- Home

- »

- Advanced Interior Materials

- »

-

Reciprocating Air Compressor Market Size, Share Report 2030GVR Report cover

![Reciprocating Air Compressor Market Size, Share & Trends Report]()

Reciprocating Air Compressor Market Size, Share & Trends Analysis Report By Technology (Single-acting, Double-acting), By Lubrication (Oil Free, Oil-filled), By Type, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-116-8

- Number of Pages: 169

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

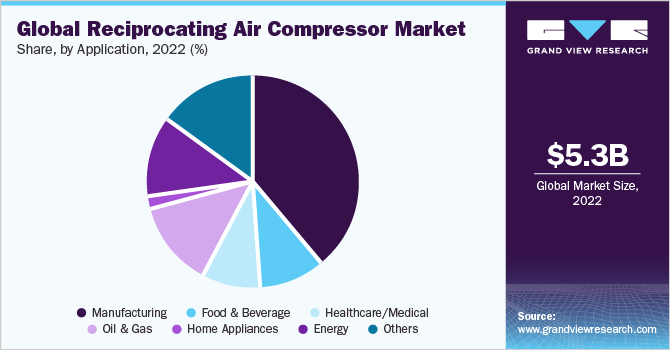

The global reciprocating air compressor market size was estimated at USD 5.26 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. Reciprocating air compressors are employed in a variety of sectors, including manufacturing, oil & gas, chemical, and electrical generation. To address the shortcomings of conventional production procedures, several industries have introduced cost-effective manufacturing strategies. Owing to the advantages such as efficient energy distribution and cost-effectiveness, these industries have a significant need for energy-efficient reciprocating air compressors. These factors are expected to positively impact the market demand during the forecast period.

Furthermore, developing countries have introduced stringent regulations for environmental protection, increasing the demand for energy-efficient reciprocating air compressors. Moreover, these compressors are versatile and find applications in many other industries and processes due to their ability to provide high-pressure air for various tasks. For instance, the automotive sector relies on reciprocating air compressors for vehicle assembly, painting, and repair activities. These aforementioned factors are anticipated to propel the demand for reciprocating air compressors in the coming years.

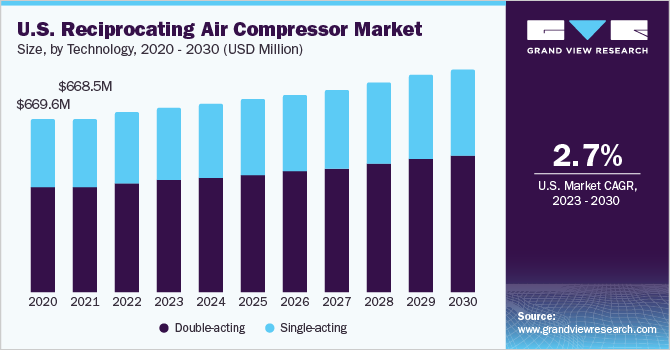

Increased industrialization in the U.S. leads to higher demand for compressed air in manufacturing, construction, and other sectors. Furthermore, stricter environmental regulations such as the Occupational Safety and Health Administration (OSHA) and Energy Policy and Conservation Act (EPCA) drive the need for efficient reciprocating air compressors for reduced energy consumption. These aforementioned factors are expected to propel the demand for reciprocating air compressors during the forecast period.

According to the U.S. Department of Agriculture, as of 2023, there are many food & beverage processing plants in the U.S. according to the Census Bureau's County Business Patterns. Food & beverage processing plants are located throughout the U.S. California had the most food & beverage manufacturing plants (6,116), while Texas (2,625) and New York (2,600) were also leading food & beverage manufacturing states. Thus, the growing food & beverage industry is expected to propel the demand for reciprocating air compressor industry over the forecast period.

In the food processing and packaging industry, compressed air is utilized for controlling actuators and valves in computerized lines used for bottling, packaging, and filling different products. The presence of oil in compressed air can result in the jamming of bottling, packaging, and filling equipment, causing slowdowns in assembly lines. In addition, as compressed air is also used for supplying oxygen to bacteria during the fermentation of food products, the presence of even a minor amount of oil in it disturbs bacterial activities resulting in the spoilage of end products. These factors are further anticipated to propel the market demand over the forecast period.

Clean air is essentially used in the healthcare industry for manufacturing pills. It is also utilized in culture vessels, aeration tanks, and the packaging of pills. Moreover, reciprocating air compressors are the main components used in medical air systems for transforming power into potential energy present in pressurized air. As the use of compressed air is extended to artificial respiration systems, surgical instruments, and other medical systems, it is anticipated to fuel the global demand for oil-free reciprocating air compressors in the coming years. For instance, ELGI EQUIPMENTS LIMITED provides oil-free air compressors for transporting medical gas used in anesthetic conditions.

Technology Insights

In terms of technology, the single-acting reciprocating air compressor technology segment led the market in 2022 with a revenue share of 40.6%. Single-acting reciprocating air compressors find application in various industries where compressed air is needed. These compressors are well-suited for tasks that require intermittent or moderate levels of compressed air. These aforementioned factors are anticipated to drive the demand for the single-acting reciprocating air compressor segment during the forecast period.

When a modest volume of air is needed, reciprocating compressors are intended to be utilized sporadically. They are ideal for workshops, home improvement projects, small companies, and construction activities. If the compressor is idle for around 33% of the time, using a reciprocating air compressor is preferable over a rotational compressor. After prolonged periods of downtime, rotary compressors may not perform as well. These aforementioned factors are expected to drive the demand for reciprocating air compressors during the forecast period.

Reciprocating air compressors are made for intermittent duty applications in challenging settings and have cheap installation costs. They work best in situations where the compressor is often turned on and off. These are employed in industrial settings, building sites, amusement parks, tire shops, car washes, and woodworking operations. These aforementioned factors are anticipated to propel the market demand over the forecast period.

Double-acting reciprocating air compressors technology segment is expected to witness a CAGR of 4.2% over the forecast period. These have crossheads that, in conjunction with the crankshaft and connection rod, produce an entirely straight movement. Due to the higher cost of construction, this technique is exclusively employed in heavy-duty industrial and process compressors starting at 45kW. These aforementioned factors are anticipated to augment the market demand in the coming years. For instance, AF Compressors offer oil-free double-acting reciprocating compressors.

Lubrication Insights

In terms of lubrication, the oil-filled lubrication segment led the market in 2022 with a revenue share of 61.8%. Oil-filled reciprocating air compressors are suitable for a wide range of industrial applications where the compressed air quality requirements are not as stringent. They are commonly used in manufacturing, automotive repair, construction, and other industrial settings. Further, these can deliver higher pressure and larger air volumes, making them suitable for heavy-duty and high-demand applications.

Oil-free reciprocating air compressors are essential for applications where air quality is a critical concern, and the risk of oil contamination must be minimized. On the other hand, oil-lubricated compressors are suitable for a wide range of general industrial applications where air quality requirements are less stringent, and factors such as capacity, pressure, and initial cost are important considerations.

The oil-free lubrication segment is anticipated to witness a CAGR of 5.1% over the forecast period. Oil-free compressors are essential in applications where the compressed air must be completely free of oil contamination. Industries such as pharmaceuticals, food & beverage, electronics manufacturing, and medical equipment rely on oil-free compressors to ensure the purity of their products and processes. These aforementioned factors are anticipated to propel the demand for oil-filled reciprocating air compressors during the forecast period.

Environments where even trace amounts of oil could cause contamination or damage, such as clean rooms or laboratories, benefit from oil-free reciprocating air compressors. Furthermore, these are preferred for painting and finishing applications where oil particles in the compressed air can reduce the quality of the finish. In addition, these are commonly used in dental and medical equipment, such as dental chairs and breathing apparatus, to maintain a clean and sterile air supply.

Type Insights

In terms of type, the stationary type segment led the market in 2022 with a revenue share of 57.2%, due to the high adoption of reciprocating air compressors in the manufacturing sector. A stationary reciprocating air compressor is used in oil refineries, gas processing, chemical and other industries. In addition, in the oil & gas sector, these compressors are widely used for operating pneumatic equipment for oil extraction & refining, pipelines, and other processes. These aforementioned factors are anticipated to propel the market demand over the forecast period.

For instance, Kaeser offers stationary reciprocating compressors that offer exceptional versatility such as the EUROCOMP series compressors that are designed and constructed for workshop use. In addition, Ingersoll Rand designs and produces robust, single-stage, two-stage reciprocating compressors, as well as related accessories, that are perfect for enterprises like car body shops, small garages, and do-it-yourself projects. A variety of types are available, including portable and lubricated systems. The reciprocating solutions have renewable components that are simple and inexpensive to maintain.

The portable reciprocating air compressor segment is expected to witness the fastest CAGR of 4.5% over the forecast period owing to the rising adoption of these products in construction and mining activities. Portable reciprocating air compressors are a reliable power source for machines and tools in the construction industry and several others. Furthermore, portable compressors require less maintenance and are easy to handle, due to which their demand is increasing in low-duty applications. These aforementioned factors are anticipated to propel the market demand over the forecast period. For instance, in May 2022, Elgi Equipments launched its high-performance, energy-efficient, and reliable electric & diesel portable air compressors.

Application Insights

The food & beverage application segment is expected to witness a CAGR of 5.1% over the forecast period. Reciprocating air compressors have gained popularity in the food & beverage industry owing to their ability to provide clean and contaminant-free compressed air. As the oil can contaminate products and compromise their quality, the food & beverage industry requires compressed air that is free of oil and other contaminants, resulting in a growing demand for reciprocating air compressors in this industry. Companies operating in the food & beverage industry are constantly looking for opportunities to reduce their carbon footprint and energy consumption, which can be achieved through the adoption of oil-free air compressors. These compressors use less energy and produce less heat, which results in lower operating costs and minimum environmental impact.

Higher pressures can be produced by reciprocating air compressors while using less energy to operate. This makes this sort of compressor extremely beneficial for more extensive applications requiring sporadic high-pressure utilization. Reciprocal air compressors’ main features are conventional, straightforward electrical controls and mechanical parts. Reciprocating air compressors are now necessary for achieving high production and efficiency to meet modern needs. Air compressor manufacturers have developed creative solutions to help industries keep a competitive edge. It is concentrated on requiring little energy, moving quickly, and being dependable with a high level of endurance in challenging circumstances.

The oil & gas application segment held 13.5% of the global market share in 2022. Reciprocating air compressors are widely used in the oil & gas industry, where they perform a crucial role in various upstream, midstream, and downstream processes. The compressors are designed to deliver clean, dry, and contaminant-free compressed air, making them a good option for drilling, well completion, and pipeline maintenance applications. Oil-free reciprocating air compressors require less maintenance than oil-lubricated reciprocating compressors, which improves system reliability and lowers the risk of costly downtime in oil & gas applications.

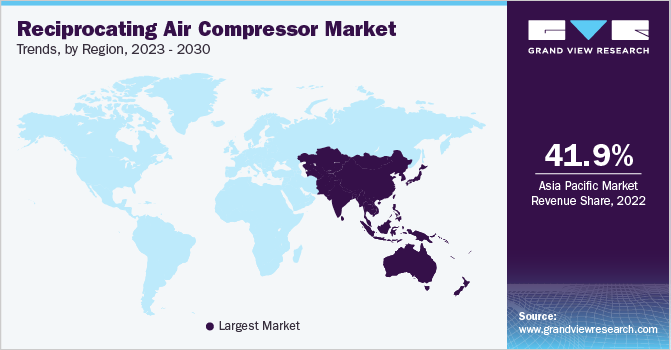

Regional Insights

Asia Pacific region dominated the market in 2022 with a revenue share of 41.9%and is expected to witness a fastest CAGR of 5.0% over the forecast period. The region has a growing healthcare industry with increasing demand for medical facilities. Reciprocating oil-free air compressors are commonly used in medical applications and pharmaceutical companies, including medical air systems, dental clinics, and laboratories, which is expected to drive market demand in the region.Some countries require the mandated usage of oil-free air compressors as part of industry standards and regulatory protocols, especially in pharmaceutical production companies. These aforementioned factors are anticipated to augment the market demand over the forecast period.

North America region is anticipated to witness a CAGR of 3.0% over the forecast period due to various factors, including environmental concerns, stricter regulations, and the need for higher air quality in critical industry applications. Reciprocating air compressors are widely used in industries such as food & beverage, pharmaceuticals, electronics, automotive, and healthcare, where the quality of compressed air is crucial to maintain product integrity, product quality, and ensure operational efficiency.

The rapid growth in the Europe region, especially across industries like manufacturing, electronics, healthcare, processing, and food & beverages, has positively influenced the purchasing power of potential customers from these industries. In addition, the increasing need for reciprocating oil-free air compressors that can deliver oil-free clean air in the above-mentioned applications is also expected to fuel the market growth. For instance, in February 2022, M.R. Organization, acquired Standard Air Limited, an air compressor component manufacturer based in the UK. The acquisition enabled M.R. Organization to expand its global footprint and capture a new customer base.

Several global players in the air compressor industry have been expanding their operations in Central and South America to cater to the growing demand for oil-free compressors. They are also investing in R&D to improve the efficiency and performance of their products. Local players are also emerging to cater to the demand for oil-free air compressors in the region. For instance, in 2021, Schulz introduced oil free piston compressor that incorporates a frequency inverter. The cutting-edge technology allows for precise control of the airflow, ensuring consistent pressure during usage, and providing additional flow during peak demand. In addition, the inverter feature provides enhanced energy efficiency, leading to improved productivity and process efficacy.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including geographical expansions, product launches, and mergers & acquisitions to enhance market penetration and cater to the changing technological requirements. In June 2023, Atlas Copco expanded its manufacturing base in Wuxi, China. The facilities were planned with the intent to cater to compressor R&D and manufacturing operations. Some prominent players in the global reciprocating air compressor market include:

-

Atlas Copco

-

Bauer Group

-

BelAire Compressors

-

Cook Compression

-

Compressor Products International (CPI)

-

Frank Compressors

-

Galaxy Auto Stationary Equipment Co. Ltd.

-

Gast Manufacturing, Inc.

-

GENERAL ELECTRIC

-

Ingersoll Rand Plc

-

Kaeser Compressors

-

MAT Industries, LLC

-

Gardner Denver

-

ELGi

-

Sollant Group

Reciprocating Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.45 billion

Revenue forecast in 2030

USD 7.22 billion

Growth rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, technology, lubrication, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Atlas Copco; Bauer Group; BelAire Compressors; Cook Compression; Compressor Products International (CPI); Frank Compressors; Galaxy Auto Stationary Equipment Co. Ltd.; Gast Manufacturing, Inc.; GENERAL ELECTRIC; Ingersoll Rand Plc; Kaeser Compressors; MAT Industries, LLC; Gardner Denver; ELGi; Sollant Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reciprocating Air Compressor Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reciprocating air compressor market report based on technology, lubrication, type, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-acting

-

Double-acting

-

-

Lubrication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil Free

-

Oil-filled

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stationary

-

Portable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Food & Beverage

-

Healthcare/Medical

-

Oil & Gas

-

Home Appliances

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global reciprocating air compressor market size was estimated at USD 5.26 billion in 2022 and is expected to be USD 5.45 billion in 2023.

b. The reciprocating air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 7.22 billion by 2030.

b. Asia Pacific region dominated the market and accounted for 41.9% of the global market share in 2022. The region has a growing healthcare industry with increasing demand for medical facilities. Reciprocating oil free air compressors are commonly used in medical applications and pharmaceutical companies, including in medical air systems, dental clinics, and laboratories, which is expected to drive market demand in the region.

b. Some of the key players operating in the reciprocating air compressor market include Atlas Copco, Bauer Group, BelAire Compressors, Cook Compression, Compressor Products International (CPI), Frank Compressors, Galaxy Auto Stationary Equipment Co. Ltd., Gast Manufacturing, Inc., GENERAL ELECTRIC, Ingersoll Rand Plc, Kaeser Compressors, MAT Industries, LLC, Gardner Denver, ELGi, Sollant Group.

b. The market is expected to be driven by proper conditioning of the air offered by Reciprocating air compressors are employed in a variety of sectors, including manufacturing, oil & gas, chemical, and electrical generation. To address the shortcomings of conventional production procedures, several industries have introduced cost-effective manufacturing strategies. Due to advantages including efficient energy distribution and cost effectiveness, these industries have a significant need for energy-efficient reciprocating air compressors. These factors are expected to positively impact the market demand during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."