- Home

- »

- Electronic Devices

- »

-

Point-of-Sale Terminal Market Size & Share Report, 2030GVR Report cover

![Point-of-Sale Terminal Market Size, Share & Trends Report]()

Point-of-Sale Terminal Market Size, Share & Trends Analysis Report By Product (Fixed, Mobile), By Component (Hardware, Software), By Deployment (Cloud, On-premise), By End-use (Healthcare, Retail), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-263-1

- Number of Pages: 189

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Semiconductors & Electronics

Report Overview

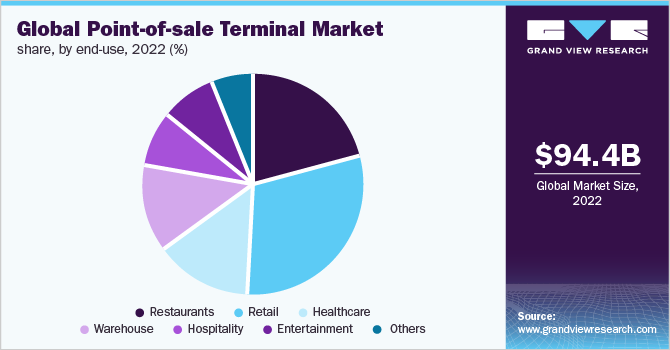

The global point-of-sale terminal market size was valued at USD 94.40 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.3% from 2023 to 2030. The Point-of-Sale (POS) terminal is an electronic appliance utilized to procedure card payments to locations, such as hospitals, pharmacies, resorts, restaurants, hotels, gas stations, and retail stores. The growth in demand for reasonable wireless communication technologies has grown the demand for the market. POS systems use wireless devices to facilitate payments for products and services. The utilization of wireless technology streamlines various processes, from rental cabs to restaurants. Businesses in the retail and hospitality sectors use POS terminals for remittance and additional operational tasks, such as accounting, sales tracking, and inventory management.

For instance, restaurants, bars, and food service providers depend on POS technology to inventory, products, operations, and track sales, operations, products, and inventory. With the help of cash registers, barcode scanners, and computers, the market concept involves devices and displays to engage in online transactions. Furthermore, the increasing adoption of POS terminals, which are mobile-based, development in payment technologies, the use of Europay, Marstercard, and Visa (EMV) cards, and the increasing adoption of the market in the e-commerce and retail sector are driving the industry growth.

In addition, the market has been captivated by security and privacy concerns linked to data breaches. The rise of the modern drive-thru is the factor promoting the growth of the POS terminals market. Various companies started adopting POS systems to link their drive-thru line, kitchen, and back-office operations for a smooth delivery and order process. For instance, fast-casual businesses, such as Chipotle, and Starbucks, Panera have added drive-thru components to some of their drive-thru locations. The growing prominence of mobile POS terminals has indued avenues for market growth.

The facility of better return on investment (ROI) offered by these systems positively impacted the market. In addition, the rising need for customer and employee management, inventory tracking, and in-store & online sale unification through tablets has increased product adoption. Furthermore, the increasing trend of contactless and penetration of near field communication (NFC) devices in many industry verticals boost the demand. Remittance companies are introducing new solutions for certain industrial purposes to gain profitability. The market allows retailers to manage their business operations and store inventory, which results in the industry growth.

Benefits offered by modern drive-thrus, such as increased convenience, have resulted in an improved customer experience. This, in turn, is also expected to provide lucrative growth opportunities for the market. However, privacy issues and security concerns related to misuse of information and data leakage on the cards are constraints to the growth of the market. In addition, the lack of awareness among the audience restraints the growth of the market. The market is challenging to secure due to its role and exposed location over the network. These systems hold critical information and are essential to be managed from rural areas.

A substantial impact of POS breaches is the possibility of identity threats. These victims encounter damaged financial loss, credit standing, and fraudulent purchases. Hence, compensating controls to handle the data flow are anticipated to improve POS security. For instance, VeriFone’s VeriShield is a provisional power for transmitting data between different parts of the POS systems. During the COVID-19 pandemic, the growth of the industry was impacted due to social lockdown and distance restrictions. As a result, many end-use verticals suffered losses, which hindered the demand for new fixed POS terminals.

Nevertheless, as the severity of the pandemic has mellowed due to a dip in positive cases and vaccination drives, countries across the globe have eased out restrictions and have started operating as usual. Moreover, COVID-19 triggered a shift in consumer habits, resulting in a surge in demand for Artificial Intelligence (AI), digital menu boards, and the expansion of drive-thrus into dual lanes for increased convenience. Owing to this, the restaurant, hospitality, and entertainment sectors are expected to witness substantial growth over the forecast period.

Product Insights

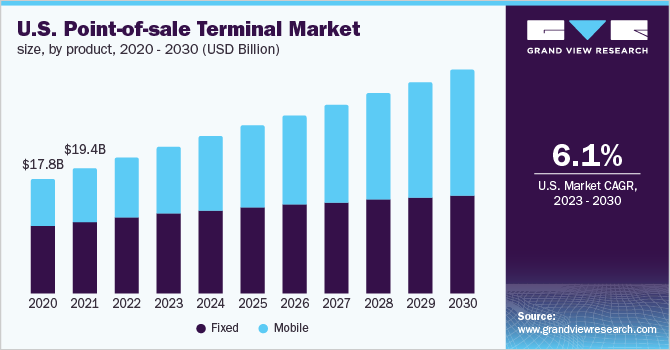

The fixed product segment led the industry in 2022 and accounted for the maximum share of more than 61.75% of the global revenue. The fixed POS segment is divided into kiosks and others. The large-scale vendors choose fixed POS terminals due to high procurement and installation costs, which currently supported the growth of the segment. Furthermore, end-users that are aware of cloud data storage install fixed POS terminals for data storage with the on-premises server. These systems have applications, such as printing bills, Customer Relationship Management (CRM), inventory management, and supporting payments devices.

The mobile POS segment is expected to register the fastest CAGR from 2023 to 2030. This growth is attributed to the rising adoption of in-store mobile payments among customers across the globe. Mobile POS terminals help carry out payments from any part of the store. Many end-users, such as restaurants, have started adopting mPOS as it helps ease payments during busy hours and avoids loss of sales due to delays, thereby improving customer satisfaction. For instance, Quick-Service Restaurants (QSRs) in China have started using systems, such as digital kiosks and tablets, to display menus and place orders. This helps the restaurants to enhance operational efficiency & customer experience, which, in turn, is likely to drive the industry.

Component Insights

The hardware segment dominated the global industry in 2022 and accounted for the largest share of more than 63.30% of the overall revenue. The segment is estimated to expand further at a steady CAGR from 2023 to 2030. Hardware components include interfaces or devices to register transaction details, such as EFT-POS machines, network devices, barcode scanners, cash drawers, receipt printers, tablets, and monitors. The fixed POS terminal comprises most of the hardware components to complete the system and facilitates the experience of managing daily activity using the system.

Furthermore, the software segment is estimated to register the highest CAGR over the forecast period. This growth can be attributed to data support functionality, multifunctional features, and sales analysis ease. There is specialized software for different applications. For instance, retail POS software offers functions, such as accounting, transaction alerts, inventory management, etc. The systematic software integration functionalities of screen terminals and barcode scanners across these systems provide backup features and data restoration, supporting segment growth.

Deployment Insights

Based on deployment, the global industry has been further segmented into cloud and on-premises. The cloud segment is expected to register the fastest growth rate of 10.9% from 2023 to 2030. This growth is attributed to the increasing adoption of SaaS technology and software integration. In the SaaS model, rather than paying for all the software, hardware, and support services in advance, customers pay a minimum monthly fee on a subscription basis. This helps restaurants and other end-users to reduce their up-front expenses.

On-premises deployment incorporates manual installation at the client’s premise. The installation includes cabling permits and cabling, hardware and software installation, and electrical work. Many companies have started adopting cloud POS due to its various benefits over on-premises deployment. For instance, In January 2022, Xenial, Inc. launched a development for Xenial Cloud POS, named 3.6 Xenial Ordering. This cloud POS offers seamless process workflow, user experience, and infrastructure updates and improvements for this developed version of Xenial Ordering UI and API.

End-use Insights

The retail segment accounted for the largest revenue share of more than 30.40% of the overall revenue. Several retailers are moving towards the simple mode of transactions to avoid long waiting queues and delays in transactions. As a result, retailers are now integrating the POS system with inventory, merchandising, marketing, and Customer Relationship Management (CRM) data to offer personalized, interactive, and unique customer experience. Furthermore, the retail segment is bifurcated into supermarkets/hypermarkets, convenience stores, grocery stores, specialty stores, and gas stations.

The supermarkets/hypermarkets segment is expected to grow at the highest CAGR over the forecasting period. The exposure of mobile wallet technology is forecasted to increase the penetration of retail-based products over the forecast period. The healthcare segment is estimated to exhibit a greater CAGR over the forecasting period. This growth is attributed to a broad product application scope in managing patient information, facilitating quick payment processes, and tracking employee statistics. The rising need to organize the payment process, and manage vaccination drives and COVID-19 patient records is expected to boost market growth.

Regional Insights

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Government initiatives that support a cashless economy are growing the demand for POS terminals in the region. A rise in digital payment technologies in the region has lucrative opportunities for mPOS in countries, such as India, Japan, and China. Nevertheless, the demand for fixed POS terminals from large enterprises to protect their business details and ensure the processing of high amounts of data of their customers is supporting segment growth. The COVID-19 pandemic impacted the most profitable sectors in the region, including hospitality, entertainment, and restaurant which led to a shrink in demand for POS terminals.

China, one of the manufacturing hubs for POS terminal hardware components, recouped early compared to other countries, while Japan executed control measures to minimize the impact on its businesses. Other Asian countries are implementing measures to revive their businesses, which is expected to increase the product demand in coming years. Moreover, a considerable unbanked population and low penetration in other developing countries, such as Vietnam and Thailand, are likely to create lucrative growth opportunities for the market. North America emerged accounted for the second-largest revenue share in 2022 and is expected to grow at a steady GAGR during the forecast period.

Several demanding payment technologies, such as contactless payments and NFC have been driving the product demand in the region. Moreover, the U.S. has many large retail brand outlets, such as Wal-Mart, Costco Wholesale Corp., Target, The Kroger Co, and The Home Depot, which need POS terminals to manage billing, payment, employee duty, and inventory daily. Also, the U.S. government is encouraging the adoption of contactless payment systems in the wake of COVID-19 to limit the spread of the virus. However, recession in the retail and other service sectors due to the pandemic slowed down the overall growth of the regional market.

Key Companies & Market Share Insights

Key companies are engaging in several inorganic growth strategies including partnerships, mergers & acquisitions, and geographical expansion, to stay afloat in the competitive market scenario. For instance, in September 2021, Elo Touch Solutions, Inc. partnered with CERTIFY Health to deliver a patient self-service solution. This partnership integrated Elo’s All-in-One touchscreen computers along with a cloud-based interface, for healthcare providers and institutions by CERTIFY Care, which optimizes patient registering workflows. Along with growing the company's size and reach, industry players are also concentrating on R&D to manufacture products with the latest technologies.

For instance, in September 2021, Presto introduced Presto Flex, which is Presto’s next-generation platform. This platform is a highly flexible, multi-purpose tablet custom-designed for the hospitality industry. It can be installed for various restaurant drive-thru and dine-in applications, including pay-at-table, staff handheld, drive-thru, and kiosk line buster. The platform also integrated Presto’s contactless QR Code payment solution and ordering to provide restaurants with complete front-of-house versatility. Some of the prominent players in the global point-of-sale terminal market include:

-

Acrelec

-

AURES Group

-

HM Electronics

-

Hewlett Packard Development LP

-

NCR Corp.

-

Oracle

-

Presto Group

-

Qu, Inc.

-

Quail Digital

-

Revel Systems

-

Toast, Inc.

-

Toshiba Corp.

-

TouchBistro

-

Xenial, Inc.

Point-of-Sale Terminal Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 103.83 billion

Revenue forecast in 2030

USD 181.5 billion

Growth rate

CAGR of 8.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Acrelec; AURES Group; HM Electronics; Hewlett Packard Development LP; NCR Corp.; Oracle; Presto Group; Qu, Inc.; Quail Digital; Revel Systems; Toast, Inc.; Toshiba Corp.; TouchBistro; and Xenial, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point-of-Sale Terminal Market Segmentation

The report forecasts revenue growth at global, regional, and at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global point-of-sale terminal market report on the basis of product, component, deployment, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Kiosks

-

Others

-

-

Mobile

-

Tablet

-

Others

-

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Restaurants

-

FSR

-

Fine Dine

-

Casual Dine

-

-

QSR

-

Drive-Thru

-

Others

-

-

Institutional

-

Fast Casual

-

Drive-Thru

-

Others

-

-

Others

-

-

Retail

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Specialty Stores

-

Gas Stations

-

Others

-

-

Hospitality

-

Spas

-

Hotels

-

Resorts

-

-

Healthcare

-

Pharmacies

-

Others

-

-

Warehouse

-

Entertainment

-

Cruise Lines/Ships

-

Cinema

-

Casinos

-

Golf Clubs

-

Stadiums

-

Amusement Parks

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global point-of-sale terminal market size was estimated at USD 94.40 billion in 2022 and is expected to reach USD 103.83 billion in 2023.

b. The global point-of-sale terminal market is expected to grow at a compound annual growth rate of 8.3% from 2023 to 2030 to reach USD 181.5 billion by 2030.

b. The Fixed segment dominated the POS terminals market and accounted for more than 60% of the global revenue share in 2022. Fixed terminals are preferred mainly by large-scale vendors due to high procurement and installation costs, which have currently contributed to market growth.

b. The hardware product segment emerged as the largest segment in 2022 in the POS terminals market, accounting for a revenue share of more than 63%. Hardware components comprise interfaces or devices to register transaction details, such as tablets, monitors, cash drawers, receipt printers, barcode scanners, EFT-POS machines, and network devices.

b. On-premise deployment emerged as the largest segment in 2022 in the point-of-sale terminal market and accounted for over 70% of the global revenue share. On-premise deployment comprises manual installation at the customer’s premise.

b. The retail segment generated the highest revenue share of over 30% in 2022 in the POS terminals market and is expected to grow further at a significant rate over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

In contrast to its related industries like consumer electronics and semiconductors, the data center and communications infrastructure industry is expected to be more buoyant with continued strategic investments made to support the increased network traffic and data usage for remote working during the lockdown phase. From school closures necessitating students to use virtual offerings (Google Classroom ) to the governments using business analytics services (Power BI) for communicating virus updates, the demand for communication services and related infrastructure has witnessed an unprecedented rise amidst the global pandemic. Digital services including telemedicine are expected to remain popular even after the pandemic is contained, thereby ensuring strong growth in the communication infrastructure industry. The report will account for Covid19 as a key market contributor.