- Home

- »

- Biotechnology

- »

-

Skin Care Supplements Market Size & Share Report, 2030GVR Report cover

![Skin Care Supplements Market Size, Share & Trends Report]()

Skin Care Supplements Market Size, Share & Trends Analysis Report By Product Type (Oral, Topical), By Content Type, By Formulation, By Application, By Gender, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-124-5

- Number of Pages: 135

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global skin care supplements market size was valued at USD 3.31 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. Growing attention to physical appearance worldwide has significantly helped the market thrive. Moreover, the increasing accessibility of skincare supplements and the rising adoption of these products across the world are anticipated to boost their demand in the coming years.

The COVID-19 pandemic positively impacted the skincare supplements market as people were at home and had more free time to take care of themselves. Salons and spas were closed due to social distancing measures and COVID-19-related restrictions, which led people to focus on home skin care practices. E-commerce platforms provided supplements to customers during the COVID-19 pandemic. Moreover, companies focused on digital platforms to provide skincare supplements. For instance, in June 2021, Unilever acquired Paula’s Choice, a direct-to-consumer e-commerce and digital-led skincare brand. Such initiatives by industry players increase the accessibility of skincare supplements, enhancing the demand for skincare products.

Moreover, the increasing geriatric population, coupled with the rising age-related skin issues such as wrinkles, loose facial skin, skin sagging, and skin aging, is anticipated to boost the demand for skin-related products. According to the WHO, around 16.66% of people will be over 60 years of age by 2030. In addition, around 80% of the senior population is estimated to live in middle and low-income nations by 2050. These statistics highlight the increasing skin aging issues and the growing senior population, which is anticipated to propel the demand for skin care supplements.

Furthermore, growing awareness about maintaining healthy skin and the rising knowledge about skin supplementation products is expected to have a positive impact on the market demand. Various players are undertaking initiatives to enhance customer knowledge and awareness about numerous products involved in skin treatments. For instance, in June 2022, Johnson & Johnson Services, Inc. (Neutrogena) launched the "Uncomplicate Skincare" campaign to enhance support for women in selecting complex beauty products.

In addition, in November 2022, Vitabiotics Ltd. appointed Frankie Bridge, a singer and TV presenter, as the new UK brand ambassador for its Perfectil brand. The Perfectil brand provides products for skincare and haircare, among others. Such strategies are expected to enhance brand awareness and increase brand promotion in the future.

Skin supplementation availability has been made easier through online and retail channels. The ease of accessibility has been a substantial factor propelling market growth. E-commerce companies and platforms are also expanding the market's demand due to the enhanced visibility of products and broader reach across all age groups. E-commerce platforms have attained significant traction in developing countries such as China, India, and Mexico.

Furthermore, multiple market players are introducing their products on e-commerce platforms to support their business. For instance, in February 2021, Vitabiotics Ltd., a skincare supplement company, collaborated with e-commerce company Lazada Group and Alibaba Group to increase its presence across China. Through this partnership, the company launched some brands such as Wellman, Cardioace, and Wellwoman in Southeast Asia. The adoption of e-commerce platforms has extended due to the pandemic and has further boosted market growth.

Product Type Insights

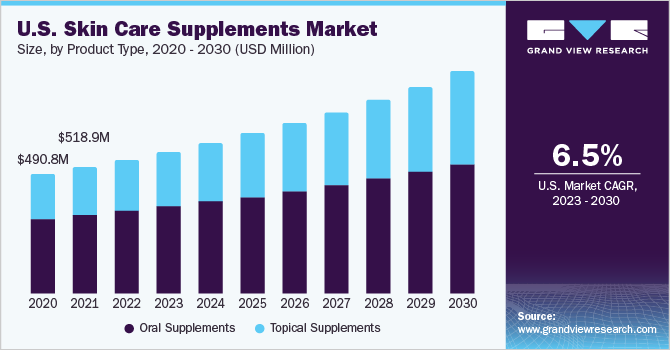

Oral supplementation products dominated the market with a revenue share of over 63.0% in 2022. The dominance of the segment is due to the availability of various oral supplements for skin care. Moreover, these supplements can be easily consumed by making drinks with milk or coffee. In addition, the availability of these supplements in various flavors helps enhance the drink's taste. These factors contribute to the dominance of oral supplementation products.

The topical supplementation products segment is anticipated to witness the fastest CAGR from 2023 to 2030. This can be attributed to the wide usage of serums, moisturizers, and skin treatments to treat various skin problems such as wrinkles, fine lines, dull skin, hyperpigmentation, and dark spots. In addition, the number of participants launching topical supplements is expected to support segment growth. For instance, in December 2021, Entice Supplement launched the Entice glow moisture cream and the Entice hyaluronic serum. Such launches in topical forms are likely to fuel segment growth over the forecast period.

Content Type Insights

Chemical supplementation products dominated the segment with a revenue share of over 76.0% in 2022. The widespread use of skin care products containing chemicals such as Alpha-hydroxy acids (AHA), Glycolic acid, Lactic acid, salicylic acid, and Retinol, among others, can be attributed to the segment's dominance. Moreover, companies are introducing various products using these chemicals to provide a smooth appearance for the skin. For instance, in June 2023, Formation Skincare introduced a Niacinamide serum to enhance skin radiance and texture.

Based on content type, the market is segmented into organic and chemical. The organic segment, which includes products made from plant-based or organic ingredients, is anticipated to expand at the fastest CAGR of 9.5% from 2023 to 2030. The growth of organic supplements can be attributed to the increasing awareness about the benefits of organic products and the adverse effects of chemical-based products.

Moreover, the industry is witnessing increased investments in organic products and companies. For instance, in August 2021, Butterfly, an equity firm, invested in MaryRuth Organics, a brand providing health and skincare supplements. Thus, the increasing focus on organic products is anticipated to support segment growth over the forecast period.

Formulation Insights

The tablets segment dominated the market in 2022 with a revenue share of 52.2%. Tablet formulations have been widely used in comparison to soft gels, oils, and liquids. Moreover, the rising popularity of effervescent tablets has encouraged segment growth. The benefits of these tablets, including even distribution and easy dissolving ability in liquids, support segment dominance.

The liquid segment is projected to exhibit the fastest growth rate of 9.0% over the forecast period. Several factors, including higher optimization rates, faster absorption, and easier digestibility than tablets and capsules, can be attributed to the segment’s growth. In addition, liquid assimilates into the body much faster, and the body does not need to break down a liquid extract. Due to these benefits, the segment is projected to showcase lucrative growth over the forecast period.

Application Insights

The skin aging segment dominated the market with a revenue share of 29.8% in 2022. The increasing geriatric population using various products to treat skin aging issues is the major reason for segment dominance. Based on the application, the market is segmented into skin aging, skin hydration, acne & blemishes, skin brightening, and others.

The skin hydration segment is anticipated to register the fastest CAGR of 9.6% over the forecast period. The availability of multiple products for skin hydration and growing product launches in this segment is expected to support segment growth. For instance, Ritual introduced HyaCera, a dermis hydration product, in May 2023. The product is aimed at reducing fine lines and hydrating the skin. The product is gluten-free, non-GMO, and vegan to target all groups.

Distribution Channel Insights

The offline segment generated a revenue of USD 2.32 billion in 2022, contributing over 70.0% to the market share. A vast number of retail outlets are marketing and selling skin care supplements. Companies have been significantly investing in opening offline stores to reach a wider customer base.

On the contrary, the online segment is projected to register the fastest CAGR of 8.7% from 2023 to 2030. Demand through the online distribution channel has skyrocketed during the COVID-19 pandemic. To increase the reach of their products, companies are collaborating with e-commerce platforms or focusing on digital distribution channels.

Gender Insights

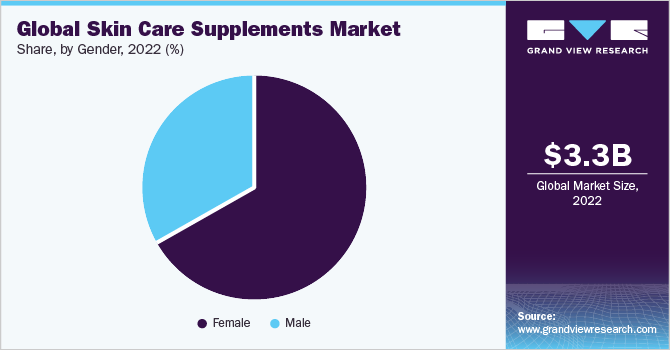

The female end-user segment dominated the market in 2022 with 66.8% of the revenue share. The number of product launches catering to the needs of female complexion is the major reason for segment dominance. For instance, in June 2022, Hims & Hers Health, Inc., a wellness platform, introduced six supplements designed for women. The newly launched supplements include products for skin health. Such initiatives are helping the segment grow. Based on gender, the market is segmented into males and females.

The male segment is anticipated to register the fastest CAGR of 9.1% over the forecast period. The growing focus of the male population on wellness and grooming is anticipated to drive segment growth. In addition, industry participants are targeting male consumers and offering products catering to their complexion needs. For instance, Vitabiotics Ltd., a key player operating in the market, offers Wellman Skin to boost collagen formation in men and provide a youthful appearance.

Regional Insights

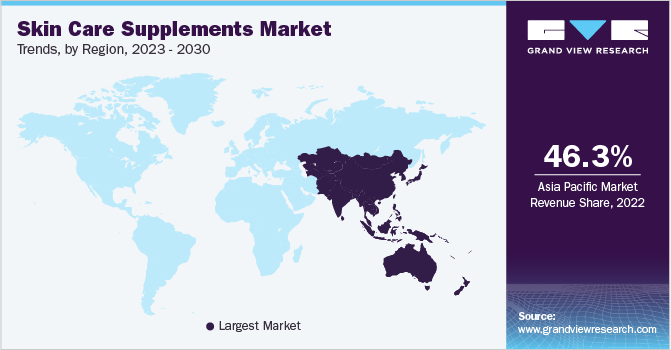

Asia Pacific dominated the market for skin care supplements with a revenue share of 46.34% in 2022. The region is also anticipated to showcase the fastest CAGR of 8.7% during the forecast period. Factors such as the increasing focus of market players on growing their footprint across developing nations such as India and China is anticipated to support regional growth over the forecast period.

For instance, in January 2020, Pure Nutrition introduced three skin care products made from natural components in India's beauty market. In another development, Shiseido announced the availability of INRYU, an ingestible beauty supplement brand, on China's e-commerce platforms in March 2022. Moreover, the growing older population in the region and increasing skin-related issues are also expected to boost the regional demand for skin supplements.

Key Companies & Market Share Insights

Major participants in the global skin care supplements business are implementing various strategic initiatives to retain their market presence and strengthen their industry position. For instance, in January 2023, Johnson & Johnson brand Neutrogena partnered with Nourished, a personalized supplements specialist, to launch 3D-printed personalized beauty gummies. These products are tailored to fulfill the conditions of each individual's complexion. Such launches help to provide more options to customers.

Moreover, in March 2023, Amway received the Friend of the Sea’s certification for its Nutrilite Omega 3 supplements. Friend of the Sea recognized the use of traceable and sustainably sourced fish oil in these Amway products. Such certifications and recognitions are expected to enhance the company’s brand reputation for wellness products. Some of the key players in the global skin care supplements market include:

-

Amway

-

HUM Nutrition, Inc.

-

Nestle

-

Meiji Holdings Co., Ltd.

-

Plix The Plant Fix

-

Unilever (Murad LLC)

-

Johnson & Johnson Services, Inc. (Neutrogena)

-

Perricone MD

-

TCH, Inc. (Researveage )

-

Vitabiotics Ltd.

Skin Care Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.55 billion

Revenue forecast in 2030

USD 6.05 billion

Growth rate

CAGR of 7.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, content type, formulation, application, gender, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Amway; HUM Nutrition Inc.; Nestle; Meiji Holdings Co., Ltd.; Plix The Plant Fix; Unilever (Murad LLC); Johnson & Johnson Services, Inc. (Neutrogena); Perricone MD; TCH, Inc. (Researveage); Vitabiotics Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Skin Care Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global skin care supplements market report on the basis of product type, content type, formulation, application, gender, distribution channel, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral Supplements

-

Topical Supplements

-

-

Content Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Chemical

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets & Capsules

-

Powder

-

Liquid

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Aging

-

Skin Hydration

-

Acne & Blemishes

-

Skin Brightening

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Female

-

Male

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

E-commerce

-

Company Website

-

-

Offline

-

Pharmacies

-

Supermarkets

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global skin care supplements market size was estimated at USD 3.31 billion in 2022 and is expected to reach USD 3.55 billion in 2023.

b. The global skin care supplements market is expected to grow at a compound annual growth rate of 7.9% from 2023 to 2030 to reach USD 6.05 billion by 2030.

b. Asia Pacific dominated the skin care supplements market with a share of 46.3% in 2022. This is attributable to increasing awareness regarding skin care routines among teenagers and adults

b. Some key players operating in the skin care supplements market include Amway, Hum Nutrition, Inc., Nestle, Meiji Holdings Co., Ltd., Plix The Plant Fix, Unilever (Murad LLC), Johnson & Johnson Services, Inc (Neutrogena), Perricone MD, TCH, Inc (Researveage)

b. Key factors that are driving the market growth include increasing awareness regarding skin care products, rising social media marketing done by manufacturers

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."