- Home

- »

- Advanced Interior Materials

- »

-

Pyrophyllite Market Size, Share And Growth Report, 2030GVR Report cover

![Pyrophyllite Market Size, Share & Trends Report]()

Pyrophyllite Market Size, Share & Trends Analysis Report By Application (Ceramics, Refractories & Foundries, Fillers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-834-3

- Number of Pages: 96

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

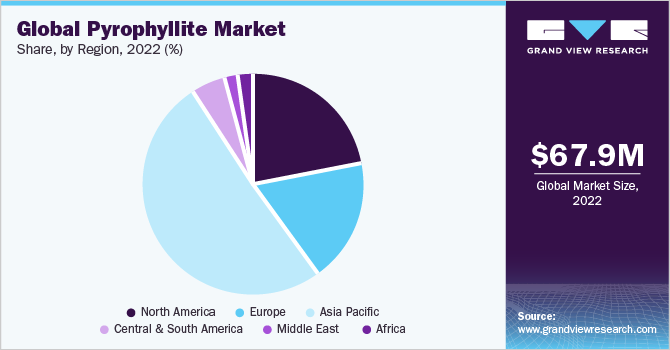

The global pyrophyllite market size was valued at USD 67.9 million in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. The rising use of ceramic products in various end-use industries such as construction, aerospace, and automotive is anticipated to contribute to the growth of the market over the coming years. Pyrophyllite plays a crucial role in the ceramics industry. It serves as an important material in numerous applications such as in the formulation of ceramic bodies and glazes, regulating thermal expansion, porcelain, insulators, kiln furniture, and glaze suspensions. Its unique properties make it a versatile and valuable material in various ceramic applications.

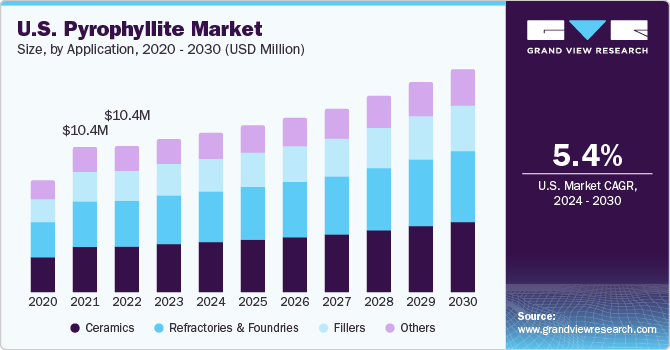

The growing industrial sectors, infrastructure projects, and technological advancements within the U.S. are aiding market growth. According to the U.S. Census Bureau, the total construction spending was USD 1,844.1 billion in February 2023, registering an increase of 5.2% compared to February 2022. The rising investments in the construction industry are expected to propel the demand for paints & coating, castings, and iron & steel, which in turn is anticipated to aid the consumption of pyrophyllite over the forecast period.

The growth of the market is further driven by the rising demand from refractories & foundries. The foundries business is experiencing significant global growth owing to factors such as flourishing automotive, aerospace, construction, and manufacturing industries that augment the demand for metal components produced by foundries.

The utilization of pyrophyllite-based refractories as furnace linings in iron & steel production is a key growth driver for the market. Despite the decline in steel production in 2022, it is projected to rebound and grow by 3.6% and 3.9% in 2023 and 2024, respectively. Thus, growth in the steel industry is expected to positively influence global market expansion over the forecast period.

The growth of the market is restricted by the harmful effects of mining on the ecosystem. Improper management of mining activities can result in an adverse socio-economic impact on the environment, animal, and human health issues. Several regional governments have imposed regulations to counter issues related to mining and processing. These regulations lead to a slow establishment process of new quarries and pyrophyllite processing plants, thereby restraining market growth.

Further, pyrophyllite in pure form offers enhanced properties to end-use products, which has augmented its usage and eventually led to the depletion of high-grade pyrophyllite reserves. The low availability of pure grade has resulted in switching to alternatives. Despite the availability of low-grade pyrophyllite, the impurities present in its mineral composition limit its usage in end-use industries. This acts as a key challenge for the growth of the pyrophyllite market.

Application Insights

Based on application, the refractories and foundries segment dominated the global pyrophyllite market with a revenue share of over 40% in 2022. Pyrophyllite can be transformed into a substance called mullite, which can endure temperatures as high as 1810 °C. This makes it suitable for making refractory materials that are cost-effective and can handle extreme heat. The increasing private investments to set up new steel manufacturing plants are expected to augment segment growth over the forecast period.

Pyrophyllite is used as a filler and finds application in end-use industries such as paper, pesticides, plastics, and paints, and also as a soil conditioner. It is primarily used in the paints industry as a suspending agent or pigment to improve the volume of paints. The unique properties of the mineral are an excellent substitute for expensive China clay and help enhance film cracking resistance by improving the drying and dispersion properties of paints.

Growing production for paints on account of rising construction activities worldwide is expected to aid segment growth over the coming years. For instance, in January 2023, Asian Paints announced to invest INR 2,000 crore (~USD 242.0 million) in Madhya Pradesh, India, with an annual production capacity of 4 lakh kilo liters per annum. The facility is expected to be commissioned in 3 years after land acquisition.

The ceramics segment is anticipated to register the fastest CAGR over the next eight years. Pyrophyllite is a versatile mineral that has several important applications in the ceramics industry. It is widely used as a cost-effective substitute for kaolin and talc minerals. Ceramics further are extensively used in sanitary ware, pottery, bricks, automobiles, and aerospace industries, which is expected to rapidly augment their production and eventually aid pyrophyllite demand over the forecast period.

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of over 50.0% in 2022. Increasing manufacturing activities and surging foreign investments are the key drivers fueling the growth of the pyrophyllite market in the Asia Pacific region. The flourishing end-use industries such as iron and steel mills, foundries, paints & coating, and building & construction are further contributing to the increased consumption of the product in the region.

Further, rising demand for ceramic-based products in the region due to initiatives undertaken by their respective governments is anticipated to propel pyrophyllite consumption over the forecast period. For instance, the Smart City project undertaken by the Government of India aims to leverage the potential of ongoing urbanization in the country. The surging construction & infrastructure development activities are the major factors driving the demand for ceramics, paints & coatings, and steel, which in turn are propelling the market growth.

The Middle East region is expected to register a CAGR of 4.8%, in terms of revenue, over the forecast period. The region is witnessing surged investments in resorts, hotels, artificial islands, and luxury residential projects to support the growth of its construction industry. For instance, in August 2022, Nakheel PJSC announced a plan to construct 5 islands spanning 17 square kilometers by 2040. Such initiatives are expected to augment market growth in the region over the forecast period.

Key Companies & Market Share Insights

The market players in the end-use industries adopt various initiatives such as capacity expansions, mergers & acquisitions, and R&D activities to gain a competitive edge. For instance, in June 2022, in an agreement with Grupo Industrial Saltillo. Mohawk Industries, Inc. acquired Vitromex ceramic tile for an approximate value of USD 293 million. This acquisition was undertaken to expand the position of the company in Mexico in terms of manufacturing efficiency, customer base, and logistical capabilities. The growth in end-use industries is eventually anticipated to support pyrophyllite market demand over the forecast period. Some prominent players in the global pyrophyllite market include:

-

ANAND TALC

-

Chirag Minerals

-

Kamlesh Minerals

-

R.T. Vanderbilt Holding Company, Inc.

-

SKKU Minerals

-

The Ishwar Mining & Industrial Corp

-

Tsuchihashi Mining Co., Ltd.

Pyrophyllite Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 71.1 million

Revenue forecast in 2030

USD 102.6 million

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; China; India; Japan; Brazil; Saudi Arabia; South Africa

Key companies profiled

ANAND TALC; Chirag Minerals; Kamlesh Minerals; R.T. Vanderbilt Holding Company, Inc.; SKKU Minerals; The Ishwar Mining & Industrial Corp; Tsuchihashi Mining Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pyrophyllite Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pyrophyllite market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ceramics

-

Refractories & Foundries

-

Fillers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East

-

Saudi Arabia

-

-

Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pyrophyllite market size was estimated at USD 67.9 million in 2022 and is expected to reach USD 71.1 million in 2023.

b. The global pyrophyllite market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 102.6 million by 2030.

b. The refractories & foundries segment dominated the market with a revenue share of over 40.0% in 2022.

b. Some of the key vendors of the global pyrophyllite market are ANAND TALC, Chirag Minerals, Kamlesh Minerals, R.T. Vanderbilt Holding Company, Inc., SKKU Minerals, The Ishwar Mining & Industrial Corp, and Tsuchihashi Mining Co., Ltd.

b. The key factors that are driving the pyrophyllite market include increasing demand for steel from the automotive and construction sectors and rising pyrophyllite penetration in paint, coating, and rubber applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."