- Home

- »

- Clinical Diagnostics

- »

-

Pharmaceutical Sterility Testing Market Size Report, 2030GVR Report cover

![Pharmaceutical Sterility Testing Market Size, Share & Trends Report]()

Pharmaceutical Sterility Testing Market Size, Share & Trends Analysis Report By Product Type (Instruments, Service), By Type (Outsourcing, In-house), By Test Type, By Sample, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-425-3

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global pharmaceutical sterility testing market size was estimated at USD 1.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.4% from 2023 to 2030. Government investments in the healthcare industry, increasing R&D activities, a rise in the number of drug launches, and a rising focus on quality & sterility are expected to drive the market growth. The development of comprehensive sterility testing procedures is regulated with stringent policies and quality control standards. For instance, the U.S. Code of Federal Regulations Sec. 610.12 requires manufacturers to demonstrate the reliability and consistency of the sterility tests in detecting the presence of viable contaminating microorganisms. These regulations help in ensuring the safety and quality of sterility tests. There is a growing demand for pharmaceuticals across the world due to the high burden of chronic and infectious diseases.

For instance, in February 2021, the World Health Organization (WHO) stated that cardiovascular diseases are one of the major causes of death, accounting for 17.9 million deaths every year, globally. The increasing burden of diseases is expected to add to the demand for pharmaceuticals and, thus drive the growth of the market over the forecast period. To address the growing demand for healthcare services, several emerging countries shortened their regulatory schedules for drug approval and accelerated drug launches. It is anticipated that these regulatory adjustments will lead to market expansion. In addition, since few drugs, such as Elagolix and Lanadelumab, are biopharmaceutical products that need unique sterility testing, their introduction is significantly supporting the market growth.

Post-pandemic, drug companies are focusing on developing and manufacturing biologics and biosimilars as they have proved to be highly effective in treating some serious diseases, such as cancer, psoriasis, and Alzheimer's disease. For instance, in June 2021, Lonza collaborated with PINTEON, a biotechnology company to develop therapeutics for Alzheimer's disease. As per this collaboration agreement Lonza decided to manufacture PNT001, Novel Tau Antibody of Pinteon Therapeutics used in the treatment of Alzheimer’s and traumatic brain injury. The growing burden of these diseases, worldwide, is expected to improve R&D and the manufacturing of these drugs. This, in turn, is expected to further propel the demand for sterility testing, thereby supporting market growth.

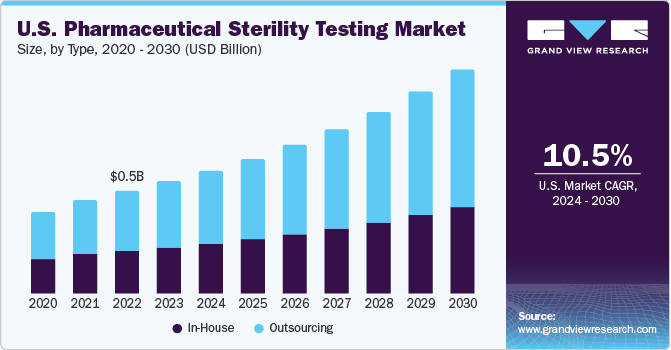

Type Insights

Based on type, the market is segmented into outsourcing and in-house sterility testing. The outsourcing segment held the largest market share of 54.8% in 2022 and is expected to grow at a CAGR of 11.5% during the forecast period. Outsourcing sterility testing is considered an attractive alternative for several small- and medium-sized pharmaceutical and medical device companies, which may lack the infrastructure to conduct quality sterility testing. Most of these companies, therefore, prefer to outsource sterility testing services to pass the FDA requirements, which is likely to stir the growth of this segment. Moreover, outsourcing helps various pharmaceutical and medical device companies to save cost and time, as they need not invest in hiring and training of employees, or different equipment needed to conduct these tests.

Major pharmaceutical companies are now emphasizing more on their core competencies, such as R&D and marketing. Therefore, these companies have to outsource pharmaceutical sterility testing services. Moreover, the presence of different laboratories that provide quality sterility testing services on a contract basis and at affordable costs, also adds to the segment growth. The in-house segment is expected to grow significantly during the forecast period. Quality and compliance issues associated with outsourcing pharmaceutical sterility testing are expected to promote segment growth. Small outsourcing firms lack the necessary infrastructure, and this may hamper the quality of sterility testing. These reasons are likely to boost demand for in-house pharmaceutical sterility testing.

Product Type Insights

Based on product type, the market is segmented into kits & reagents, instruments, and services. The kits & reagents segment dominated the market with a revenue share of 59.9% in 2022 and is expected to maintain its dominance throughout the forecast period with a CAGR of 11.8%. Kits and reagents are essential in pharmaceutical sterility testing as they provide standardized and reliable techniques to determine the absence of live microorganisms in pharmaceutical products. These include ready-to-use culture mediums, membranes, and others that help in making the testing process easier and more efficient while also maintaining accuracy and repeatability.

They are intended to support the development and detection of a wide variety of microorganisms, including bacteria and fungi, allowing possible pollutants to be identified. Furthermore, the availability of particular stains, dyes, and reagents enables the detection and separation of microorganisms, increasing the sensitivity and specificity of testing. Overall, these kits and reagents provide the instruments required for effective and compliant sterility testing to manufacture safe and high-quality pharmaceutical goods, which is expected to drive segment growth over the forecast period.

Test Type Insights

On the basis of testing type, the market is segmented into sterility testing, bioburden testing, and bacterial endotoxin testing. The bacterial endotoxin testing segment accounted for the largest market share of 39.9% in 2022. Bacterial endotoxin testing is required for all the drugs administered via parenteral routes. These tests are also used for testing medical devices, such as implants. The growing demand for parenteral drugs and implants is driving the growth of this segment. There is an increasing emphasis on product quality, along with a rising number of drug and medical device launches. The Food and Drug Administration department of the U.S. approved nearly 40 drugs in 2022, which is expected to drive the segment growth over the forecast period.

Sterility testing is expected to grow at the fastest CAGR of 11.8% during the forecast period as it aids in the prevention of several infections via assessing the product quality, and safety, mitigating any risks associated with microbial contamination, determining the shelf life of these drugs, and their compliance with regulations. Moreover, sterility testing is critical in protecting public health by confirming the absence of viable microorganisms. These factors are expected to boost market growth over the forecast period. Bioburden testing is expected to grow significantly during the forecast period. Bioburden testing is performed for pharmaceuticals, biologics, and all medical devices, including class I, II, and III. The growing demand for these products is one of the key reasons supporting segment growth. Furthermore, this testing is very important during the production process, as microbial growth in the product could lead to recalls later.

Sample Insights

Based on samples, the market is segmented into pharmaceuticals, medical devices, and biopharmaceuticals. The pharmaceuticals segment held the largest market share of 38.4% in 2022. Pharmaceuticals include products, such as parenteral, aerosols, ointments, eye drops, and others. These are the most widely used dosage forms. The growing demand for these dosage forms, globally, is one of the major factors driving the growth of this segment. Furthermore, the rising number of recalls for several dosage forms due to the lack of sterility is expected to boost the growth of sterility testing in pharmaceuticals. The biopharmaceutical segment is expected to grow at the fastest CAGR of 11.6% during the forecast period.

This rapid growth can be attributed to the factors, such as the growing demand for biologics and biosimilar drugs, owing to their effectiveness in treating serious diseases like cancer, neurological disorders, infectious diseases, and others. The improvement in the rate of approvals for biologics and biosimilars during the last 5 years and fast-approaching patent expirations for several lifesaving drugs are expected to boost the growth of this segment. For instance, according to an article published by the AJMC Center For Biosimilars, the patents of almost 20 biologics are expected to expire by 2023. This can give a further boost to the market growth.

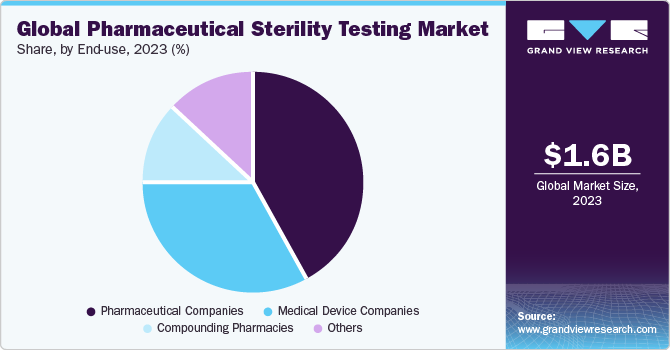

End-use Insights

Based on end-use, the market is segmented into pharmaceutical companies, medical device companies, compounding pharmacies, and others. The others segment includes biopharmaceutical firms and partnered CROs, hospitals, clinics, and research laboratories. The pharmaceutical companies segment held the largest share of 43.0% in 2022. Pharmaceutical companies have to conduct sterility tests to ensure the safety of the products, especially oral dosage forms, as most of these products are ingested by the patients.

There are specific guidelines set in the pharmacopeia of each country, which describe the necessary sterility tests that are required to be performed for a given drug. The medical device companies segment is estimated to grow at a CAGR of 11.8% during the forecast period due to the increasing demand for several medical devices. Moreover, research laboratories need to ensure that test subjects and lab equipment are free from contamination, which is expected to drive the growth of this segment during the forecast period.

Regional Insights

In terms of region, North America held the largest market share of 49.5% in 2022. The presence of a large number of major market players in this region is expected to contribute significantly to the market growth. Stringent regulatory requirements for sterility testing of pharmaceuticals and medical devices in this region further support the market growth. On the other hand, the Asia Pacific region is anticipated to witness the fastest CAGR of 12.7% over the forecast period.

This rapid growth can be attributed to the increasing harmonization of the regulatory standards with the ICH standards in developing nations. Moreover, many emerging economies in the region are undertaking initiatives to boost the domestic pharmaceutical market and encouraging multinational companies to set up operations in the region (collaborations that support outsourcing activities).

Key Companies & Market Share Insights

The market is characterized by the presence of a large number of global and domestic companies including various contract service providers and research laboratories. Regional expansions, digitalization of service delivery for sterility testing, and M&A activities are the key strategies undertaken by most of these companies. For instance, in September 2019, Charles River Laboratories launched the EndoScan-V software platform for endotoxin testing and Celsisautomated detection solutions for checking the rapid sterility of pharmaceutical drugs. Moreover, in April 2023, STEMart, a medical equipment provider company introduced bioburden and sterility testing for medical devices following ISO 11731 guidelines. Some of the prominent players in the global pharmaceutical sterility testing market include:

-

Pacific BioLabs Inc.

-

STERIS

-

Boston Analytical

-

Nelson Laboratories, LLC

-

Sartorius AG

-

SOLVIAS AG

-

SGS Société Générale de Surveillance SA

-

Laboratory Corporation of America Holdings.

-

Pace Analytical

-

Charles River Laboratories

-

Thermo Fisher Scientific, Inc.

-

Rapid Micro Biosystems, Inc.

-

Almac Group

Pharmaceutical Sterility Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.59 billion

Revenue forecast in 2030

USD 3.39 billion

Growth rate

CAGR of 11.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product type, test type, sample, end-use region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Pacific BioLabs Inc.; STERIS; Boston Analytical; Nelson Laboratories, LLC; Sartorius AG; SOLVIAS AG; SGS Société Générale de Surveillance SA; Laboratory Corporation of America Holdings; Pace Analytical; Charles River Laboratories; Thermo Fisher Scientific, Inc.; Rapid Micro Biosystems, Inc.; Almac Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Sterility Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical sterility testing marketreport on the basis of type, product type, test type, sample, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourcing

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits and reagents

-

Instruments

-

Service

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterility Testing

-

Membrane Filtration

-

Direct Inoculation

-

-

Bioburden Testing

-

Bacterial Endotoxin Testing

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Medical Devices

-

Biopharmaceuticals

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Compounding Pharmacies

-

Medical Devices Companies

-

Pharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical sterility testing market size was estimated at USD 1.4 billion in 2022 and is expected to reach USD 1.59 billion in 2023.

b. The global pharmaceutical testing sterility market is expected to grow at a compound annual growth rate of 11.4% from 2023 to 2030 to reach USD 3.39 billion by 2030.

b. North America dominated the Pharmaceutical sterility testing market with a share of 49.5% in 2022. This is attributed to the increasing number of pharmaceutical industries within the U.S. and Canada and the increasing presence of the number of major market players this region is expected to contribute significantly to the market growth.

b. Some key players operating in the pharmaceutical testing sterility market include SGS SA; Toxikon, Inc.; Pace Analytical Services, LLC; Boston Analytical; Charles River Laboratories International Inc.; Nelson Laboratories, and others.

b. Key factors that are driving the market growth include supportive government investments in the healthcare industry, increasing R&D activities, increasing number of drug launches, and increasing focus on quality and sterility.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The most common concern for the governments of all COVID-19 hit nations is the excruciating need to screen for and test large numbers of patients for possible Sars-Cov-2 infection. As a result, most of them are facing major shortages in the supply for diagnostic kits to test for the virus. Diagnostics virology entities are under immense pressure to provide reliable testing kits, and there is a surge in demand for in-vitro or point-of-care testing capacities by labs across a large number of countries. The report will account for COVID-19 as a key market contributor.