- Home

- »

- Homecare & Decor

- »

-

Safari Tourism Market Size, Share & Growth Report, 2030GVR Report cover

![Safari Tourism Market Size, Share & Trends Report]()

Safari Tourism Market Size, Share & Trends Analysis Report By Type (Adventure Safari, Private Safari), By Group (Friends, Families, Couples, Solos), By Booking Mode, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-954-4

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Safari Tourism Market Size & Trends

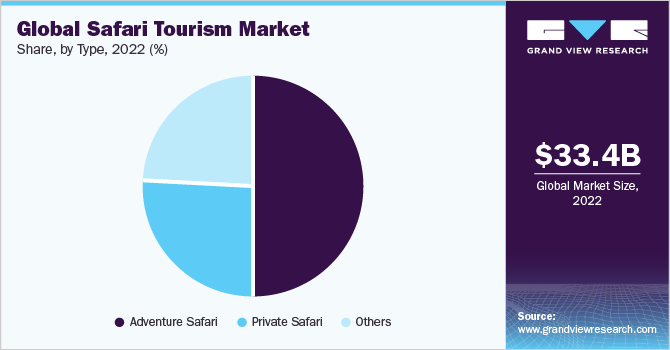

The global safari tourism market size was valued at USD 33.37 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The increasing interest of bloggers and influencers in safari travel is the key factor fueling the growth of safari tourism. There are many travel bloggers and influencers on social networking sites, with a large follower base. These people post their travel content on social media platforms. The increasing preference of people for unique as well as exotic holiday experiences, growth in middle and upper-middle-class expenditure, and the growing impact of social media on the travel industry are the major factors that drive the growth over the forecast period.

The COVID-19 outbreaks had a large negative impact on industry growth. As of June 2021, almost 60% of safari tour operators lost 75% or more bookings. About 18% of businesses recorded 50% of cancellations. The safari tourism industry's post-COVID recovery was fueled by economic rebound, increased interest in sustainable travel, the allure of wildlife destinations, enhanced health and hygiene measures, and the expansion of air transportation.

According to a United Nations World Tourism Organization (UNWTO) report titled 'Towards Measuring the Economic Value of Wildlife Watching Tourism in Africa,' wildlife tourism constitutes 7% of global tourism and experiences an annual growth rate of approximately 3%. The report further highlights that 14 African countries collectively generate around USD 142 million through entrance fees for protected sites and areas. This number is expected to grow in the coming years as more travelers, especially millennials, seek tourism activities that allow them to immerse themselves in pristine natural environments and witness wildlife in their natural habitats.

Safari tourism promotes economic growth and sustainable development by creating jobs, revitalizing wildlife areas and sites, and preserving natural habitats. Governments and local businesses worldwide leverage this unique combination of wildlife conservation and sustainable tourism. For instance, in October 2022, the Development Fund of Protected Areas (DFPA) of Georgia and UNESCO collaborated to support heritage conservation and sustainable tourism in the Wetlands World Heritage site and Colchic Rainforests. The partnership, valued at approximately USD 150,000, aims to enhance visitor management, raise awareness of the site's universal value, and aid Georgia's tourism recovery.

There's a growing focus on sustainability and responsible tourism in safaris. Travelers now prioritize minimizing environmental impact, supporting local communities, and contributing to wildlife conservation. They choose eco-friendly accommodations, engage in conservation initiatives, and prefer sustainable operators. For instance, according to the 2023 Sustainable Travel Research Report published by Booking.com, around 66% of Indians believe sustainable travel options are expensive; yet, over 80% are willing to pay more for sustainable travel options.

Similarly, almost 67% of Gen Zers and 64% of millennial travelers in the U.S. were more likely to consider sustainable travel options, according to Expedia Group’s Travel Outlook in 2021. Similarly, almost 67% of Gen Zers and 64% of millennial travelers in the U.S. were more likely to consider sustainable travel options, according to Expedia Group’s Travel Outlook in 2021.

Travelers are increasingly looking for tailor-made safari experiences that cater to their specific interests, preferences, and travel styles. They desire flexibility in itinerary planning, accommodation choices, and activities, allowing them to create personalized and unique safari adventures. As a result, market players such as Scott Dunn Ltd., &Beyond, and Abercrombie & Kent USA, LLC are adapting to this trend by offering a wide range of options and allowing travelers to curate their itineraries to match their preferences. This customization enhances the overall satisfaction of safari tourists.

Global governments and tourism organizations are promoting wildlife and safari tourism, fostering market growth. The Indian government, for example, has implemented initiatives to boost and enhance safari tourism. These efforts focus on wildlife conservation, visitor experiences, infrastructure development, and community involvement. For instance, The Ministry of Environment, Forests and Climate Change (MoEFCC) implemented the Integrated Development of Wildlife Habitats (IDWH) scheme to support the conservation and management of wildlife and their habitats. The scheme focuses on improving infrastructure, protection measures, and capacity building to promote sustainable wildlife tourism.

Group Insights

The couples segment dominated the market for safari tourism and accounted for a revenue share of over 42% in 2022. The opportunity to explore stunning landscapes, encounter wildlife together, and enjoy intimate moments in nature appeals to couples seeking unique and memorable experiences. Moreover, safari destinations are frequently chosen as honeymoon destinations by couples. According to the CBI, in 2021, 42% of millennials in Europe preferred traveling with their partners. Safari tourism is often considered a romantic and adventurous getaway for couples.

The friends segment is expected to register a lucrative CAGR of 6.0% during the forecast period. Group travel, including trips with friends, is a popular choice among travelers, particularly for adventure safari tourism. Millennials, in particular, show a strong interest in group travel experiences. According to the Centre for the Promotion of Imports from developing countries (CBI), part of the Ministry of Foreign Affairs of the Netherlands, in 2021, 37% of millennials in Europe preferred to travel with friends. This trend is expected to boost the growth of the segment over the forecast period.

Booking Mode Insights

The direct booking segment dominated the market for safari tourism and accounted for a revenue share of over 63 % in 2022. With advancements in technology, like card scanners & mobile payments, voice recognition search, and artificial intelligence (AI) and the availability of online booking platforms, more travelers are opting to book their safari experiences directly with lodges, camps, or tour operators. According to the 2022 Adventure Travel Industry Snapshot by the Adventure Travel Trade Association (ATTA), globally, roughly 62% of bookings are directly made with the service provider.

The marketplace booking mode is expected to register a CAGR of about 7.1% during the forecast period. This mode providestravelers with a convenient and accessible platform to search, compare, and book safari experiences. Marketplace booking platforms typically offer customer support services, including help with booking, itinerary changes, and addressing concerns or issues before, during, or after the safari. SafariBookings, for instance, is a reputable online marketplace for organizing African safaris. It allows users to compare safari options from highly-rated travel operators, providing reliable assistance throughout the process.

Type Insights

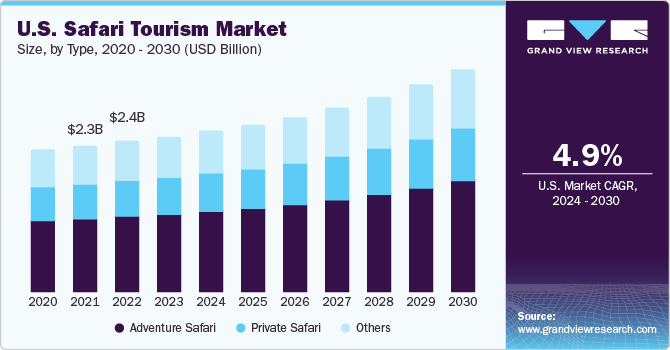

The adventure segment dominated the market and accounted for a revenue share of over 50% in 2022. A survey conducted by the Adventure Travel Trade Association (ATTA) in 2020 found that adventure tourism is becoming increasingly popular. The survey found that 72% of adventure travelers took at least one international trip in the past three years, and 63% of U.S. adventure travelers were planning on traveling domestically on their next planned trip.

The private safari type is anticipated to expand at a CAGR of 5.6% during the forecast period. The growth of this segment is driven by travelers seeking exclusive and personalized experiences. Customization and personalization, exclusivity and privacy, luxury and high-end accommodations, personalized services, and expert guides are the driving factors for private safari tourism, which is expected to boost the market growth over the forecast period.

Regional Insights

Middle East and Africa held over 51% revenue share of the safari tourism market in 2022. Strong purchasing power and increasing preference for family vacations have driven the demand for safari tourism in the region. Moreover, Africa is gaining popularity as a sought-after destination for international travelers, drawn to its sunny beaches, national parks, ecotourism offerings, and unique culture and cuisine.

The addition of diverse tourism activities is expected to increase tourist numbers in the region. For example, in March 2022, Sharjah Emirate unveiled Sharjah Safari, the largest safari park outside Africa. The park is a habitat for 1,000 bird species, including rare ones like the Northern Bald Ibis, and houses 50,000 animals from 120 different species found in South Africa.

Asia Pacific is expected to expand at the fastest CAGR of about 6.0% during the forecast period. According to the World Travel & Tourism Council, the travel and tourism sector, which is a crucial source of revenue in the Asia Pacific region, experienced a 7.5% GDP growth from 2021 to 2022. Factors such as economic growth, increased disposable income and leisure time, improving political stability, and a growing emphasis on promoting active tourism are driving the rapid expansion of tourism in Asia Pacific.

Key Companies & Market Share Insights

The market for safari tourism is highly mature with market players refining their services constantly to appeal to the new generation. Refurbishing of lodges, lodge circuit expansion, improvement in brand positioning, and launching new tours are various strategies adopted by competitors to compete effectively.

-

For instance, in May 2023, &Beyond announced the rebuilding of its Phinda Forest Lodge, situated in &Beyond Phinda Private Game Reserve, KwaZulu Natal, South Africa. To ensure minimal disruption to the delicate habitat, the lodge refurbishment will leverage the existing lodge and room structures instead of a complete rebuild. This approach allows for preserving the lodge's original 'Zulu-zen' concept while incorporating updated architectural elements.

-

For instance, in April 2023, Wilderness launched Wilderness Mokete tented camp in Botswana's Mababe Concession. Spanning 124,000 acres between the Okavango Delta and Chobe National Park, this remote oasis offers abundant wildlife sightings, including elephants, buffalos, lions, and hyenas. It is the first camp of its kind in this location.

Some prominent players in the global safari tourism market include:

-

Wilderness

-

Thomas Cook Group

-

Singita

-

Scott Dunn Ltd.

-

Rothschild Safaris

-

Travcoa & Beyond

-

Travcoa Tours & Safaris

-

Abercrombie & Kent USA, LLC

-

Gamewatchers Safaris Ltd.

-

Backroads

-

TUI Group

Safari Tourism Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 34.63 billion

Revenue forecast in 2030

USD 51.46 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, group, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Bhutan; Nepal; Brazil; South Africa; Kenya; Tanzania; Botswana; Namibia

Key companies profiled

Wilderness; Thomas Cook Group; Singita; Scott Dunn Ltd.; Rothschild Safaris; &Beyond; Travcoa Tours & Safaris; Abercrombie & Kent USA, LLC; Gamewatchers Safaris Ltd.; Backroads; TUI Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Safari Tourism Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global safari tourism market report based on type, group, booking mode, and region

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Adventure Safari

-

Private Safari

-

Others

-

-

Group Outlook (Revenue, USD Billion, 2017 - 2030)

-

Friends

-

Families

-

Couples

-

Solos

-

-

Booking Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Direct Booking

-

Agents And Affiliates Account

-

Marketplace Booking

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Bhutan

-

Nepal

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Kenya

-

Tanzania

-

Botswana

-

Namibia

-

-

Frequently Asked Questions About This Report

b. The global safari tourism market size was estimated at USD 33.37 billion in 2022 and is expected to reach USD 34.63 billion in 2023.

b. The global safari tourism market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 51.46 billion by 2030.

b. Middle East and Africa dominated the safari tourism market with a share of 51.3% in 2022. This is attributed to the constantly growing popularity of African Safaris. Major countries such as South Africa, Kenya, Tanzania, Botswana, and Namibia are largely popular destinations for safari tours in Africa.

b. Some key players operating in the safari tourism market include Wilderness; Thomas Cook Group; Singita; Scott Dunn Ltd.; Rothschild Safaris; &Beyond; Travcoa Tours & Safaris; Abercrombie & Kent USA, LLC; Gamewatchers Safaris Ltd.; Backroads; TUI Group.

b. Key factors that are driving the safari tourism market growth include the increasing interest of bloggers and influencers. Rising demand for increased travel memories, swelling in micro trips, and developing tourism all over the globe are anticipated to drive the safari tourism market.

b. The Kenya safari tourism market size was estimated at USD 3.33 billion in 2022 and is expected to reach USD 3.47 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."