- Home

- »

- Pharmaceuticals

- »

-

Retinal Vein Occlusion Treatment Market Size Report, 2030GVR Report cover

![Retinal Vein Occlusion Treatment Market Size, Share & Trends Report]()

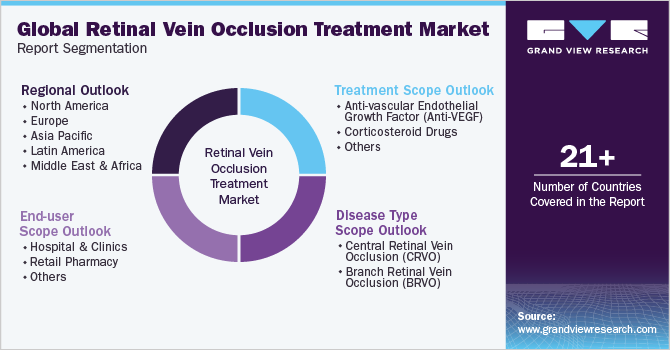

Retinal Vein Occlusion Treatment Market Size, Share & Trends Analysis Report By End-user (Retail Pharmacy, Hospital & Clinics), By Disease Type (CRVO, BRVO), By Treatment (Anti-VEGF, Corticosteroid Drugs), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-122-1

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global retinal vein occlusion treatment market size was estimated at USD 2.48 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.92% from 2023 to 2030. Some of the major factors influencing market expansion are the increasing geriatric population, the growing prevalence of retinal diseases, and rising awareness about eye diseases. Moreover, increasing R&D activities, the presence of a strong pipeline, and increasing drug approvals for treating retinal vein occlusion (RVO) are the key factors anticipated to drive the market growth over the forecast period. Key players, such as Kodiak Sciences Inc., announced positive results from the BEACON Phase 3 study of tarcocimab tedromer (KSI-301; tarcocimab) in the treatment of patients with macular edema and vision loss due to RVO in August 2022.

Consequently, the increased focus on the development of novel drugs for the treatment of RVO by these key players is expected to offer ample growth opportunities to the market during the projected period. Furthermore, treatment options for RVO in the market include oral drugs, anti-VEGF injections, and steroid injections. The choice of treatment depends on the severity and type of the disorder. While these treatments are available, there is a need for more effective options. However, it is anticipated that compounds with continuous release in the pipeline will fill this gap in the near future. The market is currently experiencing lucrative growth driven by the increasing prevalence of risk factors, such as atherosclerosis, diabetes, glaucoma, and hypertension.

According to the World Health Organization (WHO), approximately 1.28 billion adults aged 30-79 years worldwide are suffering from hypertension, with the majority (two-thirds) residing in middle- and low-income countries. Hypertension can result in the occlusion of major retinal vessels, including the central retinal vein and branch retinal vein. These complications stemming from hypertension can ultimately lead to vascular occlusion and vision loss. Consequently, the rising incidence of these secondary conditions is expected to contribute to the increased prevalence of RVO and consequently support the growth of the market.

The industry experienced a slowdown in revenue generation and market expansion amid the COVID-19 pandemic. This can be attributed to the imposition of strict lockdowns and government regulations intended to decrease the spread of the disease, which resulted in a reduction in demand for RVO treatment. In addition, the COVID-19 disease led many healthcare facilities to cancel appointments and completely halt treatments as they were considered non-essential and high contact in nature. Treatments including RVO witnessed a setback and the number of procedures declined due to the pandemic.

Disease Type Insights

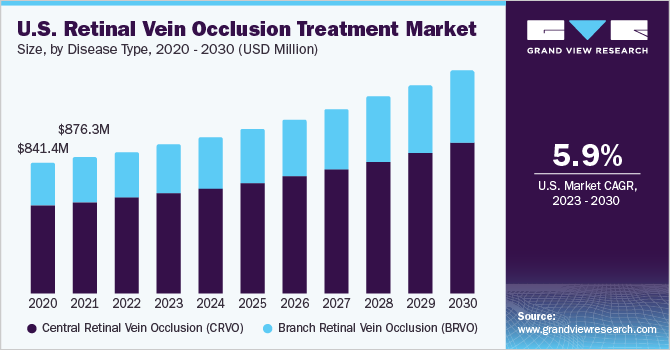

The central retinal vein occlusion (CRVO) segment held the largest market share of 66.94% in 2022 and is projected to maintain its dominance over the forecast period. CRVO is an occlusion of the main retinal vein that is typically caused due to thrombosis. The pathogenesis of CRVO involves compression of the retinal vein and vascular endothelial damage. This leads to retinal neovascularization and macular edema. A growing pipeline of specific drugs for the treatment of CRVO is projected to offer ample opportunities for the segment. For instance, an anti-VEGF monoclonal antibody, 601A developed by 3SBio, is in the two dose-escalation Phase I/IIa clinical trials for the treatment of CRVO.

The branch retinal vein occlusion (BRVO) segment is predicted to grow with a significant CAGR of 7.34% during the forecast period. Branch retinal vein occlusion is the blockage of one of the smaller branch veins. It is the most common retinal disorder. Increasing focus on the treatment of BRVO by operating players and research institutes is expected to open new avenues for the segment over the review period. For instance, in April 2023, Chugai Pharmaceutical Co., Ltd., filed for an additional application with the Ministry of Health and Welfare for Vabysmo Intravitreal Injection for treating patients suffering from macular edema associated with RVO. Similarly, a research article published in Nature in January 2023 evaluated a new individualized 2mg aflibercept treatment protocol for treatment-naive BRVO with macular edema. Such, initiatives are projected to boost the segment growth.

Treatment Insights

The anti-vascular endothelial growth factor (Anti-VEGF) segment held the largest market share of 65.83% in 2022. Anti-vascular endothelial growth factor is a breakthrough treatment for RVO including age-related macular degeneration. Anti-VEGF treatment prevents vision loss and has been shown to yield vision gains lasting up to five years. Therefore, key players in the market are focusing on the development and approval of novel anti-VEGF treatments for RVO. For instance, in February 2020, Novartis received EC approval for Beovu (brolucizumab) injection, an anti-VEGF treatment for age-related macular degeneration. These initiatives are boosting the adoption of anti-VEGF treatment and contributing to segment growth.

The corticosteroid drugs segment is expected to grow at a significant CAGR of 4.79% during the study period. Corticosteroid drugs have the advantage of targeting the three components of the pathophysiology of RVO. They stabilize the blood-retina barrier, reduce vascular permeability edema, and decrease macular edema by inhibition of inflammatory mediators. Dexamethasone, fluocinolone acetonide, and triamcinolone acetonide are three available corticosteroid drugs for the treatment of RVO. The dexamethasone is approved for the treatment of macular edema secondary to CRVO or BRVO by regulatory bodies in the U.S. Europe, and other countries in the world The drug’s efficacy lasts up to six months. Such, capabilities of corticosteroid drugs are projected to propel the segment over the forecast period.

End-user Insights

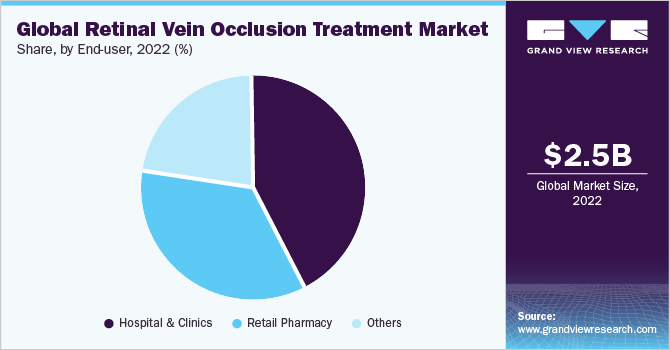

The retail pharmacy segment has shown a consistent upward trend in recent years and accounted for a share of 42.77% in 2022. This growth can be attributed to several factors, including increased accessibility of treatment options and medications for RVO through retail pharmacies. Patients are finding it more convenient to access prescribed medications and related products at local pharmacies, driving the demand for these services. In addition, the growing role of retail pharmacies in providing patient education and guidance on treatment regimens has contributed to the segment's growth.

With advancements in telemedicine and digital health platforms, retail pharmacies are also becoming focal points for disseminating information about RVO treatment and offering remote consultation services. As this trend continues, the retail pharmacy segment is expected to play a vital role in shaping the landscape of RVO treatment, ensuring broader patient reach and improved healthcare outcomes. The hospital & clinics segment is expected to demonstrate substantial growth during the projected timeframe.

The number of treatments performed in hospitals is higher than in any other healthcare setting, owing to the favorable reimbursement structure and availability of hospitals for primary care in several developing economies. Furthermore, factors, such as the increasing number of individuals visiting ophthalmic clinics in developing economies, especially in rural areas, and easy accessibility are further anticipated to boost the demand for RVO treatment in ophthalmic clinics, thereby driving segment growth over the forecast period.

Regional Insights

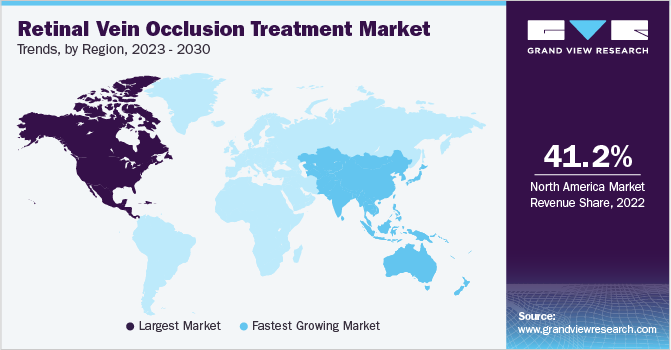

North America accounted for the largest revenue share of 41.20% in 2022 as it has a highly regulated and well-developed healthcare infrastructure. The growing collective efforts of key players to improve their product portfolios and ensure high-quality standards are expected to boost the demand for RVO treatment across this region. The increasing prevalence of eye-related issues is estimated to be a major factor influencing market growth in this country. According to the CDC, around 12 million people aged 40 years and above in the U.S. have vision impairment. In addition, favorable reimbursement regulations are expected to further boost market growth. The healthcare reimbursement system in the U.S. covers around 84% of the population with either public (26%) or private (70%) health insurance.

Asia Pacific is estimated to grow at the fastest CAGR of 8.44% during the forecast period. The market growth can be attributed to various factors, such as the presence of well-developed healthcare infrastructure in countries, such as Japan, and ongoing developments in India & China. The majority of the countries in this region are developing economies and are moving toward faster adoption of novel therapies. Major multinational companies are investing in R&D in countries, such as India and China, which is a major factor driving the regional market growth. With the increasing prevalence of eye disorders in the APAC region, governments are focusing on supporting diagnostics and treatment procedures that reduce the rate of disease progression and aid early disease diagnosis. These factors are anticipated to boost the market over the study period.

Key Companies & Market Share Insights

Companies are undertaking strategic initiatives, such as product collaborations, acquisitions, mergers, and strategic agreements, for product portfolio expansion to maximize their market share. To sustain their presence in the market, industry players are further concentrating on geographic expansion and product approval. For instance, in May 2023, F. Hoffmann-La Roche Ltd.’s Vabysmo application for the treatment of macular edema following RVO was accepted by the FDA based on two phase-3 studies.Some of the key players in the global retinal vein occlusion treatment market include:

-

AbbVie Inc.

-

F. Hoffmann-La Roche Ltd.

-

Regeneron Pharmaceuticals Inc.

-

Taiwan Liposome Company, Ltd.

-

Aerie Pharmaceuticals Inc.

-

CalciMedica Inc.

-

Outlook Therapeutics, Inc.

-

Kodiak Sciences Inc.

-

Chugai Pharmaceutical Co., Ltd.

-

Pfizer Inc.

Retinal Vein Occlusion Treatment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.62 billion

Revenue forecast in 2030

USD 4.18 billion

Growth rate

CAGR of 6.92% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease type, treatment, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

AbbVie Inc.; F. Hoffmann-La Roche Ltd.; Regeneron Pharmaceuticals Inc.; Taiwan Liposome Company, Ltd.; Aerie Pharmaceuticals Inc.; CalciMedica Inc.; Outlook Therapeutics, Inc.; Kodiak Sciences Inc.; Chugai Pharmaceutical Co., Ltd.; Pfizer Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retinal Vein Occlusion Treatment Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the retinal vein occlusion treatment market report on the basis of disease type, treatment, end-user, and region:

-

Disease Type Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Central Retinal Vein Occlusion (CRVO)

-

Branch Retinal Vein Occlusion (BRVO)

-

-

Treatment Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-vascular Endothelial Growth Factor (Anti-VEGF)

-

Corticosteroid Drugs

-

Others

-

-

End-user Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital & Clinics

-

Retail Pharmacy

-

Others

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global retinal vein occlusion treatment market size was estimated at USD 2.48 billion in 2022 and is expected to reach USD 2.62 billion in 2023.

b. The global retinal vein occlusion treatment market is expected to grow at a compound annual growth rate of 6.92% from 2023 to 2030 to reach USD 4.18 billion by 2030.

b. The central retinal vein occlusion (CRVO) segment held the largest market share of 66.94% in 2022 and is projected to maintain its dominance over the forecast period.

b. Some key players operating in the retinal vein occlusion treatment market include AbbVie Inc; F. Hoffmann-La Roche Ltd; Regeneron Pharmaceuticals Inc; Taiwan Liposome Company, Ltd; Aerie Pharmaceuticals Inc; CalciMedica Inc; Outlook Therapeutics, Inc; Kodiak Sciences Inc; Chugai Pharmaceutical Co., Ltd; Pfizer Inc.

b. Key factors that are driving the market growth include increasing geriatric population, growing prevalence of retinal diseases, rising awareness of eye diseases. Moreover, increasing R&D activities, presence of strong pipeline, and increasing drugs approvals for treating retinal vein occlusion are the key factors anticipated to drive the market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."