- Home

- »

- Semiconductors

- »

-

Retail Automation Market Size, Share, Industry Trend Report 2018-2025GVR Report cover

![Retail Automation Market Size, Share & Trends Report]()

Retail Automation Market Size, Share & Trends Analysis Report By Product (Barcode & RFID, POS, Cameras, Electronic Shelf Labels), By End User (Hypermarkets, Supermarkets, Convenience Stores), By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-219-8

- Number of Pages: 88

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Semiconductors & Electronics

Industry Insights

The global retail automation market size was valued at USD 8.96 billion in 2016 and is expected to gain traction over the forecast period businesses are increasingly looking to technology in order to provide better and fast service. The rising demand for features such as business optimization and improvement in service quality offered by retail automation is expected to propel the global market growth over the forecast period.

Automation is gaining significance as retailers are using a combination of mobile devices, self-checkout systems, digital kiosks, proximity beacons, and workforce and task management solutions to remain competitive in the market. Moreover, the market is expected to witness growth in the future owing to the growing adoption of the technology by a number of end users, such as hypermarkets, supermarkets, convenience stores, fuel stations, and retail pharmacies.

Self-service has become a trend everywhere, from entertainment venues to government entities, restaurants, hotels, gas stations, hospitals, airports, retail stores, and banks. Self-service has helped create a new era of productivity, convenience, and efficiency and has become a ubiquitous part of our world, benefiting both consumers and deployers of self-service.

Empowered by technology, the connected shopper is redefining the retail value chain. Industries are accelerating the process from simply collecting consumer data to using it to systematize and scale enhanced decision-making across the entire value chain.

Product Insights

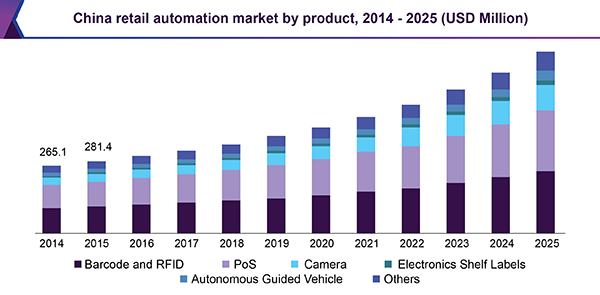

Based on product, the retail automation has been segmented into barcode and Radio-frequency identification (RFID), point of sale (POS), cameras, electronic shelf labels, autonomous guided vehicles, and others. The barcode and RFID segment is anticipated to dominate the retail automation product market by 2025. The camera segment is expected to witness significant growth owing to rising security concerns regarding administrative errors, thefts, and other security issues.

RFID technology is enabling retailers to compete with online sellers as it helps facilitate regular inventory checks, which in turn leads to inventory accuracy. To run a successful business, retailers must be confident about their inventory status, including specific details such as the color and size level.

Self-checkout terminals have grown substantially due to the benefits that they offer for retailers in improving the customer experience. These terminals are used extensively in home improvement stores, convenience stores, mass merchants/hypermarkets, and supermarkets and have high consumer acceptance.

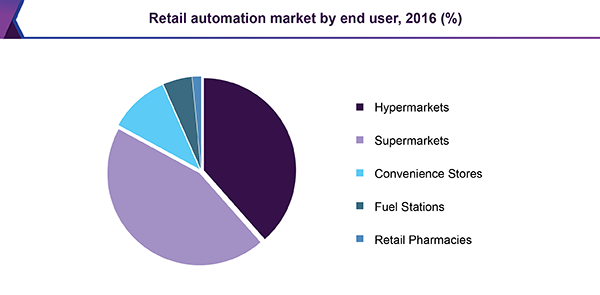

End-User Insights

Based on end users, the market has been segmented into hypermarkets, supermarkets, convenience stores, fuel stations, and retail pharmacies. The supermarket segment is anticipated to witness significant growth in the market by 2025. While there is an enormous demand for technologically advanced solutions, the need for cost-effective solutions has also increased.

Retail automation technology is witnessing increasing demand among the growing urban population since it offers improved service quality and instant access to everything ranging from carts to food. There are tremendous opportunities for advancements in the retail automation system owing to the increasing usage of smartphones.

Additionally, enhanced internet accessibility and the growing penetration of the Internet of Things (IoT) have helped direct digital controls for improved Machine-to-Machine (M2M) communication. This, in turn, has encouraged retailers to adopt the retail automation technology, thereby driving the market growth. However, factors such as high installation costs associated with the devices may pose a challenge to the market demand over the forecast period.

Regional Insights

The North American region is estimated to remain the key regional segment over the forecast period, owing to well-established manufacturers and a large consumer base. The region accounted for the largest revenue share and is expected to grow at a CAGR of more than 7% from 2017 to 2025. The North American, European, and Asia Pacific regions are anticipated to remain the key revenue-generating segments over the forecast period.

The Asia Pacific region is witnessing a rise in disposable income, which in turn is expected to drive market growth. Innovative technologies such as artificial intelligence (AI), machine learning, digital traceability, and robotics are the key factors driving the demand for retail automation over the projected period.

The market in South America is also expected to be promising over the forecast period, owing to falling inflation and the drop in interest rates. The increased demand for POS systems has significantly driven the growth of the regional market.

Retail Automation Market Share Insights

Key industry participants of the market include Datalogic S.P.A (Italy), Diebold Nixdorf, Incorporated (U.S.), First Data Corporation (U.S.), Fujitsu Limited (Japan), Honeywell International Inc. (U.S.), NCR Corporation (Georgia), Outerwall Inc. (U.S.), Pricer (Sweden), Toshiba Global Commerce Solutions, Inc. (U.S.), and ZIH Corp. (U.S.). These companies are engaged in several strategic initiatives such as new product development and continuous upgrading of existing product lines to offer avenues for increased profitability through improved customer relationships.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Revenue in USD Million and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, South America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, and Brazil

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the retail automation market based on products, end users, and regions.

-

Product Outlook (Revenue, USD Million; 2014 - 2025)

-

Barcode and RFID

-

POS

-

Cameras

-

Electronic Shelf Labels

-

Autonomous Guided Vehicles

-

Others

-

-

End-User Outlook (Revenue, USD Million; 2014 -2025)

-

Hypermarkets

-

Supermarkets

-

Convenience Stores

-

Fuel Stations

-

Retail Pharmacies

-

-

Regional Outlook (Revenue, USD Million; 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

MEA

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The exponential spread of COVID-19 worldwide has had an adverse impact on the semiconductor industry with manufacturing facilities temporarily shut, leading to a significant slowdown in the production. The outbreak could result in disruption across the ecosystem with several supply chain participants shifting their production facilities outside China, thereby reducing their over-reliance on China. Lockdowns imposed by the governments in the wake of the Covid-19 outbreak has not only affected manufacturing but also hauled consumer demand for semiconductor devices. Our analysts predict a decline in semiconductor revenue by over 1% in 2020 as compared to that in 2019. The report will account for Covid19 as a key market contributor.