ring Floodlight Cam Wired Pro in April 2021, which includes features such as 3D Motion Detection and Bird's Eye View, a 110db siren and color night vision, Audio+ that improves consumer hearing, Customizable Motion Zones that trigger recordings, and Privacy Zones that exclude areas in the camera field of view from video recording. Ring Floodlight Cam Wired Pro users can easily hardwire the device to the outside of their homes and link it to Wi-Fi for continuous power.

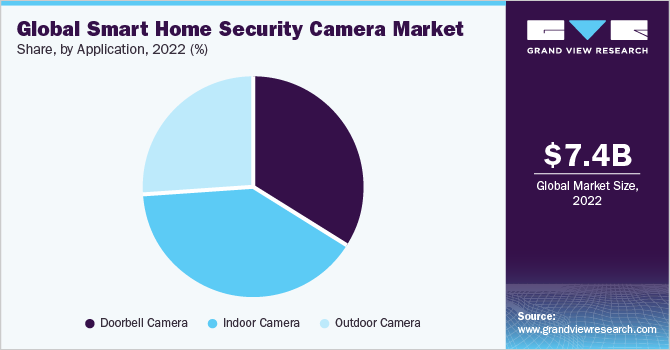

Application Insights

Indoor Camera segment held the largest share of over 38% in 2022. This is mostly due to an increase in the number of theft and burglary cases, which has raised public awareness about the importance of protecting one's house from criminal activity. Indoor smart cameras offer a variety of capabilities, including instant messaging in the event of a theft, alarm activation, and movement and behavior recognition, which has led to their widespread use in a variety of applications.

Doorbell Camera segment is expected to register the highest CAGR of 19.8% from 2023 to 2030. According to Security.org's survey on “porch pirates” in 2019, 40% of Americans have had items stolen; however, with a doorbell camera, consumers are notified as soon as the packages are delivered and they can even instruct the deliverymen where to place them. Consumers are warned immediately if anyone passes by or attempts to steal the package and can call out to them through the doorbell camera speakers. As 52% of Americans are concerned that a package may be stolen during the holidays, 23% of those polled in 2020 by C+R Research indicated they would install a doorbell or surveillance camera to avoid theft.

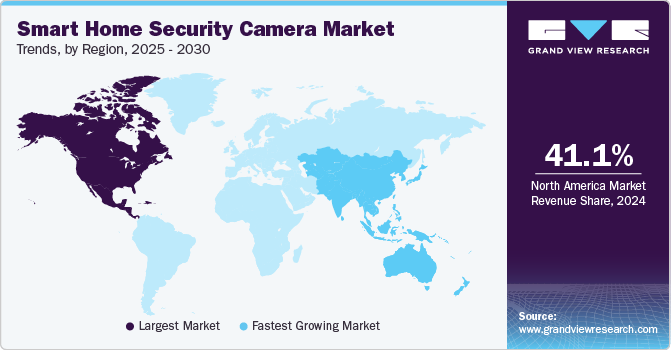

Regional Insights

In 2022, North America was the largest region and accounted for the maximum share of more than 40.0% of the overall revenue. According to Berg Insight’s research published in March 2021, the North American smart home market recorded strong growth during 2019, increasing by 28.5% (YoY) to reach 172.6 million smart home systems in 43.1 million smart homes. This corresponds to 30.2% of all households, placing North America as the most advanced smart home market in the world. In terms of units sold, the most popular point solutions to date are smart thermostats, smart light bulbs, smart plugs, connected security cameras, and voice-controlled smart speakers.

Europe is expected to register a significant CAGR of 18.8% during the forecast period. Emerging technologies and applications such as multi-dimensional perception, UHD, low light imaging, artificial intelligence, and cloud technology open new possibilities for the home security camera industry in the region. Major countries such as Germany, and the U.K. contribute significantly to the growth of the market owing to the increasing crime rates coupled with the rising penetration of smart devices in the countries.

Germany has been reporting crime at an alarming rate, with an increase of almost 10% compared to the previous year, on a year-on-year basis. According to a consumer survey by reichelt elektronik magazine, almost 53% of the participants said they relied on an emergency call to security services in case of a crime. Moreover, the number of CCTV cameras in the U.K. may be as many as 5.2 million, with 1 camera for every 13 people, as the popularity of public surveillance, home CCTV, and doorbell security cameras increases in the country.

Key Companies & Market Share Insights

Key companies undertake various strategies to gain a competitive advantage over others. For instance,

-

In September 2021, SimpliSafe established a relationship with USAA Alliance Services Company, through which, SimpliSafe will offer USAA members savings on SimpliSafe's DIY smart home security and professional monitoring. Two discounts are available on SimpliSafe's custom-designed DIY solution offering. After this strategic move, USAA members are eligible for 15% off on any new SimpliSafe system, plus a complimentary SimpliCam HD camera and a complimentary month of SimpliSafe's most comprehensive professional security monitoring.

-

In August 2021, Arlo Technologies, Inc. entered into a strategic partnership with Calix to expand the availability of its products and services. The effortless integration of Arlo's collection of products and services in the Calix portfolio enables its Broadband Service Provider customers to transform their businesses, differentiate their brand, and own the subscriber relationship cost-effectively and easily.

-

In July 2021, Vivint Smart Home, Inc. entered into a strategic partnership with Freedom Forever. The relationship between the two companies will help homeowners get one step closer to living in a smart home that generates as much energy as it uses.

The key companies operating in the global smart home security camera market include:

-

Vivinit Smart Home, Inc.

-

ADT Inc.

-

SimpliSafe Inc.

-

Brinks Home Security

-

iSmart Alarm, Inc.

-

Skylinkhome

-

Protect America, Inc.

-

Samsung Electronics Co, Ltd.

-

Frontpoint Security Solution, LLC

-

Arlo Technologies, Inc.

-

Nest Labs

-

Wyze Lab, Inc.

-

blink

-

eufy

-

Ring LLC

Smart Home Security Camera Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.54 billion

Revenue forecast in 2030

USD 30.10 billion

Growth Rate (Revenue)

CAGR of 19.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K; China; India; Brazil

Key companies profiled

Vivinit Smart Home, Inc.; ADT Inc.; SimpliSafe inc.; Brinks Home Security; iSmart Alarm, Inc.; Skylinkhome; Protect America, Inc.; Samsung Electronics Co, Ltd.; Frontpoint Security Solution, LLC; Arlo Technologies, Inc.; Nest Labs; Wyze Lab, Inc.; blink; eufy; Ring LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

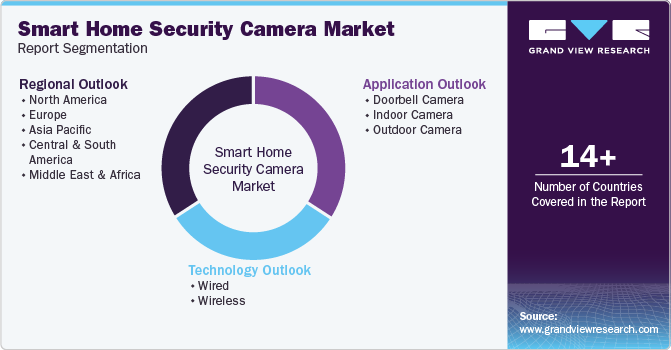

Global Smart Home Security Camera Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the smart home security camera market report on the basis of technology, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Doorbell Camera

-

Indoor Camera

-

Outdoor Camera

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include growing penetration of smart homes particularly in developing as well as developed states and rising prominence for security devices through the home automation process in order to access security 24/7.

b. The global smart home security camera market size was estimated at USD 7.37 billion in 2022 and is expected to reach USD 8.54 billion in 2023.

b. The global smart home security camera market is expected to grow at a compound annual growth rate of 19.2% from 2023 to 2030 to reach USD 30.10 billion by 2030.

b. North America region dominated the global smart home security camera market with a share of 40.6% in 2022. This is attributable to the increasing trend towards small sized households in American countries such as the U.S., Canada, and Mexico that have urged consumers to invest in household security devices in the absence of residents.

b. Some key players operating in the global smart home security camera market include Vivint, Inc., ADT, SimpliSafe, Inc., Frontpoint Security Solutions, LLC, Brinks Home Security, iSmart Alarm, Inc., LiveWatch Security LLC, Skylinkhome, Protect America, Inc. and SAMSUNG.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."