- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Plant Based Protein Supplements Market Size Report, 2030GVR Report cover

![Plant Based Protein Supplements Market Size, Share & Trends Report]()

Plant Based Protein Supplements Market Size, Share & Trends Analysis Report By Raw Material (Soy, Spirulina, Pumpkin Seed, Wheat, Hemp, Rice, Pea, Others), By Product, By Distribution Channel, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-764-3

- Number of Pages: 135

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The global plant based protein supplements market size was USD 2.52 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.8% from 2022 to 2030. The market's expansion can be attributed to rising consumer awareness of the nutritional values of plant-based products, such as high amino acids and low sodium. Due to concerns about food safety, moral considerations, food allergies, and the adoption of veganism to end animal cruelty, consumers' preferences for plant-based protein supplements have changed. The market is expanding as a result of the rising demand for environmentally friendly proteins. The COVID-19 pandemic had a moderate impact on the plant based protein supplements market. Plant-based foods demand was significantly higher during the pandemic. The sale of retail plant based foods was 35% higher amid panic buying in March and April 2020, as per a survey by the Plant-Based Foods Association.

The pandemic impacted the consuming buying preferences, and there is a growing concern regarding food safety, and people nowadays prefer to buy plant based supplements to improve their overall health as compared to animal-based products. However, the supply chain was affected due to trade restrictions and lockdown, which affected production due to raw material shortages.

The U.S. dominated the North American market for plant based protein supplements in 2021 in terms of revenue. A strong presence of leading manufacturers of plant-based protein supplements, rising interest in weight control, and maintaining a vegan as well as healthy and nutritious diet are expected to fuel the market growth in the country. Increasing health issues due to hectic schedules and the nature of work, combined with growing consumer awareness of the relationship between healthy eating and exercise, has increased the demand for plant based protein supplements for sports nutrition and is expected to benefit the growth of the market.

Various awareness campaigns launched by non-governmental organizations, government agencies, and companies have increased consumer understanding of the nutritional benefits of protein supplements, which is expected to drive market growth. Furthermore, some protein supplement manufacturers' product lines include natural and organic products, which is driving the market even further. The use of appealing packaging methods has improved consumer awareness, which has resulted in increased spending on protein supplements to improve overall health and stamina during strenuous physical activities, which is expected to boost the demand for plant based protein supplements market in the coming years.

Consumers are increasingly turning to plant-based diets as their awareness of animal welfare and environmental sustainability grows. The growing prevalence of lactose allergies and intolerance has boosted the demand for plant-based protein supplements. Furthermore, because of the higher amino acid content, protein supplements are becoming increasingly popular among fitness enthusiasts for their muscle-building properties. During the forecast period, aggressive promotion and marketing efforts in fitness centers and gyms and the introduction of novel protein supplement products such as ready-to-drink supplements are expected to boost product demand.

Raw Material Insights

The soy protein segment dominated the market and accounted for the largest revenue share of over 26.5% in 2021. The increasing popularity of soy protein as a vegetarian protein source and the inclusion of ingredients such as glutamine and BCAAs, which aid in muscle recovery and rapid absorption, contribute to the segment's growth. Furthermore, soy proteins promote bone health, improve immune function, and help to prevent cardiovascular disease. With increased awareness of lactose intolerance and glutamic disorders in developed markets such as the U.S. and Germany, demand for soy-based protein supplements is expected to rise over the projected timeframe.

The pea protein in the raw materials segment is expected to expand at a CAGR of 9.1% during the forecast period on account of its rising popularity among various consumers, such as vegans, those allergic to dairy and egg proteins, and vegetarians. Furthermore, pea protein is hypoallergenic, gluten-, cholesterol-, and fat-free as it is extracted from green peas, thus attracting a larger customer base. Pea proteins are used in manufacturing a number of protein supplements, including energy drinks, shakes, powders, and smoothies, and it is said to be a high-quality protein that is also a good source of iron.

The pumpkin seed segment was valued at USD 157.3 million in 2021 and is expected to grow with the highest CAGR of 9.4% from 2022-2030. Growing consumer demand for pumpkin seed protein as an outcome of product innovation by major producers of protein ingredients is anticipated to support the segment's expansion. Moreover, significant food authorities, including Kosher, have approved the use of pumpkin seed protein as a protein supplement.

The hemp protein supplement segment is expected to expand at a CAGR of 9.2% during the forecast period, owing to rising consumer awareness of the health benefits of hemp, as well as its comparable protein content and essential amino acids to animal-based sources such as beef and lamb. Hemp has many unique properties that set it apart in the plant-based foods industry. One of them is that its DNA structure is tightly aligned with human DNA, so it provides nutrition to the body in perfect proportion as a food source. Hemp is naturally non-GMO, gluten-free, free of trypsin inhibitors, as well as virtually free of any residual chemicals, thereby promoting segment growth.

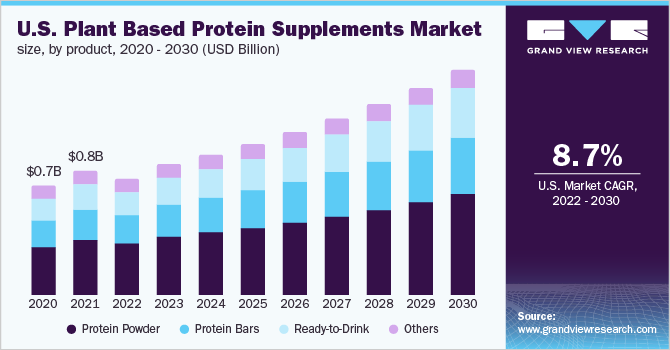

Product Insights

The protein powder segment dominated the market and accounted for the largest revenue share of 43.9% owing to the wide range of applications and the incorporation of protein powder in end-use sectors such as food & beverages. Mass distribution, increasing online sales, and an increasing number of brands by prominent players such as The Nature's Bounty Co., Iovate Health Sciences International Inc., and Glanbia PLC are factors impacting the expansion of the protein powder segment.

Protein bars are expected to grow at a compound annual growth rate of 9.2% during the forecast period due to widespread consumer adoption of protein bars due to their convenience of grab-and-go possibility. Protein bars help in supporting muscle mass and increase protein synthesis. The hectic lifestyles and no time for cooking balanced and nutritious food have boosted the demand for convenient, on-the-go snacking options with nutritional value. Furthermore, factors such as the instant energy and nutrition provided by protein bars are predicted to propel segment growth.

The ready-to-drink (RTD) segment was valued at USD 508.6 million in 2021 and is predicted to expand at a CAGR of 9.6% from 2022 to 2030. A fast-paced and hectic lifestyle, combined with a rise in the number of gyms and fitness centers, has driven consumers to seek out quick and nutritious beverages. This scenario has resulted in the penetration of RTD plant-based protein in taste-enhancing flavors such as coffee, vanilla-infused, and chocolate with organic ingredients, maple syrups, veggies, and others that provide nutrients and promote active lifestyles.

Distribution Channel Insights

The online stores segment dominated the market and accounted for the largest revenue share of more than 60.0% and is expected to expand at a CAGR of 9.2% from 2022 - 2030. As a result of rising customer demands and a focus on core competencies, manufacturers are concentrating on shorter paths to consumers. Easy product availability, simple online purchases, and a wide range of products of various brands to pick from are driving up online sales of plant-based protein supplements. Because of the industry's high fragmentation and low consumer loyalty, online sales of plant-based protein supplements are expected to rise further during the forecast period.

Offline retail stores such as supermarkets, hypermarkets, and pharmacies sell a wide range of dietary supplements, including plant-based protein supplements. One factor driving wellness and health product sales is an improvement in the retail sector. An increasing number of well-established brands prefer supermarkets as a prominent platform for selling plant-based protein supplements owing to the growing penetration of retail giants, including Walmart, Tesco, Target Brands Inc., Sainbury’s, and Asda, among others across the globe. The supplements are sold in most major grocery stores, including Kroger and Lidl. Annual memberships and bulk purchasing discounts are expected to entice customers to purchase products from supermarkets and hypermarkets, boosting market sales.

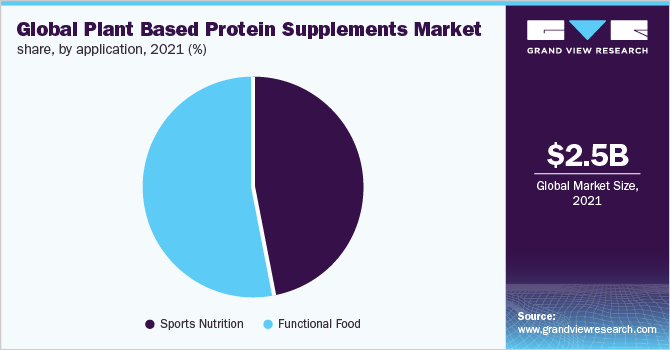

Application Insights

The sports nutrition segment accounted for a revenue share of 18.8% in 2021 and is expected to witness a higher CAGR of 9.6% during the forecast period from 2022 - 2030. This development is primarily due to new product launches, an increase in the number of young consumers choosing sports as a career, and an increase in domestic and international sporting events. Strength, core, & endurance athletes and professional athletes are expected to fuel the segment's growth with the rising demand for sports nutritional supplements. In addition, rising demand for sports nutritional products to support lean muscle growth, enhance performance, help with weight loss, and boost stamina, along with an increase in the number of people using the gym, are expected to fuel the expansion of the segment in coming years.

Functional foods accounted for a larger revenue share of 21.4% in 2021 and is expected to dominate over the forecast period. The demand for protein-rich functional foods is rising as consumers become more conscious of living a healthy, active lifestyle and better understand the link between maintaining an active lifestyle as well as eating a nutritious, well-balanced diet. Additionally, it is anticipated that the increasing prevalence of cardiovascular diseases brought on by an inactive and sedentary lifestyle, particularly in people between 30 and 40 years of age, and changing dietary habits will raise consumer awareness of the value of consuming functional protein-rich food, which will help the segment expand.

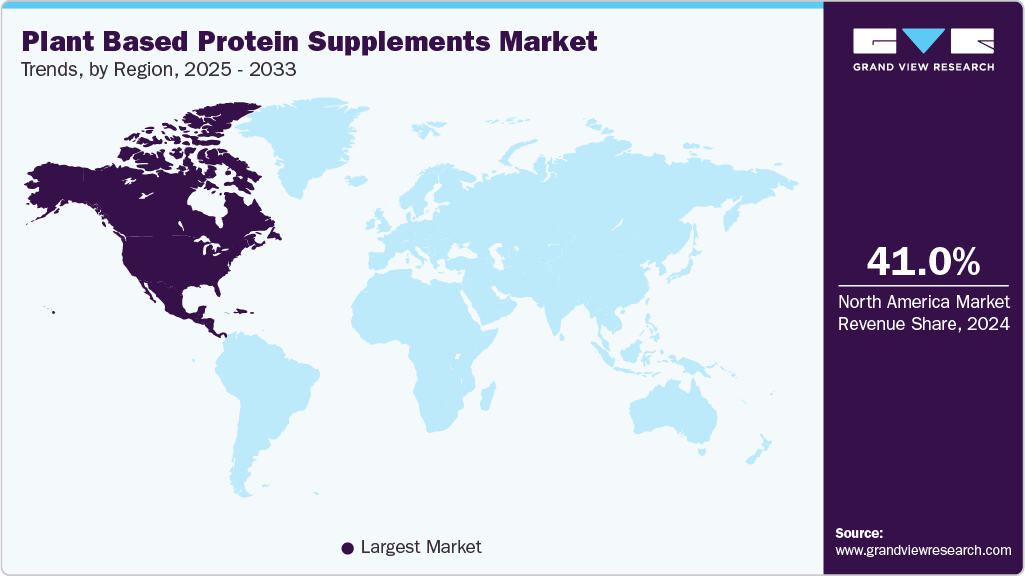

Regional Insights

North America dominated the regional plant-based protein supplements market with a share of 40.0% in 2021 and is expected to witness a CAGR of 8.5% from 2022 - 2030. The growth is attributed to the significant market for sports nutrition products in countries like the U.S. and Canada. Additionally, a solid foothold of key market players is anticipated to fuel the market's growth, along with the accessibility of raw materials. The Canadian federal government proposed to invest USD 74 million in Merit Functional Foods, a local company that makes plant-based proteins, in June 2020. This initiative aimed to increase the penetration of these products in the country by addressing the rise in demand.

Europe held a market share of over 21.0% in 2021 and is anticipated to expand at a compound annual growth rate of 8.1% from 2022-2030. The demand for these products in the region is anticipated to rise over the forecast period due to factors including a trend toward preventive health care, growing emphasis on healthy living, and rising demand from countries like Germany and the UK due to the region's growing vegan population.

Asia Pacific is predicted to grow at a CAGR of 9.6% over the forecast period. Health-conscious consumers in the Asia Pacific developing countries have led to an increase in the consumption of products. Consumption of these products has increased dramatically in countries such as Indonesia, India, and China, which will help the market expand during the forecast period. Plant-based supplements are anticipated to become significantly more popular as consumers' buying power grows and different brands are made more widely available in these countries.

Key Companies & Market Share Insights

There has been a significant change in consumer preference for buying plant-based products instead of their animal-based counterparts. Some companies are investing in other businesses that make alternatives to hedge against or prepare for the decline in demand for animal products. Over the past few years, a number of well-known companies and financial investors have invested in or funded the producers of plant protein ingredients in the value chain to sustain evolving consumer needs. Some of the key players are AMCO Proteins, NOW Foods, AMCO Proteins, Quest Nutrition, and Abbott Laboratories, among others.

The rising demand for plant based products compels the key players in the market to focus on R&D and launch new innovative products to keep up with current trends in the market. Additionally, companies are entering into partnerships, acquisitions, strategic mergers, and geographic & capacity expansions to gain a competitive edge. For instance, in May 2020, Danone commercially launched its Vega One range of plant-based protein products in China. It also included Vega One Sport created for athletes. This product comprises various proteins from various foods, such as peas, alfalfa, pumpkin seeds, and sunflower. Some prominent players in the global plant based protein market include:

-

Glanbia plc

-

AMCO Proteins

-

Quest Nutrition

-

NOW Foods

-

The Bountiful Company

-

MusclePharm Corporation

-

Abbott Laboratories

-

IOVATE Health Sciences International, Inc.

-

Transparent Labs

-

WOODBOLT DISTRIBUTION LLC

Plant Based Protein Supplements Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.35 billion

Revenue forecast in 2030

USD 4.62 billion

Growth rate

CAGR of 8.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia, Brazil; Argentina, UAE, Saudi Arabia

Key companies profiled

Glanbia plc; AMCO Proteins; Quest Nutrition; NOW Foods; The Bountiful Company; MusclePharm Corporation; Abbott Laboratories; IOVATE Health Sciences International, Inc.; Transparent Labs; WOODBOLT DISTRIBUTION LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant Based Protein Supplements Market Segmentations

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global plant based protein supplements market report on the basis of raw material, product, distribution channel, application, and region:

-

Raw Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Soy

-

Spirulina

-

Pumpkin Seed

-

Wheat

-

Hemp

-

Rice

-

Pea

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Protein Powder

-

Protein Bars

-

Ready-to-Drink

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets/Hypermarkets

-

Online Stores

-

DTC

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Sports Nutrition

-

Functional Food

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global plant based protein supplements market size was estimated at USD 2.52 billion in 2021 and is expected to reach USD 2.35 billion in 2022.

b. The global plant based protein supplements market is expected to grow at a compound annual growth rate of 8.8% from 2022 to 2030 to reach USD 4.62 billion by 2030.

b. Soy protein dominated the raw material segment with share of 26.7% in 2021 on account of its cost-effectiveness and easy availability of the raw material for plant based protein supplement manufacturers.

b. Some of the key players operating in the plant based protein supplements market include Glanbia plc, AMCO Proteins, Quest Nutrition, NOW Foods, The Bountiful Company, MusclePharm Corporation, Abbott Laboratories, IOVATE Health Sciences International, Inc., Transparent Labs, WOODBOLT DISTRIBUTION LLC.

b. The key factors that are driving the plant based protein supplements market include the rising importance of a vegan diet coupled with an increasing instances of cardiovascular diseases and type 2 diabetes among consumers associated with the consumption of meat products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The demand for nutraceuticals & functional foods is expected to witness an upward surge owing to consumers opting for immunity boosting supplements during the COVID-19 pandemic. Furthermore, a decline in the consumption of poultry, meat, and seafood products across the globe is expected to increase the demand for plant based protein supplements in the near future. The report will account for COVID-19 as a key market contributor.