- Home

- »

- Advanced Interior Materials

- »

-

Point of Use Water Treatment Systems Market Report, 2030GVR Report cover

![Point Of Use Water Treatment Systems Market Size, Share & Trends Report]()

Point Of Use Water Treatment Systems Market Size, Share & Trends Analysis Report By Technology (RO, Distillation, Disinfection, Filtration), By Device (Pitchers, Faucet Filters, Countertop), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-638-7

- Number of Pages: 115

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global point of use water treatment systems market size was valued at USD 13,510.2 million in 2022 and is anticipated to ascend at a compound annual growth rate (CAGR) of 19.0% from 2023 to 2030. This is attributed to the increasing water pollution, the rising urban population, and growing health awareness among the younger demographic. Stringent regulatory guidelines to restrict pollution in drinking water and global health awareness offered to augment the adoption of water treatment systems are predicted to drive the market over the forecast period. The point of use water treatment systems is priced in an affordable range for consumers. Increasing health awareness in the developed regions like North America and Europe, along with the developing countries in Asia Pacific, is expected to augment the market growth.

The COVID-19 outbreak had a substantial operational and economic impact on the global point-of-use water treatment sector. Since the water treatment business is classified as an essential service, the overall negative impact on the industry was moderate in comparison to other manufacturing industries. Supply chain disruptions and shortage of technicians occurred as a result of the unexpected lockdown and restrictions on the flow of commodities to minimize the spread of the virus.

According to the Water and Wastewater Equipment Manufacturers Association (WWEMA), supply chain challenges, inflation, and steel costs, particularly stainless steel prices, have risen dramatically, negatively impacting the market growth. This had a significant influence on water and wastewater equipment suppliers and contractors, affecting both raw material and acquired component pricing. The labor market was getting affected and many industries were witnessing staffing shortages. Recruiting, hiring, keeping, and paying new staff had become more expensive and complicated.

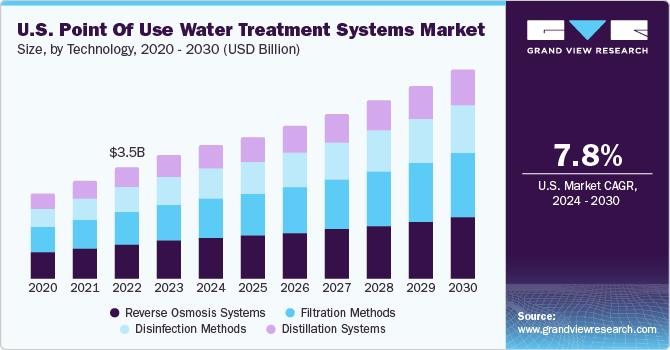

Technology Insights

In 2022, reverse osmosis systems led the market with a revenue share of over 32.7% principally owing to the extensive penetration of this technology and the hassle-free installation and usage. RO systems demand was USD 4416.23 million units globally among other point of use water treatment systems in 2022. Although RO systems are predicted to witness a slowdown by 2030, mainly due to manufacturers launching systems that have technologies in combination, for instance, RO and UV systems.

Increasing adoption of alternative upcoming technologies having more efficiency and improved features is fueling the market growth. The filtration methods segment emerged as the second-largest segment in 2022 as it is a mature technology. The distillation systems segment is estimated to witness a measured increase in terms of manufactured units during the forecast period owing to affordable products, coupled with better designs and other benefits.

Device Insights

Tabletop pitchers held the largest revenue share of over 30.0% in 2021 mainly owing to the affordability of the product, coupled with convenience in use. Faucet mounted filters are estimated to expand at a significant CAGR of 19.3% over the forecast period, in terms of revenue. These filters find wide adoption, especially in developing regions like India and South Africa.

The countertop units segment demand is likely to be 248.6 million units by 2030. Countertop units are extremely popular in Asian countries including China and South Korea owing to the economical prices and larger capacity dispensed by these units. The under the sink filters segment demand was USD 72.8 million units in 2022. Under the sink filters find wide adoption in Europe and North America due to aesthetics as these units are concealed and kitchen counters look decluttered.

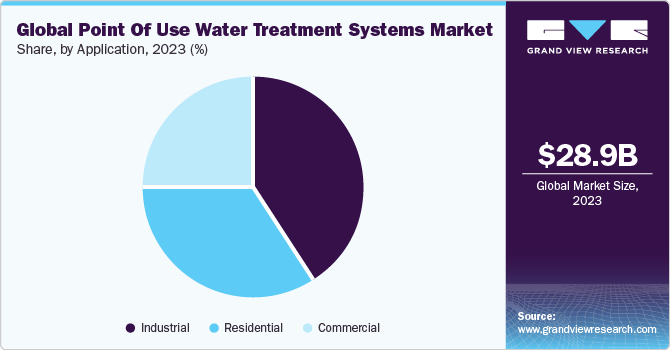

Application Insights

In 2022, the non-residential segment dominated the market for point of use water treatment systems and held a revenue share of over 62.4%. In terms of application, the market for point of use water treatment systems has been classified into residential and non-residential segments.

The non-residential segment includes small-scale commercial, industrial, and healthcare facilities, education institutions, sports facilities, and transportation facilities. The residential segment demand was USD 121.2 million units in 2022. Growth in the residential segment can be attributed to the exponential growth in residential construction across the world.

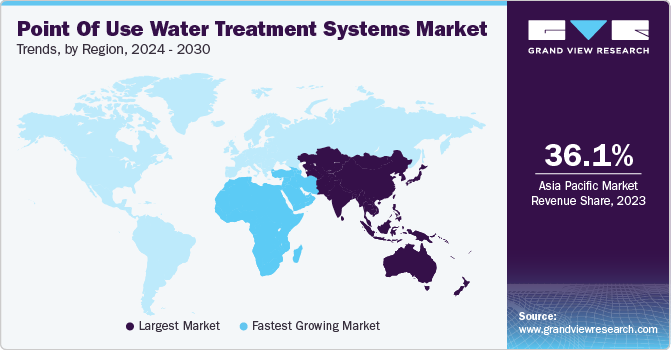

Regional Insights

Asia Pacific dominated the global market with a revenue share of over 36.5% in 2022. In 2022, the China market was valued at USD 1248.21 million. China has a large presence of local manufacturers and suppliers of the equipment helping it dominate the global scenario, primarily due to large-scale investments made for developing the technology.

Europe emerged as the second-largest regional market in 2022. The U.K. and Russia led the European market in 2022. The U.S. dominated the North American market in 2022. North America is an extremely mature market, where consumer awareness regarding the importance of a healthy lifestyle and potable drinking water is high.

Key Companies & Market Share Insights

The market is established with numerous local and international companies. A.O. Smith was designated as an "essential business" in the U.S. during the pandemic as its products are critical in sustaining good health and combating infection. Manufacturers in the market are paying close attention to the developments in the water purifier business and formulating new business strategies to consolidate their market position.

Companies are investing significantly in research and development and introducing innovative designs along with enhanced capacities to augment their adoption. Some companies in this market are doing business in a socially responsible way. For instance, Pentair has designed strategic targets such as carbon footprint reduction, water reduction, product design for sustainability, responsible supply chain, and inclusion and diversity. Some prominent players in the global point of use water treatment systems market include:

-

3M

-

Koninklijke Philips N.V.

-

Pentair

-

Panasonic Holdings Corporation

-

Unilever

-

LG Electronics

-

EcoWater Systems LLC

-

A.O. Smith

-

Culligan

-

Amway Corp.

Point Of Use Water Treatment Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13,510.26 million

Revenue forecast in 2030

USD 54.5 billion

Growth rate

CAGR of 19.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in million units, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, application, device, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; U.K.; Germany; Russia; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; UAE; Saudi Arabia

Key companies profiled

3M; Koninklijke Philips N.V.; Pentair; Panasonic Holdings Corporation; Unilever; LG Electronics; EcoWater Systems LLC; A.O. Smith; Culligan; Amway Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

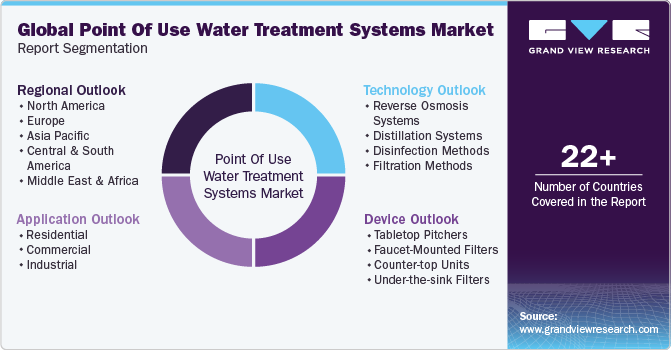

Global Point Of Use Water Treatment Systems Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels, and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global point of use water treatment systems market report on the basis of technology, device, application, and region:

-

Technology Outlook (Volume, Million Units; Revenue, USD Million; 2018 - 2030)

-

Reverse Osmosis Systems

-

Distillation Systems

-

Disinfection Methods

-

Filtration Methods

-

-

Application Type Outlook (Volume, Million Units; Revenue, USD Million; 2018 - 2030)

-

Residential

-

Non-residential

-

-

Device Outlook (Volume, Million Units; Revenue, USD Million; 2018 - 2030)

-

Tabletop Pitchers

-

Faucet Mounted Filters

-

Countertop Units

-

Under The Sink Filters

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Russia

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global point of use water treatment systems market size was estimated at USD 13,510.26 million in 2022 and is expected to reach USD 15822.0 million in 2023.

b. The global point of use water treatment systems market is expected to grow at a compound annual growth rate of 19.0% from 2023 to 2030 to reach USD 54.5 billion by 2030.

b. Asia Pacific dominated the point-of-use water treatment systems market with a share of 36.6% in 2022. This is attributable to the large presence of local manufacturers and suppliers coupled with the need for efficient water treatment systems.

b. Some key players operating in the point-of-use water treatment systems market include 3M, Philips, Pentair, Panasonic, Unilever, LG Electronics, EcoWater systems, A.O. Smith, Culligan International, and Amway.

b. Key factors that are driving the point-of-use water treatment systems market growth include increasing water pollution, rising urban population, and growing health awareness among the younger demographic.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."