- Home

- »

- Medical Devices

- »

-

Recombinant Protein Therapeutics CDMO Market Report 2030GVR Report cover

![Recombinant Protein Therapeutics CDMO Market Size, Share & Trends Report]()

Recombinant Protein Therapeutics CDMO Market Size, Share & Trends Analysis Report By Type (Growth Hormones, Interferons, Vaccines, Immunostimulating Agents), By Source, By Indication, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-116-2

- Number of Pages: 175

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global recombinant protein therapeutics CDMO market size was valued at USD 18.41 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2023 to 2030. The increasing demand for biologic drugs, including recombinant protein therapeutics as an effective option in treating various diseases, is one of the major factors supporting the growth of the recombinant protein therapeutics industry. This increased demand drives the need for CDMOs to provide manufacturing and development services for the same, thereby simultaneously augmenting the growth of the market during the analysis period. Moreover, advancements in biotechnology, such as the implementation of novel and enhanced technologies and techniques for producing recombinant protein drugs, is another significant factor supporting the market’s growth. Contract developers play a crucial role in leveraging these advancements to develop and manufacture high-quality therapeutics.

Several biopharmaceutical companies prefer to outsource the manufacturing and development of recombinant protein therapeutics to specialized CDMOs, which allows them to focus on their core competencies while benefiting from the infrastructure and expertise of CDMOs. Furthermore, the in-house development of recombinant protein drugs can be time-consuming and expensive. CDMOs offer cost-effective solutions by leveraging specialized facilities, economies of scale, and expertise in manufacturing these drugs for biopharmaceutical and pharmaceutical companies. In conclusion, the market is driven by the increasing demand for biologics, outsourcing trends, advancements in biotechnology, regulatory support, the flexibility offered by CDMOs, and cost-effectiveness.

The outbreak of the COVID-19 pandemic had a damaging effect on the overall pharmaceutical industry. However, the market witnessed a positive impact. The COVID-19 pandemic has provided an opportunity for recombinant protein drugs to demonstrate their potential and make significant contributions to public health. The development of recombinant protein-based vaccines has been a major breakthrough. The COVID-19 pandemic has also enhanced developments in manufacturing processes for recombinant protein drugs. The surged demand for recombinant protein treatments and vaccines has led to innovations in purification, large-scale production, and formulation techniques, making these therapies more cost-effective and accessible. For instance, in June 2021, FUJIFILM Diosynth Biotechnologies announced a USD 850 million investment to accelerate the growth of manufacturing capacities for biologics, including recombinant protein-based vaccines for COVID-19 and advanced gene therapies in the UK and the U.S.

The geopolitical crisis, such as the Russia-Ukraine war, has moderately impacted the market. The conflict has disrupted transportation routes, manufacturing facilities in the region, and supply chains, leading to challenges in the distribution and production of biopharmaceuticals. The directly impacted war areas faced a series of difficulties in conducting research and development, accessing raw materials, and maintaining production facilities, which has resulted in disruptions across the production of biopharmaceutical drugs, potentially leading to delays and shortages in availability.

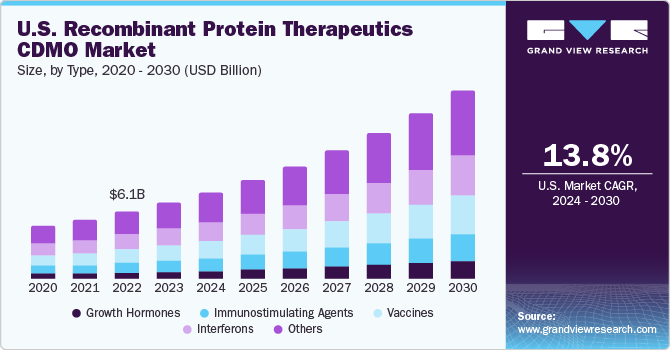

Type Insights

The growth hormones segment is anticipated to register a lucrative CAGR of 15.0% in market during the forecast period of 2023 to 2030. The recombinant protein growth hormones have a vital role in the treatment of cancer. They help in the enhancement of immune response, facilitate targeted therapies, and replace hormones in hormone-dependent cancers. Furthermore, growth hormone treatment therapies are also indicated in treating several chronic ailments. Many companies are continuously working on developing and introducing new therapies and treatments using recombinant protein growth hormones. For instance, in February 2022, OPKO Health, Inc. and Pfizer Inc. announced the marketing authorization approval by the European Commission for the long-acting, next-generation recombinant human growth hormone NGENLA in the treatment of growth hormone deficiency (GHD) in children and adolescents.

The interferons segment, on the other hand, held a considerable revenue share of 21.6% in 2022. Interferons are a group of proteins that play a crucial role in the immune response against viral infections. The use of recombinant interferons in interferon therapy treats infectious diseases, particularly those caused by viruses. For instance, in July 2022, Researchers from the National Cancer Institute and their collaborators discovered that interferons, which are proteins that help the immune system fight infections, play a significant role in limiting the severity of COVID-19 infection in individuals with the identified genetic factors. The findings also stated that the interferon treatment in COVID-19 patients improved viral clearance. Hence, interferons have significant potential in treating infectious diseases. Thus, the growing prevalence of infectious diseases is one of the prominent factors supporting the adoption of interferon therapies, thereby promoting CDMOs to manufacture the same.

Source Insights

The mammalian systems segment dominated the market and accounted for the largest revenue share of 67.3% in 2022. High shares of the segment are majorly due to an increase in the adoption of mammalian systems for the sourcing of recombinant proteins. Mammalian cell culture systems offer advantages in terms of producing complex proteins with appropriate post-translational modifications, making them suitable for a wide range of therapeutic applications. For instance, as per an article published by BioProcess International in August 2022, the mammalian-based cell culture capacity expanded around eight-fold, from nearly 795,000 L in 2002 to 6,125,000 L in 2022. Hence, growth in the production capacity of mammalian-based cell culture systems is one of the significant factors supporting the segment’s high share in the market.

The microbial systems segment is poised to witness a substantial CAGR of 13.8% from 2023 to 2030. In recent years, there has been an increase in the use of microbial systems for the production of recombinant protein therapeutics. Microbial sources, such as bacteria and yeast, offer cost advantages over mammalian cell culture systems. They have simpler growth requirements and can be cultured at larger scales, resulting in lower production costs. Microbial systems can also produce high levels of recombinant proteins. They have robust expression systems and well-characterized genetic tools that allow for efficient protein production. Hence, the aforementioned factors supported the lucrative growth of the segment in the market.

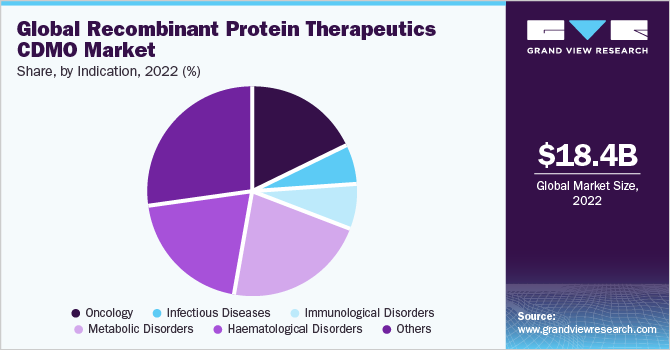

Indication Insight

The metabolic disorders segment in the market accounted for a significant revenue share of 21.9% in 2022. This is attributed to increasing R&D activities pertaining to the discovery of novel therapeutics along with a growing number of contract developers focusing on the launch of recombinant protein-based therapeutics for the treatment of several types of metabolic disorders. For instance, in November 2022, Stelis Biopharma Limited, an emerging global biopharmaceutical CDMO, announced that its recombinant human teriparatide injection Kauliv received market authorization from the European Medicines Agency (EMA) for the treatment of osteoporosis, a metabolic bone disease.

The oncology category, on the other hand, is anticipated to register a lucrative CAGR of 14.8% during the forecast period. The segment is poised to witness considerable growth owing to increasing R&D activities in the field. The growing prevalence of cancer across the globe is one of the major factors supporting the research and development activities pertaining to the discovery of novel anti-cancer therapeutics. For instance, as per the American Cancer Society, Inc., in 2022, there are around 1.9 million new cancer cases diagnosed and 609,360 cancer deaths in the U.S. Hence, the increasing prevalence of the condition has boosted the demand for recombinant protein therapeutics, thereby supporting the segment’s growth.

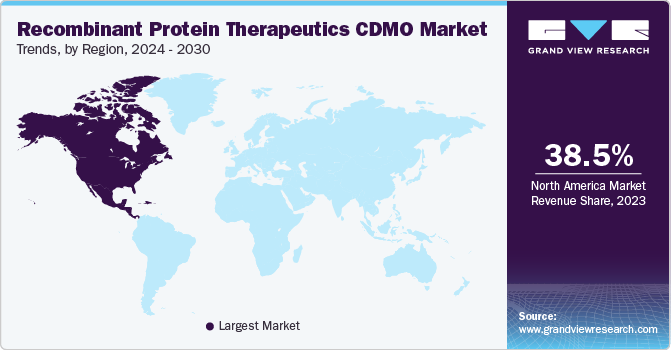

Regional Insights

North America dominated the recombinant protein therapeutics CDMO market and accounted for the largest revenue share of 38.6% in 2022. High shares of the region are majorly due to the U.S. being established as a global leader in the production of recombinant protein drugs. The country has a strong research and development infrastructure and a robust biopharmaceutical industry, which has contributed to its prominence in this field. Furthermore, the U.S. has a sophisticated and well-developed manufacturing infrastructure for biopharmaceuticals, including recombinant protein therapeutics. This infrastructure includes advanced manufacturing technologies, large-scale production facilities, and stringent quality control processes.

Asia Pacific is anticipated to register the fastest CAGR of 14.3% during the forecast period in the market. The region’s significant growth is observed due to the presence of multiple biopharmaceutical manufacturing hubs, including China, India, and Japan. Asia-Pacific region has emerged as a significant player in the production of recombinant protein drugs, offering both high production capabilities and lower costs compared to other regions. Factors such as lower labor costs, access to cost-effective raw materials, and favorable regulatory environments, contribute to the cost advantage. Hence, the above-stated factors boost the growth of the overall Asia Pacific region in the global market.

Key Companies & Market Share Insights

The major players operating across the market are focused on adopting in-organic strategic initiatives such as mergers, partnerships, acquisitions, etc. For instance, in January 2022, Thermo Fisher Scientific Inc. announced the acquisition of PeproTech, Inc., a leading manufacturer and developer of recombinant proteins, for a total cash purchase price of approximately USD 1.85 billion. Hence, the increasing adoption of in-organic strategic initiatives is highly anticipated to boost the market share of the prominent players operating across the market. Some prominent players in the global recombinant protein therapeutics CDMO market are:

-

Richter-Helm BioLogics

-

Lonza

-

Catalent, Inc

-

FUJIFILM Diosynth Biotechnologies

-

WuXi Biologics

-

Curia Global, Inc.

-

Batavia Biosciences B.V.

-

HALIX B.V.

-

AGC Biologics

-

Enzene Biosciences

Recombinant Protein Therapeutics CDMO Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.89 billion

Revenue Forecast in 2030

USD 51.95 billion

Growth rate

CAGR of 13.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments Covered

Type, source, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

Richter-Helm BioLogics; Lonza; Catalent, Inc; FUJIFILM Diosynth Biotechnologies; WuXi Biologics; Curia Global, Inc.; Batavia Biosciences B.V.; HALIX B.V.; AGC Biologics; Enzene Biosciences

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

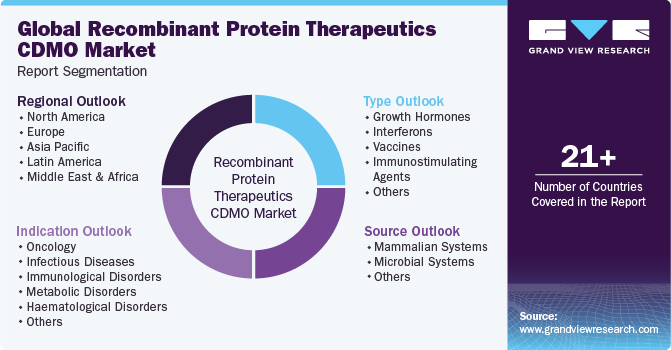

Global Recombinant Protein Therapeutics CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global recombinant protein therapeutics CDMO market report based on type, source, indication, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Growth Hormones

-

Interferons

-

Vaccines

-

Immunostimulating Agents

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Mammalian Systems

-

Microbial Systems

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Infectious Diseases

-

Immunological Disorders

-

Metabolic Disorders

-

Haematological Disorders

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global recombinant protein therapeutics CDMO market size was estimated at USD 18.41 billion in 2022 and is expected to reach USD 20.89 billion in 2023.

b. The global recombinant protein therapeutics CDMO market is expected to grow at a compound annual growth rate of 13.9% from 2023 to 2030 to reach USD 51.95 billion by 2030.

b. North America dominated the market with a share of 38.6% in 2022. This is attributable to established CMOs in the U.S. specializing in recombinant protein manufacturing services.

b. Some key players operating in the market include Richter-Helm BioLogics, Lonza, Catalent, Inc, FUJIFILM Diosynth Biotechnologies, WuXi Biologics, Curia Global, Inc., etc.

b. The recombinant protein therapeutics CDMO market is driven by the increasing demand for biologics, outsourcing trends, advancements in biotechnology, regulatory support, the flexibility offered by CDMOs, and cost-effectiveness.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."