- Home

- »

- Biotechnology

- »

-

Regenerative Medicine Market Size & Share Report, 2030GVR Report cover

![Regenerative Medicine Market Size, Share & Trends Report]()

Regenerative Medicine Market Size, Share & Trends Analysis Report By Product (Primary Cell-based Therapeutics, Stem Cell & Progenitor Cell-based Therapeutics), By Therapeutic Category (Dermatology, Musculoskeletal), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-952-4

- Number of Pages: 230

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Regenerative Medicine Market Size & Trends

The global regenerative medicine market size was estimated at USD 30.43 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 16.79% from 2024 to 2030. Recent advancements in biological therapies have resulted in a gradual shift in preference toward personalized medicinal strategies over the conventional treatment approach. This has created opportunities for companies that are involved in the development of biological therapeutics. Furthermore, the rise in the incidence of degenerative disorders has led to an increase in focus on research to discover novel regenerative therapies.

The COVID-19 outbreak has considerably impacted various markets, including the regenerative medicine and T-cell therapy manufacturing market. The SARS-CoV-2 coronavirus crisis has significantly affected the delivery of CAR T-cell therapies. This impact is not just limited to patient care. It has extended beyond patient care to administration, logistics, and limited healthcare resources. Several universities have slowed down clinical trial enrollment and other research activities. However, the market continues to expand as market players such as Novartis provide access to therapies like Athersys, Inc.’s MultiStem, which is a highly relevant COVID-19 therapy.

Furthermore, regenerative medicines have been identified to have the unique ability to alter the fundamental mechanisms of diseases. Regenerative therapies in trials provide promising solutions for specific chronic indications with unmet medical needs. In December 2021, Novartis announced the introduction of T-ChargeTM, a next-generation CAR-T platform that would be a beneficial tool for novel investigational CAR-T cell therapies.

Significant advancements in molecular medicines have resulted in the development of gene-based therapy, which uses targeted delivery of DNA as a medicine to fight against various disorders. Gene therapy has high potential in the treatment of cancer and diabetes type 1 & 2 through restoring gene function. Currently, gene-based therapies are used in the treatment of patients suffering from cancer, oncology, infectious diseases, cardiovascular disorders, monogenic diseases, genetic disorders, ophthalmological indications, and diseases of the central nervous system. These factors have contributed to the growth of the market.

In addition, a strong product pipeline in clinical trials and the presence of government & private funding to support research are expected to drive market growth over the forecast period. The presence of highly efficient products such as grafts, tissue patches, ointments, and scaffolds has resulted in the development of regenerative medicines for use in dermatology as well as musculoskeletal treatments. Advancements in nanotechnology that have further improved the efficiency of these products are expected to significantly contribute to revenue generation.

Market Dynamics

Advancements in cell biology, genomic research, and gene editing technology are anticipated to fuel the growth of the industry. Stem cell-based regenerative therapies are in-clinical trials, which may help restore damaged specialized cells in many serious and fatal diseases such as cancer, Alzheimer’s, neurodegenerative diseases, and spinal cord injuries. For instance, various research institutes have adopted Human Embryonic Stem Cells (hESCs) to develop treatments of Age-related Macular Degeneration (AMD).

AMD is a condition caused by cumulative damage to choriocapillaris, Bruch's membrane, and retinal pigment epithelium (RPE), which leads to the loss and dysfunction of RPE cells. Moreover, AMD is one of the leading causes of loss of vision in geriatric population. Hence, the rise in the number of stem cell therapies in clinical trials for spinal cord injury, heart failure, and diabetes type 1 is anticipated to influence market growth.

Technological advancements such as stem cells, tissue engineering, and nanotechnology have made regenerative medicines highly interdisciplinary in the field. Stem cells are undifferentiated cells, which have the capability to repair and/or regenerate into other cells such as cartilage, tendons, ligaments, muscle, and bones. In July 2021, BlueRock Therapeutics received FDA approval for its pluripotent stem cell-derived dopaminergic neuron therapy, DA01, for advanced Parkinson’s disease treatment. This approval was expected to expand the company’s offerings.

Furthermore, with the increasing demand for disease treatment therapies, companies have focused their efforts on accelerating R&D for gene therapies that target the cause of disease at a genomic level. The cell and gene therapies in the U.S. pipeline programs (Phase I-III trials) grew from 289 in 2018 to 362 by 2019 according to the data published by PhRMA. This represents an increase of 25% in a single year. Continuous advancements in this field would further boost the demand for regenerative medicines.

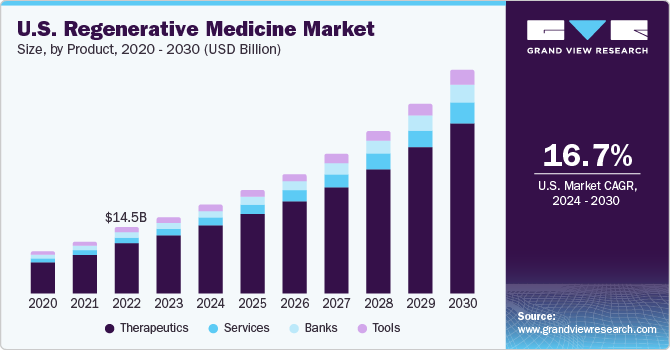

Product Insights

The therapeutics segment held the largest market share of 76.24% in 2023, owing to the growing geriatric population coupled with higher incidence rates of age-related as well as degenerative disorders. Increased prevalence of diseases with unmet medical solutions, such as cancer, diabetes, and neurodegenerative diseases including AMD, has encouraged researchers to develop alternative options. In April 2022, Kite, a Gilead Company announced of receiving U.S. FDA authorization for its CAR T-cell therapy product, Yescarta, which could be used for the treatment of refractory or relapsed large B-cell lymphoma.

The banks segment is expected to witness the fastest CAGR of 17.34% from 2024 to 2030. Banks are usually research-focused and are established with an intention to accelerate research by reducing the efforts, time, and cost for researchers in the collection, storage, and curation of human tissues or cells. However, with the rising adoption of cell-based and tissue engineering approaches in medical applications, the number of banks providing services for non-research applications has witnessed a rise. Thus, the rise in number of clinical trials for stem cell and tissue-based regenerative therapies along with an increase in demand for regenerative therapies is expected to influence segment growth.

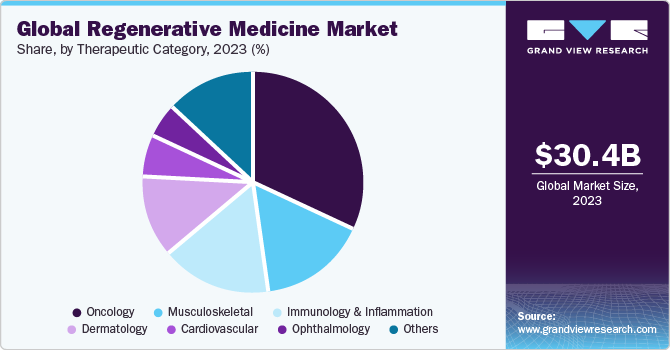

Therapeutic Category Insights

The oncology segment held the largest market share of 31.64% in 2023 and is expected to witness the fastest CAGR of 17.62% from 2024 to 2030. The growing prevalence of cancer is expected to positively influence the global market throughout the forecast period. According to the American Cancer Society estimate, the overall number of new cancer cases in 2023 was approximately 1,958,310 and the number of cancer-related deaths was 609,820 in the U.S.

The global cancer impact has resulted in worldwide efforts to decrease mortality and increase efficient treatment options pertaining to cancer. Therefore, Various government organizations along with private companies have made high investments in cancer research and the development of regenerative & advanced cell therapies. In January 2023, Calidi Biotherapeutics (CBT) and First Light Acquisition Group (FLAG) entered into a partnership agreement that aims to revolutionize oncolytic virotherapies with the help of stem cell-based platforms and further boost the market growth.

The cardiovascular segment is anticipated to witness significant growth during the forecast period. Advancements in cell-based therapies and regenerative medicines have accelerated the growth of the segment. Many key players are involved in the development of regenerative therapies to repair, restore, and revascularize damaged heart tissues. There is growing adoption of single and mixed cells from autologous as well as allogeneic sources to study the effect on CVDs. In addition, advanced biologics, small molecules, and gene therapy are being investigated to stimulate the regeneration of damaged heart cells. These factors would further fuel global market growth.

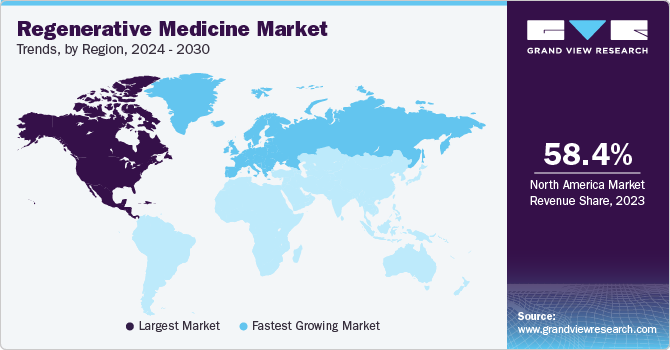

Regional Insights

North America held the largest market share of 58.40% in 2023. The high growth is attributed to the availability of government and private funding for development, the presence of advanced tech frameworks to support the rapid detection of chronic diseases and high healthcare spending in the region. Moreover, several ongoing clinical trials for regenerative medicine by significant market players have contributed to the region’s growth. In December 2021, Bristol Myers Squibb received U.S. FDA approval for Orencia for the prevention of acute graft versus host disease in adults and pediatric patients 2 years of age and elderly patients undertaking hematopoietic stem cell transplantation (HSCT).

Europe is expected to experience the fastest CAGR of 18.79% from 2024 to 2030. This growth rate is attributed to the rapid adoption of cell-based approaches in healthcare, the rising geriatric population in the region, and the emergence of key players. In recent years, China has emerged with rapid expansion in infrastructure and facilities to accelerate stem cell research. This in turn, is anticipated to fuel the growth of regenerative medicine in the region.

Key Companies & Market Share Insights

The continuous demand for regenerative medicine by multiple end-users has created numerous market opportunities for major players to capitalize on. In October 2023, Editas drug, Inc. stated that the FDA has given EDIT-301, a research-stage gene editing drug, Regenerative Medicine Advanced Therapy (RMAT) classification for the treatment of severe sickle cell disease (SCD). In October 2022, Astellas Pharma Inc. and Pantherna Therapeutics GmbH announced a technology evaluation agreement to develop mRNA-based regenerative medicine programs through direct reprogramming. Their collaborative effort aims to expand treatment options for diseases with high unmet medical needs by targeting new organs.

In July 2022, Mogrify Limited and Astellas Pharma Inc. announced a collaborative research agreement to develop regenerative medicine approaches for sensorineural hearing loss. Astellas Gene Therapies will fund the research and provide expertise in AAV-based genetic medicine, while Mogrify will leverage its bioinformatic platform for screening and validation to identify potential therapeutic factors. Their shared goal is to transform the lives of patients with hearing loss through innovative regenerative therapies.

In January 2022, Novartis unveiled a strategic collaboration with Alnylam to harness Alnylam's established siRNA technology in inhibiting a target identified at Novartis Institutes for BioMedical Research. By merging regenerative medicine principles with cutting-edge siRNA technology, both companies aim to create a potential treatment fostering the regrowth of functional liver cells, offering an alternative to transplantation for patients suffering from liver failure.

In November 2021, Astellas Pharma, Inc. entered into an agreement with Pantherna Therapeutics GmbH to study mRNA-based regenerative medicine. Under this initiative, Astellas' high drug discovery capabilities and Pantherna's state-of-the-art mRNA platform will be used to promote research on developing a new program. In May 2021 , Bayer AG entered into a collaboration with Senti Bio for gene circuit-engineered cell therapies development for regenerative medicine.

Key Regenerative Medicine Companies:

- AstraZeneca plc

- F. Hoffmann-La Roche Ltd.

- Integra Lifesciences Corp.

- Astellas Pharma, Inc.

- Cook Biotech, Inc.

- Bayer AG

- Pfizer, Inc.

- Merck KGaA

- Abbott

- Vericel Corp

- Novartis AG

- GlaxoSmithKline (GSK)

Regenerative Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 35.47 billion

Revenue forecast in 2030

USD 90.01 billion

Growth rate

CAGR of 16.79% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, therapeutic category, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

AstraZeneca plc; F. Hoffmann-La Roche Ltd.; Integra Lifesciences Corp.; Astellas Pharma, Inc.; Cook Biotech, Inc.; Bayer AG; Pfizer, Inc.; Merck KGaA; Abbott; Vericel Corp.; Novartis AG; GlaxoSmithKline (GSK)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

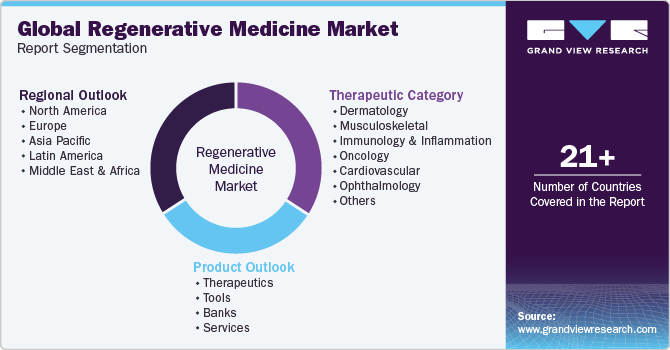

Global Regenerative Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global regenerative medicine market report based on product, therapeutic category, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutics

-

Primary Cell-based Therapeutics

-

Dermatology

-

Musculoskeletal

-

Surgical

-

Dental

-

Others

-

-

Stem Cell & Progenitor Cell-based Therapeutics

-

Autologous

-

Allogenic

-

Others

-

-

Cell-based Immunotherapies

-

Gene Therapies

-

-

Tools

-

Banks

-

Services

-

- Therapeutic Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatology

-

Musculoskeletal

-

Immunology & Inflammation

-

Oncology

-

Cardiovascular

-

Ophthalmology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global regenerative medicine market size was estimated at USD 30.43 billion in 2023 and is expected to reach USD 35.47 billion in 2024

b. The global regenerative medicine market is expected to grow at a compound annual growth rate of 16.79% from 2024 to 2030 to reach USD 90.01 billion by 2030.

b. North America dominated the regenerative medicine market with a share of 58.4% in 2023. This is attributable to the availability of advanced technologies and the presence of research institutes involved in the development of novel therapeutics in the region.

b. Some key players operating in the regenerative medicine market include Integra LifeSciences Corporation; MiMedx Group, Inc.; AstraZeneca; F. Hoffmann-La Roche Ltd; Merck & Co., Inc.; Pfizer Inc.; and Baxter.

b. Key factors that are driving the market growth include the presence of a strong pipeline portfolio and a high number of clinical trials, high economic impact of regenerative medicine and technological advances in regenerative medicine.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Biopharmaceutical innovators are at the forefront of the human response to the coronavirus pandemic. A significant number of major biotech firms are in the midst of a race to investigate the Sars-Cov-2 genome and prepare a viable vaccine for the same. As compared to the speed of response to SARS/MERs etc, the biotech entities are investigating SARs-Cov-2 at an unprecedented rate and a considerable amount of funds are being put into the R&D. With multiple candidates in trial, the public and private sectors are anticipated to work in unison for the foreseeable period, until a vaccine is developed for Covid-19. The report will account for Covid19 as a key market contributor.